Patient Death in Hympavzi Trial Deepens Pfizer's Blood Disorder Woes

December 23, 2025 · by Fintool Agent

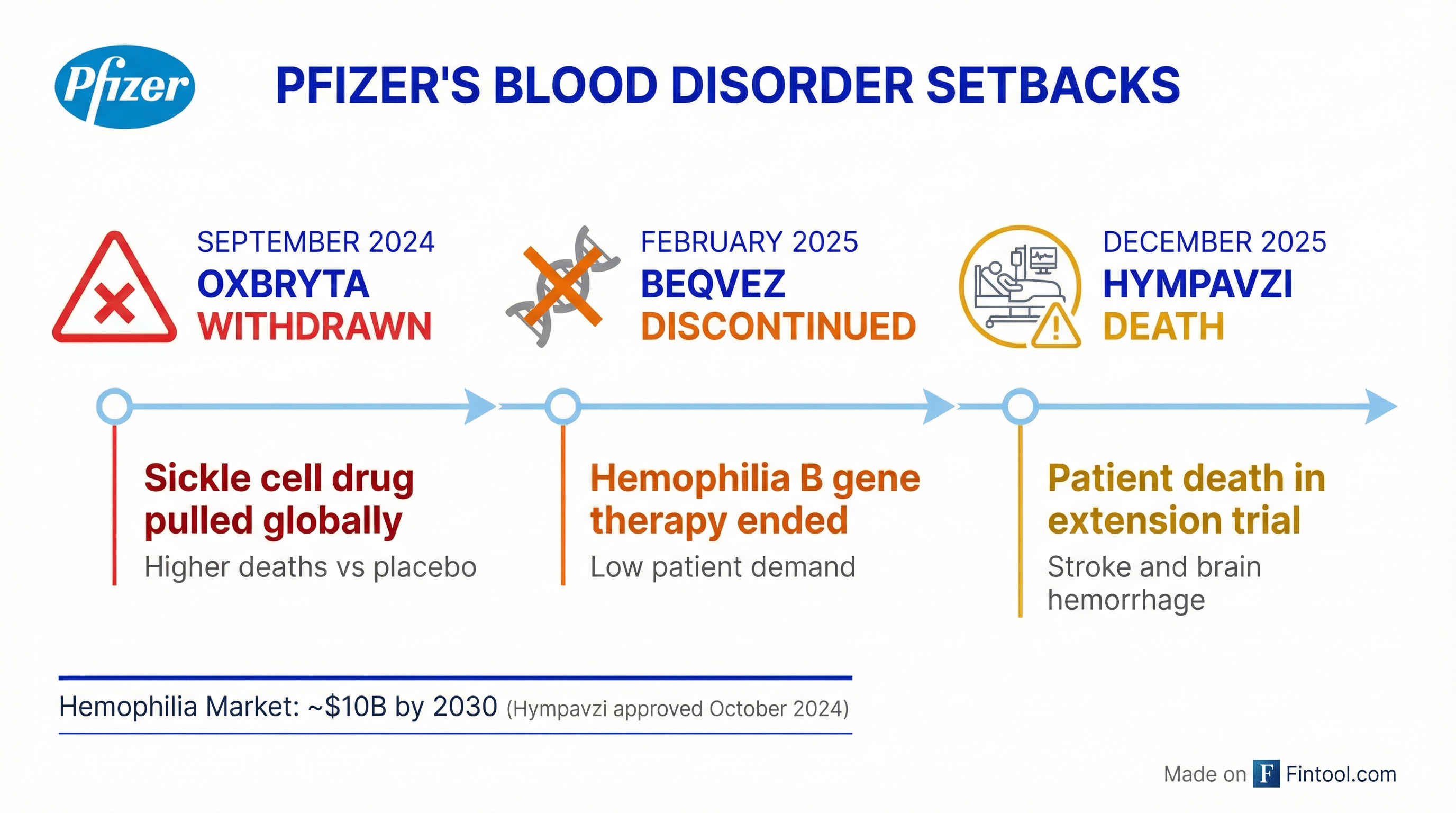

A patient has died in an ongoing clinical trial of Pfizer's hemophilia drug Hympavzi (marstacimab), the company disclosed Monday—marking the third major setback for Pfizer's blood disorder portfolio in just 15 months.

The patient, who had hemophilia A with inhibitors, died on December 14 after experiencing a cerebellar infarction (stroke) followed by a cerebral hemorrhage, according to the European Haemophilia Consortium. The death occurred during a long-term extension study of marstacimab, where the patient was receiving the drug as prophylaxis along with recombinant factor VIIa following minor surgery.

The news comes as Pfizer was counting on Hympavzi to anchor its hemophilia franchise after abandoning two other blood disorder treatments this year. The drug was approved in October 2024 as the first anti-TFPI (tissue factor pathway inhibitor) therapy for hemophilia A and B—and the first hemophilia treatment available in a pre-filled auto-injector pen.

A Pattern of Blood Disorder Setbacks

The Hympavzi death caps a troubled stretch for Pfizer's hematology ambitions:

September 2024: Oxbryta Withdrawn Pfizer voluntarily pulled its sickle cell disease drug Oxbryta (voxelotor) from all global markets after postmarketing data revealed a higher rate of vaso-occlusive crises and deaths in patients receiving the drug compared to placebo. The FDA had granted accelerated approval in 2019, but confirmatory trials showed the benefit no longer outweighed the risk.

February 2025: Beqvez Discontinued Pfizer ended global development and commercialization of Beqvez, its $3.5 million hemophilia B gene therapy, citing weak patient demand. The company had licensed the therapy from Spark Therapeutics in 2014 and won FDA approval in April 2024, but failed to generate meaningful sales. The decision effectively ended Pfizer's gene therapy ambitions.

December 2025: Hympavzi Patient Death Now, Pfizer's remaining hemophilia asset faces scrutiny following the trial fatality. The company says it is working with investigators and an independent Data Monitoring Committee to understand the circumstances, including the patient's underlying conditions and concurrent medications.

Why the Mechanism Matters

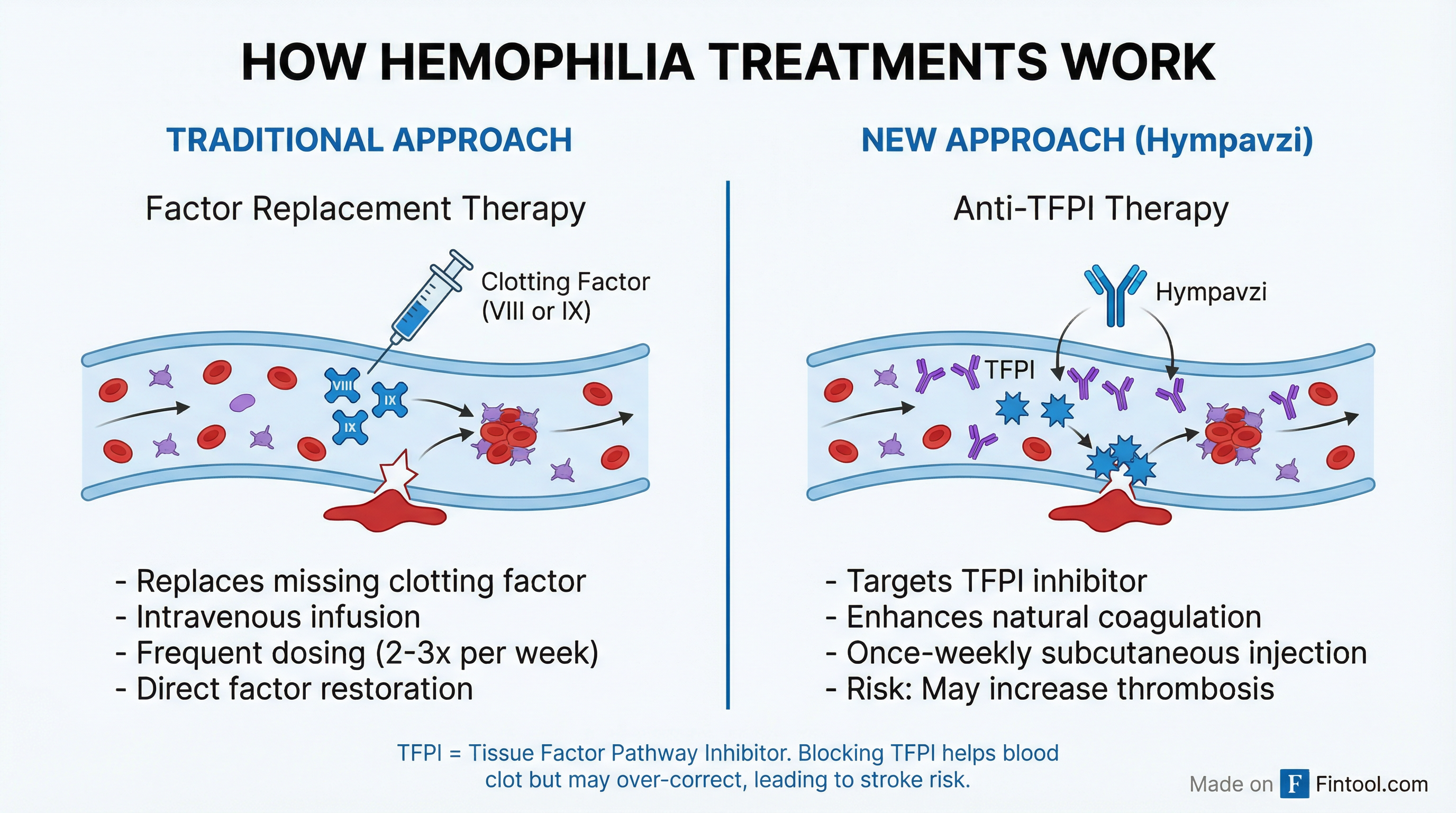

The death highlights the inherent risk of anti-TFPI therapies. Unlike traditional factor replacement treatments that add missing clotting proteins, Hympavzi works by blocking TFPI—one of the body's natural mechanisms that inhibits blood clotting.

By targeting the Kunitz 2 domain of TFPI, Hympavzi enhances thrombin generation to help blood clot more effectively. But that same mechanism carries thrombotic risk—the possibility of clots forming inappropriately, leading to stroke or other cardiovascular events.

"Thrombotic events are considered an adverse event for rebalancing therapies such as marstacimab," the European Haemophilia Consortium noted in its statement. Similar events have been reported with other non-factor hemophilia treatments, particularly when used alongside clotting factor concentrates in surgical settings.

Pfizer emphasized that no deaths or thromboembolic events had been reported in the Phase 3 BASIS study for patients without inhibitors. But the extension trial—which enrolled patients who may have more complex cases—now raises questions about long-term safety in real-world use.

Hympavzi's Differentiated Position

Despite the setback, Hympavzi occupies a unique position in the hemophilia market:

- First anti-TFPI approved in the U.S. and Europe for hemophilia A or B

- Once-weekly subcutaneous dosing via pre-filled auto-injector pen

- Only weekly subcutaneous option for hemophilia B patients

- 93% reduction in bleeding versus on-demand treatment in patients with inhibitors

The Phase 3 BASIS study showed Hympavzi demonstrated "a statistically significant and clinically meaningful 93% reduction in annualized bleeding rate" in the inhibitor cohort—results that management said compared favorably to competing products.

Pfizer had been planning regulatory filings to expand Hympavzi's label to patients with inhibitors, a population with limited treatment options and higher disease burden. That path now faces uncertainty.

Competitive Landscape

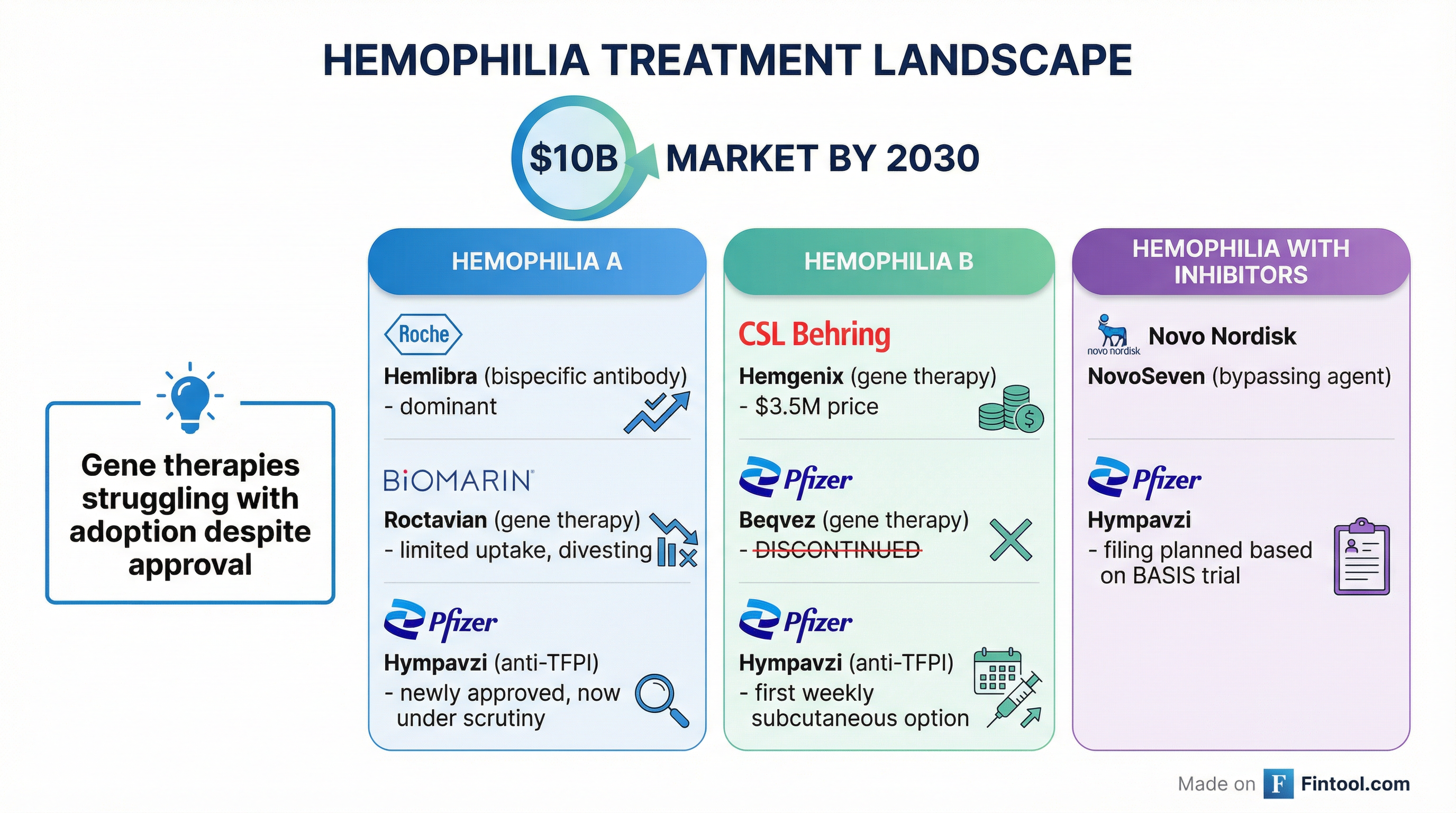

The hemophilia market is projected to reach nearly $10 billion by 2030, according to Pfizer. But the competitive dynamics are shifting:

Gene Therapy Struggles Despite approvals, hemophilia gene therapies have disappointed commercially. Biomarin recently announced plans to divest Roctavian, its hemophilia A gene therapy, after struggling with adoption in the U.S., Germany, and Italy. CSL Behring's Hemgenix and Pfizer's now-discontinued Beqvez faced similar challenges—high price tags ($3.5 million), durability concerns, and logistical hurdles have limited uptake.

Bispecific Antibodies Dominate Roche's Hemlibra (emicizumab) has emerged as the dominant hemophilia A treatment, offering subcutaneous dosing and broad efficacy. Hympavzi was positioned as an alternative for patients seeking a different mechanism—but the safety question now looms larger.

Bypassing Agents Remain Standard For patients with inhibitors, Novo Nordisk's NovoSeven and other bypassing agents remain standard of care. Hympavzi's potential expansion into this population was seen as a significant growth opportunity.

Financial Context

Pfizer reported Q3 2025 revenue of $16.7 billion, with net income of $3.5 billion. The company has not disclosed specific Hympavzi sales figures, though management noted "considerable quarter-over-quarter growth" in the hemophilia B market where subcutaneous treatments were newly available.

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $17.8 | $13.7 | $14.7 | $16.7 |

| Net Income ($B) | $0.4 | $3.0 | $2.9 | $3.5 |

| Gross Margin | 67.7% | 81.1% | 76.1% | 76.1% |

Hympavzi is unlikely to move Pfizer's needle immediately—the hemophilia patient population is small (roughly 800,000 people worldwide), and the drug was only recently approved. But it represented a strategic commitment to specialty rare disease markets where Pfizer could establish durable franchises.

What Happens Next

Pfizer said it does not anticipate any immediate impact to patients currently on Hympavzi based on "the overall clinical data collected to date." The company is reviewing surgical management protocols within the marstacimab development program and has notified regulatory authorities.

Key questions going forward:

-

Will regulators require label changes? The FDA and EMA may mandate additional warnings or restrictions, particularly around perioperative use.

-

Can Pfizer still pursue the inhibitor indication? The deceased patient had hemophilia A with inhibitors—the exact population Pfizer hoped to target with a label expansion.

-

What does this mean for the TFPI inhibitor class? Other companies developing anti-TFPI therapies may face increased regulatory scrutiny.

-

Will Hympavzi's launch trajectory stall? Physicians may become more cautious about prescribing, particularly in surgical settings where the death occurred.

For Pfizer, the death adds to a mounting narrative of blood disorder missteps—raising questions about whether the company can establish credibility in hematology after three high-profile setbacks in rapid succession.