Taiwan Tells Washington 40% Chip Capacity Shift Is 'Impossible'

February 8, 2026 · by Fintool Agent

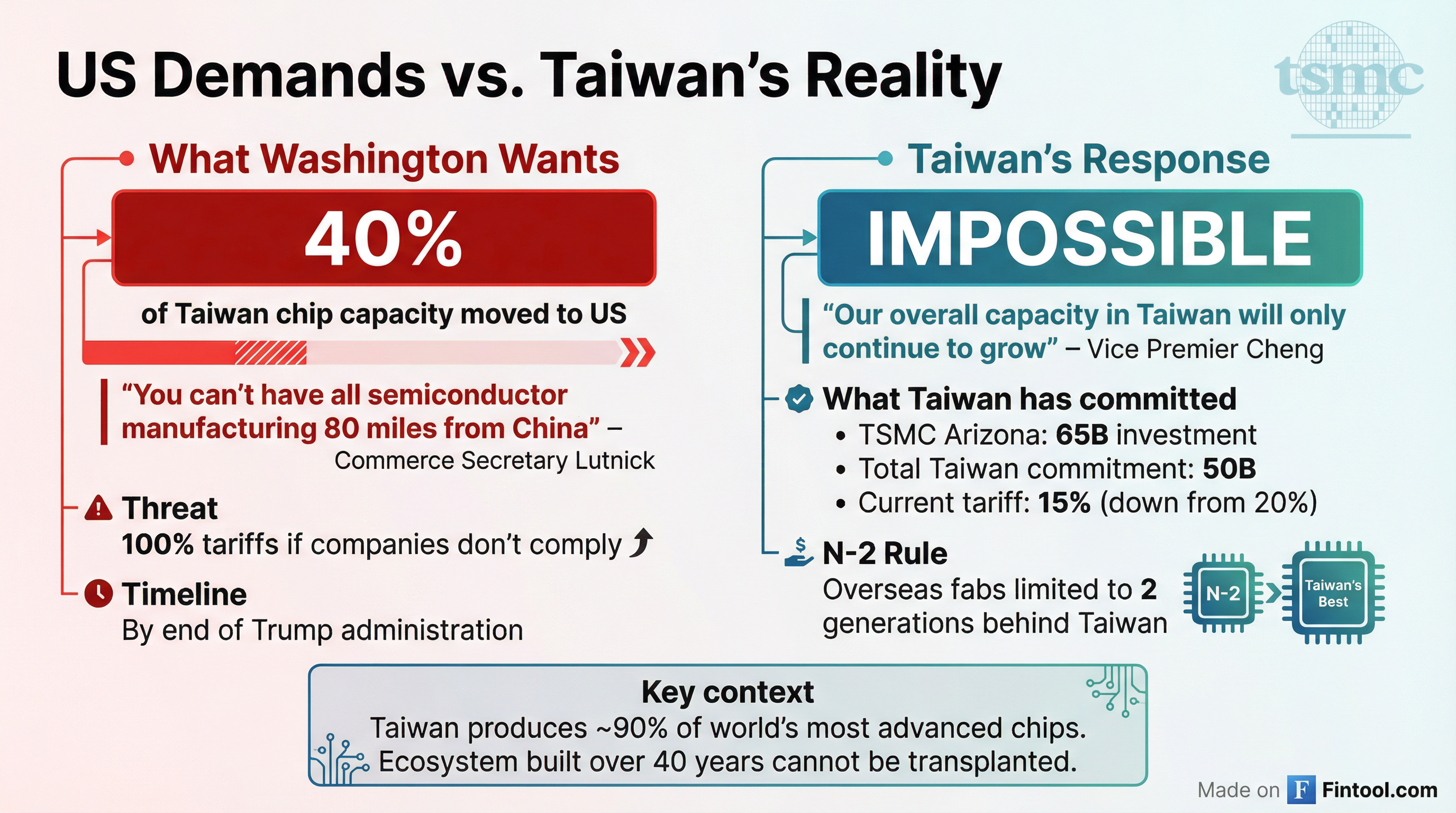

Taiwan's top trade negotiator delivered a blunt message to Washington: relocating 40% of the island's semiconductor capacity to the United States is "impossible."

In an interview broadcast Sunday on Taiwanese television channel CTS, Vice Premier Cheng Li-chiun said she has made the position "very clear" to US officials, pushing back against Commerce Secretary Howard Lutnick's demands for a massive production shift that would fundamentally reshape the global chip industry.

"Our overall capacity in Taiwan will only continue to grow," Cheng said. "But we can expand our presence in the United States. Our international expansion, including increased investment in the United States, is based on the premise that we remain firmly rooted in Taiwan and continue to expand investment at home."

The statement underscores the limits of US economic leverage over the world's most important semiconductor supplier—even as Washington dangles 100% tariff threats to extract concessions.

The 40% Ultimatum

Lutnick set the benchmark last month, telling CNBC that bringing 40% of Taiwan's entire chip supply chain to the US was "the goal for this administration."

"You can't have all semiconductor manufacturing 80 miles from China," Lutnick said. "That's just illogical... So we need to bring it back."

The implication was clear: companies that don't build in America face tariffs "likely to be 100%."

But semiconductor experts have consistently called the target unrealistic. Taiwan's dominance in advanced chipmaking didn't happen overnight—it was built over four decades through an intricate web of specialized suppliers, materials companies, equipment makers, and engineering talent that cannot simply be transplanted.

What Taiwan Already Committed

The pushback comes just weeks after Taiwan and the US reached a trade deal that was supposed to settle tensions.

| Agreement Terms | Details |

|---|---|

| Taiwan Investment Commitment | $250 billion in US chip manufacturing |

| TSMC Arizona Investment | $165 billion across multiple fabs |

| US Tariff Rate | Reduced to 15% from 20% |

| Tariff-Free Categories | Generic pharmaceuticals, aircraft parts |

Under the January 15 deal, Taiwanese chip and technology companies committed to investing at least $250 billion in US production capacity, with the Taiwanese government guaranteeing $250 billion in credit. In exchange, the US lowered "reciprocal" tariffs on Taiwanese goods to 15% from 20%.

TSMC alone is investing $165 billion to build factories in Arizona, where it has already begun production of chips for Apple and Nvidia. The company recently purchased hundreds of additional acres adjacent to its Phoenix property for future expansion.

But there's a crucial catch.

The N-2 Rule: Taiwan's Silicon Shield

Taiwan maintains strict restrictions on its most advanced technology leaving the island. Under the so-called "N-2 rule," TSMC's overseas fabs are limited to manufacturing processes at least two generations behind those produced domestically.

This means that while TSMC's Arizona facilities will produce cutting-edge chips by global standards, they won't match what's rolling out of Taiwan's domestic fabs. The island's "silicon shield"—its leverage against any military threat through its indispensable role in global technology supply chains—remains firmly in place.

Analysts at SemiAnalysis project Taiwan's silicon shield will remain strong through the end of the decade, with the world's most critical advanced capacity concentrated on the island.

Market Impact

TSMC shares have shrugged off the political tension, trading near 52-week highs as AI demand continues to drive record results.

| Metric | Value |

|---|---|

| Stock Price (Feb 6 close) | $348.85 |

| 52-Week High | $351.33 |

| 52-Week Low | $134.25 |

| Market Cap | $1.81 trillion |

| YTD Performance | +34% |

The company posted quarterly revenue of $32.5 billion in Q3 2025, with gross margins near 60%—reflecting its pricing power in a market where no competitor can match its advanced manufacturing capabilities.*

| Quarter | Revenue ($B) | Gross Margin | Net Income ($B) |

|---|---|---|---|

| Q3 2025 | $32.5 | 59.5% | $14.8 |

| Q2 2025 | $31.9 | 58.6% | $13.6 |

| Q1 2025 | $25.2 | 58.8% | $10.9 |

| Q4 2024 | $26.5 | 59.0% | $11.0 |

*Values retrieved from S&P Global.

For investors in TSMC's major customers—including Nvidia, Apple, Amd, and Qualcomm—the standoff highlights persistent geopolitical risk in AI hardware supply chains. While Arizona expansion provides some diversification, the most advanced chips will continue flowing from Taiwan.

The Ecosystem Can't Be Copied

Vice Premier Cheng offered a compromise: Taiwan would share its experience building an industry cluster and help the US develop a similar environment—but there would be no relocation of Taiwan's science parks.

The comment illuminates why the 40% goal remains fantasy. TSMC doesn't operate in isolation—it sits at the center of a dense ecosystem of hundreds of specialized suppliers within hours of its fabs. Materials companies, equipment maintenance specialists, precision tooling firms, and a deep bench of trained engineers have all clustered around Taiwan's semiconductor parks over decades.

Replicating that ecosystem in Arizona would require not just factory construction but the wholesale relocation of an industrial complex—something no amount of tariff pressure can accelerate.

What to Watch

Near-term catalysts:

- Whether Lutnick follows through on 100% tariff threats or accepts Taiwan's position

- TSMC's Q4 2025 earnings report and updated capacity guidance

- Progress on Arizona Fab 2 construction timeline

Longer-term questions:

- Will Intel emerge as a viable domestic alternative for advanced chips?

- Can the US develop its own supply chain ecosystem, or will it remain dependent on Asian manufacturing?

- How does this standoff factor into China-Taiwan military contingency planning?

Related Companies: Taiwan Semiconductor · Nvidia · Apple · Amd · Intel · Qualcomm