Snap's Pivot to Profitability: Q4 Earnings Beat as Company Sacrifices User Growth for Margins

February 4, 2026 · by Fintool Agent

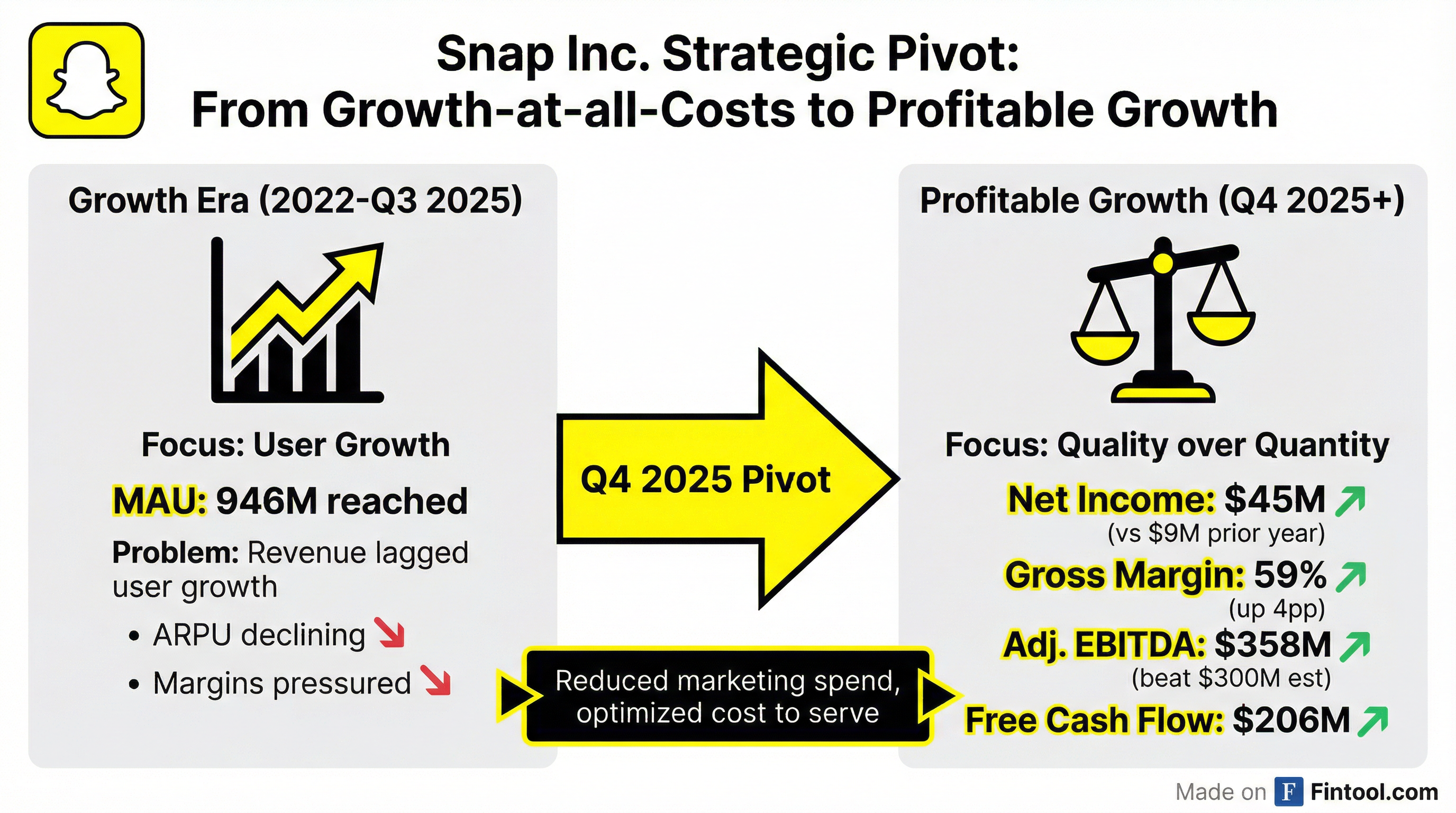

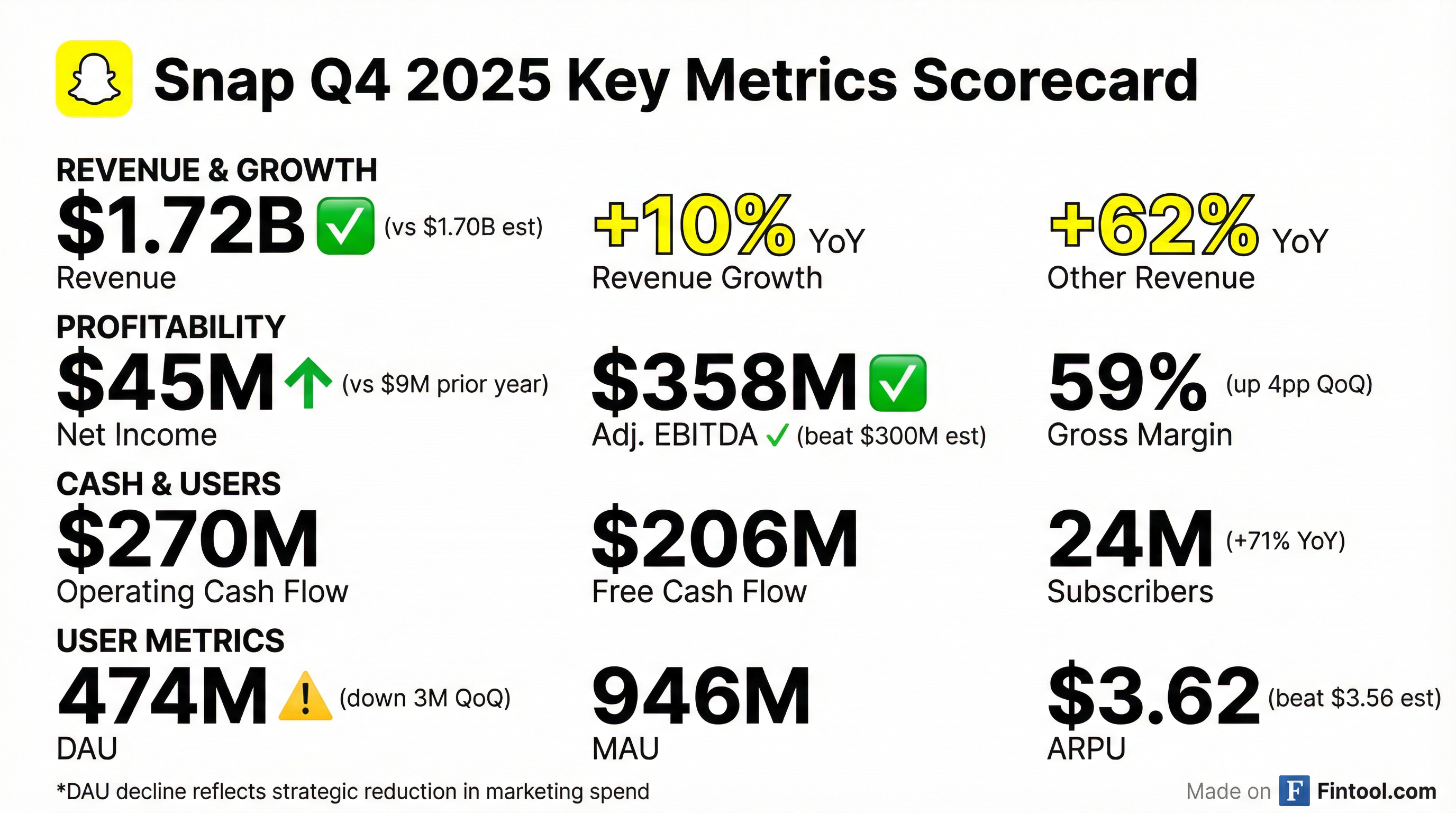

Snap delivered its clearest signal yet that the era of growth-at-all-costs is over. Q4 revenue came in at $1.72 billion, beating estimates by $20 million, while net income surged nearly 400% to $45 million . The twist: daily active users fell by 3 million—and management says that's the plan.

CEO Evan Spiegel calls it a "crucible moment." After growing monthly active users by 150 million over three years to reach 946 million, Snap is now deliberately trading user acquisition for margin expansion . The company slashed community growth marketing, optimized cost-to-serve by geography, and introduced paid features that cannibalize engagement.

Shares jumped over 5% in after-hours trading .

The Strategic Pivot

For years, Snap's narrative was simple: grow users, monetization will follow. But the math stopped working. "Over the past three years, our community growth has really outpaced our revenue growth, and ARPU has actually declined while we've simultaneously increased the cost to serve, which has put downward pressure on our margins," Spiegel acknowledged on the call .

The pivot centers on three pillars:

- Reduce marketing in low-ARPU markets: Snap cut community growth spending to focus resources on "more profitable growth"

- Calibrate infrastructure costs to monetization potential: The company is adjusting cost-to-serve based on each market's long-term revenue potential

- Monetize core engagement directly: Memory storage plans, Snapchat+ subscriptions, Sponsored Snaps, and Promoted Places all prioritize revenue over free engagement

The results are immediate. Gross margin reached 59% in Q4, up from 55% in Q3 and 57% a year ago . Adjusted EBITDA hit $358 million, beating estimates by $58 million. Free cash flow was $206 million.

The Turnaround In One Chart

After eight consecutive quarters of net losses, Snap finally turned profitable in Q4 2025. The trajectory is clear: gross margins expanded from 52% in early 2024 to 59% in Q4 2025, while net losses narrowed quarter after quarter until flipping positive.

Q4 By The Numbers

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $1.72B | $1.56B | +10% |

| Net Income | $45.2M | $9.1M | +397% |

| Adjusted EBITDA | $358M | $276M | +30% |

| Gross Margin | 59.1%* | 56.9% | +220 bps |

| DAU | 474M | 453M | +5% |

| Subscribers | 24M | 14M | +71% |

| Other Revenue | $232M | $143M | +62% |

*Values retrieved from S&P Global

The advertising business grew 5% to $1.48 billion, with direct response advertising driving the gains . Small and medium businesses "contributed the majority of advertising revenue growth for the sixth consecutive quarter" .

But the real growth engine is now subscriptions and direct monetization. Other revenue surged 62% year-over-year, with Snapchat+ subscribers hitting 24 million—up 71% .

The User Trade-Off

Here's where it gets controversial. Daily active users dropped from 477 million in Q3 to 474 million in Q4 . In North America—Snap's most lucrative market—DAU fell 4 million.

Management frames this as deliberate. "The decline in global DAU in Q4 reflects, in part, our decision to substantially reduce our community growth marketing investments in order to focus on more profitable growth," Spiegel said .

Regulatory headwinds also played a role. Australia's social media age verification law forced Snap to remove approximately 400,000 accounts .

| Region | Q4 2025 DAU | Q3 2025 DAU | Change |

|---|---|---|---|

| North America | 94M | 98M | -4M |

| Europe | 100M | 100M | Flat |

| Rest of World | 280M | 279M | +1M |

The question for investors: can Snap keep growing revenue while users stagnate or decline?

2026 Guidance: Slower Growth, Better Margins

Q1 2026 guidance came in light. Revenue is expected at $1.50-$1.53 billion, below analyst estimates of $1.55 billion . But the company expects adjusted EBITDA of $170-$190 million, with the midpoint above Street estimates .

For the full year, Snap guided operating expenses of approximately $3 billion and stock-based compensation of about $1.2 billion .

CFO Derek Andersen emphasized that the pivot is working: "We are excited to execute on our pivot towards profitable growth and to make incremental progress toward our medium-term goal of delivering meaningful net income profitability" .

The company also announced a $500 million stock repurchase program —a notable capital return for a company that until recently was burning cash.

The Catalyst Calendar

Near-term catalysts:

- Consumer launch of Spectacles AR glasses (2026)

- Perplexity AI integration (pending commercial agreement)

- Continued subscriber growth from memory storage plans and Snapchat+

Risks:

- Regulatory pressure from age verification laws globally

- User attrition from monetization features

- Advertising market sensitivity to economic conditions

What to Watch

The bull case: Snap has proven it can grow profitably. With 946 million monthly users approaching the 1 billion goal, the focus on monetization makes sense. Subscription revenue is high-margin and recurring. If advertising ARPU improves in wealthy markets, the math could work even with flat users.

The bear case: User growth was Snap's core narrative. Once it stops, so does optionality. Meta and TikTok continue to compete aggressively for the same audience. Regulatory risks in teen-focused social media are intensifying globally.

The stock's 5% after-hours pop suggests investors are willing to buy the profitability story—for now.

Related: