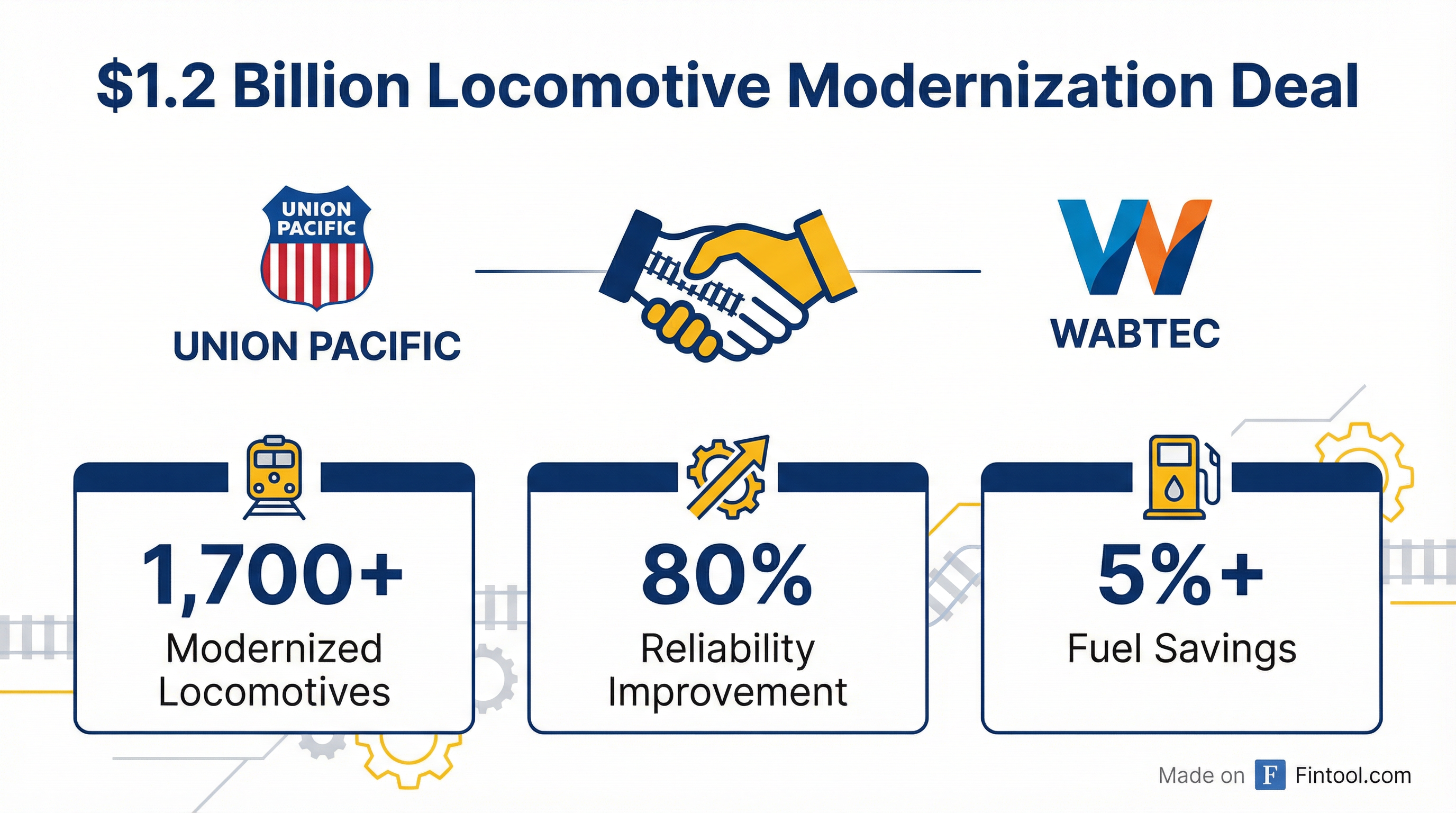

Union Pacific and Wabtec Ink $1.2 Billion Locomotive Deal — Largest Modernization Program in Rail History

February 4, 2026 · by Fintool Agent

Union Pacific and Wabtec have signed a $1.2 billion agreement to modernize the railroad's AC4400 locomotive fleet — the largest single locomotive modernization investment in rail industry history. The deal will upgrade roughly 670 locomotives and bring Union Pacific's total modernized fleet to more than 1,700 units, positioning the nation's largest railroad for growth as it pursues a landmark merger with Norfolk Southern.

The announcement sent Wabtec shares higher, though analysts note the stock is already trading above fair value estimates following a string of locomotive orders.

The Deal at a Glance

| Metric | Value |

|---|---|

| Total Value | $1.2 billion |

| Locomotives to Upgrade | 670 units (est.) |

| Fuel Savings | 5%+ reduction |

| Tractive Effort | 14% increase |

| Reliability | 80% improvement |

| Deliveries Begin | 2027 |

| Total Fleet After Completion | 1,700+ modernized units |

What's Being Upgraded

The AC4400 locomotive — a six-axle, 4,400-horsepower workhorse introduced by General Electric in 1993 — has been a mainstay of Union Pacific's fleet for three decades. The railroad took delivery of these units between 1994 and 2004, including some acquired through the Southern Pacific merger in 1995.

Each modernized locomotive will receive:

- FDL Advantage (FDLA) Engine Upgrade — Enhanced fuel savings

- LOCOTROL® Expanded Architecture — Supports safe, efficient operation of longer trains

- Modular Control Architecture — Next-generation data, diagnostics, and software capabilities

"These redesigned locomotives will be just like new, providing the improved fuel efficiency and enhanced reliability that we need to grow with our customers and to win new business," said Union Pacific CEO Jim Vena.

A Deepening Partnership

This marks Union Pacific's fourth major modernization order from Wabtec since 2018. The 2022 order covered roughly 600 locomotives — 525 AC4400s and AC6000s plus 75 Dash-9s — and is scheduled for completion in 2026.

| Order | Year Signed | Estimated Units | Value |

|---|---|---|---|

| First | 2018 | 400 | Undisclosed |

| Second | 2020 | 300 | Undisclosed |

| Third | 2022 | 600 | $1.0B |

| Fourth (Current) | Q4 2025 | 670 | $1.2B |

Production will occur at Wabtec's U.S. facilities in Erie, Pennsylvania and Fort Worth, Texas.

"Our continued partnership with Union Pacific reflects a steady, forward-looking investment that positions the railroad and its customers for continued success," said Wabtec CEO Rafael Santana.

Strategic Context: The Norfolk Southern Merger

The locomotive investment comes as Union Pacific prepares to re-file its $85 billion merger application with Norfolk Southern. CEO Vena has spoken publicly about maintaining a buffer of hundreds of locomotives to accommodate traffic surges — a strategy that becomes critical if the merger creates a transcontinental freight network.

Union Pacific has emphasized locomotive fleet modernization as a pillar of its capital strategy. In its most recent 10-Q, the company noted plans to "continue to make investments to support our growth strategy, improve the safety, resiliency, and operational efficiency of the network... including modernization of our locomotive fleet."

The railroad's capital plan has remained steady at approximately $3.4 billion annually, with locomotive and freight car investments a significant component.

Financial Snapshot: Union Pacific

| Metric | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|

| Revenue | $22.6B | $22.8B | $23.2B |

| Net Income | $6.4B | $6.7B | $7.1B |

| EBIT Margin | 37.9%* | 40.3%* | 40.2%* |

| Capex | $3.6B* | $3.5B* | $3.8B* |

*Values retrieved from S&P Global

Union Pacific remains the largest U.S. railroad by market capitalization at approximately $143 billion.

Wabtec's Locomotive Dominance

Wabtec, formerly Westinghouse Air Brake Technologies, has emerged as the dominant force in North American locomotive modernization and new builds. The company reported $10.4 billion in revenue for FY 2024 and has expanded margins through higher-value digital and aftermarket services.

Recent locomotive wins include:

- CPKC — 135-unit order split between Wabtec and Progress Rail (January 2026)

- Norfolk Southern — 40 new ES44AC locomotives (January 2026)

- MRS Logística (Brazil) — 30 ES44ACi units (2024)

The company's market cap stands at roughly $40 billion.

What to Watch

- Merger regulatory timeline — Union Pacific and Norfolk Southern are expected to re-file their merger application with the Surface Transportation Board. Fleet readiness will be scrutinized.

- 2027 delivery schedule — Any delays could impact Union Pacific's operational flexibility, particularly if freight volumes surge.

- Fuel efficiency gains — The 5%+ fuel savings will be tracked as Union Pacific reports quarterly environmental metrics and works toward its decarbonization targets.

- Wabtec backlog — Investors will monitor whether the locomotive order pipeline remains robust across Class I railroads.