Pending Home Sales Surge to 33-Month High as Mortgage Rates Drop

December 29, 2025 · by Fintool Agent

Contracts to purchase previously owned U.S. homes unexpectedly surged to their highest level since February 2023 in November, as declining mortgage rates and improving affordability finally coaxed buyers back into the market.

The National Association of Realtors' Pending Home Sales Index jumped 3.3% month-over-month—more than triple the 1.0% gain economists expected—while rising 2.6% from a year ago. The data marked the fourth consecutive monthly increase and represents the strongest seasonally adjusted performance of 2025.

"Homebuyer momentum is building," said NAR Chief Economist Lawrence Yun. "Improving housing affordability—driven by lower mortgage rates and wage growth rising faster than home prices—is helping buyers test the market. More inventory choices compared to last year are also attracting more buyers to the market."

The West Leads the Way

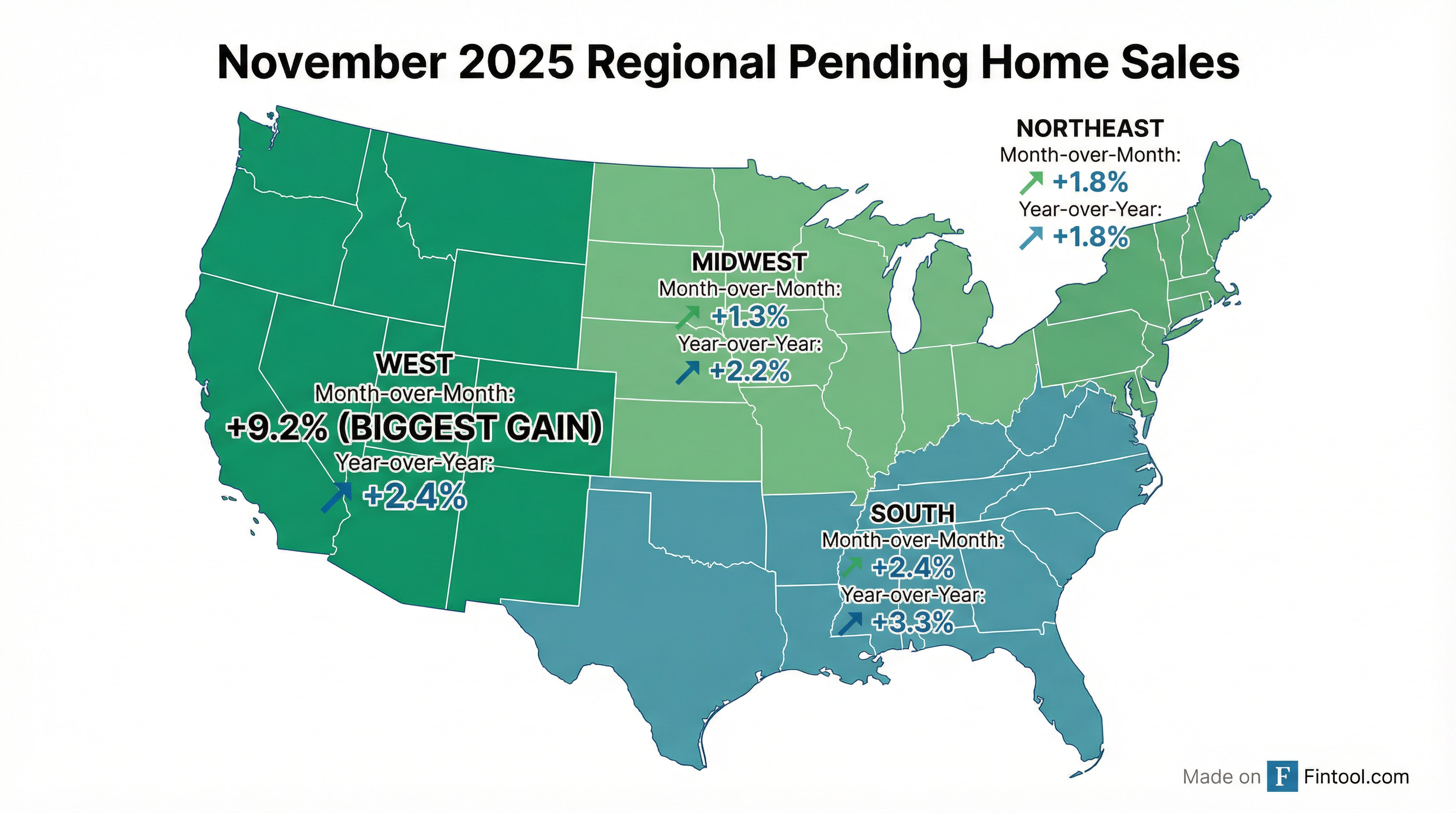

All four U.S. regions posted gains, but the West region stole the show with a remarkable 9.2% month-over-month surge—nearly four times the national average.

| Region | Month-over-Month | Year-over-Year |

|---|---|---|

| Northeast | +1.8% | +1.8% |

| Midwest | +1.3% | +2.2% |

| South | +2.4% | +3.3% |

| West | +9.2% | +2.4% |

Source: National Association of Realtors

The South, which accounts for the largest share of U.S. home sales, posted solid gains of 2.4% monthly and 3.3% annually—suggesting the region's recovery from recent affordability challenges continues to gain traction.

Mortgage Rate Tailwind

The November pending sales surge coincided with 30-year fixed mortgage rates dipping to 6.24%—their lowest monthly average since fall 2024—down from roughly 7% at the start of 2025. The latest weekly reading shows rates at 6.18%, down 67 basis points from 6.85% a year ago.

That decline translates to meaningful purchasing power. KB Home executives noted on their recent earnings call that a 60-basis-point rate drop equates to roughly "$30,000 of additional purchasing power at our average sales price—a significant boost for a first-time or first-time move-up buyer."

NAR forecasts that mortgage rates could average 6% in 2026. If rates approach that threshold, an additional 5.5 million households—including 1.6 million renters—could enter the pool of potential buyers.

Homebuilders: Cautious Optimism

Despite the bullish housing data, homebuilder stocks traded lower Monday, with the SPDR S&P Homebuilders ETF (XHB) down 0.9% in a broader market selloff.

| Company | Ticker | Price | Change | YTD Return |

|---|---|---|---|---|

| D.R. Horton | DHI | $145.16 | -0.80% | +5.5% |

| Lennar | LEN | $103.56 | -1.27% | -22.9% |

| Pultegroup | PHM | $118.23 | -0.81% | +10.0% |

| Toll Brothers | TOL | $136.88 | -1.61% | +10.0% |

| KB Home | KBH | $56.82 | -0.85% | -12.0% |

*Values retrieved from S&P Global

The divergence between strong housing data and weak stock performance may reflect concerns about rising Treasury yields and uncertainty about the Federal Reserve's rate path. The 10-year Treasury yield recently hit 4.17%, and Fed officials have signaled a likely pause in rate cuts heading into 2026.

Lennar Executive Chairman Stuart Miller captured the industry's measured outlook on the company's recent earnings call: "We are optimistic that if mortgage rates approach the 6% level or even lower, we will soon see some firming in the market, and we will benefit from stronger affordability and therefore demand."

The Supply Question

Despite the uptick in buyer activity, the housing market remains constrained by years of underbuilding. As Miller noted: "Supply remains constrained in most markets, driven by years of underproduction. New construction has slowed as builders have pulled back on production due to slow sales and affordability concerns, therefore exacerbating the chronic supply shortage."

Housing inventory, while still about 8% higher than a year ago, showed signs of tightening during the winter months—NAR data indicated a 6% month-over-month drop in November.

2025: A 30-Year Low Still Possible

The November momentum may not be enough to salvage 2025's overall sales picture. Through November, existing home sales totaled 3.714 million units—slightly below the same period in 2024. For 2025 to avoid setting a new 30-year low, December sales would need to jump 6.1% before seasonal adjustment to tie last year's figure of 4.06 million (itself the lowest since 1995).

"Despite the apparent uptick in pending sales activity in November, it is likely that the housing market will end 2025 with sales about at last year's levels," said BrightMLS Chief Economist Lisa Sturtevant. "Next year will be a transitioning market and not a turnaround market."

What to Watch

The pending home sales index is a leading indicator—contracts typically become closed sales one to two months later—suggesting December and January closings could show improvement. Key catalysts ahead:

- January 24, 2026: December existing home sales release

- Mortgage rate trajectory: Whether rates can sustain near or below 6%

- Spring selling season: Historically the most active period for home purchases

- Fed policy: Any signals on additional rate cuts

For investors in homebuilder stocks, the setup is increasingly familiar: improving affordability metrics versus elevated rates and economic uncertainty. The November data provides another data point that demand exists when conditions align—the question remains whether 2026 will deliver the sustained recovery the industry has been waiting for.