Oil Crashes 3% as Trump Says Iran 'Seriously Talking' on Nuclear Deal

February 1, 2026 · by Fintool Agent

Oil prices tumbled nearly 3% to start the week as President Donald Trump revealed that Iran is "seriously talking" with Washington about a nuclear deal—a dramatic pivot from last week's rhetoric about military strikes that had pushed crude to six-month highs.

Brent crude futures plunged $1.90 per barrel, or 2.8%, to $67.39—erasing much of January's geopolitical risk premium. West Texas Intermediate crude fell an identical $1.90 to $63.32, down 2.9%.

The selloff comes just days after Brent hit $71.89, its highest level since August, as markets priced in the possibility of U.S. military action against OPEC member Iran.

"The crude oil market is interpreting this as an encouraging step back from confrontation, easing the geopolitical risk premium built into the price during last week's rally and prompting a bout of profit-taking," said Tony Sycamore, market analyst at IG.

From Threats to Talks: A Weekend Pivot

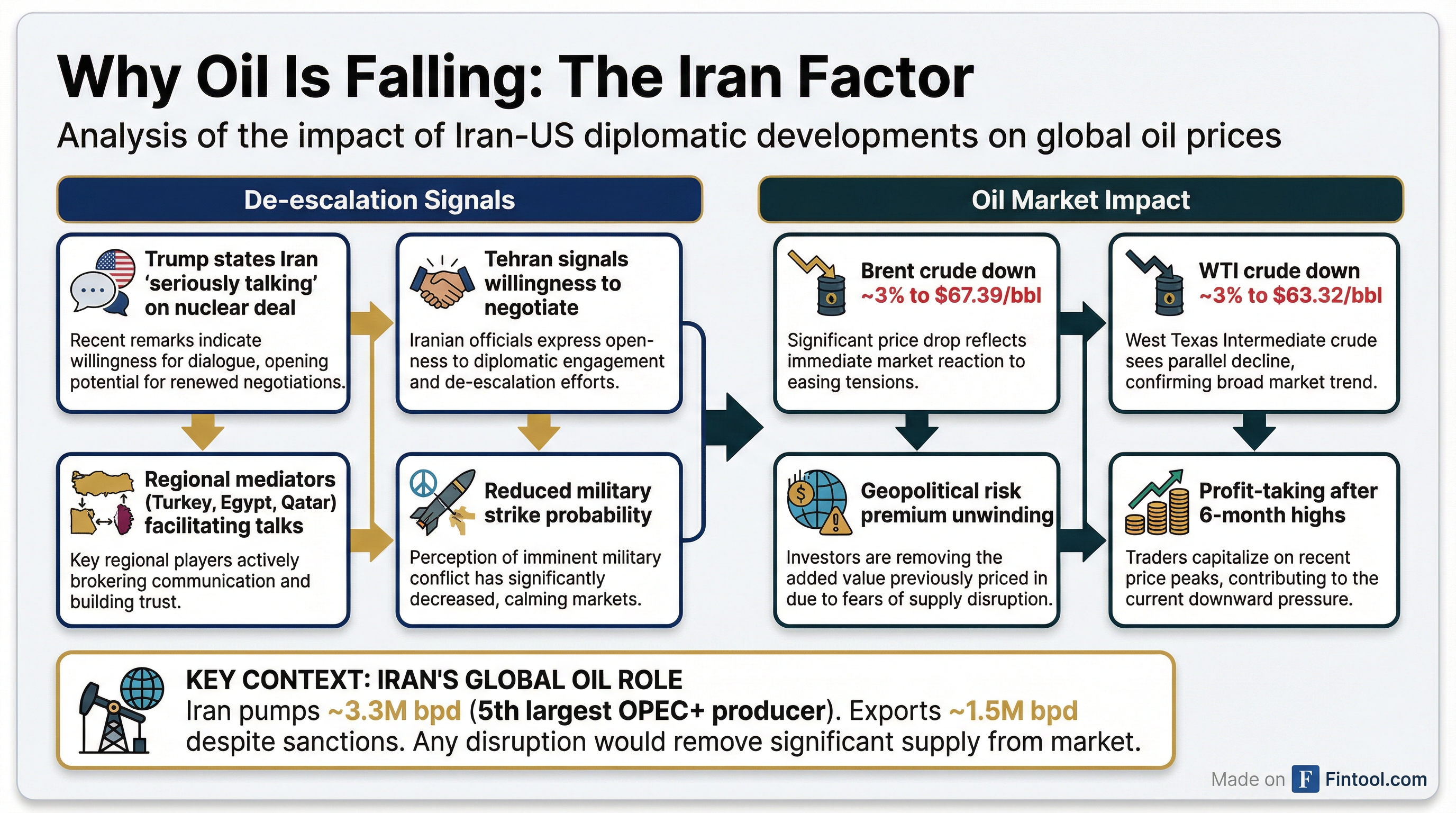

The de-escalation marks a stunning reversal from Thursday, when multiple sources told Reuters that Trump was weighing targeted strikes against Iranian security forces and leaders—sending oil prices soaring.

On Saturday, Trump told reporters Iran was "seriously talking" with Washington, hours after Tehran's top security official Ali Larijani said on X that "arrangements for negotiations were underway."

"I hope they negotiate something acceptable," Trump said. "You could make a negotiated deal that would be satisfactory with no nuclear weapons."

Regional mediators Turkey, Egypt, and Qatar are reportedly working to organize a meeting in Ankara between White House envoy Steve Witkoff and senior Iranian officials later this week.

OPEC+ Holds the Line for March

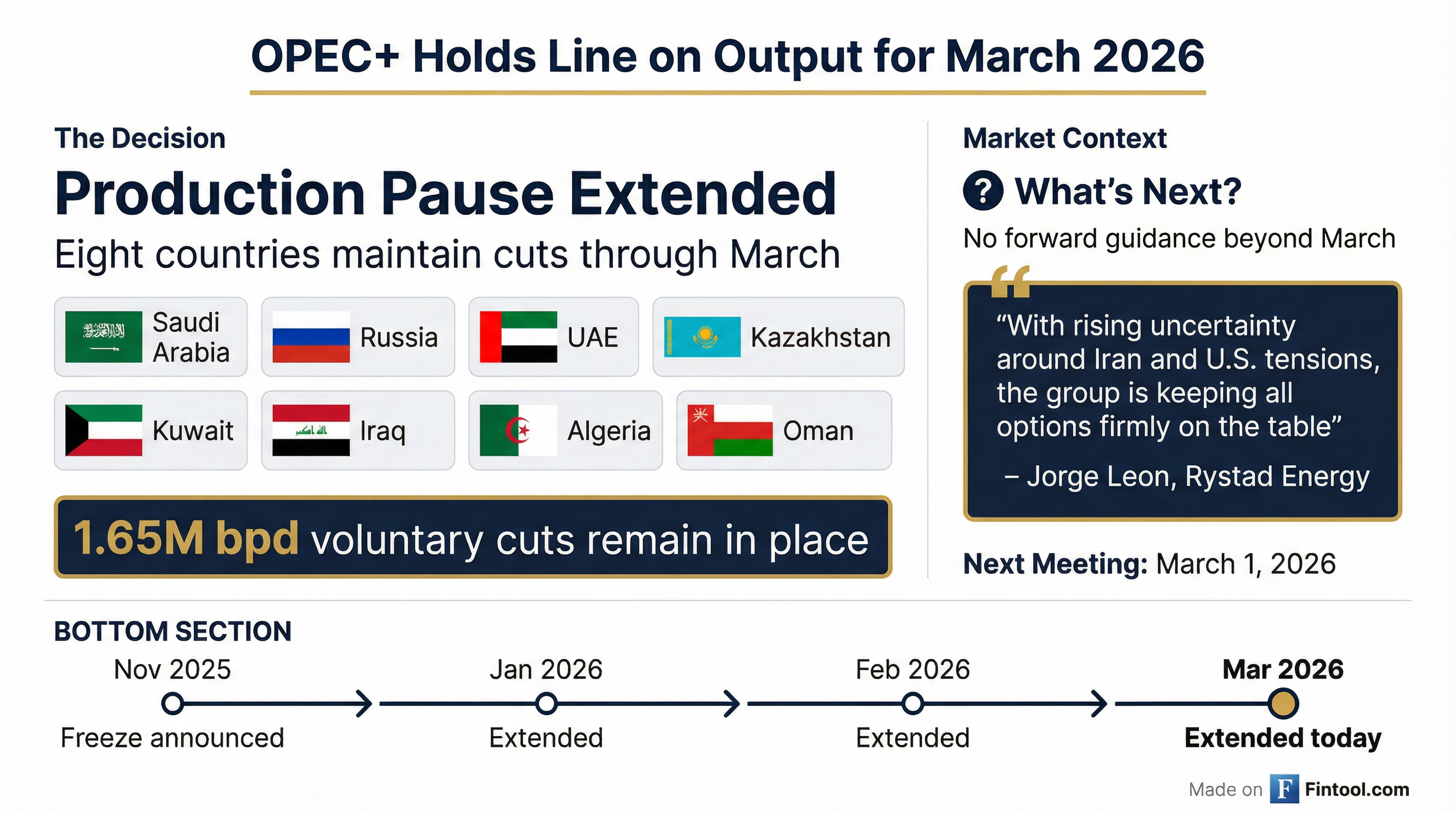

The diplomatic breakthrough overshadowed Sunday's OPEC+ meeting, where eight member countries agreed to keep oil production unchanged for March 2026—extending their November decision to pause output hikes.

The eight producers—Saudi Arabia, Russia, the United Arab Emirates, Kazakhstan, Kuwait, Iraq, Algeria, and Oman—had raised production quotas by about 2.9 million barrels per day from April through December 2025, roughly 3% of global demand.

Notably, the group provided no forward guidance beyond March.

"With rising uncertainty around Iran and U.S. tensions, the group is keeping all options firmly on the table," said Jorge Leon, a former OPEC official now heading geopolitical analysis at Rystad Energy. "OPEC's own numbers point to a lower call on OPEC+ crude in the second quarter, which could limit the scope for production increases."

The Iran Variable: 3.3 Million Barrels Per Day

Iran remains the wildcard in global oil markets. The country pumps approximately 3.3 million barrels per day, making it the fifth-largest OPEC+ producer. Despite years of sanctions, Iranian exports remain resilient at around 1.5 million barrels per day, flowing through "dark fleets" and ship-to-ship transfers.

If diplomatic efforts fail and military action disrupts Iranian supply, the impact could be severe:

- Moderate scenario: Barclays estimates oil prices could jump from mid-$60s to around $80 per barrel

- Extreme scenario: If Iranian exports were completely removed, BloombergNEF projects Brent could average $91 per barrel by late 2026

- Current risk premium: Only $4 per barrel of "war premium" is currently built into prices, according to BloombergNEF

Any escalation could also threaten Persian Gulf oil flows through the Strait of Hormuz, where approximately 20 million barrels per day pass—roughly 20% of global oil supply.

Fundamentals Still Bearish

Despite the geopolitical premium, underlying fundamentals remain challenging for oil bulls. Capital Economics warned in a January 30 note that "geopolitical risks mask a fundamentally bearish oil market."

The firm pointed to last year's 12-day war between Israel and Iran as evidence that supply disruptions may be shorter-lived than feared, and noted that a well-supplied global market should continue to weigh on prices through year-end.

A Reuters poll of 32 analysts found that most expect prices to hold near $60 per barrel this year as the prospect of oversupply offsets potential disruptions from geopolitical tensions.

What to Watch

- Ankara talks: Turkey, Egypt, and Qatar are coordinating to facilitate direct U.S.-Iran negotiations this week

- March 1 OPEC+ meeting: The next opportunity for production policy decisions, with no forward guidance currently in place

- Iranian response: Tehran has signaled defense capabilities should not be included in any talks, a potential sticking point

- Dollar strength: A stronger dollar following Kevin Warsh's Fed nomination could continue to pressure oil prices denominated in the U.S. currency

Related Company Profiles: Exxon Mobil · Chevron · Conocophillips · Occidental Petroleum · SLB · Halliburton