Waabi Raises $1 Billion, Partners With Uber to Deploy 25,000 Robotaxis

January 28, 2026 · by Fintool Agent

Toronto-based autonomous vehicle startup Waabi has raised $1 billion and struck a major partnership with Uber Technologies to deploy at least 25,000 robotaxis on the ride-hailing giant's platform—a deal that marks one of the largest autonomous vehicle commitments ever announced and significantly escalates the race for robotaxi dominance.

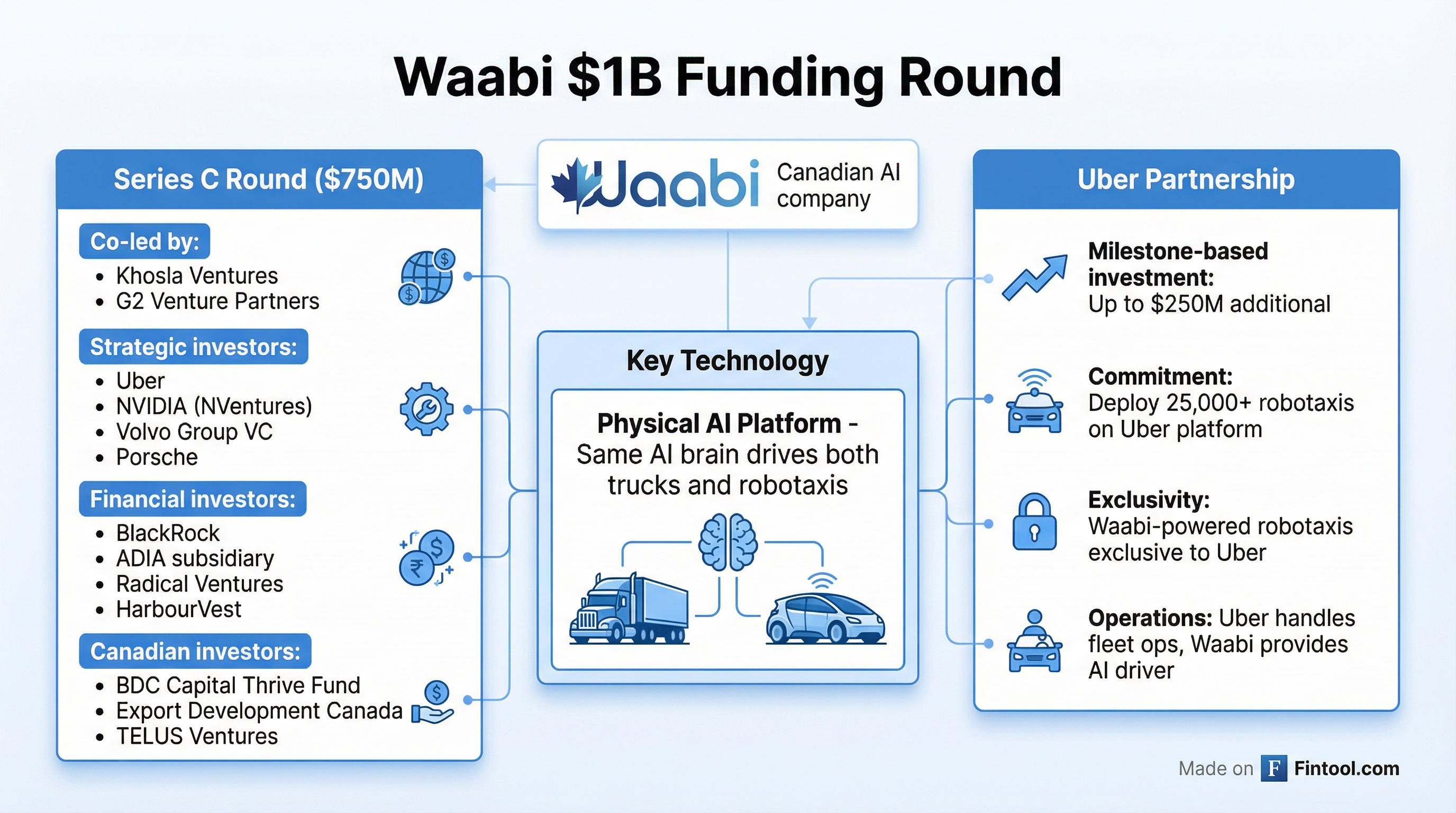

The funding represents the largest venture capital raise in Canadian history and consists of a $750 million Series C round co-led by Khosla Ventures and G2 Venture Partners, plus an additional $250 million in milestone-based capital from Uber tied to the robotaxi deployment.

"The moment is here and fully upon us. Everything is coming together for physical AI to have its moment, with self-driving as the first manifestation at scale," said Lior Ron, Waabi's COO and former Uber Freight CEO.

The Deal Structure

The Series C round attracted a roster of strategic and financial heavyweights:

Strategic Investors:

- Uber Technologies (existing board seat holder)

- NVentures (Nvidia's venture capital arm)

- Volvo Group Venture Capital

- Porsche Automobil Holding SE

Financial Investors:

- Funds managed by Blackrock

- Radical Ventures

- HarbourVest Partners

- Abu Dhabi Investment Authority (ADIA) subsidiary

- Linse Capital, Incharge Capital

Canadian Investors:

- BDC Capital's Thrive Venture Fund

- Export Development Canada (EDC)

- TELUS Global Ventures

- BMO Global Asset Management

The deal brings Waabi's total funding to approximately $1.28 billion after its $200 million Series B in June 2024. The Globe and Mail previously reported Waabi was seeking a $3 billion pre-money valuation, though the company declined to confirm.

A Full-Circle Moment for Urtasun

The partnership has particular resonance for Waabi founder and CEO Raquel Urtasun, who previously served as chief scientist at Uber's autonomous vehicle division, Uber ATG. Uber sold that unit to Aurora Innovation in 2020 for approximately $4 billion as part of a broader retreat from direct AV development.

Now, through Waabi, Urtasun is returning to Uber's ecosystem—but on her own terms.

"We're going to enter and deploy in robotaxi markets much faster than you've seen to date," Urtasun told reporters, though she declined to specify launch cities or timelines. She also would not identify which automaker will manufacture the Waabi-powered vehicles, saying only that Waabi believes in "vertically integrating with a fully redundant platform from the OEM."

The "Physical AI" Difference

Waabi represents part of what the industry calls "AV 2.0"—a new generation of autonomous vehicle companies using end-to-end AI models that learn to drive from data, rather than extensive hand-coded rules.

The company's key differentiator is its "Physical AI Platform," which uses a single AI model to power both autonomous trucks and robotaxis. The same neural network that navigates a semi-truck on a Texas highway will operate a robotaxi in city traffic.

"The model will be aware which vehicle it's driving, but it will be the same model," Urtasun explained. "Think of us as humans—we are not switching our brain, but we know each vehicle we are driving."

This approach contrasts sharply with Alphabet's Waymo, which built separate systems for different applications. Waabi argues its unified model enables faster scaling and allows improvements in trucking to benefit robotaxis, and vice versa.

"We invest in the companies that are leading the AI era," said Vinod Khosla, founder of Khosla Ventures. "Waabi has developed a truly groundbreaking Physical AI platform that represents a fundamental leap forward in how next generation driverless technology is being developed."

Uber's Aggressive AV Pivot

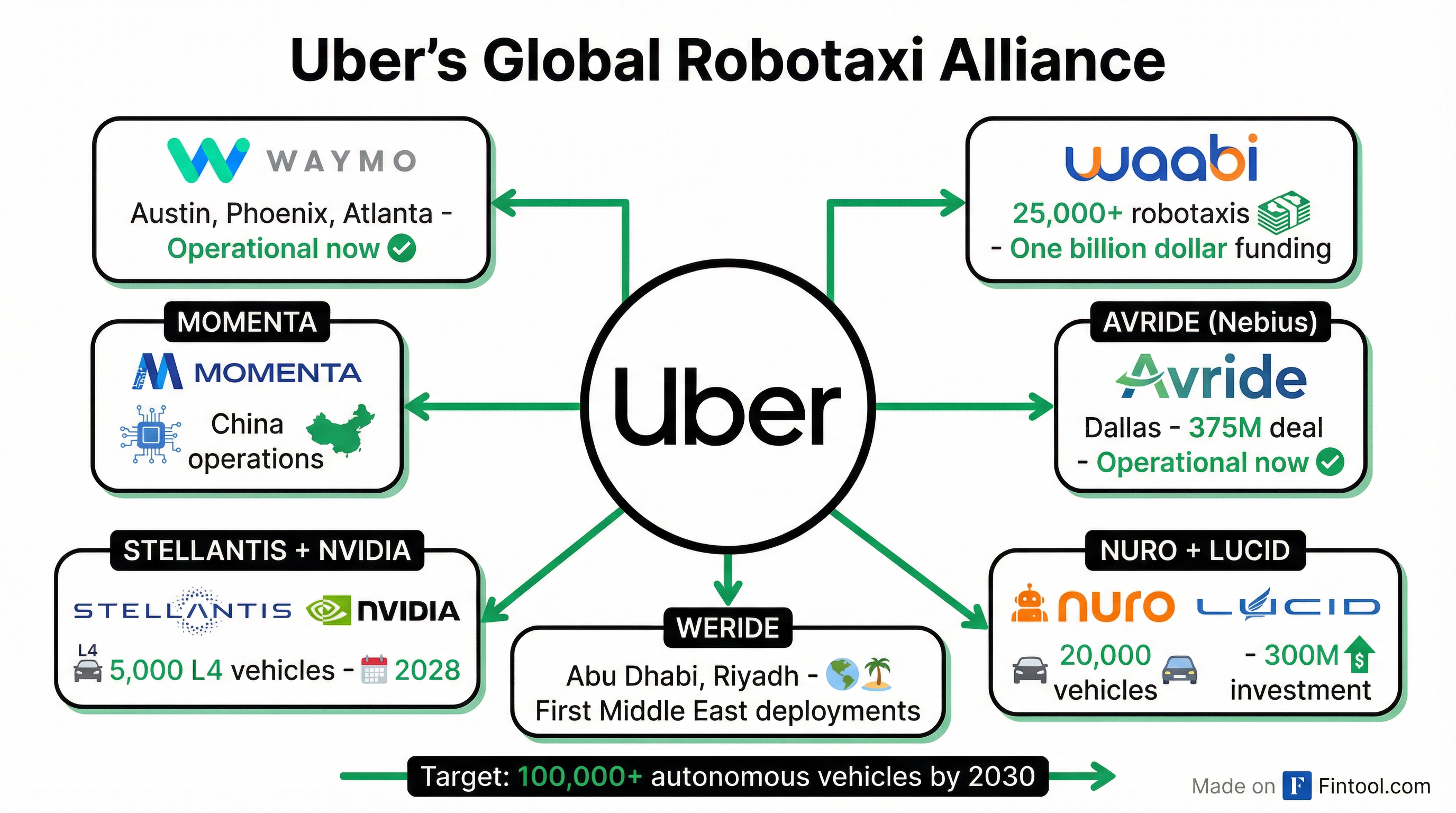

The Waabi deal is the latest in a flurry of autonomous vehicle partnerships that Uber has announced over the past year, signaling an aggressive pivot to defend its ride-hailing dominance against the robotaxi threat.

Uber's Major AV Partnerships:

| Partner | Commitment | Status | Investment |

|---|---|---|---|

| Waymo (Googl) | Integrated rides in Austin, Phoenix, Atlanta | Operational | Partnership |

| Waabi | 25,000+ robotaxis | In development | Up to $250M milestone-based |

| Avride (Nebius) | 500+ vehicles in Dallas | Operational | $375M deal |

| Nuro + Lucid | 20,000 robotaxis | In development | $300M investment |

| WeRide | Abu Dhabi, Riyadh | Operational | Partnership |

| Stellantis + Nvidia | 5,000 L4 vehicles | 2028 SOP | Partnership |

In October 2025, Uber announced a sweeping partnership with NVIDIA to "scale the world's largest level 4-ready mobility network" targeting 100,000 autonomous vehicles over time. The strategy represents a stark contrast to Uber's earlier approach of developing autonomous technology in-house through Uber ATG.

"Autonomous mobility will transform our cities for the better, and we're thrilled to partner with NVIDIA to help make that vision a reality," CEO Dara Khosrowshahi said at the time.

Financial Context: Uber's Strong Position

Uber enters these partnerships from a position of financial strength. The company has generated consistent profitability and strong cash flows in recent quarters:

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue | $12.0B* | $11.5B | $12.7B | $13.5B |

| Net Income | $6.9B | $1.8B | $1.4B | $6.6B |

| Operating Cash Flow | $1.8B | $2.3B | $2.6B | $2.3B |

*Values retrieved from S&P Global

Uber shares traded at $80.09 as of Wednesday afternoon, down 1.4% on the day. The stock has declined from its 52-week high of $101.99 but remains well above its 52-week low of $60.63.

The company's market capitalization of approximately $166 billion gives it substantial firepower to continue investing in AV partnerships and defend its position against potential disruption from Tesla's robotaxi ambitions and Waymo's expanding operations.

Competitive Landscape: The Race Intensifies

The robotaxi market is projected to reach $4.45 trillion by 2034, according to industry research, creating enormous stakes for the players vying for dominance.

Waymo currently leads in deployed robotaxi services, operating a fleet of more than 2,500 vehicles across Phoenix, San Francisco, Los Angeles, Austin, and Atlanta. The Alphabet subsidiary has logged over 20 million autonomous miles on public roads and recently received approval to begin operations at San José airport.

Tesla launched its first robotaxi pilot in Austin in June 2025, deploying Model Y vehicles with Full Self-Driving software in a geofenced zone. CEO Elon Musk has long promised a robotaxi service, though Tesla's approach differs fundamentally—relying on camera-only vision rather than lidar and maintaining a direct-to-consumer model.

Baidu's Apollo Go continues to expand in China and is eyeing Southeast Asian markets, while Pony.ai unveiled its Gen-7 robotaxi platform with significantly reduced hardware costs.

What to Watch

Several questions remain unanswered as the Waabi-Uber partnership unfolds:

Timeline uncertainty: Neither company has disclosed when or where the first Waabi robotaxis will launch, or what milestones Uber's investment is contingent upon. The 25,000-vehicle commitment could take years to fulfill.

Vehicle manufacturer: Waabi hasn't identified which automaker will build its robotaxis. For comparison, the Nuro-Lucid deal specifies Lucid Gravity SUVs, while Stellantis will provide vehicles for the NVIDIA-powered fleet.

Regulatory path: Waabi has been operating autonomous trucks in Texas with safety drivers. Fully driverless trucking operations have been delayed "until the Volvo platform is fully validated—a decision she framed as prioritizing safety over speed," Urtasun said. Volvo has indicated validation is "just quarters away."

Competition with partners: Uber's multi-partner strategy means Waabi will compete for deployment priority alongside Waymo, Avride, and others within Uber's own ecosystem.

The deal represents a significant bet by Uber that the future of mobility will be powered by artificial intelligence—and that the best strategy is to partner broadly rather than build internally. For Waabi, it's validation that a simulation-first, end-to-end AI approach can compete with the billions invested by Waymo, Tesla, and others.

As Vinod Khosla put it: "This breakthrough will define AI for decades to come."

Related Companies: