Swift and LSEG Launch Blockchain Settlement Systems on Same Day, Signaling TradFi's Digital Pivot

January 15, 2026 · by Fintool Agent

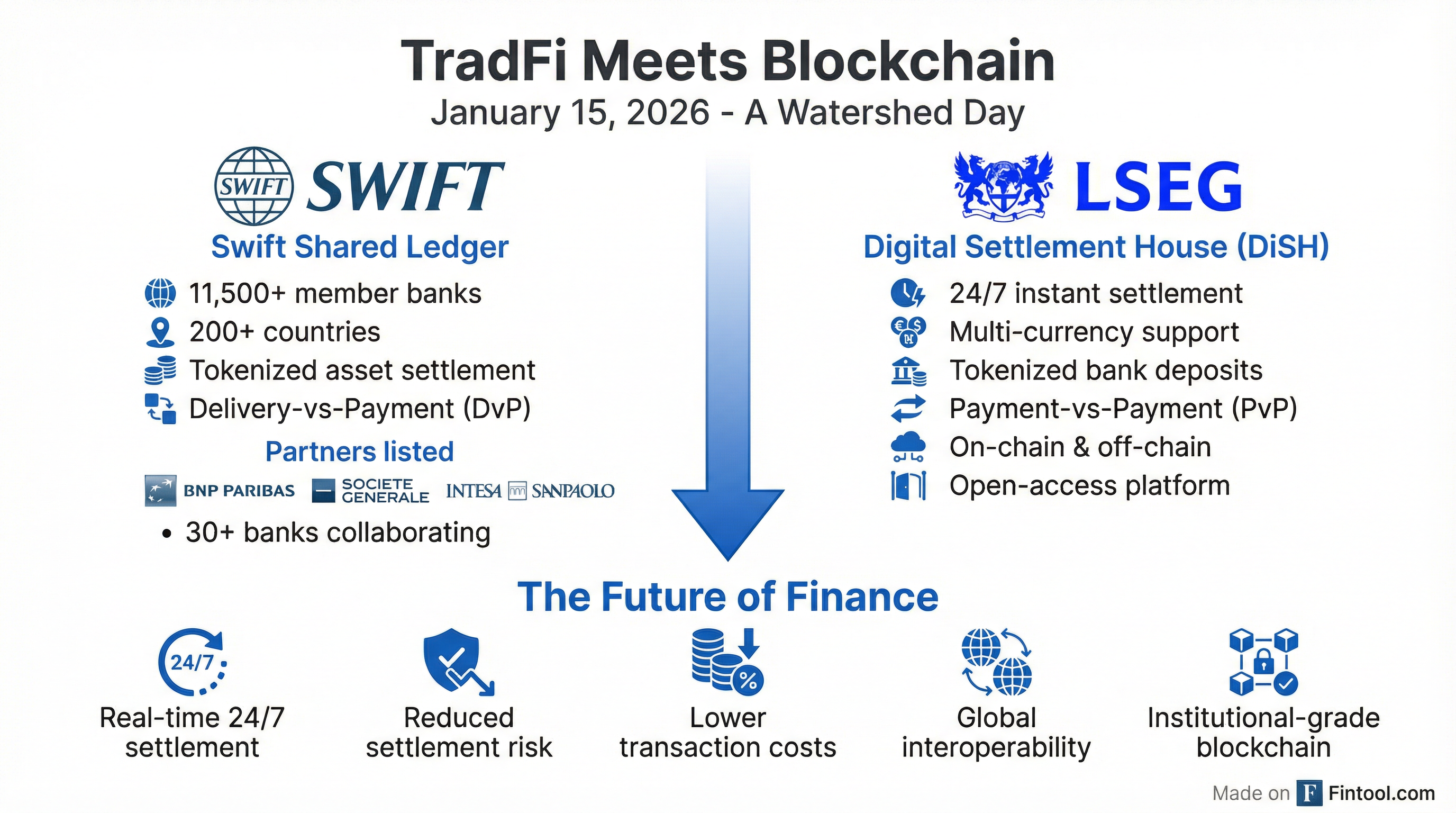

In a watershed moment for global finance, both Swift and the London Stock Exchange Group announced major blockchain infrastructure moves on the same day—signaling that traditional finance's digital pivot has entered a new, accelerated phase. Swift completed a "landmark" tokenized bond trial and announced plans for a shared blockchain ledger, while LSEG launched its Digital Settlement House (DiSH) for 24/7 tokenized settlement.

For portfolio managers, the message is clear: the plumbing of global finance is being rebuilt in real-time, with implications spanning financial services, fintech, and crypto infrastructure.

Swift: From Messaging Network to Digital Settlement Layer

Swift—the Belgium-based cooperative that processes trillions of dollars daily across 11,500+ member banks in 200+ countries—completed an interoperability trial that demonstrated its ability to orchestrate tokenized asset transactions across blockchain platforms and traditional systems.

The trial, conducted with Societe Generale-1.14%'s SG-FORGE, BNP Paribas+1.97% Securities Services, and Intesa Sanpaolo+2.29%, successfully executed:

- Delivery-versus-payment (DvP) settlement of tokenized bonds

- Interest payments and redemption using both fiat currency and SG-FORGE's EURCV stablecoin

- Cross-platform coordination linking blockchain networks with traditional banking rails

"This milestone demonstrates how collaboration and interoperability will shape the future of capital markets," said Thomas Dugauquier, Swift's tokenized assets product lead. "We're paving the way for our members to adopt digital assets with confidence, and at scale."

The Shared Ledger Vision

Swift is now building a blockchain-based shared ledger with over 30 major global banks, initially focused on real-time, 24/7 cross-border payments. The coalition includes heavyweights across regions:

| Region | Participating Banks |

|---|---|

| Europe | BNP Paribas, Societe Generale, Intesa Sanpaolo, Credit Agricole, NatWest |

| Asia-Pacific | DBS Bank, Standard Chartered |

| Americas | Major US banks (names not disclosed) |

The ledger will provide what Swift calls "execution assurance"—turning point-to-point connectivity into coordinated settlement where actions, timing, and outcomes are aligned across all parties.

LSEG: Digital Settlement Goes Live

The same day, London Stock Exchange Group launched its Digital Settlement House—a production-ready blockchain platform for instantaneous settlement using tokenized commercial bank deposits.

Key capabilities of LSEG DiSH:

| Feature | Description |

|---|---|

| DiSH Cash | Tokenized commercial bank deposits providing instant ownership and transferability |

| 24/7 Operation | Round-the-clock settlement across time zones |

| Multi-Currency | Support for multiple currencies and jurisdictions |

| PvP/DvP | Payment-versus-payment and delivery-versus-payment settlement |

| Dual-Rail | Works with both on-chain and traditional payment networks |

"LSEG DiSH expands the tokenised cash solutions available to the market, and for the first time, offers a real cash solution tokenised on the blockchain utilising cash in multiple currencies held at commercial banks," said Daniel Maguire, Group Head of LSEG Markets and CEO of LCH Group.

The platform addresses critical pain points in traditional settlement:

- Trapped liquidity: Assets locked during settlement cycles can now move instantly

- Settlement risk: Reduced timelines and synchronized settlement minimize counterparty exposure

- Operational hours: Markets that close overnight can now settle 24/7

Why This Matters: The End of T+1?

The simultaneous announcements suggest that the recent move to T+1 settlement in US equities may have been merely a stepping stone. With both Swift (cross-border payments) and LSEG (securities settlement) embracing real-time, blockchain-based infrastructure, the industry appears to be positioning for T+0—or even instant settlement.

The Competitive Landscape Shifts

Traditional financial infrastructure providers now face a strategic imperative. The blockchain initiatives from Swift and LSEG create pressure on:

- Exchanges: Cme Group+1.64%, Intercontinental Exchange+0.42%, and Nasdaq-0.80% must accelerate their own digital asset strategies

- Custodians: Bank of New York Mellon+3.17%, State Street+2.83%, and Northern Trust+3.17% are investing heavily in digital custody

- Payment Networks: Visa and Mastercard continue expanding blockchain and stablecoin integrations

- Crypto Infrastructure: Coinbase+13.00% and crypto-native firms see validation of their infrastructure investments

Bank Support: A Coalition of the Willing

The Swift initiative has garnered explicit support from major global banks, suggesting this isn't a technology experiment but a committed industry transition:

DBS Bank: "Blockchain technology can usher in the next generation of 'always-on' and 'smarter' financial services. Swift's initiative has the potential to form the backbone of a resilient and future-ready global financial infrastructure." — Lim Soon Chong, Group Head of Global Transaction Services

NatWest: "Swift's blockchain-based ledger provides the foundational infrastructure needed for trusted, real-time cross-border payments alongside existing ways of moving money." — Lee McNabb, Head of Group Payment and Digital Asset Strategy

Societe Generale: "This initiative is fully aligned with our commitment to offer clients robust and widely accessible market infrastructure alongside a new pathway for the digital financial industry." — Jean-Marc Stenger, CEO of SG-FORGE

Investment Implications

The convergence of traditional finance and blockchain infrastructure creates several investable themes:

Near-Term Winners

- Financial Technology Providers: Companies building the middleware between traditional and digital rails

- Blockchain Infrastructure: Institutional-grade blockchain platforms and security providers

- Digital Custodians: Firms with regulatory approval to custody digital assets

Potential Disintermediation Risk

- Correspondent Banking: Swift's direct settlement capabilities could reduce the need for intermediary banks

- Legacy Settlement Systems: Older infrastructure may face accelerated obsolescence

- High-Fee Payment Rails: Real-time, low-cost settlement pressures traditional fee structures

What to Watch

H1 2026: Swift targets an MVP scheme for its blockchain-based retail payment framework with over 30 partner banks.

Ongoing: LSEG DiSH adoption metrics—look for announcements of member banks tokenizing deposits on the platform.

Regulatory: EU's MiCA framework and potential US stablecoin legislation could accelerate or complicate institutional adoption.

Competition: Watch for responses from US-based infrastructure providers and Asian exchanges pursuing similar capabilities.