Qualcomm Stock Crashes 8% as AI Devours Memory, Squeezing Smartphones

February 5, 2026 · by Fintool Agent

Qualcomm shares plunged 8.5% to $136.30 on Thursday after the chipmaker delivered record quarterly results but slashed next-quarter guidance, warning that AI's insatiable appetite for high-bandwidth memory is starving the smartphone industry of critical components.

The paradox is stark: record revenues of $12.3 billion and EPS of $3.50 at the high end of guidance, yet a guidance cut that sent shares tumbling and dragged fellow chip designer Arm Holdings down 7.5% as both companies confirmed that memory shortages will constrain smartphone production through at least fiscal 2026—and potentially into 2027.

The Memory Squeeze: AI Eats First

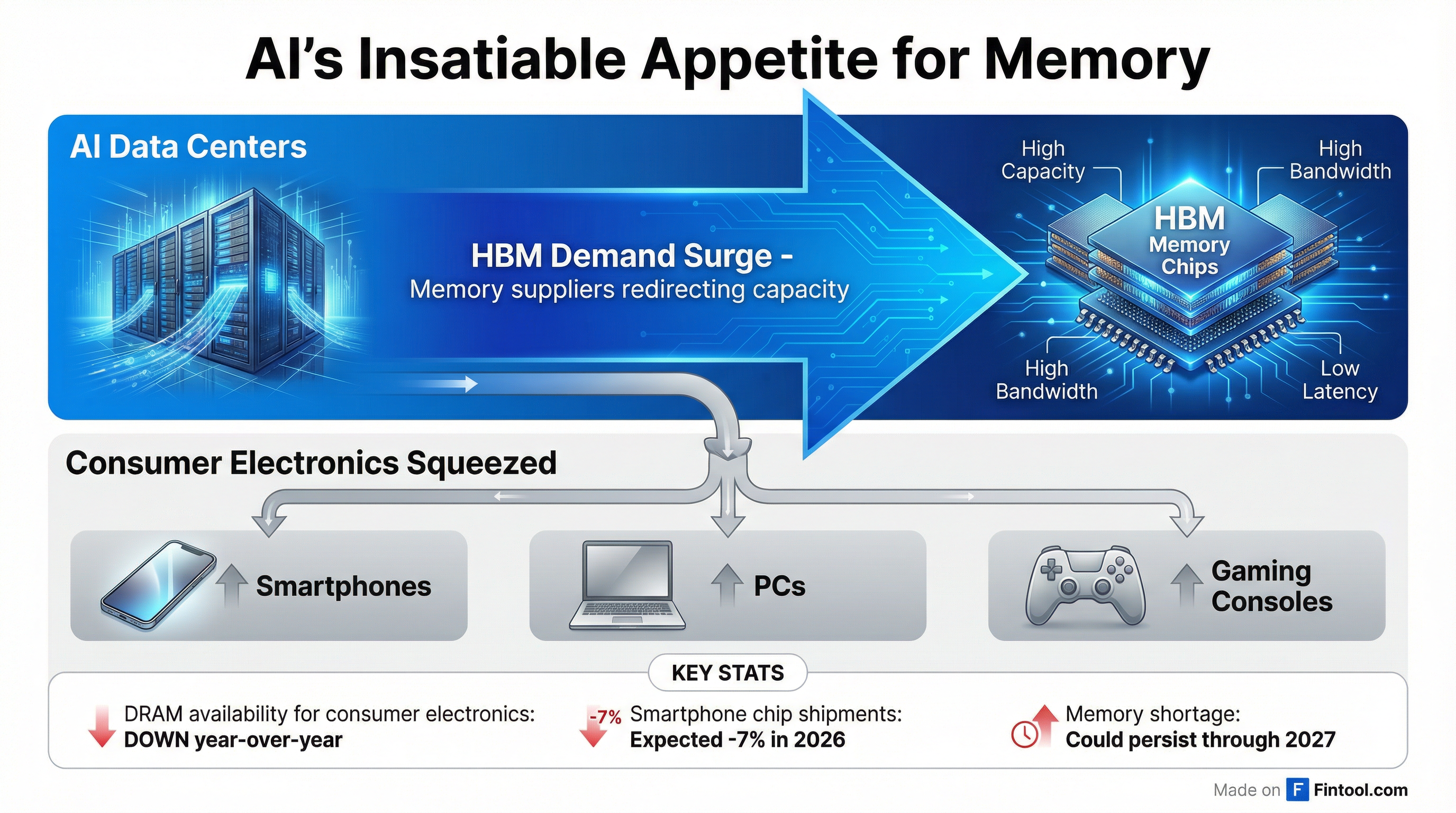

The culprit is not weak demand—it's physics and economics. Memory suppliers are redirecting manufacturing capacity from standard DRAM to High Bandwidth Memory (HBM), the specialized chips required to feed AI data centers.

"As memory suppliers redirect manufacturing capacity to HBM to meet AI data center demand, the resulting industry-wide memory shortage and price increases are likely to define the overall scale of the handset industry through the fiscal year," CEO Cristiano Amon said on the earnings call.

The problem extends well beyond Qualcomm. Goldman Sachs analyst William Chan warned clients: "Memory shortage is real and accelerating due to the AI infra demand... If you want to buy any consumer goods, PCs, or smartphones—do it now."

Record Quarter, Slashed Outlook

Qualcomm's Q1 FY2026 results delivered records across nearly every metric—total revenue, non-GAAP EPS, handset revenue, and automotive revenue. But the forward guidance told a different story.

| Metric | Q1 FY26 Actual | Q2 FY26 Guidance | Change |

|---|---|---|---|

| Total Revenue | $12.3B (Record) | $10.2B-$11.0B | -11% to -17% |

| QCT Handsets | $7.8B (Record) | $6.0B | -23% |

| QCT Automotive | $1.1B (+15% YoY) | +35% YoY guidance | Accelerating |

| Non-GAAP EPS | $3.50 | $2.45-$2.65 | -24% to -30% |

CFO Akash Palkhiwala was blunt about causation: "We've seen several OEMs, especially in China, take actions to reduce their handset build plans and channel inventory. Our guidance for the upcoming quarter reflects the latest signals from these customers, which includes reduced chipset orders aligned with their scaled-back expectations for build plans."

When asked if any other factors were driving the weakness, Amon was unequivocal: "It's 100% related to memory."

Arm Confirms Industry-Wide Pain

Arm Holdings, whose chip architecture powers most of the world's smartphones including those using Qualcomm chips, confirmed the cascading impact.

"Arm's royalty revenues over its next year could be hurt by as much as 2% due to the impact of memory shortages on cell phone supply," CFO Jason Child said on the company's earnings call.

Arm shares fell 7.5% in after-hours trading, with analysts noting that smartphones remain the company's largest end market at roughly half of revenues.

J.P. Morgan now expects double-digit percentage decline in global smartphone shipments as rising memory costs crush demand in the mid-to-low-end device segment. Counterpoint Research projects global advanced smartphone chip shipments to decline 7% in 2026 due to memory constraints.

The Winners and Losers

The memory shortage creates a hierarchy of winners and losers within the smartphone ecosystem.

More Insulated:

- Apple: Large scale provides better memory allocation access; internal chip design team

- Samsung: Integrated memory division gives priority access to internal supply

- Premium tier devices: Can absorb price increases; OEMs will prioritize profitable flagships

Most Exposed:

- Chinese OEMs: Qualcomm specifically called out Chinese phone makers reducing build plans

- Mid-to-low-end devices: Cannot absorb price increases; will face largest volume cuts

- Smaller OEMs: Less bargaining power for memory allocation

Amon acknowledged the asymmetry: "OEMs with larger scale will have probably better ability to have enough memory, and they will make priority calls than OEMs with smaller scale."

The premium tier has historically proven resilient to supply constraints. "When we go back to situations that we saw in the past, I think the best proxy is what happened during the pandemic," Amon said. "The premium and high tier has proven to be more resilient to price increases."

How Long Will This Last?

The outlook remains uncertain, but executives and analysts expect extended pain:

| Source | Duration Estimate |

|---|---|

| Qualcomm (Amon) | "Through the fiscal year" (ends Sept 2026) |

| Morningstar | Memory tightness persisting "well into 2027" |

| J.P. Morgan | Supply shortage "through 2027" |

| DRAM Makers | Satisfying only 50%-70% of demand; shortages possible through 2028 |

Memory manufacturers are caught in a profitable trap: HBM commands significantly higher margins than standard DRAM. Every wafer allocated to AI data centers is a wafer not available for smartphones.

Bright Spots: Automotive and Data Center

While handsets suffer, Qualcomm's diversification strategy is paying off in other segments.

Automotive: Record revenue of $1.1 billion grew 15% year-over-year, with guidance for 35%+ growth in Q2. New partnerships with Volkswagen Group (including Audi and Porsche), Toyota's RAV4, and expanded ADAS design wins reinforce the trajectory.

Data Center: Qualcomm expects memory shortages will NOT affect its AI chip rollout. "We do not expect the global memory shortage to affect our rollout of AI chips for data centers," Amon told Reuters. The company expects meaningful data center revenue in fiscal 2027.

IoT: Revenue grew 9% year-over-year to $1.7 billion, with low-teens growth expected in Q2 from industrial and consumer products.

What to Watch

Near-term catalysts:

- Samsung Galaxy unpacked launch (Qualcomm expects ~75% share of premium devices)

- Memory pricing trajectory through Q2

- Chinese OEM inventory drawdowns

Longer-term questions:

- How long will memory suppliers prioritize HBM over consumer DRAM?

- Can capacity additions alleviate shortages before 2028?

- Will premium tier resilience offset mid/low-end volume declines?

The irony is not lost on investors: the same AI boom driving semiconductor valuations is now constraining the smartphone industry that still represents the majority of Qualcomm's revenue. The memory shortage may be temporary, but its impact on 2026 smartphone volumes appears locked in.