Uber Commits $100M to Build Robotaxi Charging Network, Signaling Strategic Pivot

February 18, 2026 · by Fintool Agent

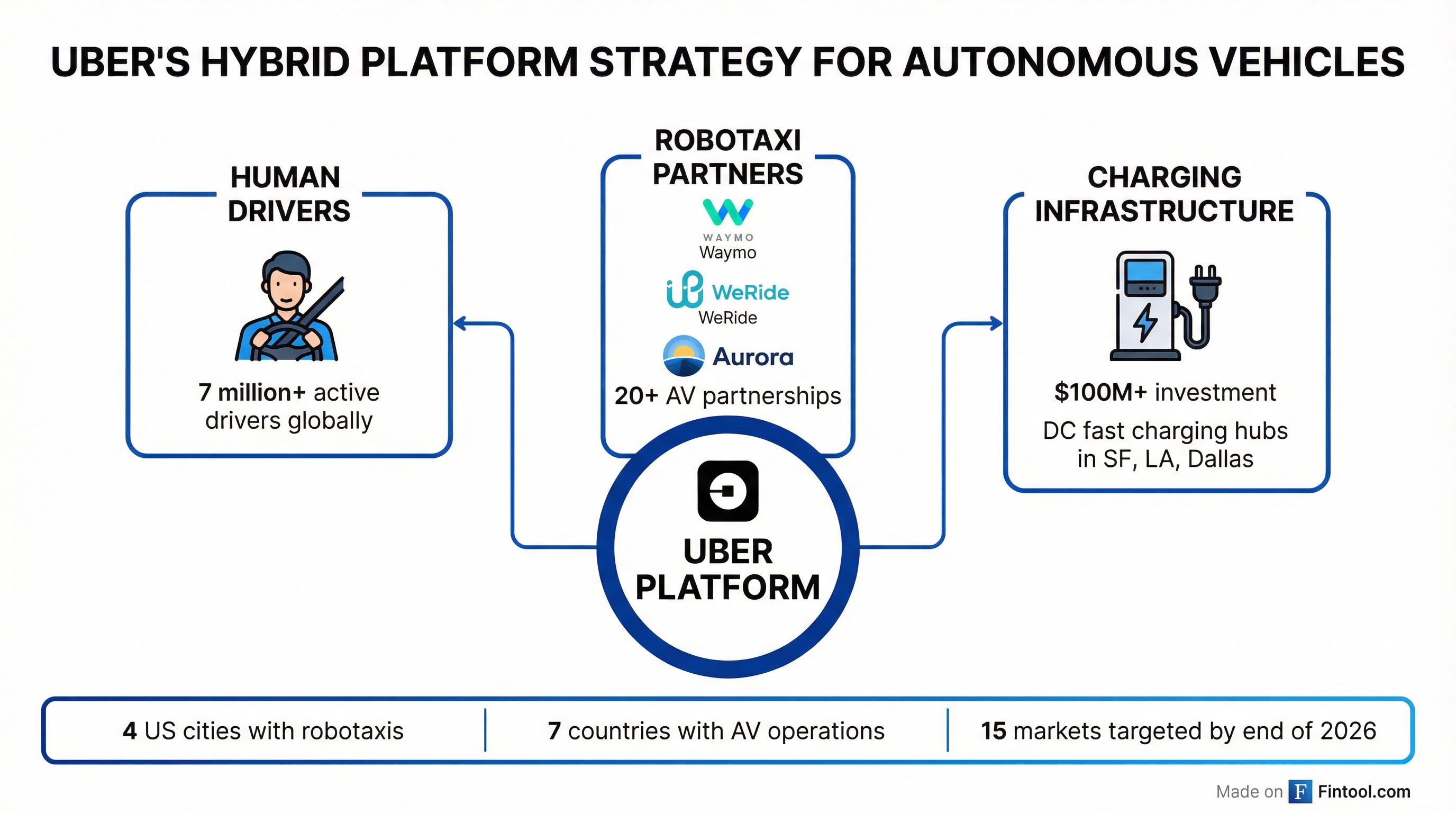

Uber Technologies announced Wednesday it will invest more than $100 million to build autonomous vehicle charging infrastructure, marking a significant departure from its historically asset-light business model as it races to establish itself as a critical player in the robotaxi industry.

The investment will fund DC fast-charging hubs at Uber's autonomous vehicle depots—where robotaxis are cleaned, maintained, and inspected—starting in the San Francisco Bay Area, Los Angeles, and Dallas. The company also plans to build "pit stop" charging stations at convenient locations throughout major cities for mid-shift vehicle top-ups.

From Platform to Infrastructure Owner

The announcement represents a strategic evolution for Uber, which built its $147 billion market cap on an asset-light model that connected drivers with riders without owning vehicles. CEO Dara Khosrowshahi signaled this shift on the company's Q4 2025 earnings call: "We are setting up depots, acquiring real estate, making sure we have the charging infrastructure in place," he said, describing the machinery required to scale autonomous operations.

The $100 million investment covers site development, equipment, grid connections, and associated capital expenditure. While significant, it remains modest relative to Uber's financial position—the company generated $2.9 billion in operating cash flow in Q4 2025 alone and ended the quarter with $7.1 billion in cash.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $11.5 | $12.7 | $13.5 | $14.4 |

| Operating Cash Flow ($B) | $2.3 | $2.6 | $2.3 | $2.9 |

| Cash & Equivalents ($B) | $5.1 | $6.4 | $8.4 | $7.1 |

Global Charging Partnerships

Beyond building its own infrastructure, Uber is partnering with charging network operators worldwide through "utilization guarantee agreements"—essentially promising minimum usage levels in exchange for discounted rates for Uber drivers.

The partnerships include:

- Evgo in New York, Los Angeles, San Francisco, and Boston

- Electra in Paris and Madrid

- Hubber and Ionity in London

- Revel in New York (existing partnership with 25% driver discount)

"Electrification of ride share is something that we've been seeing quarter after quarter, year after year," said EVgo CEO Badar Khan. Rideshare vehicles now account for roughly 25% of EVgo's network energy, up from about 10% in 2021.

The Robotaxi Race Intensifies

Uber currently offers robotaxi services in four U.S. cities—Austin, Atlanta, Phoenix, and San Francisco—plus Dubai, Abu Dhabi, and Riyadh internationally. The company has partnered with more than 20 autonomous vehicle firms, including Alphabet's Waymo and China's WeRide, and targets deployment in 15 markets by year-end 2026.

The infrastructure push reflects the reality that charging is a critical bottleneck for scaling autonomous fleets. Unlike human drivers who can charge at home or find stations during off-hours, robotaxis need to maximize utilization—meaning rapid charging during brief maintenance windows.

"Cities can only unlock the full promise of autonomy and electrification if the right charging infrastructure is built for scale. That infrastructure needs to work for today's drivers and the fleets of the future," said Pradeep Parameswaran, Uber's global head of mobility.

Competitive Positioning

The investment comes as Uber faces mounting competitive pressure. Tesla is preparing to launch its robotaxi service, and Waymo continues expanding its driverless operations. By controlling charging infrastructure, Uber aims to become indispensable to robotaxi operators—even potential competitors.

Khosrowshahi has framed Uber's approach as analogous to the hotel industry: "Just like Marriott doesn't have to own its hotels, you've got REITs that own their hotels and make an appropriate return on equity, you will see the same thing in the future on fleets." The company expects the AV ecosystem to "financialize" over time, with third-party capital funding vehicle purchases while Uber controls the platform and critical infrastructure.

The strategy also includes data collection. Uber is partnering with NVIDIA to build what Khosrowshahi called a "real-world data collection factory," targeting over 3 million hours of passenger AV-specific driving data to share with its AV partners.

What to Watch

Uber's stock traded at $70.53, down roughly 31% from its 52-week high of $101.99, as investors weigh the capital intensity of its AV strategy against near-term profitability. Key catalysts ahead:

- Market expansion: Progress toward the 15-market robotaxi target by year-end 2026

- Charging infrastructure buildout: Timelines for depot completion in SF, LA, and Dallas

- Partnership announcements: Additional utilization guarantee agreements and OEM relationships

- Regulatory developments: Approval timelines for driverless operations in new markets

The charging infrastructure bet signals that Uber views physical assets as essential to its autonomous future—a significant evolution for a company that once prided itself on owning nothing but software.

Related companies: Uber Technologies · Evgo · Alphabet · Tesla · Chargepoint