Powell to Attend Supreme Court Arguments in Constitutional Showdown Over Fed Independence

January 19, 2026 · by Fintool Agent

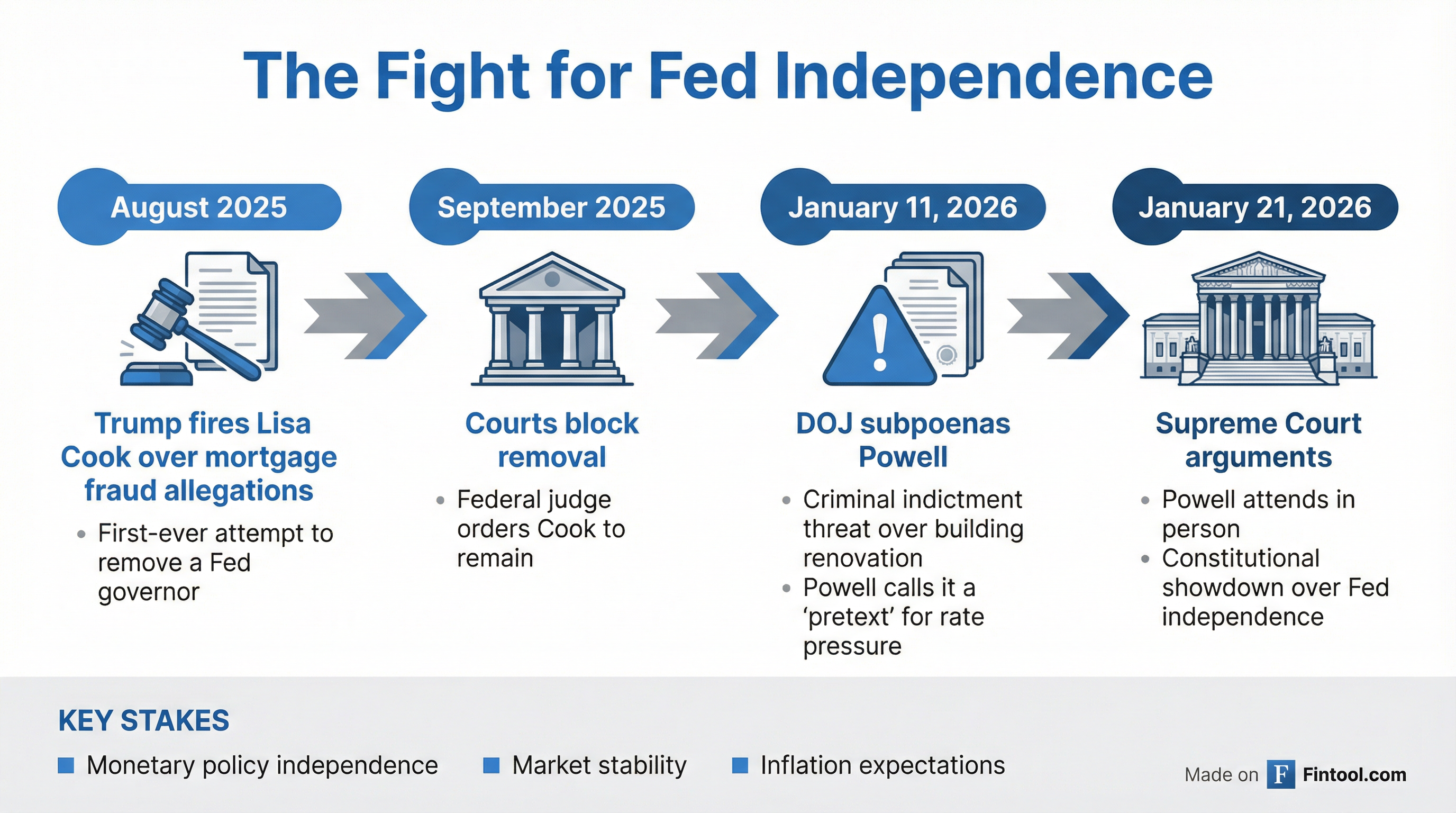

Federal Reserve Chair Jerome Powell will attend the Supreme Court's oral arguments Wednesday in Trump v. Cook, the first-ever constitutional test of a president's power to remove a Fed governor—an extraordinary public showing as the central bank fights to preserve its century-old independence from political interference .

Powell's decision to attend comes just 10 days after he delivered a rare video statement condemning Department of Justice subpoenas threatening criminal indictment as "pretexts" for President Trump's campaign to force sharper interest rate cuts .

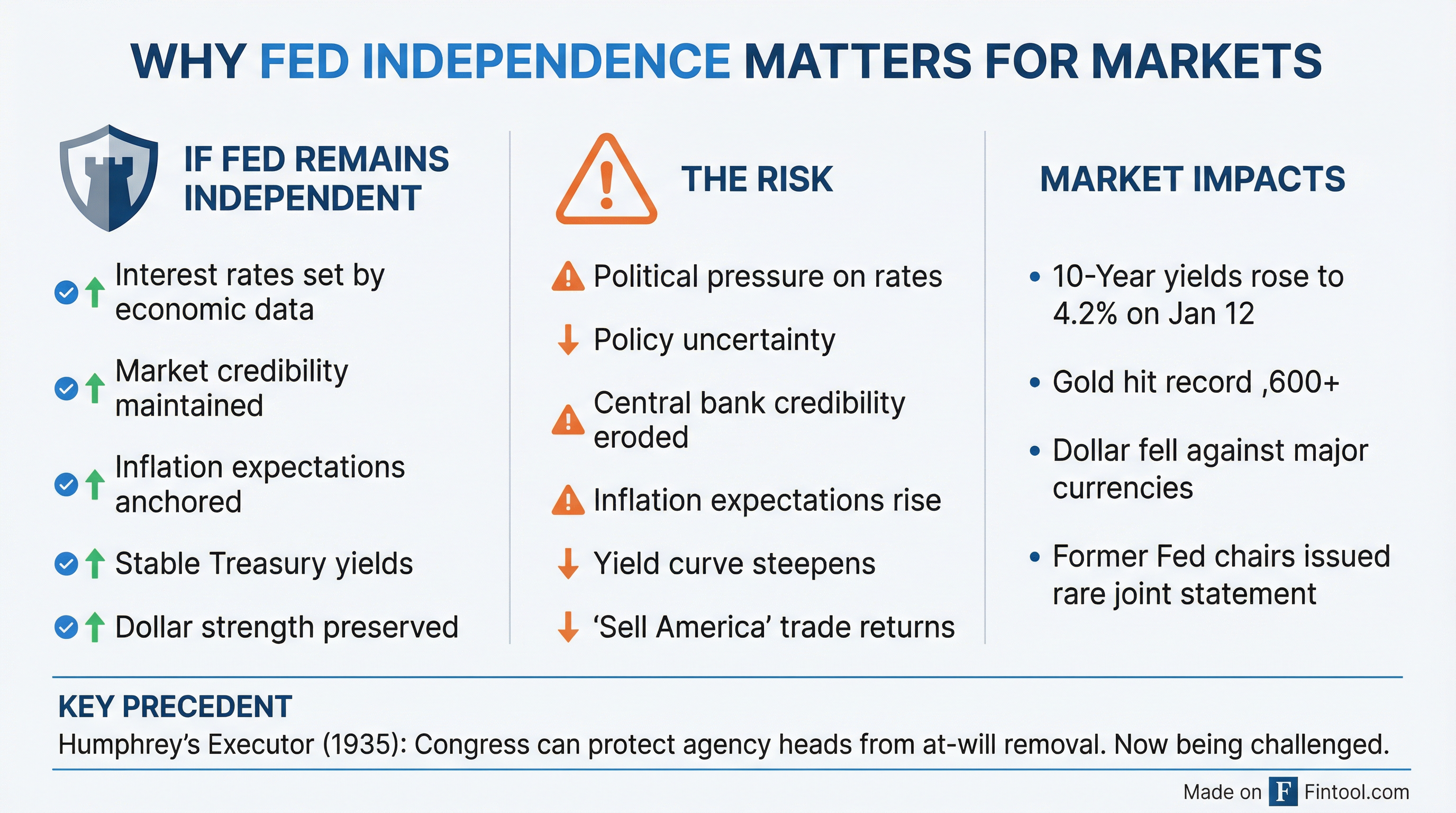

The stakes couldn't be higher: a ruling favoring Trump could erode the Fed's ability to set monetary policy free from political pressure—the cornerstone of credible central banking that keeps inflation expectations anchored and financial markets stable.

The Case: Trump v. Cook

The case centers on President Trump's August 2025 attempt to fire Fed Governor Lisa Cook over allegations of mortgage fraud—the first time a president has ever tried to remove a Fed governor .

Cook, the first Black woman to serve on the Federal Reserve Board, has "unequivocally" denied the fraud allegations and remains in her position after lower courts blocked her removal .

The Federal Reserve Act provides that governors can only be removed "for cause"—a protection Congress designed to insulate the central bank from political meddling . The exact parameters of that standard have never been tested in court until now.

The Escalation: Criminal Threats Against Powell

The Cook case has escalated into a broader assault on Fed independence. On January 11, Powell revealed that the Justice Department served grand jury subpoenas threatening criminal indictment related to his Senate testimony about a $2.5 billion headquarters renovation .

Powell's public rebuke was unprecedented for a Fed chair:

"This new threat is not about my testimony last June or about the renovation of the Federal Reserve buildings... Those are pretexts. The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

— Jerome Powell, Fed Chair, January 11, 2026

The probe was approved by Jeanine Pirro, the U.S. Attorney in Washington and a longtime Trump ally, without briefing Attorney General Pam Bondi or Deputy Attorney General Todd Blanche .

Trump denied knowledge of the investigation but added: "He's certainly not very good at the Fed, and he's not very good at building buildings" .

Former Fed Chiefs Unite in Defense

The attack prompted an extraordinary joint statement from former Fed chairs Ben Bernanke, Janet Yellen, and Alan Greenspan, alongside former Treasury secretaries, calling it "an unprecedented attempt to use prosecutorial attacks" to undermine Fed independence .

Fourteen central bank heads from around the world issued a solidarity statement on January 12: "We stand in full solidarity with the Federal Reserve System and its Chair Jerome H. Powell" .

Yellen, who served under Trump before Powell replaced her, told CNBC the probe was "extremely chilling" and that "the market should be concerned" .

Market Reaction: The 'Sell America' Trade Returns

The subpoena announcement initially triggered a "Sell America" trade reminiscent of Trump's Liberation Day tariff rollout last April .

| Metric | Movement | Date |

|---|---|---|

| 10-Year Treasury Yield | Rose to 4.2% (highest since August) | Jan 12 |

| 30-Year Treasury Yield | Rose above 4.8% | Jan 12 |

| Gold | Hit record $4,600+ | Jan 12 |

| Dollar Index | Fell 0.34% to 98.90 | Jan 12 |

| S&P 500 | Recovered to close up 0.2% at record high | Jan 12 |

"The combined drop in the dollar, equities and Treasuries was a reminiscence of the 'sell America' days of last spring," ING strategists wrote .

Markets ultimately steadied, but the episode highlighted investor sensitivity to Fed independence. As Krishna Guha of Evercore ISI noted: "The readiness to use criminal subpoenas to pressure the Fed will make it even harder for the next chair to convince markets and the public of his own technocratic independence, making it harder to control inflation and inflation expectations" .

The Legal Framework: Humphrey's Executor Under Fire

The constitutional question hinges on Humphrey's Executor v. United States (1935), the landmark precedent that allowed Congress to protect certain agency heads from at-will presidential removal .

The Trump administration has aggressively challenged this 90-year precedent. In Trump v. Wilcox last May, the Supreme Court allowed Trump to fire officials from the NLRB and MSPB while their challenges proceed—but notably carved out the Federal Reserve as different .

The Court wrote: "The Federal Reserve is a uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States" .

Legal analysts see this as a sign the justices may protect the Fed specifically while narrowing Humphrey's for other agencies. But Justice Kagan warned in dissent that the Fed's independence "rests on the same constitutional and analytic foundations" as other agencies .

Congressional Backlash

Several Republican senators have condemned the administration's actions:

-

Sen. Thom Tillis (R-NC): "I will oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is fully resolved"

-

Sen. Lisa Murkowski (R-AK): "The stakes are too high to look the other way: if the Federal Reserve loses its independence, the stability of our markets and the broader economy will suffer"

-

Senate Majority Leader John Thune (R-SD): "If the Justice Department is pursuing something, I hope they have a smoking gun or something, because I don't think you trifle with the Federal Reserve"

The backlash could complicate Trump's plans to nominate a new Fed chair when Powell's term expires in May.

Who Is Lisa Cook?

Lisa Cook, 61, is a renowned economist who became the first Black woman on the Fed Board when confirmed in 2022 .

Her credentials are formidable:

- Education: BA from Spelman College (magna cum laude), PPE from Oxford (Marshall Scholar), PhD in Economics from UC Berkeley

- Career: Professor at Michigan State, Senior Economist at Obama's Council of Economic Advisers, Harvard Kennedy School faculty

- Research: Pioneering work on racial discrimination's economic costs, Russian banking systems

- Confirmation: 51-50 Senate vote with VP Harris casting tie-breaker

Cook's term runs until 2038. She has denied the mortgage fraud allegations and says she is "prepared to refute the allegations in an appropriate forum" .

What to Watch

Wednesday, January 21: Supreme Court oral arguments in Trump v. Cook. Powell's attendance will be closely watched as a symbol of Fed solidarity.

January 27-28: Next FOMC meeting with interest rate decision. Both Powell and Cook will participate.

May 2026: Powell's term as chairman expires. He could remain on the Board until 2028, but Trump has been openly interviewing replacements.

The Court's eventual ruling—likely not until later this year—could either cement the Fed's independence for generations or provide a roadmap for presidents to exert control over monetary policy.

As Reuters noted: "The most consequential test of the Federal Reserve's independence in more than a century of existence comes before the U.S. Supreme Court this week" .