Earnings summaries and quarterly performance for ARM HOLDINGS PLC /UK.

Research analysts who have asked questions during ARM HOLDINGS PLC /UK earnings calls.

Vivek Arya

Bank of America Corporation

8 questions for ARM

Andrew Gardiner

Citigroup

6 questions for ARM

Harlan Sur

JPMorgan Chase & Co.

6 questions for ARM

Lee Simpson

Morgan Stanley

6 questions for ARM

Timm Schulze-Melander

Rothschild & Co Redburn

5 questions for ARM

Vijay Rakesh

Mizuho

5 questions for ARM

John DiFucci

Guggenheim Securities

4 questions for ARM

Krish Sankar

TD Cowen

4 questions for ARM

Ross Seymore

Deutsche Bank

4 questions for ARM

Charles Shi

Needham & Company

3 questions for ARM

Joe Quatrochi

Wells Fargo

3 questions for ARM

Mark Lipacis

Evercore ISI

3 questions for ARM

Sebastien Naji

William Blair

3 questions for ARM

Srini Pajjuri

Raymond James Financial

3 questions for ARM

Jim Schneider

Goldman Sachs

2 questions for ARM

Joe Quattrocchi

Wells Fargo & Company

2 questions for ARM

Joseph Quatrochi

Wells Fargo Securities, LLC

2 questions for ARM

Mehdi Hosseini

Susquehanna Financial Group

2 questions for ARM

Simon Leopold

Raymond James

2 questions for ARM

Sreekrishnan Sankarnarayanan

Wolfe Research, LLC

2 questions for ARM

David O'Connor

BNP Paribas

1 question for ARM

Sebastien Cyrus Naji

William Blair & Company, L.L.C.

1 question for ARM

Srinivas Pajjuri

Raymond James & Associates, Inc.

1 question for ARM

Stephane Houri

ODDO BHF

1 question for ARM

Steven Chin

TD Cowen

1 question for ARM

Toshiya Hari

Goldman Sachs Group, Inc.

1 question for ARM

Recent press releases and 8-K filings for ARM.

- AI inference hardware leader Positron AI completed a $230 million Series B financing round, achieving a post-money valuation exceeding $1 billion.

- The financing was co-led by ARENA Private Wealth, Jump Trading, and Unless, with strategic investments from Arm and Qatar Investment Authority (QIA).

- The funds will accelerate the development of Positron's next-generation Asimov chip, targeting tape-out by end of 2026 and production by early 2027.

- Positron anticipates rapid revenue growth in 2026, aiming to become one of the fastest-growing semiconductor companies.

- Positron AI completed an oversubscribed Series B funding round, raising $230 million with a post-money valuation exceeding $1 billion.

- The funding round was led by ARENA Private Wealth, Jump Trading, and Unless, with strategic investments from Qatar Investment Authority (QIA), Arm, and Helena.

- The new capital will accelerate the development of Positron's Atlas systems and the next-generation Asimov silicon, with tape-out planned for late 2026 and production for early 2027.

- Positron's upcoming Asimov chip is projected to offer significantly higher memory capacity, with over 2304 GB RAM per device, and improved energy efficiency compared to competitors like Nvidia's Rubin GPU.

- Positron expects strong revenue growth for 2026, aiming to become one of the fastest-growing silicon companies.

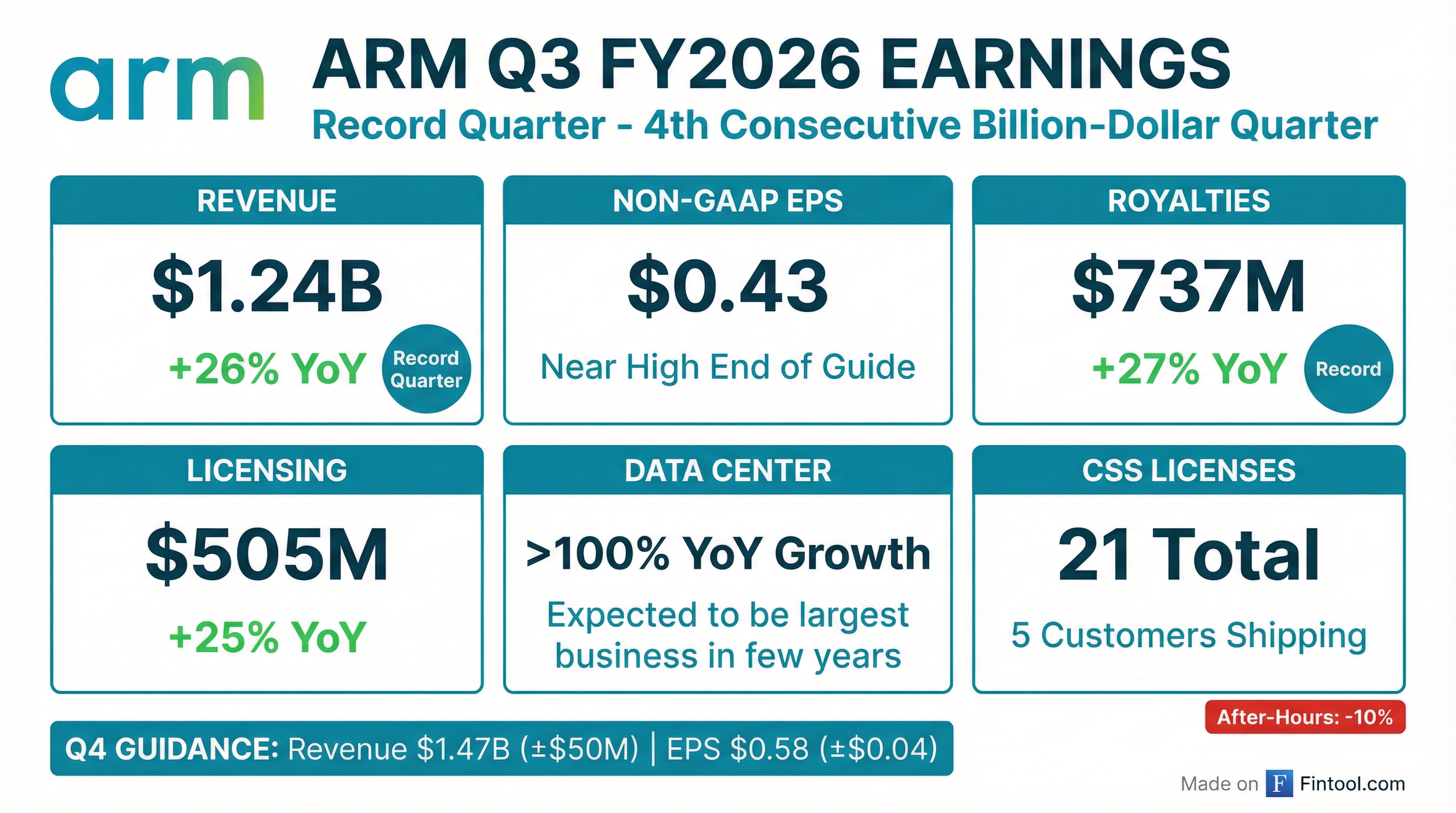

- Arm Holdings reported a strong Q3 2026, with revenue growing 26% year-over-year to $1.24 billion and non-GAAP EPS reaching $0.43.

- Royalty revenue increased 27% to a record $737 million, driven by strength in AI and general-purpose data centers, with data center royalty revenue growing over 100% year-over-year.

- License revenue was $505 million, up 25% year-over-year, with $200 million contributed by SoftBank.

- The company provided Q4 2026 revenue guidance of $1.47 billion plus or minus $50 million, representing approximately 18% year-over-year growth at the midpoint.

- Arm expects its data center business to become its largest business in a few years, with its share among top hyperscalers projected to reach 50%. Compute Subsystems (CSS) are also gaining traction, with their contribution to royalty mix expected to grow from teens to potentially 50% over the next 2-3 years.

- Arm reported a record Q3 2026 with total revenue of $1.24 billion, a 26% year-over-year increase, and non-GAAP EPS of $0.43. For Q4 2026, revenue is guided to approximately $1.47 billion (midpoint) with non-GAAP EPS of $0.58 ± $0.04.

- Royalty revenue grew 27% to $737 million, significantly boosted by data center royalty revenue increasing over 100% year-over-year, with the data center business projected to become Arm's largest.

- Compute Subsystems (CSS) momentum continues, with 21 licenses now across 12 companies, and CSS is anticipated to comprise up to 50% of the royalty mix within the next two to three years.

- Non-GAAP operating expenses rose 37% year-over-year to $716 million due to R&D investments, but the company anticipates full-year royalties to grow north of 20% and maintains a 20% growth rate as reasonable for 2027.

- Arm Holdings achieved a record third quarter for 2026, with total revenue increasing 26% year-on-year to $1.24 billion and non-GAAP EPS reaching $0.43.

- Royalty revenue grew 27% to a record $737 million, primarily driven by higher royalty rates in smartphones and triple-digit year-on-year growth in data center royalties, while license revenue rose 25% to $505 million.

- For Q4 2026, Arm expects revenue of $1.47 billion ± $50 million and non-GAAP EPS of $0.58 ± $0.04.

- The company's Compute Subsystems (CSS) are showing strong momentum, contributing well into the teens of the royalty mix and projected to reach upwards of 50% in the next two to three years.

- Growth in the Cloud AI business is currently more than compensating for potential demand destruction risks in consumer electronics.

- Arm Holdings plc reported total revenue of $1,242 million for the three months ended December 31, 2025, representing a 26% increase compared to the same period in the prior year, with net income of $223 million.

- For the nine months ended December 31, 2025, total revenue grew 24% to $3,430 million, and net income was $591 million.

- The company generated $1,264 million in net cash from operating activities for the nine months ended December 31, 2025, and held $2,807 million in cash and cash equivalents as of December 31, 2025.

- Arm received $143.4 million for its equity interest in Ampere and $39.3 million from the settlement of a convertible promissory note in December 2025, following SoftBank Group's acquisition of Ampere.

- The document also discusses recent U.S. export control regulations, including revised license review policies for AI chips to China and new tariffs, which could impact the semiconductor industry.

- Arm Holdings plc reported record third-quarter revenue of $1.24 billion, a 26% year-over-year increase, and non-GAAP diluted EPS of $0.43 for the fiscal year ending 2026.

- The company issued strong Q4 FYE26 guidance, forecasting revenue of $1.470 billion +/- $50 million and non-GAAP fully diluted EPS of $0.58 +/- $0.04.

- Royalty revenue grew 27% year-over-year to $737 million, driven by increased adoption of Arm technology in AI, data center, smartphones, physical AI, and edge AI markets.

- Demand for Arm Compute Subsystems (CSS) is robust, with 21 CSS licenses across 12 companies and five customers shipping CSS-based chips, contributing to royalty growth.

- SpacemiT, a Chinese RISC-V chip company, launched its new K3 AI CPU on January 29, 2026, designed to combine the open RISC-V instruction set with general-purpose and AI computing capabilities for intelligent terminals and edge computing.

- The K3 chip integrates eight high-performance X100 RISC-V CPU cores with a maximum frequency of 2.4GHz, delivering up to 60 TOPS of AI compute and supporting up to 32GB of LPDDR5 memory.

- SpacemiT's previous-generation K1 chip achieved over 150,000 unit shipments, and the K3 has already received orders, with initial deliveries planned from the end of April 2026.

- The company aims to establish differentiated advantages in the mid-range computing segment by focusing on lower power consumption, higher integration, and better cost efficiency, rather than directly competing with high-end server CPUs or GPUs.

- Arm Holdings reported Q2 revenue of $1.14 billion, a 34% year-over-year increase, and issued an optimistic Q3 forecast of approximately $1.23 billion, surpassing analyst expectations.

- The company's growth is primarily fueled by robust demand in artificial intelligence (AI) and data center markets, leading to increased royalties from chips using its designs and higher licensing revenue.

- Arm is strategically expanding its role by designing and developing its own chips through 'Compute Subsystems' (CSS), with its Neoverse platform revenue doubling and projected to achieve nearly 50% of top-tier data center deployments by 2025.

- Arm's business diversification includes contributions from cloud and networking (10%), automotive (7%), and IoT/embedded systems (18%), though smartphones still account for 45% of royalties.

- Arm reported strong Q2 FY26 results with revenue of $1.14 billion, up 34% year-on-year, marking its third consecutive billion-dollar quarter.

- Royalty revenue reached a record $620 million, increasing 21% year-on-year, primarily driven by growth in data center, smartphones, automotive, and IoT, with data center Neoverse royalties more than doubling.

- Licensing revenue rose 56% to $515 million, fueled by demand for next-generation architectures and strategic engagements, including an expanded agreement with SoftBank.

- Non-GAAP EPS for Q2 FY26 was $0.39, exceeding the high end of guidance.

- For Q3 FY26, Arm projects revenue of $1.225 billion (midpoint), an approximate 25% year-on-year growth, and non-GAAP EPS of $0.41 (midpoint).

Quarterly earnings call transcripts for ARM HOLDINGS PLC /UK.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more