Homebuilders Pitch 'Trump Homes' Program to Build 1 Million Entry-Level Houses

February 3, 2026 · by Fintool Agent

Major U.S. homebuilders including Lennar and Taylor Morrison are developing a proposal dubbed "Trump Homes" that would deploy billions in private capital to construct up to one million entry-level houses through a pathway-to-ownership model, according to Bloomberg.

The program, informally named by industry players, would represent one of the largest privately funded affordable housing initiatives in U.S. history—potentially exceeding $250 billion in new housing supply—at a time when elevated mortgage rates and limited inventory have pushed homeownership out of reach for millions of Americans.

Homebuilder Stocks Rally

The news sent homebuilder stocks sharply higher, with Lennar gaining 3.4% and Taylor Morrison rising 3.1%. The broader sector caught a bid, with D.R. Horton (+2.7%), Pultegroup (+2.7%), and KB Home (+3.2%) all posting meaningful gains.

| Stock | Close | Change | % Change |

|---|---|---|---|

| Len | $112.53 | +$3.73 | +3.4% |

| TMHC | $63.57 | +$1.93 | +3.1% |

| KBH | $59.41 | +$1.85 | +3.2% |

| Dhi | $153.83 | +$4.06 | +2.7% |

| PHM | $130.46 | +$3.39 | +2.7% |

| Tol | $146.45 | +$0.97 | +0.7% |

How the Program Would Work

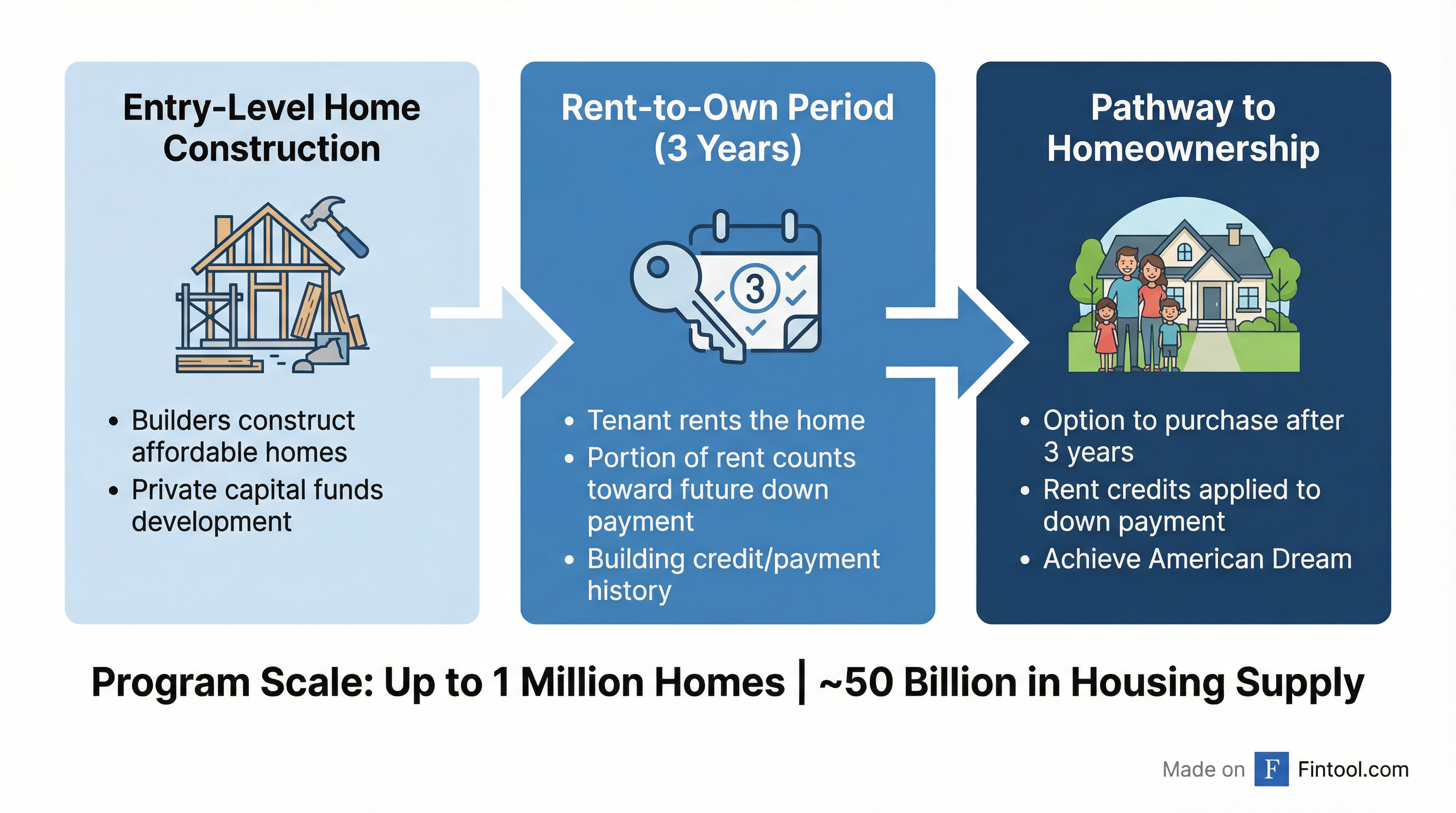

The proposal envisions private investors funding the construction of entry-level homes, which would then be rented to tenants under a structured rent-to-own arrangement. After three years of rental payments, a portion of each payment would be credited toward a down payment if the tenant chooses to purchase the home.

This structure attempts to thread a needle: providing a pathway to homeownership for first-time buyers who struggle with down payments, while avoiding the zero-down-payment programs that contributed to the 2008 housing crisis. It also sidesteps the need for taxpayer funding or government subsidies.

White House Response

A White House official told Bloomberg that the administration is "not actively considering" the plan. However, the proposal aligns closely with President Trump's stated housing priorities.

Taylor Morrison acknowledged the discussions, with a spokesperson stating the company was "encouraged by the thoughtful discussions between home builders and the administration that could help more Americans step into home ownership," while noting it was "too early to understand any details." Lennar declined to comment.

The proposal was first pitched to the administration last year and is still being refined, according to people familiar with the discussions.

Policy Context: Trump's Housing Agenda

The "Trump Homes" proposal comes as the administration has made housing affordability a central focus. On January 20, President Trump signed an executive order titled "Stopping Wall Street from Competing with Main Street Homebuyers," which restricts large institutional investors from purchasing single-family homes through federal programs.

The executive order directed agencies including HUD, FHFA, and the VA to issue guidance within 60 days to:

- Prevent federal programs from facilitating sales of single-family homes to large institutional investors

- Promote sales to individual owner-occupants through first-look policies

- Implement anti-circumvention provisions and disclosure requirements

"Homeownership has always been a symbol of health and vigor of American society," Trump said at the World Economic Forum in Davos. "But that goal fell out of reach for millions and millions of people in the Biden era because interest rates went up so high. Today, I'm taking action to bring back this bedrock of the American dream."

Builder Financials Show Affordability Pressure

The proposal emerges as homebuilders grapple with persistent affordability headwinds. Lennar, the nation's second-largest homebuilder by market cap ($27B), has seen margins compress as it ramps up buyer incentives to maintain sales velocity.

| Metric | FY 2024 | FY 2025 | Change |

|---|---|---|---|

| Revenue | $34.3B | $33.0B | -4% |

| Net Income | $3.9B | $2.1B | -47% |

| Gross Margin | 22.5% | 17.7% | -480 bps |

| Cash | $4.7B | $3.5B | -26% |

Values retrieved from S&P Global

Lennar CEO Stuart Miller addressed affordability challenges in a recent earnings call, noting that "inflation has been a difficult component in enabling our customer base to accumulate a down payment. And there's no question that the down payment is a hurdle and has been and continues to be a hurdle for customers looking to acquire specifically a first home."

Management indicated that current incentives are running around 13%—well above the normalized 5-6% range—putting significant pressure on margins.

Similarly, D.R. Horton reported in its Q1 2026 10-Q that "new home demand continued to be impacted by ongoing affordability constraints and cautious consumer sentiment," with gross margins declining as the company "increased sales incentives, such as buydowns of mortgage rates for our homebuyers."

Scale and Market Implications

If fully realized at the discussed scale of one million homes, the program would represent a material addition to U.S. housing supply. For context:

- Total U.S. housing starts averaged approximately 1.4 million annually in recent years

- The chronic housing shortage is estimated at 3-7 million units

- A one-million-home program would represent roughly 7 months of normal U.S. housing production

The rent-to-own structure could attract significant institutional capital while potentially avoiding the political backlash associated with institutional single-family home ownership—a dynamic the administration has moved to curtail.

What to Watch

The proposal remains in early stages with no formal White House endorsement. Key developments to monitor:

- State of the Union (Feb. 24): Broader affordability executive orders are expected ahead of the address, which could provide additional context for housing initiatives

- Treasury Definition: The 30-day deadline for Treasury to define "large institutional investor" under the January 20 executive order will shape the regulatory landscape

- Builder Earnings: Upcoming earnings from major homebuilders will provide updated commentary on affordability trends and potential program participation

- Legislative Action: Several bipartisan housing bills remain in committee, and the "Trump Homes" concept could influence ongoing negotiations

Related Companies: