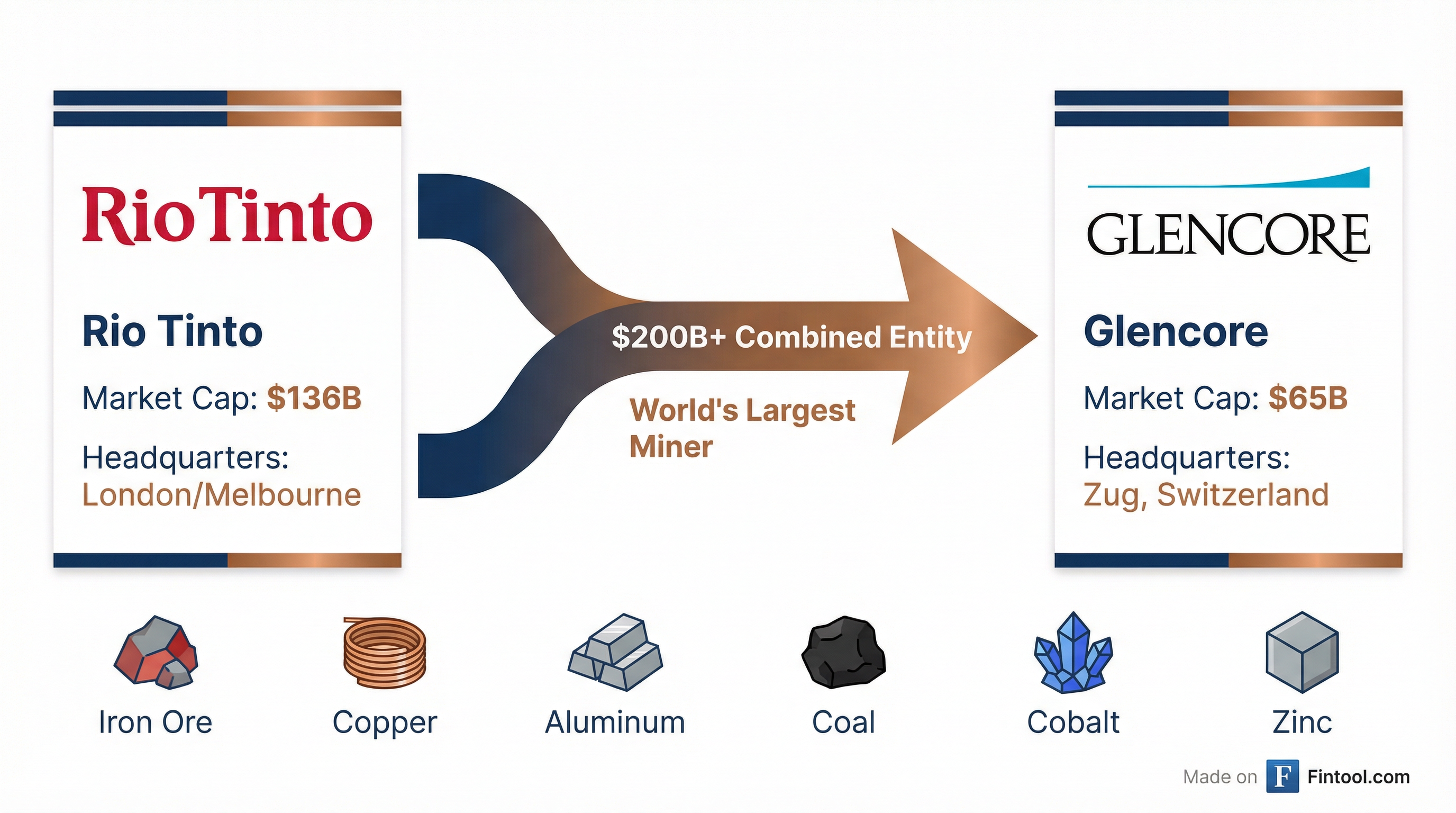

Rio Tinto Assembles Dream Team of Bankers for $200B Glencore Pursuit

January 13, 2026 · by Fintool Agent

Rio Tinto has assembled a powerhouse roster of investment bankers—including legendary dealmaker Simon Robey—to pursue what could become the largest mining acquisition in history: a takeover of Glencore that would create a $200 billion-plus behemoth dominating global copper supply.

Rio Tinto has retained JPMorgan, Evercore, Macquarie, and UBS to advise on the pursuit, sources told Reuters and Bloomberg. The roles are highly coveted—bankers are jostling for a share of what could exceed $100 million in advisory fees.

Rio Tinto shares rose 1% to $83.75 on the news, while Glencore has yet to formally retain an adviser. Citigroup, which has longstanding ties to Glencore and advised on its failed 2023 bid for Teck Resources, is reportedly in discussions for a role.

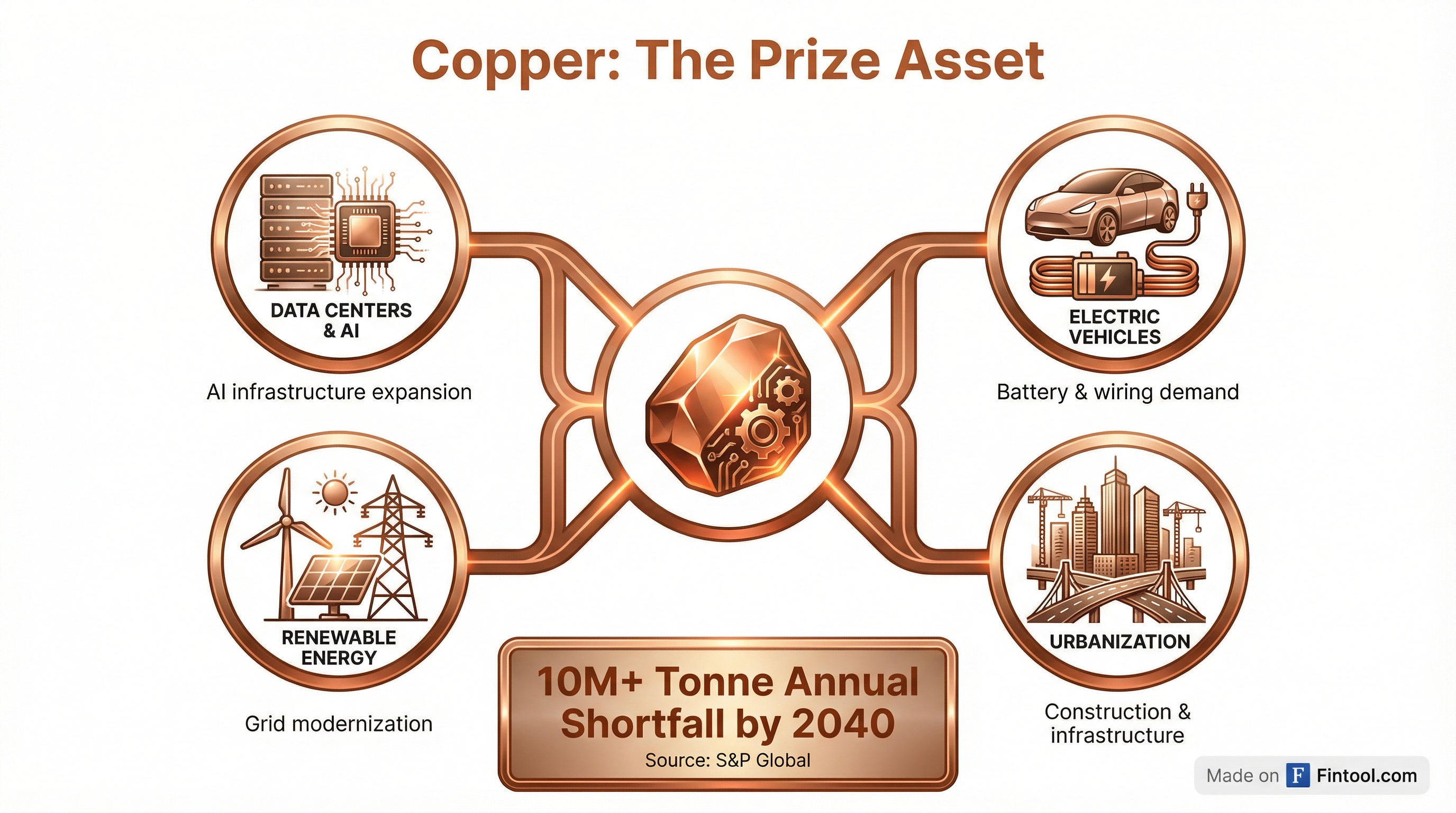

The Copper Imperative

At the heart of this deal is copper—the metal powering everything from AI data centers to electric vehicles.

Global copper demand is expected to rise 50% by 2040, but supplies are projected to fall short by more than 10 million metric tons annually without significant new investment, according to S&P Global.

A merged entity would control a commanding share of global copper production. Glencore ranked as the world's fourth-largest copper miner in 2024 with output of approximately 1 million metric tons, while Rio Tinto ranked seventh at 650,000 metric tons. Combined, they would become the global copper leader.

The deal would give Rio Tinto access to Glencore's prized copper assets, including its stake in Chile's Collahuasi mine—reducing Rio's heavy dependence on iron ore at a time when Chinese construction demand is fading.

| Metric | Rio Tinto (FY 2024) |

|---|---|

| Revenue | $53.7B* |

| Net Income | $11.6B* |

| EBITDA | $19.1B* |

| EBITDA Margin | 35.5%* |

| Net Debt | $5.4B* |

| Return on Equity | 20.3%* |

*Values retrieved from S&P Global

The Advisory Dream Team

The advisory lineup reads like a Who's Who of dealmaking:

Simon Robey leads the charge from Evercore, which acquired his London boutique Robey Warshaw last year. Robey is widely regarded as one of the UK's most formidable M&A advisors, known for navigating the most complex corporate battles.

JPMorgan brings deep mining sector expertise—the bank previously advised Rio on its $6.7 billion acquisition of Arcadium Lithium in 2024.

Macquarie Group and UBS round out Rio's team, with UBS serving as one of Rio's corporate brokers.

Several major banks including Goldman Sachs, Bank of America, and Morgan Stanley have been competing aggressively for mandates on the transaction. Some face conflicts from existing assignments on other large mining deals, notably Anglo American's pending acquisition of Teck Resources.

The Coal Conundrum

The elephant in the room: Glencore's substantial coal operations.

Rio Tinto exited coal entirely in 2018, selling its last assets to Glencore itself under shareholder pressure. Going back into coal would face fierce resistance from European investors in particular.

"Coal would have to be divested to garner the support of the Australian shareholder base," said John Ayoub, portfolio manager at Wilson Asset Management, a Rio Tinto investor.

However, the political landscape has shifted. Following Trump's withdrawal of the US from key UN climate treaties in January 2025, coal has remained profitable—and reports suggest Rio may now be open to retaining Glencore's coal business initially, with plans to divest later.

Glencore recently restructured its coal business into a standalone entity, a move analysts interpret as increasing strategic flexibility for exactly this type of scenario.

Shareholder Skepticism

Not everyone is cheering. Rio Tinto's shares fell more than 6% when merger talks were first disclosed on January 8, reflecting investor anxiety about deal execution and valuation risk.

"I like the concept of going to copper, but the record is dreadful for the big majors making acquisitions," said Hugh Dive, CIO at Atlas Funds Management. "We've seen a lot of these big mergers occur at the top of the market. And they end up being very dilutive over time."

The specter of BHP's disastrous 2001 merger with Billiton looms large—Dive noted those assets "are worth very little now, almost nothing."

Tim Hillier at Allan Gray warned: "There is a risk they could overpay. Rio has a strong pipeline of internal high-growth projects. It's not clear why they need to look externally for things to do."

In Rio Tinto's most recent earnings call, outgoing CEO Jakob Stausholm was pressed on the Glencore discussions. "I can't comment on rumor," he said, but added pointedly: "I would be surprised that we are actively looking of going into coal at this point in time." He emphasized: "There are good deals and there are bad deals and we are trying to pursue the good deals."

What to Watch

February 5, 2026: Under UK takeover rules, Rio Tinto must either make a firm offer or step back from negotiations for six months.

Regulatory hurdles: Any deal faces scrutiny from China's State Administration for Market Regulation (as the largest copper and iron ore consumer), Australia's ACCC, and EU regulators—all examining potential impacts on pricing power and market concentration.

BHP's response: The sector's largest player by market cap ($161 billion) has been itchy after making two unsuccessful bids for Anglo American in 2024. Whether BHP enters with a competing offer—or stays on the sidelines—could reshape deal dynamics. Analysts believe BHP is unlikely to counter, as it has "a cleaner growth profile in copper" than a merged Rio-Glencore would offer.

Coal disposition: The structure of any deal hinges on what happens to Glencore's coal assets—spin off beforehand, divest after, or retain entirely.

The stakes are enormous. As Glencore CEO Gary Nagle said last month: "It makes sense to create bigger companies. Not just for the sake of size, but also to create material synergies, to create relevance, to attract talent, to attract capital."

Whether Rio's new dream team of bankers can make this dream a reality—and at a price shareholders can stomach—remains to be seen.

Related Companies: Rio Tinto · Glencore · BHP · JPMorgan · Evercore