UPS Cutting 30,000 More Jobs as Amazon Breakup Reaches Finale

January 27, 2026 · by Fintool Agent

United Parcel Service will eliminate up to 30,000 operational positions in 2026 as it races to complete the final phase of its strategic divorce from Amazon, a relationship CEO Carol Tomé once called "extraordinarily dilutive" to margins.

The cuts add to 48,000 positions eliminated in 2025, bringing total workforce reductions to roughly 78,000 over two years—a transformation that has closed nearly 200 facilities while building what management describes as a "leaner, more agile" network optimized for premium shipments.

Shares rose 2.2% to $109.31 in afternoon trading after the company beat Q4 expectations and forecast a surprise revenue increase for 2026.

Q4 Results: Revenue Quality Beats Volume Decline

Despite a 10.8% drop in average daily volume, UPS reported fourth quarter results that exceeded expectations on nearly every metric:

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $24.5B | $25.3B | -3.2% |

| Operating Profit | $2.9B | $2.1B | +38% |

| Operating Margin | 11.8% | 8.1% | +370 bps |

| Adjusted EPS | $2.38 | $2.01 | +18% |

| Revenue Per Piece | +8.3% YoY | — | — |

The strongest Q4 revenue per piece growth in four years offset volume declines, demonstrating the margin power of shedding low-profit Amazon packages in favor of premium shipments.

"We delivered a very efficient peak, which is a testament to the transformational effects from the additional automation and network reconfiguration we made throughout the year," said CFO Brian Dykes.

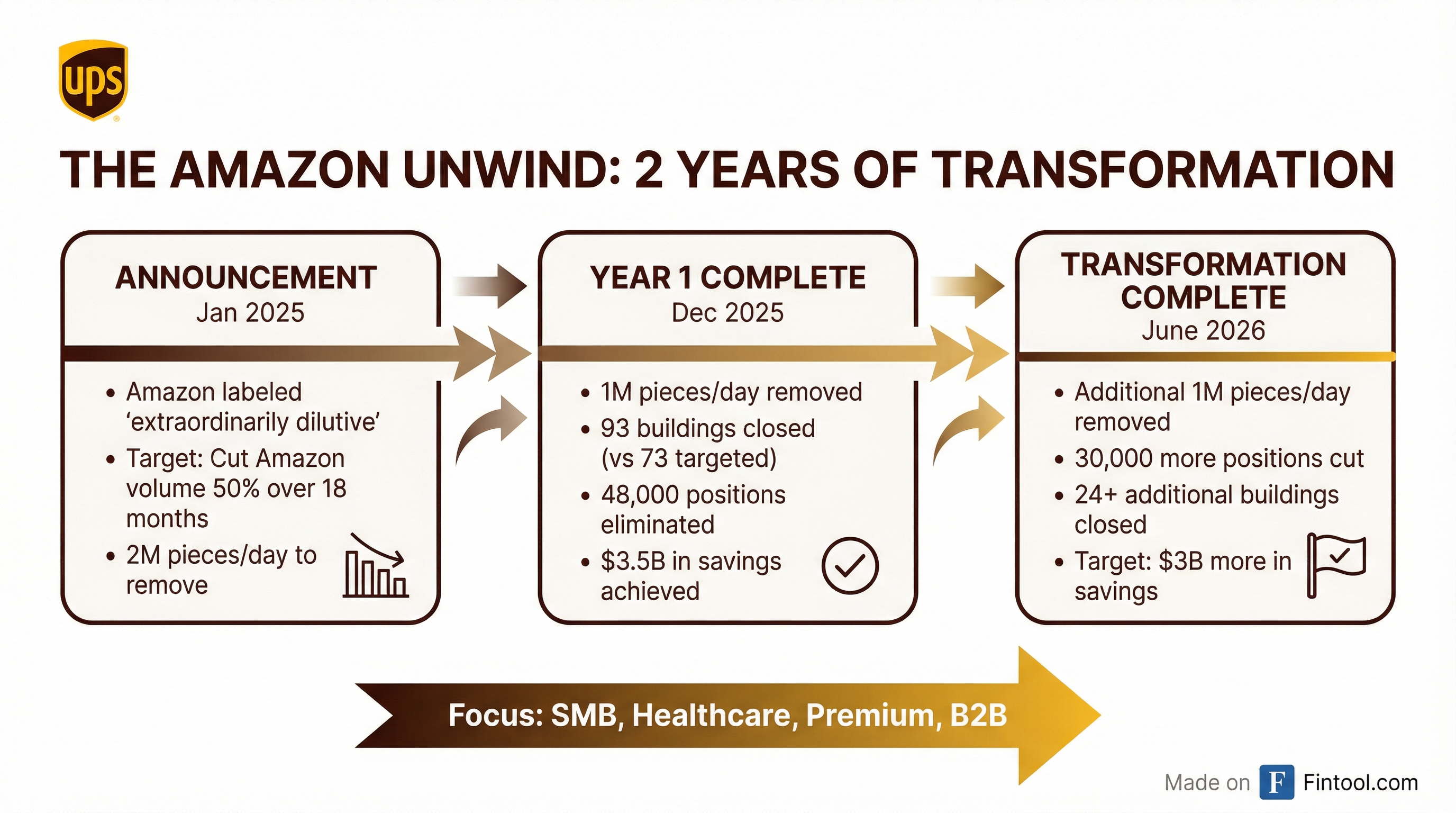

The Amazon Unwind: 78,000 Jobs in Two Years

The 30,000 position cuts announced Tuesday mark the final chapter of UPS's "Amazon Accelerated Glide Down" plan, a six-quarter initiative to halve Amazon volume that management says is proceeding ahead of schedule.

2025 Accomplishments:

- Reduced Amazon volume by 1 million pieces per day

- Closed 93 buildings (vs. 73 originally targeted)

- Eliminated 48,000 positions

- Removed 26.9 million labor hours

- Achieved $3.5 billion in savings

2026 Targets:

- Remove another 1 million Amazon pieces per day

- Cut 25 million operational hours

- Eliminate up to 30,000 positions

- Close 24+ additional buildings

- Generate $3 billion in additional savings

"This will be accomplished through attrition, and we expect to offer a second voluntary separation program for full-time drivers," Dykes explained on the earnings call.

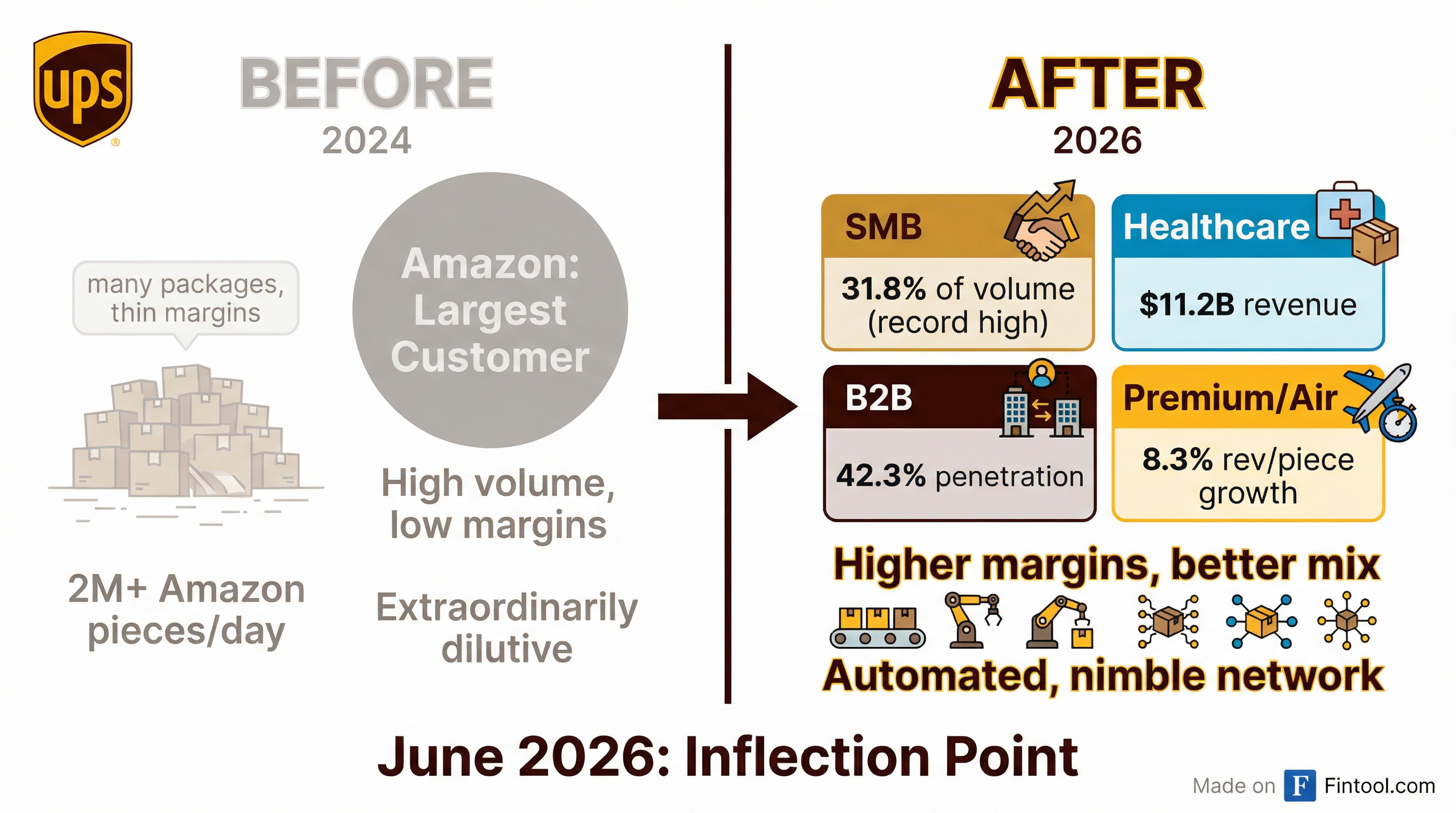

Why Amazon Had to Go

When Tomé launched the glide down in January 2025, she described Amazon's business as "extraordinarily dilutive" to margins—a stark assessment of UPS's largest customer.

The numbers tell the story of why: Amazon represented massive volume but razor-thin margins that dragged down the overall business. As Amazon built out its own delivery network—now a direct competitor to UPS—the economics deteriorated further.

The pivot has fundamentally reshaped UPS's customer mix:

| Customer Segment | Q4 2025 | Change vs Q4 2024 |

|---|---|---|

| SMB Penetration | 31.2% of volume | +340 bps |

| B2B Penetration | 37.5% of volume | +220 bps |

| Healthcare Revenue | $11.2B (FY) | Growing |

| Digital Access Program | $4.1B | +25% YoY |

"The product and customer mix improvement we saw in the fourth quarter demonstrate the progress we are making as we shift our U.S. mix to more premium volume with a focus on revenue quality," Dykes noted.

The Bathtub Effect: A Difficult First Half

Management was unusually candid about near-term challenges. Tomé described 2026 as a "bathtub effect"—with the first half under pressure before a strong recovery in the second half.

First Half Headwinds:

- Continued Amazon volume decline before anniversary

- Transition costs as GroundSaver shifts to USPS

- $100 million in additional aircraft lease costs from MD-11 retirement

- Timing lag between cost-out actions and P&L benefits

Dykes warned that Q1 operating margin will be "mid-single digits" due to these transition costs, with roughly 100 basis points of margin pressure in H1 that relieves in H2.

Second Half Recovery:

- Network reconfiguration complete

- GroundSaver economics stabilized with USPS partnership

- SMB and enterprise growing mid-single digits

- Driver staffing aligned to new delivery volumes

- Exit rate at "healthy double-digit margin"

"June of 2026 will be the inflection point," Tomé emphasized. "Our strategy is not a shrink the company strategy, but rather one where we grow in the best parts of the market."

2026 Guidance: Flat Revenue, Transformation Complete

For full-year 2026, UPS provided guidance that reflects both the ongoing transformation and confidence in the post-Amazon network:

| Metric | 2026 Guidance | 2025 Actual |

|---|---|---|

| Revenue | $89.7B | $88.7B |

| Operating Margin | 9.6% | 9.8% |

| Diluted EPS | Flat to 2025 | $6.54 |

| Free Cash Flow | $6.5B | $5.0B |

| CapEx | $3B | $3.7B |

| Dividends | $5.4B | $5.4B |

The guidance excludes any significant changes to the current tariff landscape, a notable caveat given ongoing trade policy uncertainty.

Automation: The Productivity Engine

A key enabler of the workforce reductions is aggressive automation deployment. UPS now processes 66.5% of U.S. volume through automated facilities, rising to 68% by year-end 2026.

The productivity gains are substantial: cost per piece in automated buildings runs 28% below conventional facilities, according to Tomé.

"We have 127 buildings that are automated. We are adding another 24 in 2026," Tomé said. "The cost per piece in these automated buildings is 28% less than the cost per piece in our conventional buildings."

The company is also deploying RFID technology across 5,500 UPS Stores, processing 1.3 million packages daily with "smart" labeling that improves tracking and reduces defects.

Fleet Modernization: Retiring the MD-11s

UPS accelerated the retirement of its entire MD-11 aircraft fleet in Q4, recording a $137 million charge. The decision followed the company's proactive grounding during peak season and successful operation using repositioned aircraft and leased capacity.

Over the next 15 months, UPS will take delivery of 18 new Boeing 767 aircraft—15 this year and 3 in 2027—replacing the aging MD-11s with more fuel-efficient alternatives.

"With the learnings from operating during peak season, we made the decision to accelerate the retirement of our MD-11 fleet," Dykes explained. "We believe these actions are consistent with building a more efficient global network positioned for growth, flexibility, and profitability."

International Pressures: De Minimis and Tariffs

The international segment faces ongoing challenges from trade policy shifts. U.S. imports declined 24.4% in Q4, with China-to-U.S. lanes down 20.9% as de minimis exemption changes disrupted cross-border e-commerce.

International margin fell to 18% in Q4 from 21.4% a year ago, with management warning of continued pressure through Q1 2026 before anniversarying the tariff impacts.

"We will lap the tariff impact in May and start to see positive growth from that, and then we'll lap the de minimis impact in September," Dykes noted.

What to Watch

The UPS transformation enters its final phase with several catalysts ahead:

Near-term (Q1-Q2 2026):

- Voluntary driver separation program launch

- GroundSaver transition to USPS completion

- Additional building closures (24+ targeted for H1)

- New Boeing 767 deliveries begin

Mid-term (H2 2026):

- June inflection point as Amazon glide down completes

- Return to operating profit growth

- Network efficiency gains materialize

- Exit rate margin trajectory for 2027

Risks:

- Macroeconomic slowdown affecting package demand

- Further tariff or trade policy changes

- Execution risk on 30,000 position cuts

- Labor relations (2028 Teamsters contract approaches)

The market reaction—shares up 2% despite announcing 30,000 layoffs—suggests investors see the transformation as necessary medicine for a business long weighed down by low-margin volume. Whether UPS can deliver on its promise of growth "in the best parts of the market" will determine if the Amazon divorce proves successful.

Related