Earnings summaries and quarterly performance for Uber Technologies.

Executive leadership at Uber Technologies.

Dara Khosrowshahi

Chief Executive Officer

Jill Hazelbaker

Chief Marketing Officer and Senior Vice President, Public Affairs

Mac Macdonald

President and Chief Operating Officer

Nikki Krishnamurthy

Senior Vice President and Chief People Officer

Prashanth Mahendra-Rajah

Chief Financial Officer

Tony West

Senior Vice President, Chief Legal Officer and Corporate Secretary

Board of directors at Uber Technologies.

Alexander Wynaendts

Director

Amanda Ginsberg

Director

David Trujillo

Director

John Thain

Director

Nikesh Arora

Director

Revathi Advaithi

Director

Robert Eckert

Director

Ronald Sugar

Independent Chairperson of the Board

Turqi Alnowaiser

Director

Ursula Burns

Director

Research analysts who have asked questions during Uber Technologies earnings calls.

Brian Nowak

Morgan Stanley

8 questions for UBER

Eric Sheridan

Goldman Sachs

8 questions for UBER

Justin Post

Bank of America Corporation

8 questions for UBER

Douglas Anmuth

JPMorgan Chase & Co.

6 questions for UBER

Nikhil Devnani

Bernstein

5 questions for UBER

Ross Sandler

Barclays

5 questions for UBER

John Colantuoni

Jefferies

4 questions for UBER

Mark Mahaney

Evercore ISI

4 questions for UBER

Michael Morton

MoffettNathanson

4 questions for UBER

Ronald Josey

Citigroup Inc.

3 questions for UBER

Benjamin Black

Deutsche Bank AG

2 questions for UBER

Doug Anmuth

J.P. Morgan

2 questions for UBER

Kenneth Gawrelski

Wells Fargo & Company

1 question for UBER

Michael Nathanson

MoffettNathanson

1 question for UBER

Shweta Khajuria

Wolfe Research, LLC

1 question for UBER

Recent press releases and 8-K filings for UBER.

- Uber and WeRide will deploy at least 1,200 Robotaxis across Abu Dhabi, Dubai, and Riyadh by 2027.

- All Robotaxis will be bookable via the Uber app, with fleet growth tied to regulatory approvals and performance milestones.

- The expansion is the largest Robotaxi commercial commitment in MENA, building on WeRide’s existing fleet of 200+ Robotaxis in three cities, with 12 more cities planned by 2030.

- WeRide’s asset-light model assigns fleet operations to Uber or local partners, minimizing capital deployment by the technology provider.

- Current Abu Dhabi operations average dozens of daily trips per vehicle and are approaching breakeven unit economics.

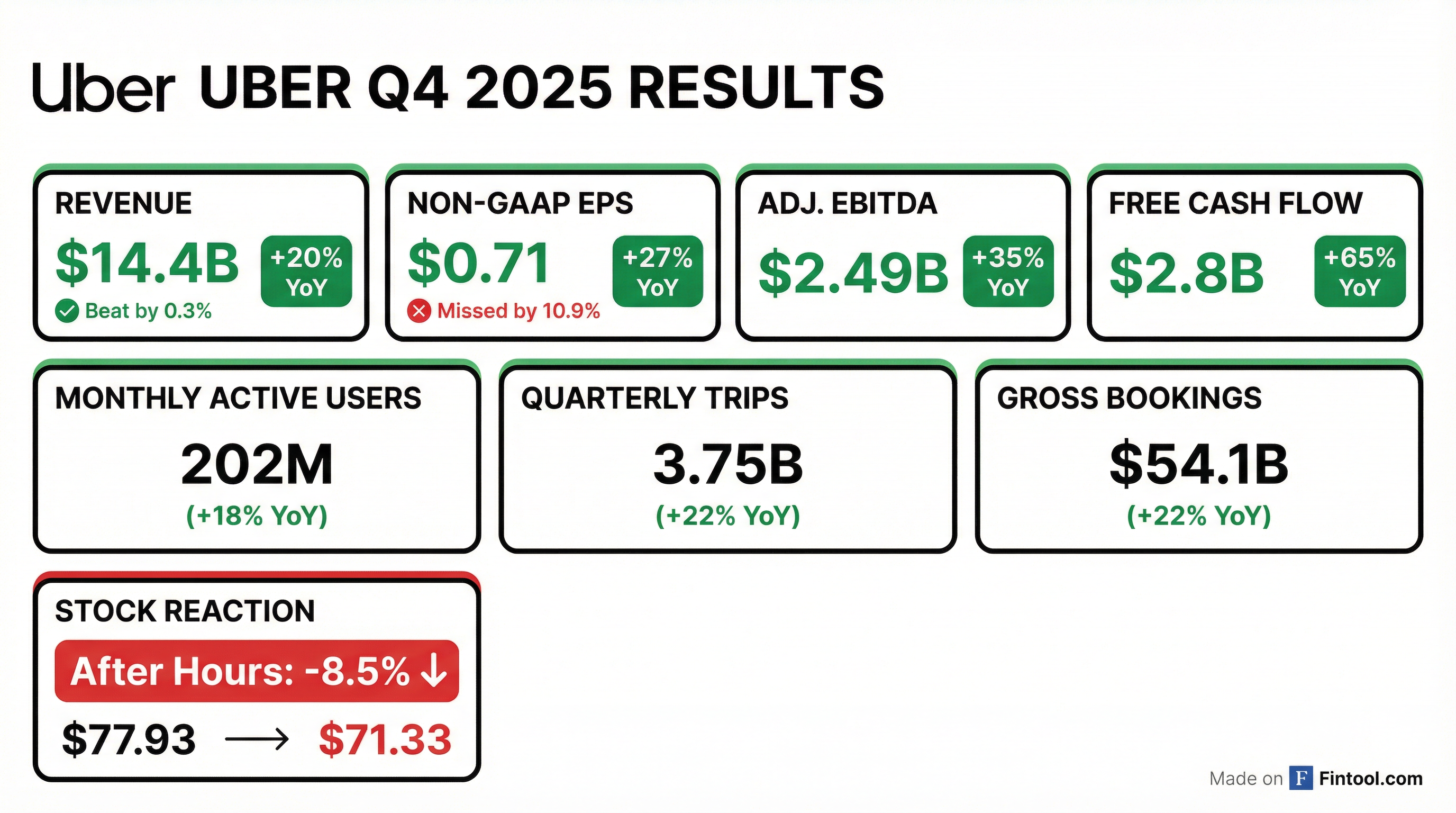

- Uber closed Q4 2025 with 3.8 billion trips (+22% YoY), $54.1 billion gross bookings, and $14.37–$14.4 billion revenue, but missed profit expectations and issued weaker-than-expected Q1 guidance, sending shares lower.

- For full-year 2025, gross bookings reached $193 billion with approximately $10 billion in free cash flow.

- Delivery revenue rose 30% to $4.9 billion, mobility revenue grew 19% to $8.2 billion, while Uber Freight’s bookings remained flat at $1.27 billion; the freight unit achieved breakeven adjusted EBITDA.

- Uber announced CFO Prashanth Mahendra-Rajah will step down, with Balaji Krishnamurthy named as his successor.

- Shares slid after Uber reported Q4 adjusted EPS of $0.71 and issued Q1 guidance of $0.65–$0.72, both below analyst expectations.

- The company highlighted strong demand: total gross bookings rose 22% to $54.1 billion, revenue reached $14.4 billion, and adjusted EBITDA and cash flow hit record levels.

- Balaji Krishnamurthy will become CFO on Feb. 16, with outgoing Prashanth Mahendra-Rajah remaining as an adviser through July.

- Uber reiterated its push into autonomous vehicles, committing capital and partnerships to launch robotaxi services in up to 15 markets by end-2026.

- Gross bookings rose 22% year-over-year in Q4; 2025 full-year bookings exceeded $20 billion for the fifth straight year, with adjusted EBITDA of $8.7 billion and free cash flow of $9.8 billion (+42%).

- Platform scale reached a 15 billion annualized trip run rate and over 200 million monthly active users in Q4.

- CFO transition: Prashanth Mahendra-Rajah will step down on February 16, 2026, to be succeeded by Balaji Krishnamurthy.

- Committed to returning ~50% of free cash flow via share repurchases, targeting ongoing reductions in share count.

- Autonomous vehicle roadmap advanced through partnerships (e.g., Waymo, NVIDIA, Waabi), aiming to deploy in 15 cities by end-2026 to bolster growth and margins.

- Gross bookings rose 22% y/y to a 15 billion annual run rate; 2025 full-year adjusted EBITDA was $8.7 billion (35% margin) and free cash flow was $9.8 billion, up 42% y/y.

- Prashanth Mahendra-Rajah will step down as CFO on February 16, 2026; Balaji Krishnamurthy will assume the role.

- Autonomous vehicle deployments expected in 15 cities by year-end, with partnerships including Waymo, NVIDIA, Waabi, Nuro, and Lucid; AV trips on Uber’s platform show 30% higher utilization vs. standalone AV services.

- Monthly active users grew from 14% y/y at the start of 2025 to 18% y/y by year-end, reaching 202 million MAPCs, with 40% of consumers using more than one Uber product.

- Uber will reinvest in core growth areas (AV, selective M&A) while committing roughly 50% of free cash flow to share repurchases, maintaining an aggressive buyback cadence.

- Industry-leading growth in Q4 2025: trips reached a 15 billion annual run rate and monthly active users topped 200 million, driving 22% year-over-year gross bookings growth.

- Full-year 2025 results include over $20 billion in annual gross bookings (fifth consecutive year), $8.7 billion of adjusted EBITDA (35% margin) and $9.8 billion of free cash flow (up 42%).

- CFO transition: Prashanth will step down on February 16, with Balaji appointed as his successor to lead financial strategy.

- Strong start to 2026 with a profitable platform and planned targeted investments across six strategic focus areas.

- In Q4 2025, Trips grew 22% YoY to 3.8 billion, Gross Bookings rose 22% YoY to $54.1 billion, and Revenue increased 20% YoY to $14.4 billion.

- Q4 2025 GAAP Income from operations was $1.8 billion (+130% YoY), GAAP Net Income was $296 million (EPS $0.14), and Adjusted EBITDA reached $2.5 billion (+35% YoY).

- For the full year 2025, Gross Bookings totaled $193 billion, Revenue was $52 billion, and Free Cash Flow amounted to $10 billion.

- Q1 2026 outlook: Gross Bookings of $52.0 billion to $53.5 billion (17–21% YoY growth) and Non-GAAP EPS of $0.65 to $0.72.

- CFO transition: Prashanth Mahendra-Rajah will step down on February 16, 2026; Balaji Krishnamurthy will assume the CFO role on that date.

- Uber delivered a record Q4 with GAAP operating income of $1.8 B and adjusted EBITDA of $2.5 B (up 35% YoY), on $54.1 B gross bookings (+22% YoY) and $14.4 B revenue (+20% YoY).

- For full-year 2025, Uber achieved $193.5 B in gross bookings (+19% YoY), $52.0 B in revenue (+18% YoY) and $9.8 B in free cash flow (+42% YoY).

- Unrestricted cash and short-term investments totaled $7.6 B at Q4 end, underpinning strong liquidity.

- CFO Prashanth Mahendra-Rajah noted $10 B in free cash flow for 2025, and incoming CFO Balaji Krishnamurthy will lead disciplined investment toward an AV-future.

- Q1 2026 guidance calls for $52.0 B–$53.5 B in gross bookings (+17% to 21% YoY) and non-GAAP EPS of $0.65–$0.72 (up ~37% YoY).

- Uber relaunched operations in Macau, marking its first new Asian market entry in years by enabling ride booking and payment for licensed taxis through its app.

- Launched a cross-border limousine service between Hong Kong and Macau with upfront pricing (including tolls), 24-hour advance reservations up to 90 days, operated by partner Kwoon Chung.

- Positioned as a cautious, fully licensed model in collaboration with local authorities to support Macau’s tourism rebound and Greater Bay Area connectivity.

- Market analysts maintain a Strong Buy consensus on UBER stock based on 30 Buys, 3 Holds, and 1 Sell over the past three months.

- CEO Dara Khosrowshahi expects to roll out robotaxi services in over 10 markets by end of 2026, potentially including Hong Kong and Japan.

- Waabi raised up to $1 billion—a $750 million Series C co-led by Khosla Ventures and G2 Venture Partners plus a $250 million milestone-based commitment from Uber—bringing total funding to $1.28 billion.

- Under the deal, Uber will deploy at least 25,000 Waabi Driver–powered robotaxis exclusively on its ride-hailing platform, with additional capital tied to deployment milestones.

- Strategic and financial backers include Uber, Nvidia’s VC arm (NVentures), Volvo Group Venture Capital, Porsche, BlackRock, Radical Ventures and an ADIA subsidiary; Waabi’s valuation is reported at $3 billion.

- Waabi’s single, end-to-end “physical AI” shared brain aims to power both autonomous trucking and robotaxis, though timelines, vehicle partners and safety plans remain undisclosed.

Fintool News

In-depth analysis and coverage of Uber Technologies.

Quarterly earnings call transcripts for Uber Technologies.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more