Trane CEO Sees 'Strongest Pipeline in Years' as Data Center and Commercial HVAC Demand Surges

February 17, 2026 · by Fintool Agent

Trane Technologies CEO Dave Regnery delivered a bullish message at the Barclays Industrial Select Conference today: the commercial HVAC pipeline is the strongest he has seen in his career, and the company is uniquely positioned to capture AI data center demand through its recently announced LiquidStack acquisition.

"I've been in this industry a long time, and I would tell you that I haven't seen a pipeline quite this strong in a long time," Regnery said during a fireside chat with Barclays analyst Julian Mitchell in Miami.

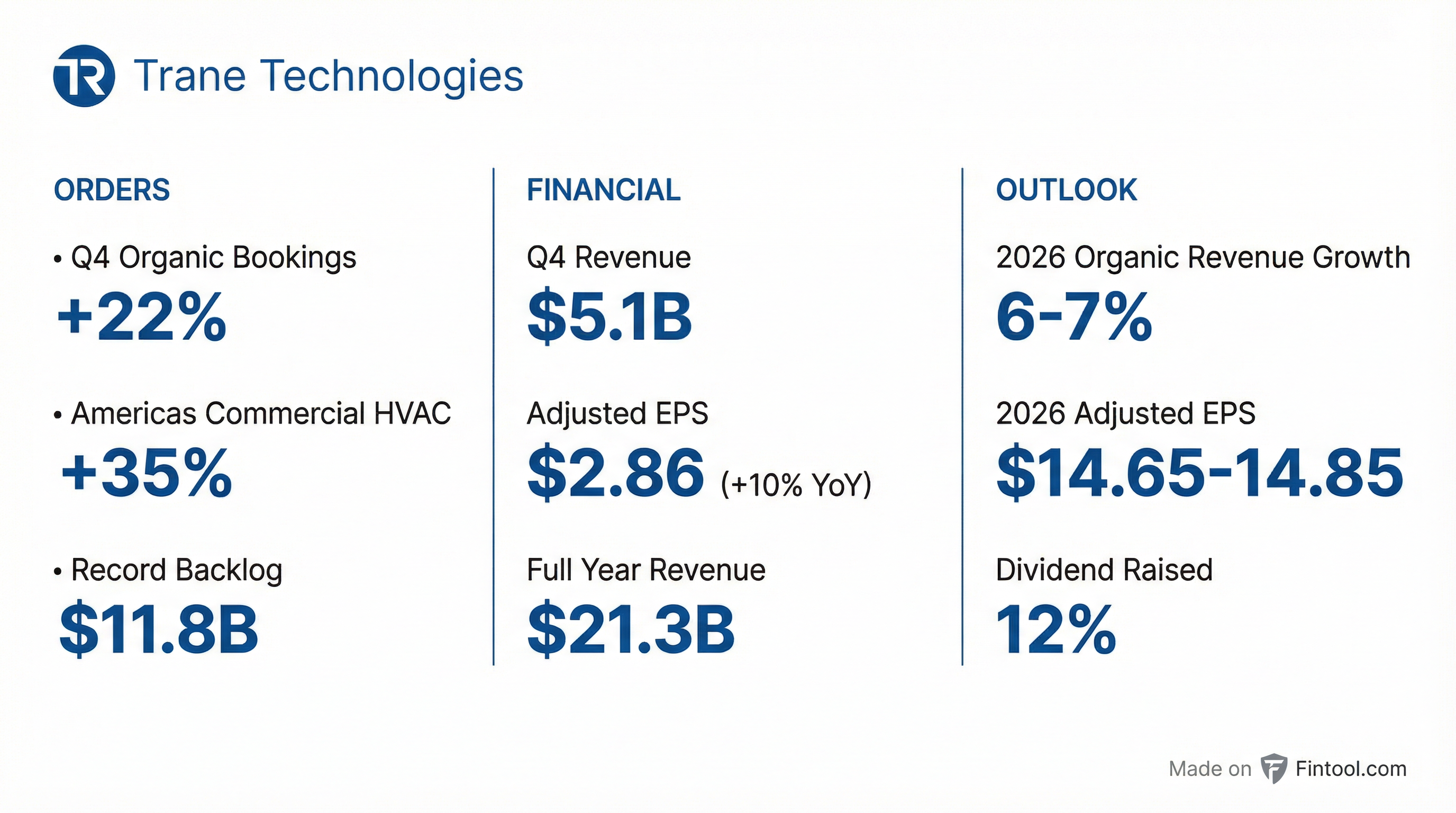

The comments come three weeks after Trane reported Q4 results that beat expectations, with organic bookings surging 22% and Americas Commercial HVAC orders jumping over 35%.

Data Center Strategy: Systems Over Components

Investors pressed Regnery on concerns raised at CES 2026, when Nvidia CEO Jensen Huang suggested next-generation GPU racks may not require water chillers. Regnery pushed back firmly.

"I have not seen a reference design or data center of the future that does not include chillers, just to be very clear," he stated.

The CEO emphasized Trane's differentiated approach—selling integrated thermal management systems rather than individual components:

"Think of the thermal management system... we're working with many, if not all, of the influencers in this space, whether that be the hyperscalers, the large colos, or in some cases, actually the chip manufacturers, to develop what that future thermal management system looks like within a data center."

This systems philosophy extends across Trane's business. "We don't tell a customer, 'Oh, here's a VRF solution,' or, 'Here's a rooftop solution.' We sit down and understand what their needs are and what's going to be the best solution," Regnery explained.

LiquidStack Acquisition: Fortifying the AI Cooling Position

Just one week ago, Trane announced the acquisition of LiquidStack, a leader in direct-to-chip and immersion cooling for AI data centers. The deal builds on a minority investment Trane made in 2023.

"The acquisition of LiquidStack really just fortifies our position in the CDU space," Regnery said.

LiquidStack recently secured a 300-megawatt CDU order from a major U.S. data center operator, underscoring the demand trajectory for liquid cooling solutions as chip power densities rise.

Q4 Results and 2026 Outlook

Trane's Q4 2025 results demonstrated the breadth of demand. Orders grew in 12 of 14 tracked verticals, with strength in data centers, higher education, healthcare, and industrial.

| Metric | Q4 2025 | YoY Change |

|---|---|---|

| Organic Bookings | $5.76B | +22% |

| Net Revenue | $5.14B | +6% |

| Adjusted EPS | $2.86 | +10% |

| Backlog | $7.8B (record) | +15% |

Source: Trane Technologies Q4 2025 Earnings Release

For full-year 2025, Trane delivered $21.3 billion in revenue—nearly double the $12.5 billion from five years ago—and adjusted EPS of $13.06, up 16% year-over-year.

Management guided 2026 organic revenue growth of 6-7% and adjusted EPS of $14.65-$14.85, representing 12-14% earnings growth. CFO Chris Kuehn reiterated the company's 25%+ organic incremental margin target.

Residential Reset and Europe Investments

Not all segments are firing equally. Trane intentionally reduced residential production in Q4—cutting roughly a third of production days—to right-size channel inventories after a turbulent 2025 marked by pre-buys and a refrigerant transition.

"2025 was a very strange year in residential. Two pre-buys, a refrigerant transition that did not go well for the industry, and a very short cooling season," Regnery noted.

Management is guiding residential flat to down 5% on a dollar basis for 2026, with Q1 facing the toughest year-over-year comparison. A 5% price increase goes into effect April 1.

In Europe, Trane made intentional investments in 2025 to expand its direct sales channel across more countries, temporarily pressuring margins. Kuehn expects EMEA to deliver 25%+ organic incrementals in 2026 as these investments pay off.

CEO Confidence and Capital Deployment

Regnery concluded with a forward-looking perspective that underscored his optimism. Five years ago, he took over as CEO with a goal to transform Trane into a growth company. Revenue has compounded at 11% annually since 2020, and adjusted EPS at 24%.

"I could tell you with confidence, I sit up here today and tell you that I see more opportunities in the future than I saw five years ago," he said.

The company raised its dividend 12% in January—the 77th increase since March 2020—and has $4.7 billion remaining on its share repurchase authorization, roughly 5% of the current market cap.

Trane shares traded at $465.63 today, up 0.1%, hovering near the 52-week high of $479.37. The stock has gained 56% over the past year, outpacing the S&P 500 Industrials sector.

What to Watch

- Q1 2026 Results: Management guided Q1 organic revenue flat with adjusted EPS around $2.50, reflecting tough residential comps and seasonal patterns

- LiquidStack Integration: Deal expected to close early 2026; watch for updates on CDU pipeline and hyperscaler wins

- Stellar Energy Closing: Trane's modular chiller acquisition expected Q1 2026, enhancing data center capabilities

- Tariff/Price Dynamics: April 1 residential price increase; monitoring industry discipline