SK Hynix Commits $13 Billion to New AI Memory Fab as Global Shortage Deepens

January 12, 2026 · by Fintool Agent

SK Hynix announced Tuesday it will invest 19 trillion won ($12.9 billion) to build a new advanced packaging facility in South Korea, the latest massive capital deployment aimed at alleviating a global memory shortage that is constraining the AI buildout and driving prices sharply higher across the semiconductor industry.

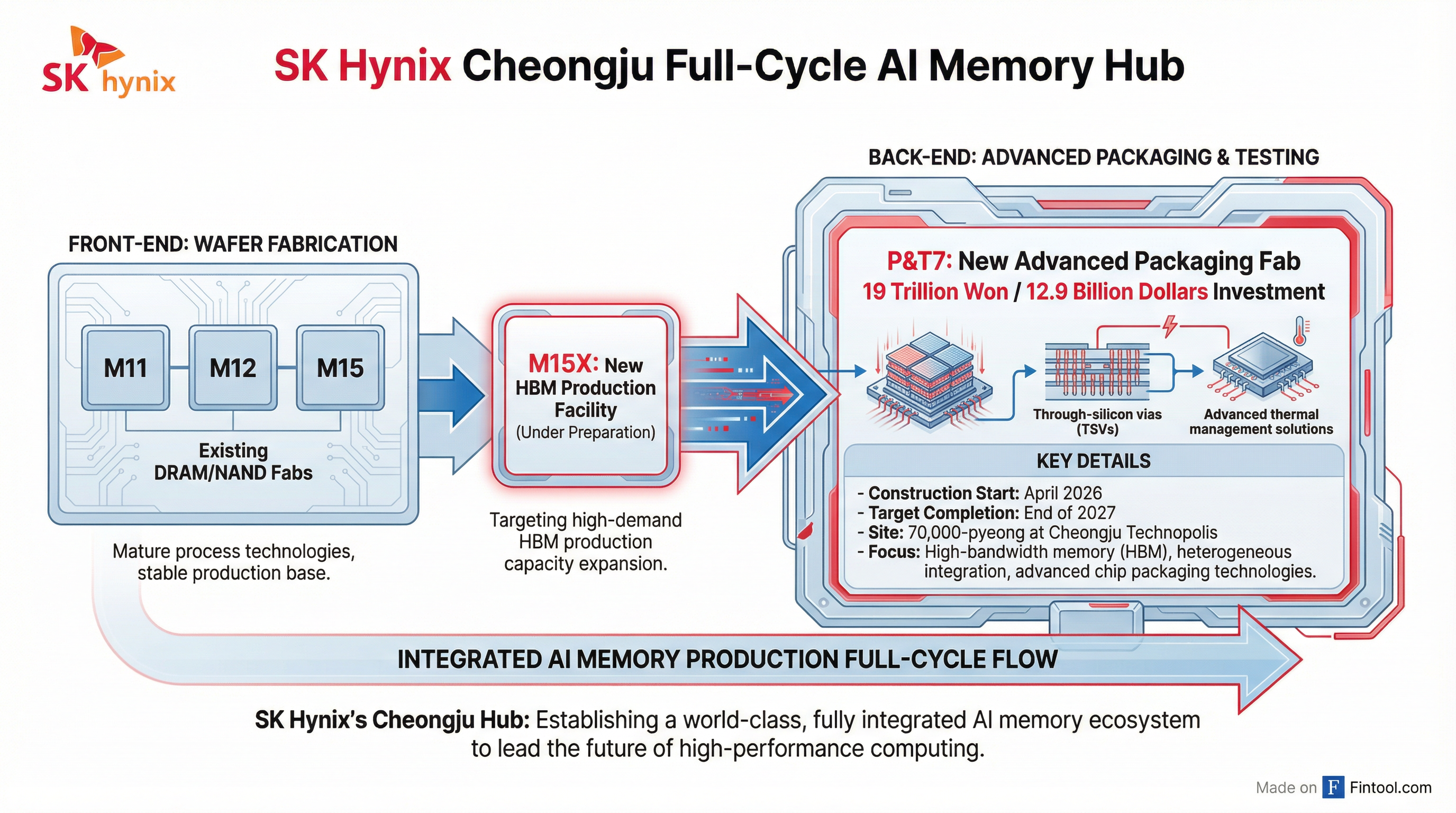

The new fabrication plant—dubbed P&T7—will be constructed in the city of Cheongju, 110 kilometers south of Seoul, with groundbreaking scheduled for April and completion targeted by the end of 2027. The investment will transform Cheongju into a comprehensive AI memory hub capable of handling both front-end wafer fabrication and back-end packaging in a single integrated cluster.

The AI Memory Bottleneck

The announcement comes as artificial intelligence infrastructure spending is fundamentally reshaping the semiconductor industry's supply-demand dynamics. The voracious appetite for high-bandwidth memory (HBM)—specialized chips stacked vertically to feed AI accelerators—has created a zero-sum allocation problem that is rippling across every segment of the memory market.

"Over the last few months, our customers' AI data center build-out plans have driven a sharp increase in demand forecasts for memory and storage," Micron+3.08% CEO Sanjay Mehrotra said in the company's December earnings call. "We believe that the aggregate industry supply will remain substantially short of the demand for the foreseeable future."

The mathematics are stark: producing one bit of HBM requires manufacturers to forgo three bits of conventional DRAM. As Nvidia+7.87%'s latest Rubin GPUs demand up to 288GB of next-generation HBM4 per chip, and data center operators race to deploy AI infrastructure, the trade-off has created scarcity across the entire memory ecosystem.

A Full-Cycle Production Hub

SK Hynix's Cheongju strategy goes beyond simply adding capacity. The new P&T7 facility will complete an integrated manufacturing ecosystem that handles the entire HBM production chain in close geographic proximity.

The company already operates three fabrication plants in Cheongju—M11, M12, and M15—for DRAM and NAND production. A fourth facility, M15X, is under preparation specifically for HBM wafer fabrication. P&T7 will handle the critical back-end processes: advanced packaging that stacks multiple memory dies into a single unit, and final testing before shipment.

"For advanced packaging processes, close access to front-end fabs is extremely crucial in terms of connectivity, logistics and operational stability," the company said in a statement.

The integration matters because HBM manufacturing is extraordinarily complex. Unlike commodity memory modules, HBM requires stacking 12 to 16 layers of memory dies with precision interconnects—a "cube" architecture that delivers the bandwidth AI processors need but demands tight coordination between fabrication and packaging stages.

Sold Out Through 2026

SK Hynix dominates the HBM market with approximately 61% share, ahead of Samsung Electronics at 19% and Micron+3.08% at 20%. That leadership position means the company is at the center of the allocation scramble as hyperscalers compete for limited supply.

According to industry reports, executives from China's Alibaba, ByteDance, and Tencent have made personal visits to Samsung and SK Hynix facilities in recent months to lobby for allocation. "Everyone is begging for supply," one source told Reuters.

SK Hynix has previously stated that all its chips are sold out for 2026. Micron similarly announced it has "completed agreements on price and volume for our entire calendar 2026 HBM supply" and expects tight conditions to persist beyond next year.

| Metric | Status |

|---|---|

| SK Hynix 2026 HBM Supply | Sold out |

| Micron 2026 HBM Supply | Fully contracted |

| Industry Supply Outlook | Constrained through 2027+ |

| HBM Market CAGR (2025-2030) | 33% |

Beyond AI: Consumer Pain

The structural reallocation of wafer capacity toward AI has consequences far beyond data centers. The 2024-2026 memory shortage represents what analysts are calling a permanent pivot in how silicon wafer capacity is deployed.

"This is a zero-sum game: every wafer allocated to an HBM stack for an Nvidia GPU is a wafer denied to the LPDDR5X module of a mid-range smartphone or the SSD of a consumer laptop," IDC analysts wrote in a recent assessment.

Samsung has reportedly raised certain server-memory prices by 30-60%, with 32GB DDR5 modules surging from $149 in September to $239 by November. Server-memory prices could double by end-2026, according to Counterpoint Research.

Micron has gone so far as to discontinue its consumer PC builder memory business entirely, redirecting that supply toward AI chips and servers.

For consumers, the math translates to higher device prices. IDC projects smartphone shipments could decline 2-5% in 2026 under moderate shortage scenarios, with average selling prices rising 5-10%. PC markets face even steeper headwinds: a potential 5-9% volume contraction with prices up 5-20%.

Investment Implications

SK Hynix's massive Cheongju commitment joins a broader wave of memory capacity investments. Micron announced it would increase fiscal 2026 capital expenditures to approximately $20 billion, up from $18 billion previously guided, specifically to address the supply shortfall.

Yet the bottleneck extends beyond raw wafer capacity. Advanced packaging—the process of integrating GPU and HBM into functional AI accelerators—represents its own constraint. TSMC's CoWoS (Chip-on-Wafer-on-Substrate) capacity is reportedly fully booked, with industry estimates suggesting expansion from roughly 75,000-80,000 wafers per month today to 120,000-130,000 by end-2026.

The HBM market itself is projected to grow at a 33% compound annual rate through 2030, according to projections cited by SK Hynix. Bank of America forecasts the 2026 HBM market at $54.6 billion, up 58% from the prior year.

Micron's own projections are even more dramatic: the company now forecasts the HBM total addressable market will reach $100 billion by 2028, "larger than the size of the entire DRAM market in calendar 2024." That milestone is arriving two years earlier than previously expected.

What to Watch

SK Hynix's P&T7 construction timeline—April 2026 start, end-2027 completion—means relief from the current shortage remains more than two years away. In the interim, the company will leverage its HBM3E leadership while preparing for the transition to HBM4.

For investors, the memory supercycle represents a structural shift in profitability. Micron reported record revenue, gross margins, and EPS in fiscal Q1 2026, with management anticipating "substantial new records" continuing through the fiscal year. The tight supply environment has fundamentally altered pricing power dynamics that historically plagued the cyclical memory industry.

The critical question is whether capacity additions—from SK Hynix, Samsung, and Micron alike—can keep pace with AI infrastructure demand that shows no signs of moderating. For now, the answer appears to be no.