NVIDIA, Microsoft, Amazon in Talks to Invest Up to $60 Billion in OpenAI

January 28, 2026 · by Fintool Agent

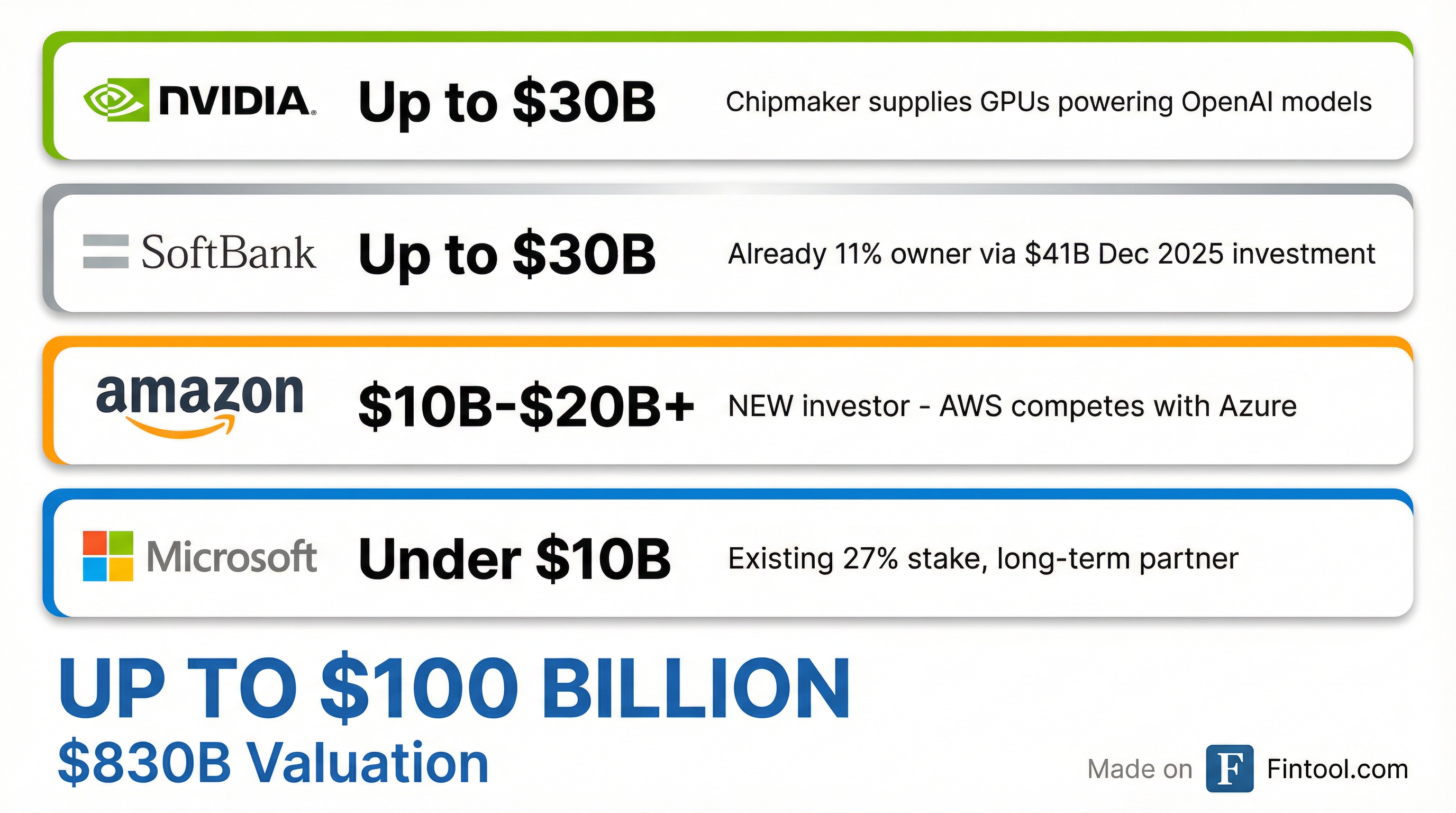

Nvidia, Microsoft, and Amazon are in talks to invest a combined $60 billion or more in OpenAI, The Information reported Wednesday evening, a development that would bring the AI maker's mega-funding round to as much as $100 billion and cement its position as the most valuable private company in history.

The potential investments come on top of SoftBank's ongoing discussions to invest an additional $30 billion in OpenAI, which was reported earlier this week. Together, the four investors could push the ChatGPT maker's valuation to approximately $830 billion—roughly equal to Berkshire Hathaway's market capitalization and trailing only five S&P 500 companies.

The talks mark several firsts: NVIDIA would be making an unprecedented investment in one of its largest customers, Amazon would be entering as a new investor despite AWS competing directly with Microsoft's Azure cloud, and the sheer scale of the round dwarfs anything in private market history.

Breaking Down the Potential Investments

According to The Information, the investment discussions break down as follows:

| Investor | Potential Investment | Status | Strategic Rationale |

|---|---|---|---|

| Nvidia (nvda) | Up to $30B | In talks | GPUs power OpenAI's entire infrastructure |

| SoftBank | Up to $30B | In talks | Stargate co-lead, already 11% owner |

| Amazon (amzn) | $10B-$20B+ | NEW investor | AWS AI competition, anthropic hedge |

| Microsoft (msft) | Under $10B | In talks | Existing 27% stake, long-term partner |

| Total | ~$100B | — | $830B valuation |

Source: The Information

OpenAI is reportedly close to receiving term sheets from these firms, suggesting the round could close in the coming weeks.

NVIDIA: The Chipmaker Buying Into Its Biggest Customer

NVIDIA's potential $30 billion investment would be one of the most unusual corporate investments in tech history—a supplier taking a massive equity stake in one of its largest customers.

The logic is compelling: NVIDIA's dominance in AI chips is built largely on the backs of companies like OpenAI. By the end of 2025, NVIDIA had captured over 90% of the AI accelerator market, with its H100 and H200 GPUs powering virtually every frontier AI model in development.

| NVIDIA Financials | Q4 2025 | Q1 2026 | Q2 2026 | Q3 2026 |

|---|---|---|---|---|

| Revenue ($B) | $39.3 | $44.1 | $46.7 | $57.0 |

| Net Income ($B) | $22.1 | $18.8 | $26.4 | $31.9 |

| Cash Position ($B) | $8.6 | $15.2 | $11.6 | $11.5 |

With a market capitalization of approximately $4.6 trillion, a $30 billion investment would represent less than 1% of NVIDIA's value. But it would give the company direct upside in the AI applications layer—not just the infrastructure layer where it currently dominates.

Jensen Huang has been explicit about the symbiotic relationship: OpenAI's success drives demand for NVIDIA chips, and NVIDIA's chips enable OpenAI's breakthroughs. An equity stake would align their interests even further.

Amazon: The Cloud Rival Joins the Party

Perhaps the most surprising potential investor is Amazon. The e-commerce and cloud giant has been notably absent from OpenAI's cap table, despite being a major player in AI through its own investments in Anthropic (Claude) and its AWS AI services.

Amazon has reportedly invested around $8 billion in Anthropic since September 2023, positioning Claude as a potential OpenAI competitor. An OpenAI investment of $10 billion or more would represent a significant strategic pivot—hedging its AI bets across both leading frontier model companies.

| Amazon Financials | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $187.8 | $155.7 | $167.7 | $180.2 |

| CapEx ($B) | $27.8 | $25.0 | $32.2 | $35.1 |

| Cash Position ($B) | $78.8 | $66.2 | $57.7 | $66.9 |

The investment would also be awkward for Microsoft, OpenAI's exclusive cloud partner. Microsoft has built Azure OpenAI Service as a crown jewel offering, selling access to GPT-4 and other OpenAI models to enterprise customers. Amazon joining the cap table could complicate that exclusivity over time.

Microsoft: Deepening an Already Deep Partnership

Microsoft's potential sub-$10 billion investment would be modest relative to its history with OpenAI. The company already owns approximately 27% of OpenAI on an as-converted basis and has committed $13 billion in total funding, of which $11.7 billion was funded as of December 31, 2025.

The latest Microsoft 10-Q confirms the depth of the partnership: "We have a long-term strategic partnership with OpenAI. In October 2025, we signed a new definitive agreement with OpenAI that extends this partnership... We hold rights to OpenAI's intellectual property, including models and infrastructure, for integration into our products."

| Microsoft Financials | Q3 2025 | Q4 2025 | Q1 2026 | Q2 2026 |

|---|---|---|---|---|

| Revenue ($B) | $70.1 | $76.4 | $77.7 | $81.3 |

| CapEx ($B) | $16.7 | $17.1 | $19.4 | $29.9 |

| Cash Position ($B) | $28.8 | $30.2 | $28.8 | $24.3 |

In Q2 2026, Microsoft recorded a $7.6 billion gain from its OpenAI investment due to dilution effects from OpenAI's recapitalization—an indication of how rapidly the AI company's valuation has increased.

Microsoft's Q2 CapEx surged to nearly $30 billion, reflecting its aggressive buildout of AI infrastructure. The company noted "continued investments in AI infrastructure and growing AI product usage" as a key driver of costs.

The Stargate Connection

The funding round intersects with Stargate, the $500 billion AI infrastructure initiative that OpenAI and SoftBank announced in January 2025. The project aims to build 10 gigawatts of data center capacity across the United States by 2029—enough to power AI training and inference at unprecedented scale.

Oracle is a key Stargate partner, building and operating data centers for OpenAI's workloads. By October 2025, Stargate had announced six major sites with nearly 7 gigawatts of planned capacity and over $400 billion in investment commitments.

The $100 billion equity raise serves a different purpose than Stargate's infrastructure debt: it provides OpenAI with balance sheet capital to fund:

- Training costs for next-generation models (GPT-5 and beyond)

- Inference infrastructure to serve hundreds of millions of ChatGPT users

- Research talent acquisition in a hypercompetitive market

- Strategic acquisitions as the AI industry consolidates

If the equity raise closes, it would give Stargate's debt holders significantly more comfort—a $100 billion equity cushion makes the infrastructure loans far less risky.

What It Means for Investors

The potential $100 billion round crystallizes several market dynamics:

For NVIDIA shareholders: The chipmaker would be taking a rare step of investing in the application layer, not just selling picks-and-shovels. A $30 billion investment at an $830 billion valuation implies NVIDIA believes OpenAI is worth roughly 3.6% of its own market cap.

For Microsoft shareholders: The company's existing 27% stake would be diluted by the new round, but the dilution gain accounting treatment means Microsoft could book additional profits. The partnership remains Microsoft's most important AI asset.

For Amazon shareholders: An OpenAI investment would signal that AWS sees OpenAI as a necessary partner, not just a competitor to be defeated through Anthropic. It's a tacit admission that the AI race requires multiple bets.

For Oracle shareholders: More capital flowing into OpenAI and Stargate means more demand for Oracle's data center services. The company's CapEx has already surged to support AI infrastructure buildout.

What to Watch

Near-term catalysts:

- Confirmation of term sheets and investment amounts

- Any changes to Microsoft's exclusive partnership rights

- Regulatory review—a deal of this size involving major tech companies may draw scrutiny

Longer-term questions:

- Does Amazon's investment change the competitive dynamics between AWS and Azure?

- Will NVIDIA's customer relationships be affected by picking OpenAI over other AI labs?

- How does this funding affect OpenAI's path to profitability (or lack thereof)?

The talks remain ongoing, and terms could change. But if the $100 billion round materializes as reported, it would be the largest private funding round in history—by a factor of roughly 5x—and would value a company founded in 2015 at more than Walmart, JPMorgan, and Visa combined.

Related Companies: Nvidia (nvda) · Microsoft (msft) · Amazon (amzn) · Oracle (orcl) · Arm Holdings (arm)

Photo: Fintool