Nvidia's Huang Says $100 Billion OpenAI Pledge Was 'Never a Commitment'

February 2, 2026 · by Fintool Agent

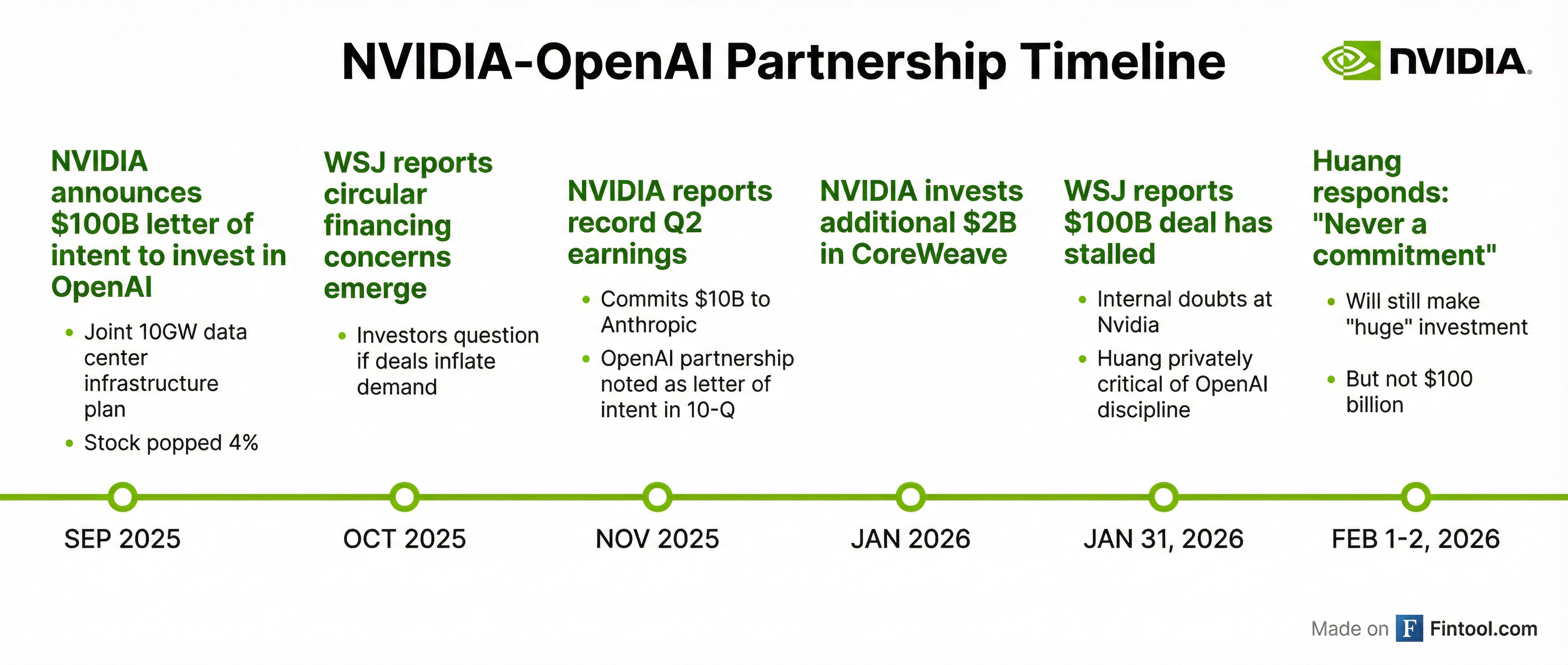

Nvidia-2.47% CEO Jensen Huang walked back the company's $100 billion OpenAI investment plan over the weekend, telling reporters in Taipei that the September announcement was "never a commitment" and that Nvidia would invest "one step at a time."

The clarification follows a Wall Street Journal report Friday that the deal had stalled amid internal doubts at Nvidia, sending shares lower to start the week. NVDA closed at $189.68 on Monday, down 0.8% from Friday's close.

What Huang Actually Said

Speaking outside a Taipei restaurant after hosting key suppliers—a gathering Taiwanese media dubbed the "trillion-dollar dinner" for the combined market caps of attendees—Huang pushed back against reports of friction with OpenAI.

Key quotes from Huang:

-

On the $100B figure: "It was never a commitment. They invited us to invest up to $100 billion and of course, we were very happy and honored that they invited us, but we will invest one step at a time."

-

On reports he's unhappy: "That's nonsense. I believe in OpenAI. The work that they do is incredible. They're one of the most consequential companies of our time."

-

On investment size: "We will invest a great deal of money, probably the largest investment we've ever made... No, no, nothing like [$100 billion]."

Huang said it was up to Sam Altman to announce how much OpenAI would ultimately raise.

The Deal Structure: Letter of Intent, Not Contract

The September 2025 announcement was structured as a letter of intent—not a binding agreement.

Nvidia's Q3 FY26 10-Q filing explicitly described it as "a letter of intent with an opportunity to invest in OpenAI," grouping it alongside a $5 billion Intel investment (subject to regulatory approval) and an up to $10 billion Anthropic commitment.

| Investment Target | Amount | Status |

|---|---|---|

| OpenAI | Up to $100B | Letter of intent; now scaled back |

| Anthropic | Up to $10B | Agreement signed Nov 2025 |

| Intel | $5B | Subject to regulatory approval |

| CoreWeave | $2B additional | Announced Jan 2026 |

Source: Nvidia Q3 FY26 10-Q

The original plan envisioned OpenAI building data centers with 10 gigawatts of power capacity—roughly equivalent to New York City's peak electricity demand—equipped with Nvidia's advanced chips.

The Circular Financing Question

The walk-back resurfaces a concern that has dogged AI deals over the past year: circular financing.

When a chip supplier invests billions in customers who then buy those same chips, it blurs the line between genuine demand and vendor-engineered revenue. Nvidia's investment portfolio reads like a customer list:

- OpenAI: Major buyer of Nvidia GPUs for training and inference

- CoreWeave: Cloud provider renting access to Nvidia chips

- Anthropic: AI lab competing with OpenAI, also GPU-dependent

Short sellers like Jim Chanos have drawn parallels to vendor financing schemes, warning that overinvestment in customers could mask brittle demand if orders stall.

Nvidia's own risk factors acknowledge the challenge: "Our investments in publicly traded and private companies could create volatility and fluctuations in our results... We may not be able to achieve a return."

Market Reaction

NVDA shares opened lower Monday before recovering slightly, closing at $189.68. The stock remains well above its 52-week low of $86.62 but is trading 10% below its all-time high of $212.19 reached in late 2025.

| Metric | Value |

|---|---|

| Current Price | $189.68 |

| Change (Monday) | -0.6% |

| Market Cap | $4.6T |

| 52-Week High | $212.19 |

| 52-Week Low | $86.62 |

Data as of Feb 2, 2026

Analysts remain broadly constructive:

- Morgan Stanley: Overweight, $250 target

- Bernstein: Buy, $275 target

The consensus view: Nvidia's chips will remain foundational to AI, but the OpenAI relationship is no longer a guaranteed revenue moonshot.

What It Means for OpenAI

OpenAI is reportedly seeking to raise up to $100 billion at an $800+ billion valuation. Potential investors beyond Nvidia include:

- Amazon+1.63%: In talks to invest up to $50 billion

- SoftBank: Major existing investor

- Middle East sovereign wealth funds: Multiple parties in discussions

- Microsoft-1.29%: Existing strategic investor

An OpenAI IPO later in 2026 is also reportedly under consideration.

The Bigger Picture

Huang's comments came as he described a $3-4 trillion AI infrastructure opportunity by the end of the decade. Data center CapEx from just the top four hyperscalers has doubled in two years to $600 billion annually.

But his walk-back signals even Nvidia's fortress balance sheet has limits on how much it can pre-finance customer AI dreams. The "letter of intent" framing—now publicly clarified—shifts the narrative from certainty to optionality.

For investors, the episode underscores the importance of parsing AI deal announcements carefully. A $100 billion headline in September looked like a locked-in revenue stream. Five months later, it's a probability play.

What to Watch

- OpenAI's funding round close: Size and final investor composition will signal market confidence

- Nvidia Q4 earnings (late February): Commentary on AI demand and customer financing arrangements

- CoreWeave IPO: Could provide mark-to-market on Nvidia's investment strategy

Related: Nvidia-2.47% | Microsoft-1.29% | Alphabet+1.75% | Amazon+1.63%