TSMC Posts First Trillion-Dollar Quarter as AI Demand Powers Record 2025

January 9, 2026 · by Fintool Agent

Taiwan Semiconductor Manufacturing Company reported fourth-quarter revenue of NT$1.046 trillion ($33.11 billion)—the first time the world's largest chipmaker has exceeded NT$1 trillion in a single quarter—as insatiable demand for AI processors continues to redefine the semiconductor supply chain.

The result beat the LSEG SmartEstimate of NT$1.036 trillion and landed near the high end of TSMC's own guidance of $32.2 billion to $33.4 billion. For full-year 2025, consolidated revenue reached NT$3.81 trillion, up 31.6% from 2024's already-record NT$2.89 trillion.

TSMC shares rose 1.8% to $323.63 on the news, extending a 60.5% rally over the past twelve months.

The Numbers

| Metric | Q4 2025 | Q3 2025 | Q4 2024 | YoY Change |

|---|---|---|---|---|

| Revenue (NT$ billions) | 1,046 | 990 | 868 | +20.4% |

| Revenue (USD billions) | $33.1 | $33.1 | $27.5 | +20.4% |

December alone delivered NT$335 billion, up 20.4% year-over-year but down 2.5% from November—a seasonal pattern TSMC had forecast as smartphone build activity typically eases after the holiday production surge.

| Period | 2025 Revenue (NT$ billions) | 2024 Revenue (NT$ billions) | Growth |

|---|---|---|---|

| Full Year | 3,809 | 2,894 | +31.6% |

| Q4 | 1,046 | 868 | +20.4% |

AI Drives the Mix

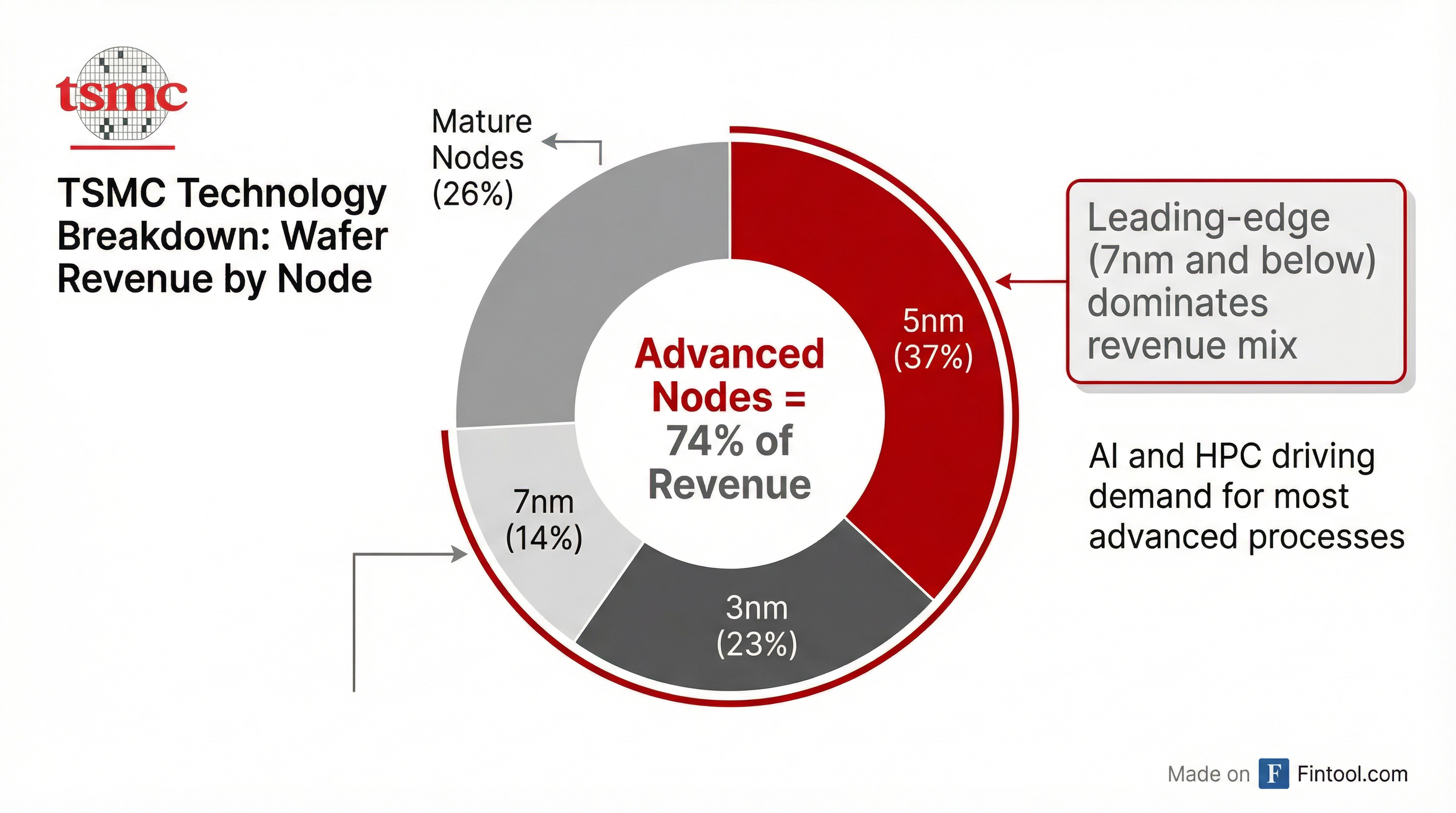

The revenue surge reflects TSMC's stranglehold on the most advanced chipmaking processes that power AI training and inference. In Q3 2025—the most recent period with detailed disclosure—advanced nodes accounted for 74% of wafer revenue:

| Process Node | Q3 2025 Revenue Share |

|---|---|

| 3nm | 23% |

| 5nm | 37% |

| 7nm | 14% |

| Advanced (7nm & below) | 74% |

CFO Wendell Huang attributed the performance to "strong demand for our leading-edge process technologies," noting that Q4 would see "continued strong demand" from AI and high-performance computing customers.

Nvidia, now the world's most valuable company, relies almost exclusively on TSMC to manufacture its H100, H200, and Blackwell-series AI accelerators. Apple similarly sources its M-series and A-series chips from TSMC's most advanced fabs. Together, these two customers likely account for over 40% of TSMC revenue.

Margins and Profitability

Q3 2025 provided the last detailed earnings snapshot before next week's call:

| Metric | Q3 2025 |

|---|---|

| Net Income | NT$452.3 billion |

| EPS | NT$17.44 |

| Gross Margin | 59.5% |

| Operating Margin | 50.6% |

For Q4, management guided gross margin to 59-61% and operating margin to 49-51%—remarkably stable given the aggressive $42 billion capital expenditure program underway.

Stock Performance

| Metric | Value |

|---|---|

| Current Price | $323.63 |

| Change Today | +1.8% |

| 52-Week High | $327.43 |

| 52-Week Low | $141.37 |

| 1-Year Return | +60.5% |

| Market Cap | $1.68 trillion |

TSMC's 60.5% gain over the past year dwarfs Taiwan's broader market, which rose 25.7%. The stock is trading within 2% of its all-time high, reflecting confidence that AI infrastructure spending will sustain through 2026 and beyond.

Goldman Sachs recently raised its price target to NT$2,330 (~$375), citing stronger-than-expected AI infrastructure demand.

Semiconductor Rally Extends

TSMC's results capped a strong day for chipmakers. Intel surged 10.8% after President Trump said he had a "great meeting" with CEO Lip-Bu Tan, while Broadcom added 3.8%. The broader market also rallied, with the S&P 500 closing at a record high.

Taiwan's Foxconn, NVIDIA's primary server manufacturing partner, reported Q4 revenue of NT$2.6 trillion on Monday—another data point confirming that AI capital expenditure remains robust.

What to Watch: January 15 Earnings Call

TSMC will report full Q4 results on January 15, 2026 at 1:00 AM Eastern Time, providing:

- Full Q4 financials: Net income, margins, segment breakdown

- Q1 2026 guidance: Revenue, gross margin, operating margin outlook

- 2026 capital expenditure plans: Whether the ~$42 billion spend continues or accelerates

- Technology roadmap updates: 2nm ramp progress and potential 1.4nm timeline

The January 15 call is the most important semiconductor event of Q1, setting the tone for AI spending expectations across the tech sector.

The Investment Case

TSMC's trillion-dollar quarter crystallizes a simple thesis: every major AI advancement—from ChatGPT to autonomous vehicles to humanoid robots—requires more advanced chips, and TSMC makes over 90% of them.

Bulls argue:

- AI demand shows no signs of slowing; hyperscaler capex guides remain elevated

- 2nm production is ramping with yields exceeding expectations

- Pricing power allows margin expansion even as capex accelerates

- Geographic diversification (Arizona, Japan, Germany fabs) reduces Taiwan concentration risk

Bears caution:

- Valuation at ~30x forward earnings prices in substantial growth

- Geopolitical risk around Taiwan remains an overhang

- Customer concentration (NVIDIA + Apple > 40%) creates dependency

- Consumer electronics recovery remains sluggish outside AI

For now, the numbers speak clearly: TSMC's first trillion-dollar quarter proves that the AI infrastructure buildout has room to run.