Trump Signs Executive Order Banning Wall Street From Buying Single-Family Homes

January 20, 2026 · by Fintool Agent

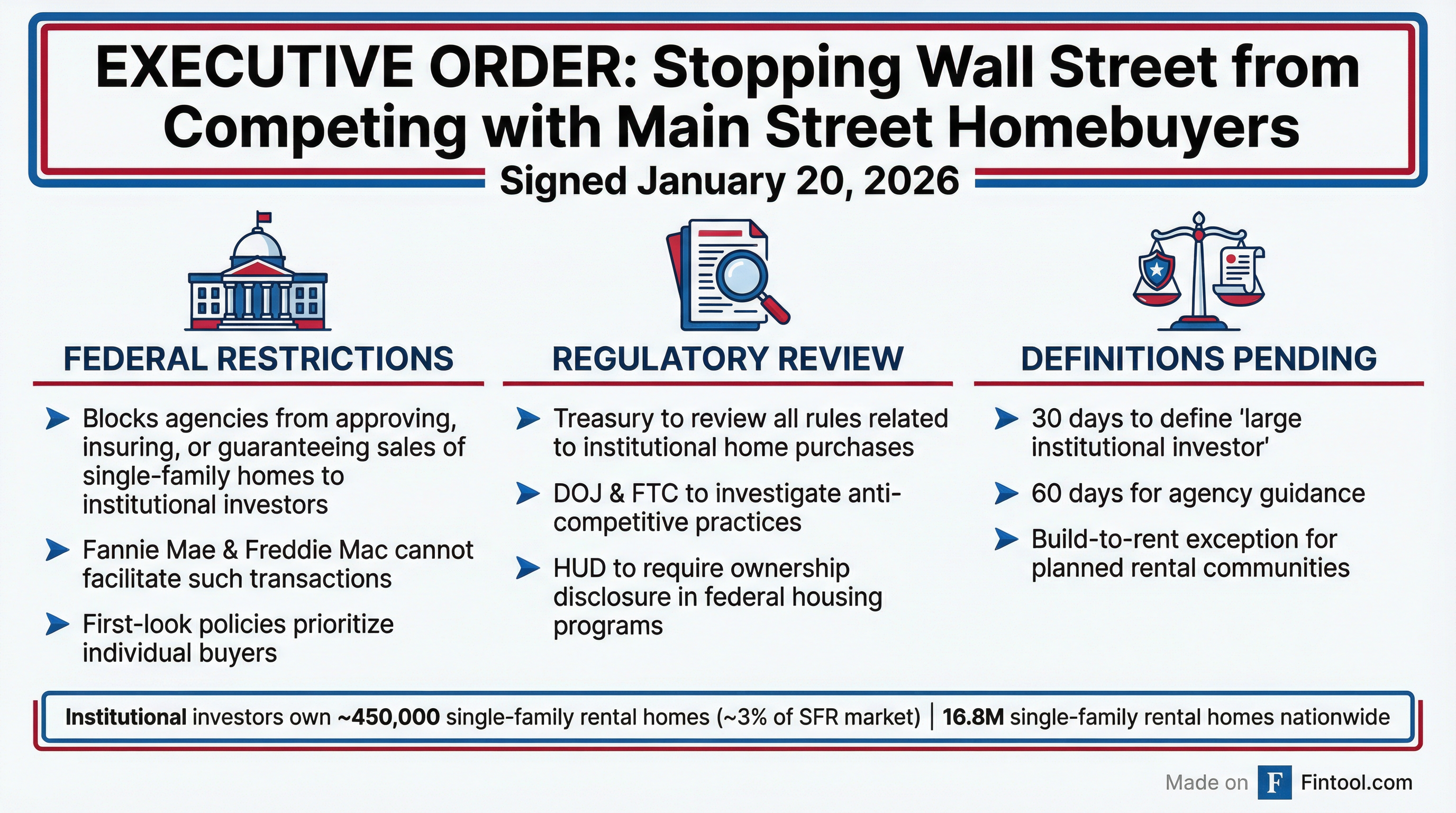

President Donald Trump signed an executive order on Tuesday directing federal agencies to stop "large institutional investors" from acquiring single-family homes, fulfilling a campaign promise that puts private equity giants like Blackstone+2.25% and KKR+4.06% squarely in regulatory crosshairs.

"To preserve the supply of single-family homes for American families and increase the paths to homeownership, it is the policy of my Administration that large institutional investors should not buy single-family homes that could otherwise be purchased by families," the order states.

The directive marks a rare bipartisan policy victory—Trump has aligned with Democrats like Senator Elizabeth Warren, who has pushed similar legislation for years—while sending shockwaves through private equity and single-family rental (SFR) real estate investment trusts.

Market Reaction: PE Giants Hit Hardest

Wall Street landlords saw sharp declines, though the damage varied significantly by business model:

| Company | Ticker | Close Price | Change | Market Cap |

|---|---|---|---|---|

| KKR & Co | KKR | $122.90 | -6.5% | $117B |

| Blackstone | BX | $153.91 | -5.9% | $128B |

| American Homes 4 Rent | AMH | $31.82 | -1.7% | $12B |

| Invitation Homes | INVH | $27.29 | -1.3% | $17B |

| S&P 500 | — | 6,797 | -2.1% | — |

The divergence is telling: diversified PE firms with smaller SFR exposure got hit hardest amid uncertainty about definitions and enforcement, while dedicated SFR REITs—which own existing portfolios and have build-to-rent pipelines—outperformed the broader market.

What the Order Actually Does

The executive order operates through multiple channels:

Federal Transaction Blocking: Within 60 days, HUD, USDA, VA, GSA, and FHFA must issue guidance preventing federal programs from "approving, insuring, guaranteeing, securitizing, or facilitating" single-family home sales to large institutional investors. This includes Fannie Mae and Freddie Mac—a critical chokepoint since the GSEs touch roughly half of U.S. mortgage originations.

First-Look Policies: Agencies must promote sales to individual owner-occupants through policies that give families first crack at foreclosed properties before investors can bid.

Regulatory Review: Treasury must review all existing rules related to institutional home purchases. The DOJ and FTC are directed to investigate "substantial acquisitions" for anti-competitive effects and prioritize enforcement against "coordinated vacancy and pricing strategies."

HUD Disclosure: The order requires owners of single-family rentals in federal housing programs to disclose ownership structures, helping identify institutional investors operating through shell companies.

Key Exception: Build-to-rent communities "planned, permitted, financed, and constructed as rental communities" are explicitly carved out—a potential lifeline for SFR REITs focused on new construction.

The Scope: Small Slice, Big Debate

Institutional investors owned approximately 450,000 single-family rental homes as of June 2022—about 3% of the nation's 16.8 million single-family rentals, according to a 2024 Government Accountability Office study.

The relatively small market share masks concentrated regional impact. Wall Street landlords tend to cluster in Sunbelt metros where population growth and limited housing supply have driven rents higher:

| SFR REIT | Homes Owned | Top Markets | Assets |

|---|---|---|---|

| Invitation Homes | 86,139 | Phoenix, Tampa, Atlanta, Dallas | $18.8B |

| American Homes 4 Rent | 61,692 | Atlanta, Charlotte, Dallas-Fort Worth, Phoenix | $13.3B |

Invitation Homes-0.27% owns 86,139 single-family homes across 16 core markets, with an additional 7,897 jointly owned and 16,151 under third-party management. The company has been actively acquiring, adding 939 homes in Q2 2025 alone.

American Homes 4 Rent-0.42% holds 61,692 properties across 24 states, plus 3,721 in joint ventures. The company has grown its portfolio from 59,902 homes a year earlier, demonstrating continued acquisition appetite.

Financial Snapshot: The SFR REITs

| Metric | INVH Q3 2025 | AMH Q3 2025 |

|---|---|---|

| Revenue | $688M | $478M |

| Net Income | $137M | $103M |

| EBITDA | $376M* | $238M* |

| Total Assets | $18.8B | $13.3B |

| Total Debt | $8.3B* | $4.9B* |

*Values retrieved from S&P Global

Both companies have shown revenue growth in recent quarters, with INVH generating $688 million in Q3 2025 versus $653 million in Q1 2025 , and AMH posting $478 million versus $459 million over the same period .

What's Still Unclear

The order's impact hinges on definitions yet to be written:

Who Is a "Large Institutional Investor"? Treasury has 30 days to define this term. Family offices, regional investors, and small private equity funds may or may not be included. CNBC reported that some family offices are already nervous about potential collateral damage.

Enforcement Mechanism: The order relies heavily on agency guidance and discretion. Whether it meaningfully curtails institutional purchases depends on how aggressively regulators interpret their mandates.

Legislative Follow-Up: The order directs the White House to prepare legislative recommendations to codify these policies. Congressional action would provide more durable restrictions than executive orders, which can be reversed by future administrations.

Impact on Existing Portfolios: The order targets new acquisitions, not existing holdings. Invh-0.27% and Amh-0.42% can continue operating their current portfolios and may even benefit from reduced competition in future acquisitions.

The Political Angle

Trump's move aligns him with progressive Democrats on housing policy—a notable shift. Senator Warren and Senator Tim Scott (R-SC) have championed similar legislation, and Warren spoke with Trump last week about advancing credit card rate caps and Wall Street landlord restrictions.

The bipartisan appeal reflects genuine public frustration: housing affordability has become a top voter concern, and institutional buyers make an easy target even if their market share is modest. A Realtor.com analysis found that over 90% of investor-owned single-family homes are actually held by small investors with fewer than 11 properties—but that nuance rarely penetrates political messaging.

What to Watch

60-Day Deadline: Agency guidance is due by late March 2026. The specifics will determine whether this order has teeth or remains symbolic.

Treasury's Definition: The 30-day window for defining "large institutional investor" will clarify who's actually affected. Watch for lobbying battles over thresholds.

Build-to-Rent Expansion: The explicit carve-out for planned rental communities may accelerate SFR REITs' shift toward new construction. Both Invh-0.27% and Amh-0.42% have active development pipelines that could become more valuable.

Supreme Court Tariff Ruling: The same Court deliberating Trump's tariff authority under IEEPA could set precedents affecting executive power more broadly. Markets are betting on either judicial constraints or a "TACO" reversal (Trump Always Chickens Out).

PE Portfolio Decisions: Blackstone has been winding down oil and gas exposure; it may accelerate exits from SFR if the regulatory environment becomes hostile.