TSMC Smashes Earnings with Record $16B Profit, Unveils $56B Capex for Arizona Gigafab

January 15, 2026 · by Fintool Agent

Taiwan Semiconductor Manufacturing Company delivered its eighth consecutive quarter of profit growth Thursday, reporting record net income of NT$505.74 billion ($16 billion) - a 35% year-over-year surge that crushed analyst estimates and signaled the AI infrastructure buildout shows no signs of slowing.

The world's most important chipmaker also dropped a capex bombshell: $52-56 billion in 2026 spending, up to 37% higher than last year, with CEO C.C. Wei acknowledging the company is "very nervous" about the massive bet even as customer demand remains insatiable.

TSMC shares surged 5-6% in pre-market trading.

The Numbers That Matter

Fourth quarter results beat estimates across the board:

| Metric | Q4 2025 | Q4 2024 | YoY Change |

|---|---|---|---|

| Revenue | $33.73B | $26.88B | +25.5% |

| Net Income | $16.02B | $11.87B | +35.0% |

| Gross Margin | 62.3% | 59.0% | +330 bps |

| Operating Margin | 54.0% | 49.0% | +500 bps |

| EPS (NT$) | 19.50 | 14.45 | +35.0% |

Full-year 2025 revenue reached $122.42 billion, up 36% year-over-year, with operating cash flow of NT$2.27 trillion.

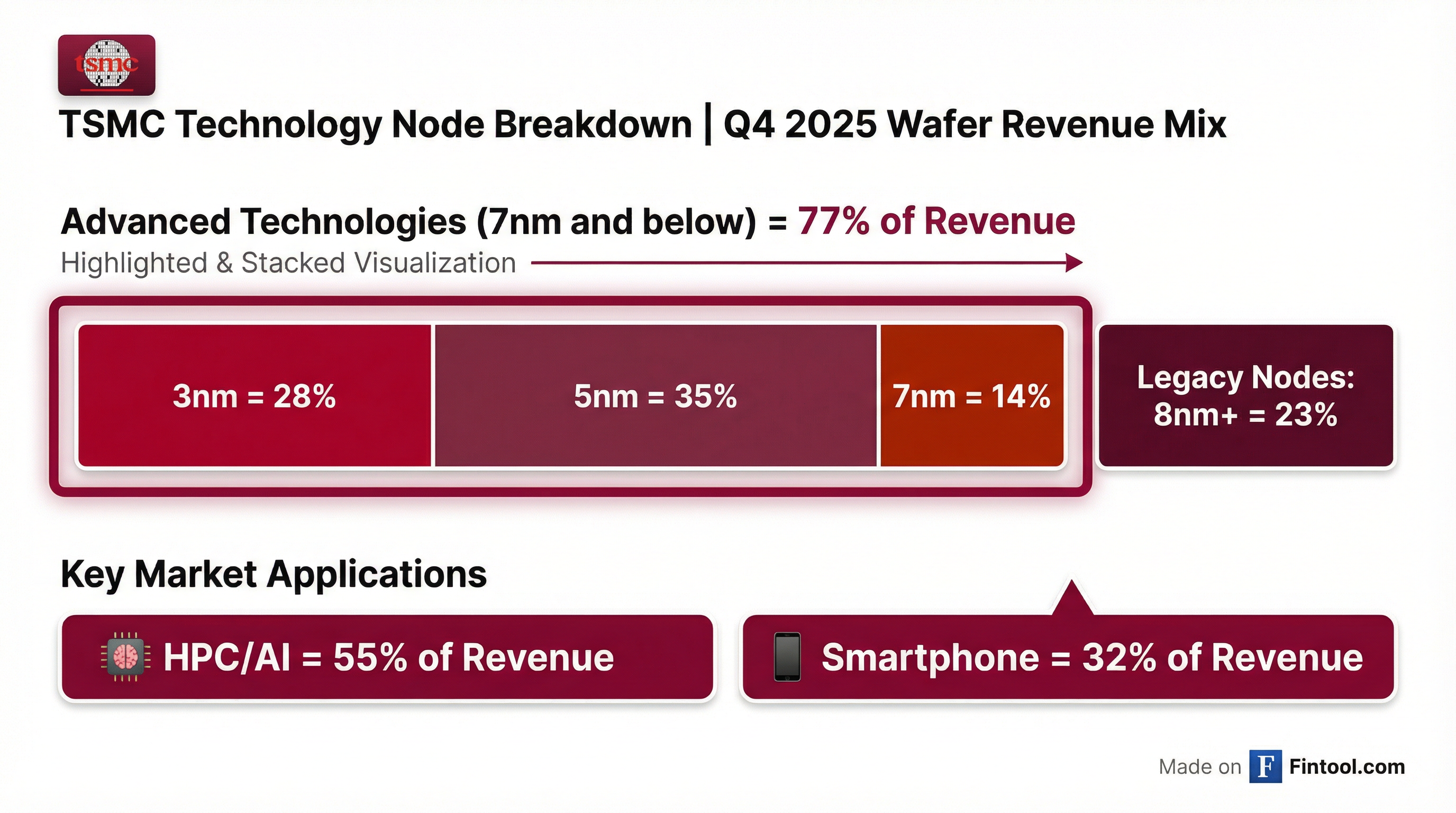

AI Dominance: 77% Advanced, 55% HPC

The technology mix tells the story of TSMC's stranglehold on AI computing. Advanced chips - defined as 7-nanometer and smaller - now represent a staggering 77% of wafer revenue, up from 69% in 2024.

The breakdown within advanced nodes:

| Node | Q4 2025 Share | Application |

|---|---|---|

| 3nm | 28% | Latest AI accelerators, flagship mobile |

| 5nm | 35% | Nvidia data center GPUs, Apple silicon |

| 7nm | 14% | Previous-gen AI, gaming GPUs |

High-performance computing (HPC), which encompasses AI server chips and accelerators, drove 55% of fourth quarter revenue. Smartphones accounted for 32%, with IoT and automotive each at 5%.

"The demand for AI remains very strong, driving overall chip demand across the entire server industry," Counterpoint Research analyst Jake Lai told CNBC, predicting 2026 will be another "breakout year" for AI server demand.

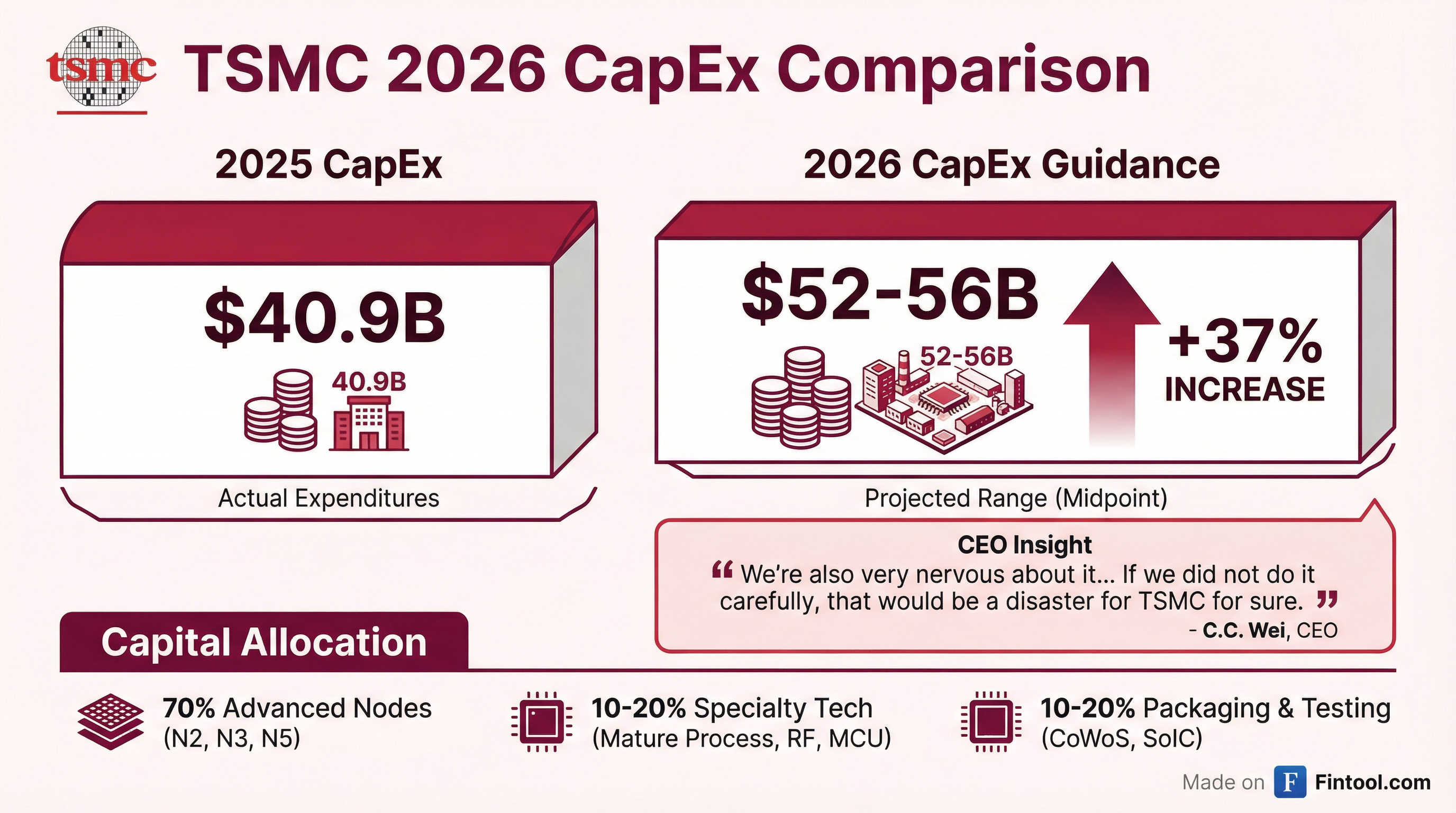

The $56 Billion Question

TSMC's 2026 capital expenditure guidance of $52-56 billion represents the largest annual investment in the company's history - and Wei isn't hiding his concerns.

"We're also very nervous about it. We're investing $52-$56 billion in capex. If we did not do it carefully, that would be a disaster for TSMC for sure," Wei said during the earnings call, when asked about concerns of an AI bubble.

The allocation plan:

- 70% for advanced process technologies (3nm, 2nm)

- 10-20% for specialty technologies

- 10-20% for advanced packaging, testing, and mask making

CFO Wendell Huang framed the spending as opportunity-driven: "A higher level of capital expenditures is always correlated with higher growth opportunities in the following years."

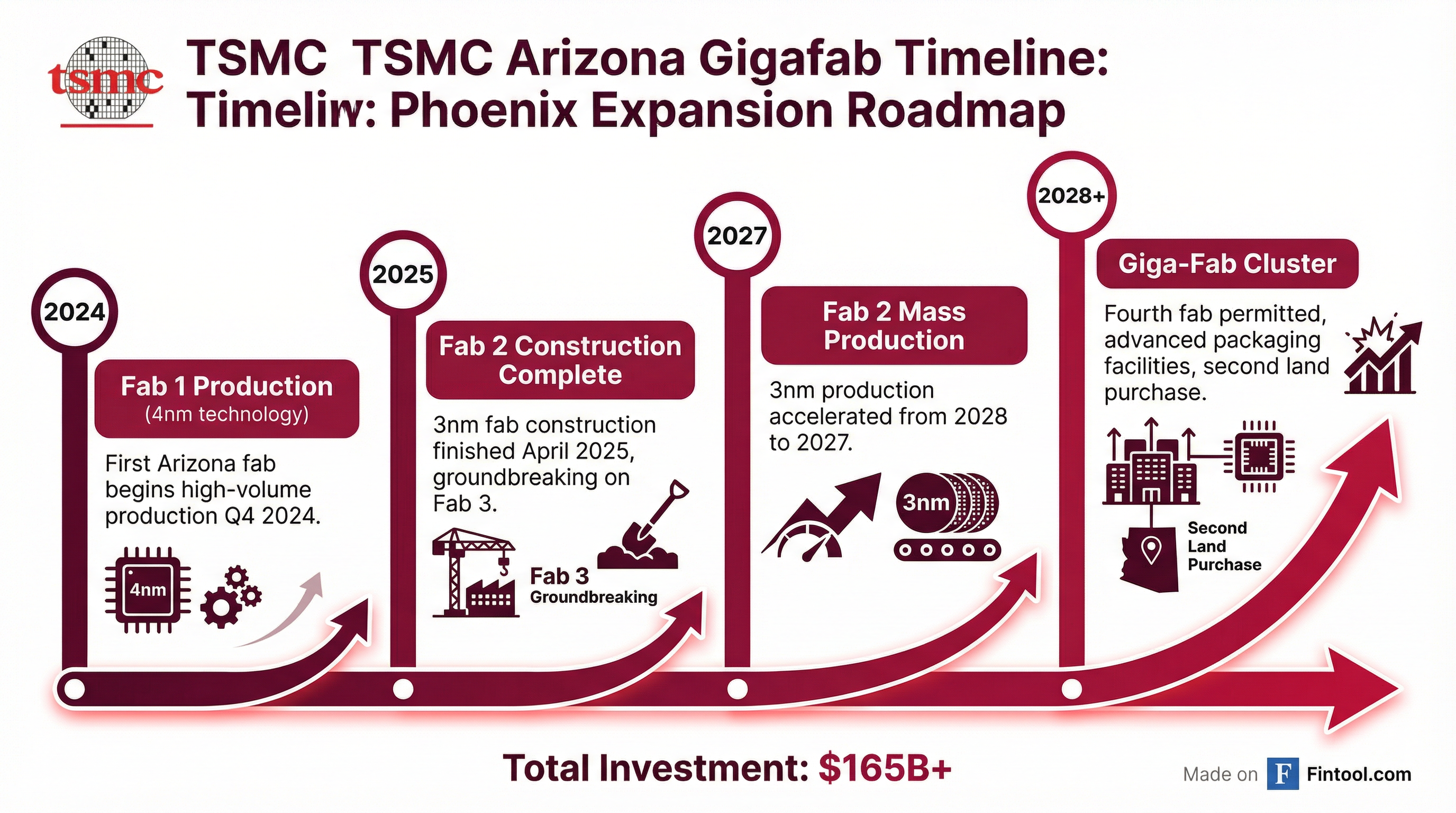

Arizona: From Fab to Gigafab

The Phoenix expansion is accelerating. TSMC now plans to bring its second Arizona fab online in 2027 - a full year earlier than originally projected - with equipment installation beginning Q3 2026.

The Phoenix roadmap:

| Facility | Process | Status | Production Timeline |

|---|---|---|---|

| Fab 1 | 4nm | Operating | High-volume since Q4 2024 |

| Fab 2 | 3nm | Construction complete | 2027 (accelerated from 2028) |

| Fab 3 | 2nm | Groundbreaking | TBD |

| Fab 4 | TBD | Permits filed | TBD |

| Advanced Packaging | CoWoS | Planned | Multiple facilities |

"We have just completed the purchase of a second large piece of land nearby," Wei revealed on the Q3 call, noting the additional acreage provides flexibility for multi-year AI demand. "Our plan will enable TSMC to scale up to an independent gigafab cluster in Arizona."

Total US investment commitment: $165 billion and climbing.

Q1 2026 Guidance: The Beat Goes On

Management's outlook for Q1 2026 remains bullish:

| Metric | Q1 2026 Guidance |

|---|---|

| Revenue | $34.6B - $35.8B |

| YoY Growth | 38% at midpoint |

| Gross Margin | 63% - 65% |

| Operating Margin | 54% - 56% |

For full-year 2026, TSMC expects revenue to increase "by close to 30%" in US dollar terms. Looking further out, management forecasts a 25% revenue CAGR from 2024-2029.

The Risk Factor: Tariffs and Trade

Wei flagged global tariff policies as the primary risk factor entering 2026, particularly for consumer electronics and price-sensitive market segments.

On the same day TSMC reported earnings, President Trump signed a proclamation imposing 25% tariffs on certain advanced semiconductors including Nvidia's H200 and Amd's MI325X. The tariff applies when chips enter the US and are resold to data centers - a direct hit to AI infrastructure spending.

Yet Wei remains confident in the fundamental demand picture, telling analysts that TSMC's customers "are providing strong signals" and requesting capacity, with 2026 revenue growth forecast near 30% despite trade uncertainties.

What to Watch

Near-term catalysts:

- Q3 2026: Equipment installation begins at Phoenix Fab 2

- H1 2026: 2nm volume production ramp

- Q1 2026: Earnings (late April) - first read on tariff impacts

Longer-term:

- Late 2027: Arizona Fab 2 mass production

- 2028-2029: Capex "increases significantly" per management

- Ongoing: Intel foundry competitive positioning

The bottom line: TSMC's AI dominance is accelerating, not plateauing. With 77% of revenue from advanced nodes, a $56 billion capex program, and an Arizona gigafab taking shape, the company is betting the demand supercycle has years to run. Wei's candid admission of nervousness is actually reassuring - it suggests TSMC is stress-testing its assumptions rather than blindly building.

For investors, the question isn't whether AI chip demand is real. It's whether the current pace of infrastructure spending can be sustained without margin compression - and whether tariffs will disrupt the economics. So far, TSMC's 62% gross margin suggests pricing power remains firmly intact.

Related Research: