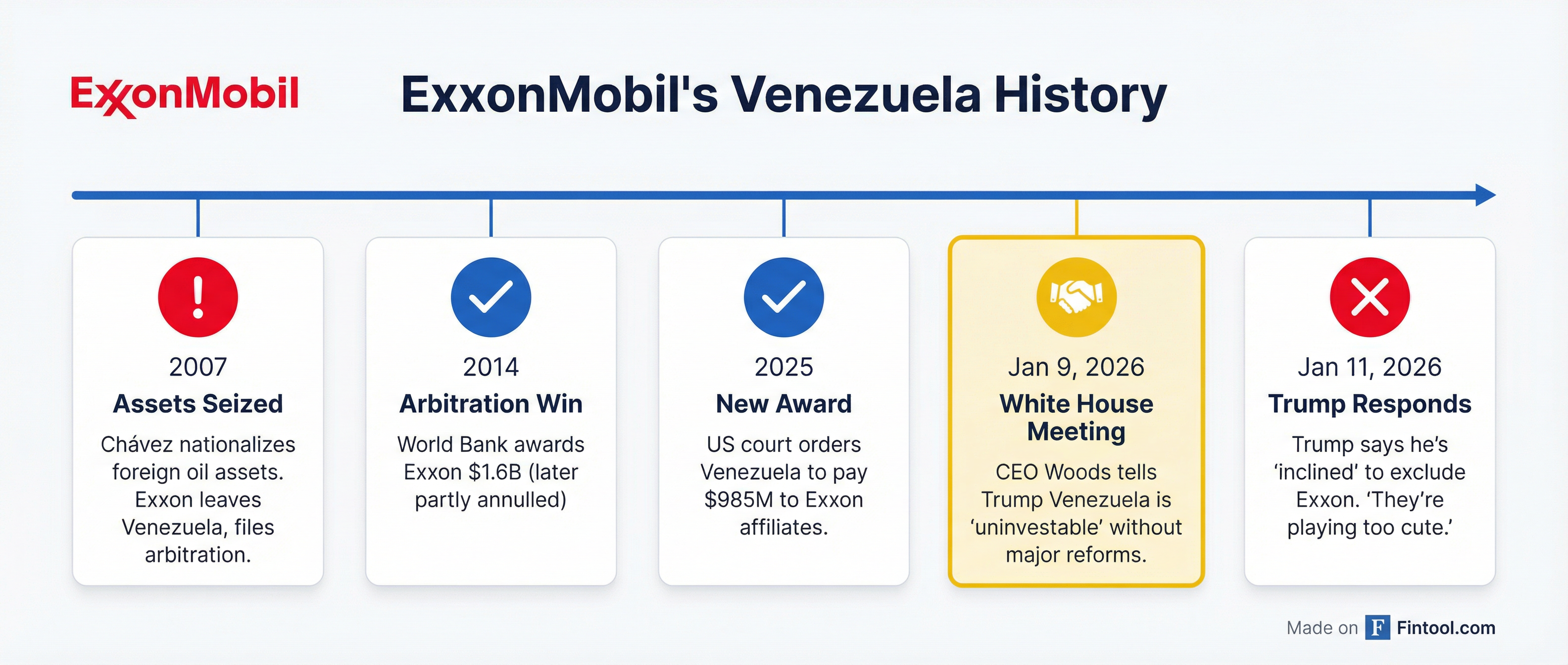

Trump Threatens to Bar ExxonMobil from Venezuela After CEO Calls Country 'Uninvestable'

January 11, 2026 · by Fintool Agent

President Donald Trump said Sunday he is "inclined" to exclude Exxonmobil+2.01% from Venezuela's oil sector after CEO Darren Woods publicly told him the country is "uninvestable" at a White House meeting two days earlier—a stunning rebuke that exposes a rift between the administration and America's largest oil company over one of the world's most ambitious energy projects.

"I didn't like Exxon's response," Trump told reporters aboard Air Force One departing West Palm Beach. "They're playing too cute."

The clash marks a rare public confrontation between a sitting president and a Fortune 10 CEO—and signals that Trump's plans to rebuild Venezuela's oil industry with $100 billion in American investment face skepticism from some of the very companies he needs to execute it.

Woods' "Uninvestable" Declaration

At Friday's White House meeting with oil executives, Woods delivered a blunt assessment that drew a stark contrast with more enthusiastic peers.

"If we look at the legal and commercial constructs—frameworks—in place today in Venezuela, today it's uninvestable," Woods told Trump directly. "And so significant changes have to be made to those commercial frameworks, the legal system, there has to be durable investment protections, and there has to be a change to the hydrocarbon laws in the country."

The remarks were extraordinary for their directness. Woods was polite but unyielding, emphasizing that Exxon's twice-burned history in Venezuela—with assets seized under Hugo Chávez's nationalization campaign—required fundamental reforms before any re-entry.

"We've had our assets seized there twice, and so you can imagine to re-enter a third time would require some pretty significant changes from what we've historically seen here," Woods explained.

A Divided Industry

The White House meeting revealed a clear split among America's oil majors:

The Cautious Camp:

Exxonmobil+2.01% and Conocophillips+2.51%—both burned by the 2007 nationalizations—demanded structural reforms. ConocoPhillips CEO Ryan Lance called for restructuring state oil company PDVSA entirely, noting the banking sector would need to provide billions in financing for infrastructure restoration.

Venezuela owes the two companies collectively over $13 billion in arbitration awards that have largely gone unpaid.

The Ready-to-Go Camp:

Chevron+0.84% struck a different tone entirely. Vice Chairman Mark Nelson, seated next to Trump adviser Stephen Miller, highlighted Chevron's century of operations in Venezuela and its status as the only American major still operating there.

"We are also able to increase our production within our own disciplined investment schemes by about 50% just in the next 18 to 24 months," Nelson said, noting Chevron could double its liftings immediately.

Private operator Hilcorp's chairman was even more direct: "We're going to Venezuela."

ExxonMobil's Venezuela Scars

The history explains Exxon's caution. Between 2004 and 2007, Venezuela under Hugo Chávez forcefully renegotiated contracts with international oil companies, eventually nationalizing foreign assets. ExxonMobil and ConocoPhillips refused to accept minority positions and exited the country, triggering years of international arbitration.

A World Bank tribunal awarded Exxon $1.6 billion in 2014, though much of that was later annulled. As recently as September 2025, a U.S. federal court ordered Venezuela to pay nearly $1 billion to Exxon affiliates in a separate case.

The message from Woods was clear: history matters, and corporate memory runs deep.

Trump's Blunt Response

Trump's reaction on Sunday was equally direct. Rather than acknowledging Exxon's legitimate concerns about rule of law and property rights, the president framed the company's caution as gamesmanship.

The president has argued that U.S. companies would be dealing directly with Washington rather than any Venezuelan government—an unprecedented arrangement that still requires legal and commercial frameworks that don't currently exist.

Trump dismissed concerns about recovering past losses: "We're not going to look at what people lost in the past, because that was their fault. That was a different president. You're going to make a lot of money, but we're not going to go back."

Market Reaction and Financial Context

ExxonMobil shares closed Friday at $124.62, up 1.4% and near their 52-week high of $125.93. The company's $525 billion market cap makes it America's largest oil company by a wide margin.

The company's fundamentals remain robust:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($B) | $81.1* | $81.1 | $79.5 | $83.3 |

| Net Income ($B) | $7.6 | $7.7 | $7.1 | $7.5 |

| Operating Cash Flow ($B) | $12.2 | $13.0 | $11.6 | $14.8 |

*Values retrieved from S&P Global

Exxon can afford to be patient. With $14.8 billion in quarterly operating cash flow and major projects in Guyana—where it has become the dominant operator of newly discovered reserves—Venezuela represents an option, not a necessity.

What to Watch

For ExxonMobil:

- Whether Trump follows through on exclusion threats or uses them as negotiation leverage

- How the company responds publicly—Woods' statement was posted on Exxon's corporate website, suggesting the company stands by its position

- Whether other cautious majors face similar pressure

For the Venezuela Play:

- Chevron's ability to ramp production quickly will test whether Trump's security guarantees translate into operational reality

- The legal frameworks Woods demanded don't exist yet—watch for any Venezuelan government moves to accommodate American demands

- China and Russia hold significant oil-backed interests in Venezuela and will seek to protect their positions

For the Broader Market:

- This public clash between a president and Fortune 10 CEO could have chilling effects on corporate candor with the administration

- Oil companies with Venezuelan exposure may face investor questions about political risk from both directions

The Bottom Line

Trump's threat to exclude America's largest oil company from Venezuela reveals the tension between his ambitious plans for the country's oil sector and the hard-learned lessons of companies that have been burned there before.

Woods wasn't wrong—Venezuela's legal and commercial frameworks genuinely are inadequate for major capital investment. But being right doesn't mean being rewarded in Trump's Washington.

For investors, the episode underscores that Venezuela's oil opportunity comes with political risk from multiple directions: not just from whatever government emerges in Caracas, but from Washington as well.

Related: