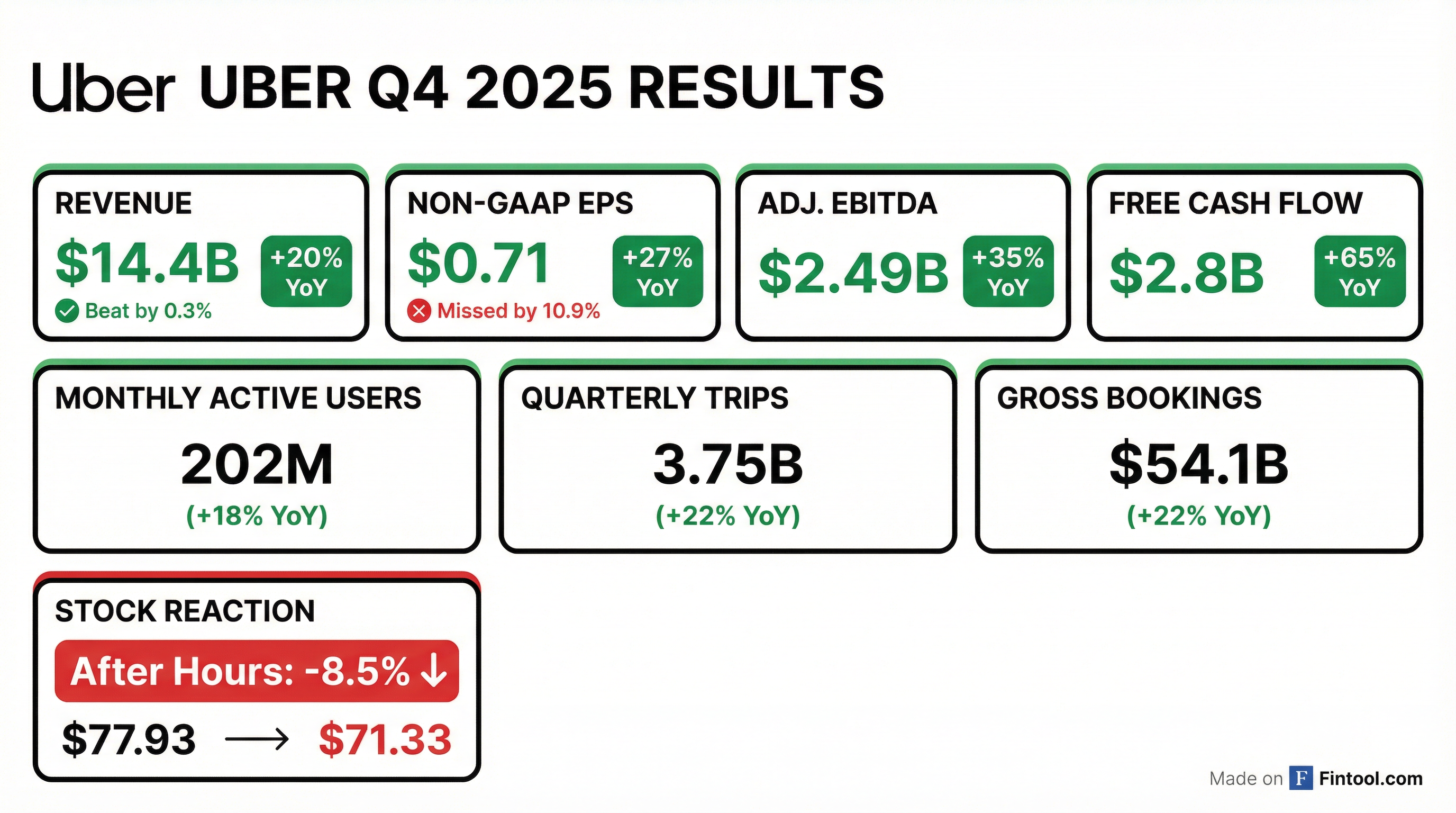

Earnings summaries and quarterly performance for Uber Technologies.

Executive leadership at Uber Technologies.

Dara Khosrowshahi

Chief Executive Officer

Jill Hazelbaker

Chief Marketing Officer and Senior Vice President, Public Affairs

Mac Macdonald

President and Chief Operating Officer

Nikki Krishnamurthy

Senior Vice President and Chief People Officer

Prashanth Mahendra-Rajah

Chief Financial Officer

Tony West

Senior Vice President, Chief Legal Officer and Corporate Secretary

Board of directors at Uber Technologies.

Alexander Wynaendts

Director

Amanda Ginsberg

Director

David Trujillo

Director

John Thain

Director

Nikesh Arora

Director

Revathi Advaithi

Director

Robert Eckert

Director

Ronald Sugar

Independent Chairperson of the Board

Turqi Alnowaiser

Director

Ursula Burns

Director

Research analysts who have asked questions during Uber Technologies earnings calls.

Brian Nowak

Morgan Stanley

8 questions for UBER

Eric Sheridan

Goldman Sachs

8 questions for UBER

Justin Post

Bank of America Corporation

8 questions for UBER

Douglas Anmuth

JPMorgan Chase & Co.

6 questions for UBER

Nikhil Devnani

Bernstein

5 questions for UBER

Ross Sandler

Barclays

5 questions for UBER

John Colantuoni

Jefferies

4 questions for UBER

Mark Mahaney

Evercore ISI

4 questions for UBER

Michael Morton

MoffettNathanson

4 questions for UBER

Ronald Josey

Citigroup Inc.

3 questions for UBER

Benjamin Black

Deutsche Bank AG

2 questions for UBER

Doug Anmuth

J.P. Morgan

2 questions for UBER

Kenneth Gawrelski

Wells Fargo & Company

1 question for UBER

Michael Nathanson

MoffettNathanson

1 question for UBER

Shweta Khajuria

Wolfe Research, LLC

1 question for UBER

Recent press releases and 8-K filings for UBER.

- Uber Air powered by Joby enables riders to book Joby Aviation’s all-electric air taxi directly through the Uber app, with first passenger flights planned for later this year in Dubai.

- Riders access one-tap booking via the “Where to?” bar, seamlessly combining air travel with Uber Black pickup and drop-off.

- Joby’s eVTOL aircraft carries up to four passengers, uses six tilting propellers, and can reach 200 mph with a 100-mile range on a single charge.

- Joby has completed over 50,000 miles of flight tests and is in the final stage of FAA certification ahead of U.S. commercial operations.

- Uber is acquiring parking‐reservation app SpotHero for an undisclosed amount, integrating its booking features directly into the Uber app.

- SpotHero’s network covers over 13,000 garages and lots across more than 400 U.S. and Canadian cities.

- The transaction is expected to close in 1H 2026, subject to regulatory approvals, initially targeting commuter parking with plans to expand to events, venues and airports.

- The deal fits Uber’s push to become a super‐app for car owners, with potential tie-ins to fleet services and vehicle charging; shares fell about 4% on the announcement.

- Uber Technologies agreed to acquire parking reservation app SpotHero, adding parking capabilities to the Uber app.

- SpotHero operates in over 13,000 locations across more than 400 cities in North America, with over $2 billion in reservations sold.

- Uber will integrate native in-app parking reservations for commuters, events, venues, and airports, and extend benefits to Uber One members.

- The transaction, subject to regulatory approval, is expected to close in the first half of 2026.

- Uber launched Uber Autonomous Solutions, an end-to-end suite for autonomous-vehicle developers covering infrastructure, user experience and fleet operations.

- The company invested $500 million in Waabi and ordered 25,000 autonomous vehicles, and is committing over $100 million to AV charging hubs in U.S. markets.

- Uber aims to operate AV services in 15 cities by end of 2026, including London, Los Angeles and Hong Kong.

- Partnerships include deploying Lucid SUVs outfitted with Nuro sensors in San Francisco and a shared AV service with Volkswagen in Los Angeles.

- Uber will invest more than $100 million to build high-speed DC charging stations at robotaxi depots in the San Francisco Bay Area, Los Angeles and Dallas.

- The company has signed “utilization guarantee” agreements with EVgo, Electra, Hubber and Ionity to deploy hundreds of chargers in high-demand locations.

- The initiative marks a strategic shift from Uber’s historically asset-light model to a more capital-heavy approach, including investments in vehicle partners to secure supply and accelerate autonomous deployments.

- The plan also addresses heavy fast-charging use by ride-hail drivers; about 13,000 EV drivers in NYC, such as Charles Iwuoha, rely on these chargers for cost-effective operations.

- Uber and WeRide launched the first commercial Robotaxi service in downtown Abu Dhabi, covering routes between Corniche Road, Sheikh Zayed Grand Mosque, Khalifa City, Masdar City, and Rabdan.

- The fleet has quadrupled in size since starting operations in December 2024 and now comprises over 200 Robotaxis, serving approximately 70% of Abu Dhabi’s core areas.

- Operations are endorsed by the Integrated Transport Centre and run with Tawasul Transport as the main fleet operator, with vehicle specialists on board in a phased move towards fully driverless service.

- In February 2026, Uber and WeRide committed to deploy at least 1,200 Robotaxis across the Middle East by 2027; Level 4 fully driverless commercial operations began on Yas Island in November 2025.

- Uber partners with Baidu and Dubai’s RTA to integrate Apollo Go autonomous vehicles into the Uber app, launching next month in the Jumeirah area.

- The service will be available via Uber Comfort, UberX, or an “Autonomous” option, with fleet management handled by New Horizon.

- This deployment supports Dubai’s goal of 25% autonomous trips by 2030 and builds on the July strategic partnership between Apollo Go and Uber.

- As of October 31, 2025, Apollo Go has logged over 240 million autonomous kilometers (including 140 million driverless) across 22 cities, with 250,000+ weekly rides and 17 million cumulative rides.

- Uber agreed to acquire Getir’s delivery portfolio in Türkiye, combining Getir and Trendyol Go into the Uber platform across food, grocery, retail, and water delivery services.

- The transaction includes $335 million in cash for 100% of Getir’s food delivery business and a $100 million investment for a 15% stake in Getir’s grocery, retail, and water delivery operations, with the remainder to be acquired upon meeting performance conditions.

- Getir’s food delivery unit reported generating over $1 billion in gross bookings in 2025, a more than 50% increase year-over-year on a constant currency basis.

- The deal is subject to regulatory approval, with the food delivery acquisition expected to close in H2 2026.

- Uber and Mubadala Investment Company agreed for Uber to acquire Getir’s delivery portfolio in Türkiye, covering food, grocery, retail, and water services.

- Post-close, Uber will integrate Getir and Trendyol Go delivery operations to enhance selection, support more courier opportunities, and boost demand for restaurants and retailers.

- Getir customers will continue using the Getir Super App with added Trendyol Go restaurants, while Trendyol Go users will access Getir’s grocery offerings through their app.

- The agreement highlights Uber’s long-term commitment to Türkiye’s digital economy and Mubadala’s continued investment focus in the market.

- Uber and WeRide will deploy at least 1,200 Robotaxis across Abu Dhabi, Dubai, and Riyadh by 2027.

- All Robotaxis will be bookable via the Uber app, with fleet growth tied to regulatory approvals and performance milestones.

- The expansion is the largest Robotaxi commercial commitment in MENA, building on WeRide’s existing fleet of 200+ Robotaxis in three cities, with 12 more cities planned by 2030.

- WeRide’s asset-light model assigns fleet operations to Uber or local partners, minimizing capital deployment by the technology provider.

- Current Abu Dhabi operations average dozens of daily trips per vehicle and are approaching breakeven unit economics.

Fintool News

In-depth analysis and coverage of Uber Technologies.

Uber Acquires SpotHero, Brings Parking Into Its Super-App Ecosystem

Uber Launches Autonomous Solutions: The Robotaxi Broker Bet

Uber Commits $100M to Build Robotaxi Charging Network, Signaling Strategic Pivot

Uber Ordered to Pay $8.5 Million in First Federal Sexual Assault Bellwether Trial

Uber CFO Departs After Just 27 Months as Stock Plunges 12% on Weak Guidance

Waabi Raises $1 Billion, Partners With Uber to Deploy 25,000 Robotaxis

Quarterly earnings call transcripts for Uber Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more