Ubisoft Crashes 33% in Record Plunge as Prince of Persia Axed, Studios Shuttered

January 22, 2026 · by Fintool Agent

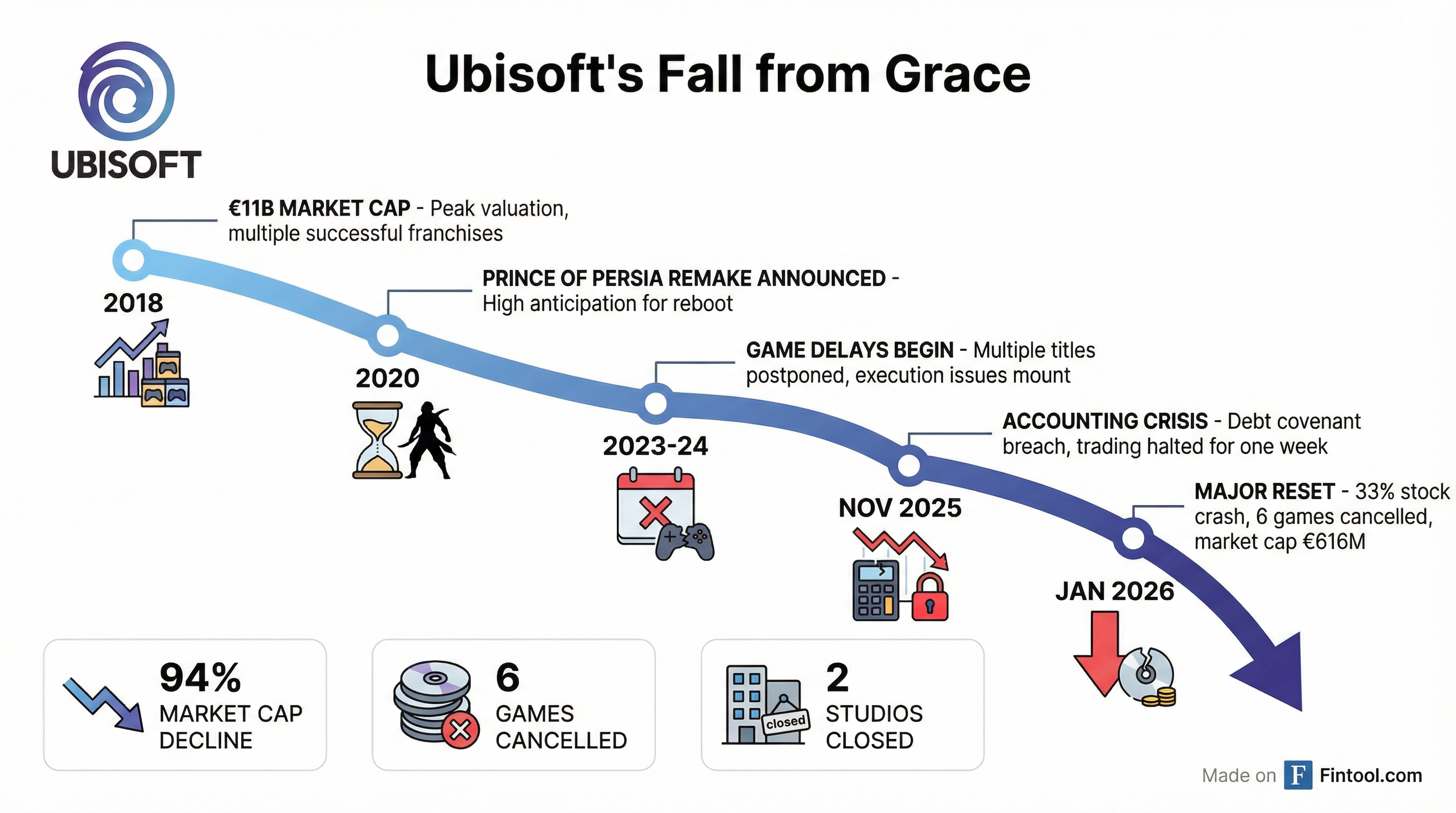

Ubisoft shares plunged 33% Thursday in the company's worst single-day collapse since its 1996 IPO, as the Assassin's Creed creator announced a sweeping "major reset" that includes canceling six games—among them the long-awaited Prince of Persia remake—shuttering two studios, and expecting a €1 billion operating loss for the fiscal year.

The stock cratered to roughly €4.50, its lowest level in more than 14 years, valuing the Paris-based publisher at approximately €616 million—a staggering 94% decline from its €11 billion peak in 2018.

The Restructuring: What's Being Cut

CEO Yves Guillemot unveiled what he called a "decisive turning point" that tears apart the company's current structure and rebuilds it around five genre-focused "Creative Houses":

Games Cancelled (6 total):

- Prince of Persia: The Sands of Time remake — First announced in 2020 to significant fan anticipation

- Four unannounced titles, including three new intellectual properties

- One mobile game

Games Delayed (7 total): One title originally planned for release before April 2026 has been pushed to fiscal 2027. The others remain unspecified.

Studios Shuttered:

- Ubisoft Halifax (Canada) — Was working on mobile titles for Assassin's Creed

- Ubisoft Stockholm (Sweden) — Was developing a new IP

Additional restructurings are underway at studios in Abu Dhabi, Helsinki, and Malmö.

Financial Devastation

The numbers paint a grim picture of a company in crisis:

| Metric | Figure |

|---|---|

| Expected FY2026 Operating Loss | €1 billion |

| Write-Down from Restructuring | €650 million |

| Net Bookings Guidance (FY2026) | €1.5 billion (cut by €330M) |

| Cost Savings Target | €500 million |

| Fixed Costs Target (by March 2028) | €1.25 billion (down from €1.75B) |

| Current Market Cap | €616 million |

| Peak Market Cap (2018) | €11 billion |

The company also withdrew guidance for fiscal 2026/27 entirely, signaling deep uncertainty about its trajectory.

The New Structure: Five Creative Houses

Ubisoft is reorganizing its operations into five decentralized divisions, each with full financial ownership and responsibility for brand development:

Creative House 1 — Vantage Studios (Tencent owns 25%)

- Flagship franchises: Assassin's Creed, Far Cry, Rainbow Six

- Goal: Scale these into "annual billionaire brands"

Creative House 2 — Competitive Shooters

- Brands: The Division, Ghost Recon, Splinter Cell

Creative House 3 — Live Service Games

- Brands: For Honor, The Crew, Riders Republic, Brawlhalla, Skull & Bones

Creative House 4 — Fantasy & Narrative

- Brands: Anno, Might & Magic, Rayman, Prince of Persia, Beyond Good & Evil

Creative House 5 — Casual & Family

- Brands: Just Dance, Hungry Shark, Uno, Hasbro titles

A Pattern of Crisis

Thursday's collapse caps years of mounting problems:

November 2025: Ubisoft postponed its half-year results at the last minute, triggering a week-long trading halt. The company later revealed auditors had found improperly booked revenue, forcing an accounting restatement that breached debt covenants.

Tencent Bailout: Chinese gaming giant Tencent invested €1 billion for a 25% stake in Vantage Studios, the subsidiary housing Ubisoft's crown jewels. Proceeds were immediately used to repay €286 million in breached loans.

Workforce Reduction: Headcount has fallen by approximately 1,500 employees over the past 12 months to around 17,000. The company cut 185 jobs across Europe in 2025 alone, including closing its Leamington Spa office in the UK.

Management's Pitch

Guillemot framed the overhaul as necessary medicine:

"While these decisions are difficult, they are necessary for us to build a more focused, efficient and sustainable organisation over the long term... These measures mark a decisive turning point for Ubisoft and reflect our determination to confront challenges head-on to reshape the Group for the long term."

He pointed to the increasingly selective triple-A market, where development costs have soared while competition intensifies. Successes like Grand Theft Auto, Call of Duty, and Fortnite dominate player attention, leaving less room for mid-tier releases.

Analyst Reaction

TP ICAP Midcap analyst Corentin Marty called it "the big shake-up" but struck a cautious tone:

"The prospect of a return to positive cash generation appears remote, and the maturity of the 675-million-euro bond in November 2027 is likely to put additional pressure on the group's financial structure."

Gaming analyst Piers Harding-Rolls noted the move reflects deep risk aversion: "It's less risky to maintain scale by investing in existing big franchises such as Assassin's Creed and Rainbow Six than launch entirely new IPs."

What to Watch

Near-term catalysts:

- Execution of studio closures and workforce reductions

- Details on which 7 games were delayed and new release timelines

- Whether additional assets are sold (Ubisoft indicated it's considering divestments)

Longer-term risks:

- €675 million bond maturing November 2027

- Whether the Creative Houses model can actually revive growth

- Tencent's potential to increase its stake or exert more control

- Competition from delayed blockbusters like GTA VI (now November 2026)

The question now is whether this reset represents the bottom for Ubisoft—or merely another chapter in a longer decline. With 94% of its market value already erased and the gaming industry growing more Darwinian by the year, the publisher behind Assassin's Creed faces an existential test of whether its legendary franchises can still carry the weight of an entire company.

Related: