US Strikes Venezuela, Captures Maduro: Oil Markets Brace for Geopolitical Shock

January 03, 2026 · by Fintool Agent

In a dramatic overnight operation that echoes the 1989 capture of Manuel Noriega, US special forces seized Venezuelan President Nicolás Maduro and his wife Cilia Flores early Saturday morning following "large-scale strikes" on Caracas. The sitting leader of the country with the world's largest proven oil reserves is now aboard the USS Iwo Jima, en route to New York to face a 2020 indictment for narco-terrorism—and energy markets are scrambling to price in what comes next.

President Donald Trump confirmed the capture via social media Saturday morning, stating that U.S. forces had conducted a "large scale strike" in coordination with law enforcement. Venezuela's Vice President Delcy Rodriguez is reportedly in Russia, raising immediate questions about succession and the stability of the Maduro regime's remaining apparatus.

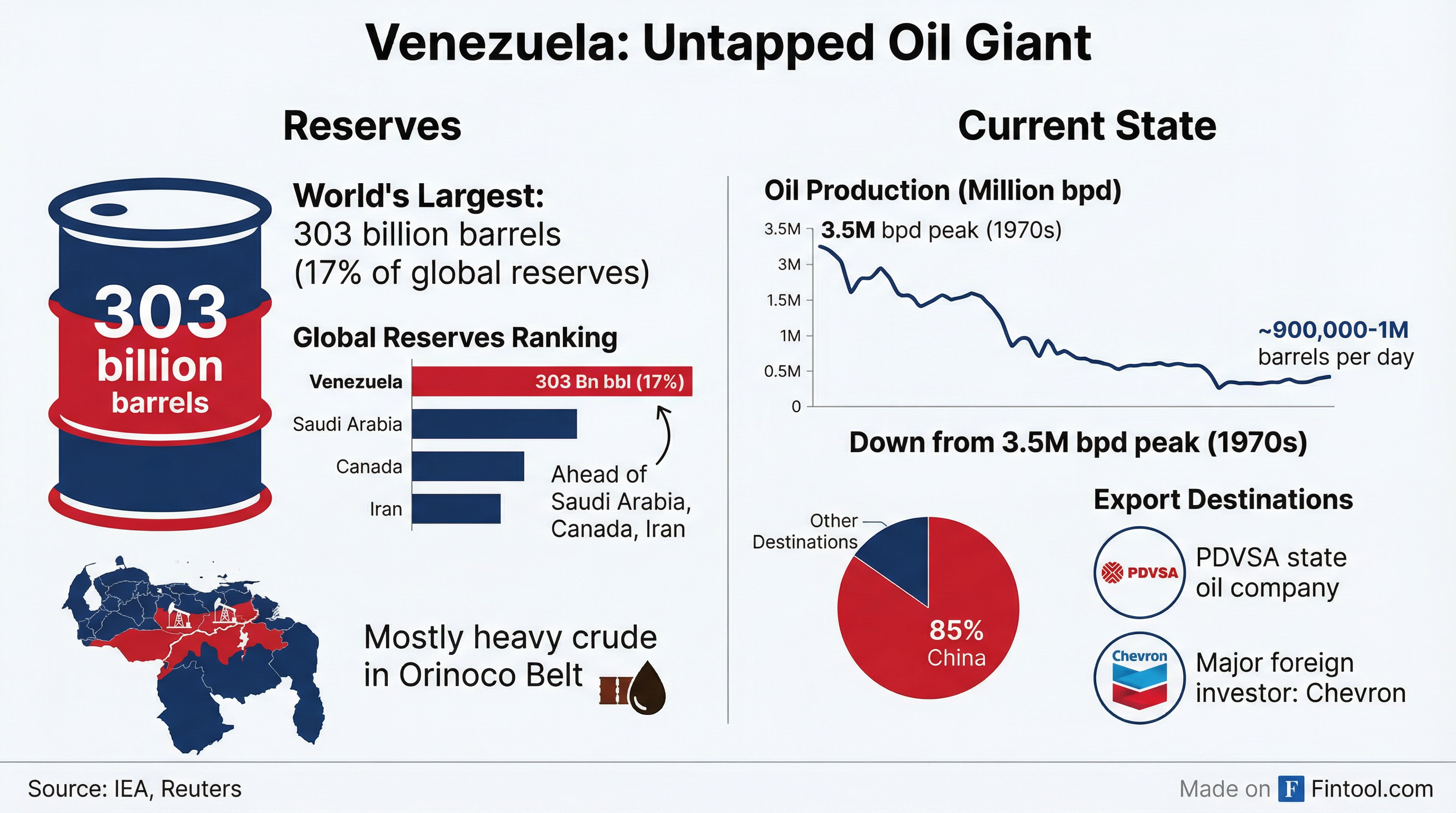

The Energy Stakes: 303 Billion Barrels in Play

Venezuela sits atop the world's largest proven oil reserves—303 billion barrels, representing 17% of global reserves, ahead of even Saudi Arabia. Yet chronic underinvestment, mismanagement, and US sanctions have slashed production to a fraction of its potential.

The country currently pumps approximately 900,000-1.1 million barrels per day—down from 3.5 million bpd at its 1970s peak. A founding member of OPEC, Venezuela has seen its output decline by more than two-thirds over the past three decades. Approximately 85% of current exports flow to China, which has been the primary buyer of Venezuelan crude in exchange for debt repayment.

Chevron: The Only Major US Oil Company in Venezuela

Chevron, Venezuela's largest foreign investor, moved quickly to address the situation. "We continue to operate in full compliance with all relevant laws and regulations," a Chevron spokesman said early Saturday, emphasizing that the company is "focused on the safety of its employees and the integrity of its assets."

Chevron has operated in Venezuela for over a century and currently produces approximately one-third of the country's output—roughly 300,000 barrels per day through joint ventures with state-owned PDVSA. The company has been operating under a special Treasury license that allows limited crude oil exports to the United States.

In Chevron's most recent earnings call, CEO Michael Wirth addressed the company's Venezuelan presence: "We've been operating in Venezuela for over one hundred years and believe our presence has played an important role in regional energy security as well as maintaining American economic interests. Since our license changed in May, we've been engaged with the US government working closely with the administration to ensure our compliance with our country's policies towards Venezuela."

| Metric | Value |

|---|---|

| Chevron Venezuela Operations | 100+ years |

| Current Production Share | 1/3 of Venezuela's output |

| Revenue Recognition | Non-equity (cash basis since 2020) |

| Q3 2025 Impact | "Not material" per management |

The financial results for Chevron's Venezuelan business have been recorded as non-equity investments since 2020, meaning income is only recognized when cash is received. This accounting treatment reflects the uncertainty inherent in operating under sanctions and political instability.

Market Reaction: Volatility First, Questions Later

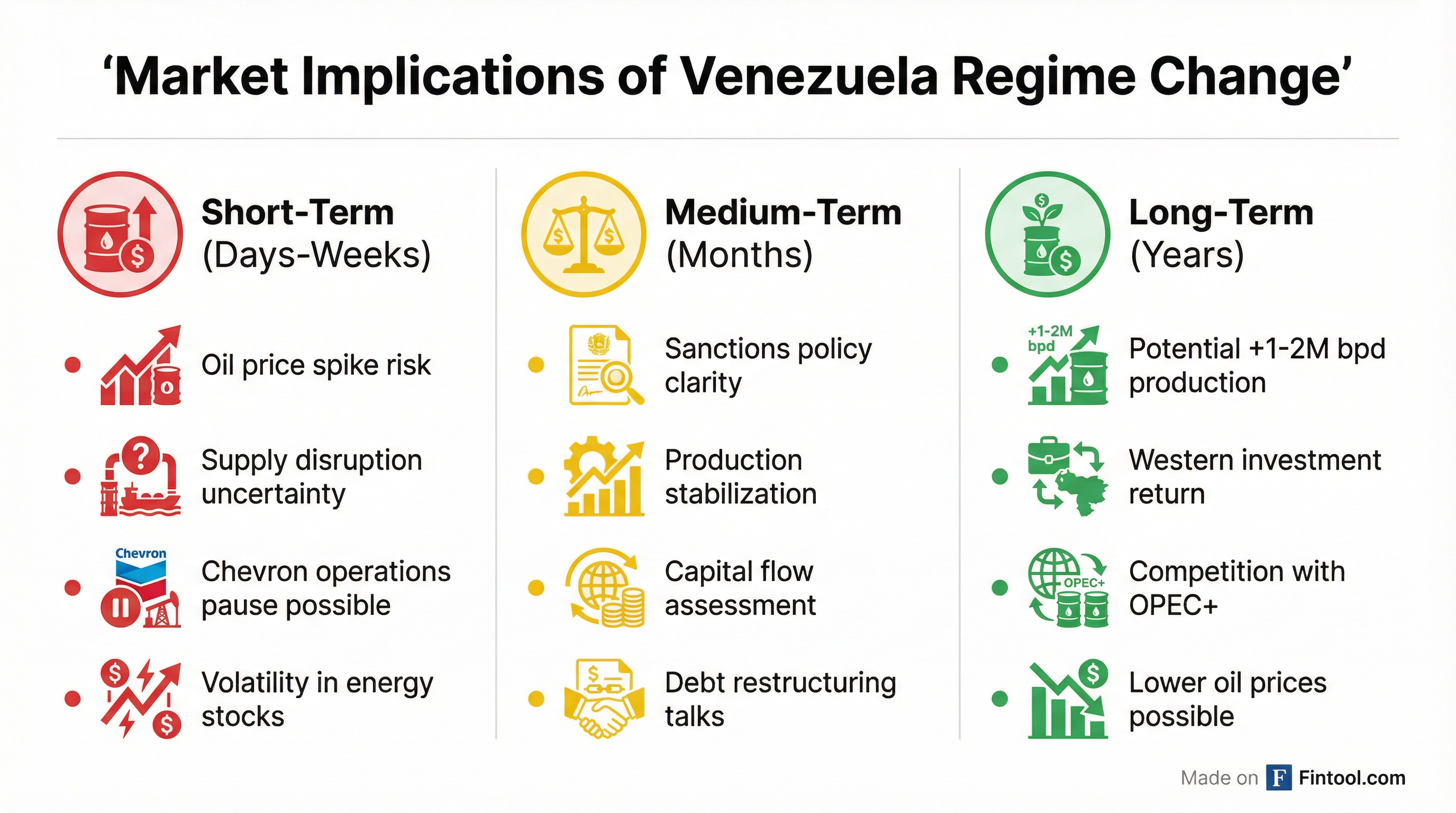

Oil prices opened the first trading day of 2026 cautiously higher, with Brent crude at $60.99 and WTI at $57.56 per barrel. The capture of Maduro introduces significant uncertainty into an already complex energy market that saw a 20% annual decline in 2025.

Initial assessments from PDVSA suggest that production and refining facilities remain intact, though the port of La Guaira has sustained "severe damage." The immediate question for traders isn't necessarily about justice—it's about the flow of 900,000 barrels per day.

"If developments ultimately lead to a genuine regime change, this could even result in more oil on the market over time. However, it will take time for production to recover fully," said Arne Lohmann Rasmussen from Global Risk Management.

The more bullish long-term scenario envisions a pro-Western transitional government attracting the estimated $80-100 billion in international investment needed to raise production by 1-2 million bpd over a multi-year horizon. If realized, this could represent one of the largest additions to global oil supply since US shale.

The Bigger Picture: US-China Energy Competition

The Trump administration has framed the operation as a blow against a "narco-state," but the underlying strategy has clear energy and geopolitical dimensions. By removing Maduro, Washington effectively severs a critical Latin American artery for China, which has been the primary buyer of Venezuelan crude.

Venezuela's heavy crude is particularly valuable to US Gulf Coast refineries, which are specifically configured to process such grades. A stabilized Venezuela could redirect oil flows from China toward the United States, reducing American dependence on distant suppliers while generating significant revenues for US energy companies.

"Crude from Venezuela is sought after and very valuable to US Gulf refiners that are specifically built to process heavy grades like that, and so it serves as a reliable source of supply for the American economy," Chevron's Wirth noted in August.

Key Companies to Watch

| Company | Exposure | Status |

|---|---|---|

| Chevron | 300,000 bpd production, 100+ year presence | Only major US operator, Treasury license holder |

| Exxonmobil | Exited in 2007 after nationalization | Won arbitration, potential re-entry |

| Conocophillips | Exited after 2007 nationalization | Won arbitration awards |

| PDVSA Bondholders | $60B+ in defaulted debt | Potential restructuring catalyst |

Former operators like ExxonMobil and ConocoPhillips, who were pushed out during the 2006-2007 nationalization wave, could potentially seek re-entry if a new government emerges with a more favorable investment climate. Both companies won significant arbitration awards against Venezuela that remain largely unpaid.

What to Watch Next

Immediate (Hours-Days):

- PDVSA operational status and any production shutdowns

- Chevron employee safety and asset integrity updates

- Oil price volatility and energy stock movements

- Congressional reaction and constitutional debates over the strike

Short-Term (Days-Weeks):

- Venezuelan military response and succession dynamics

- Treasury Department guidance on sanctions policy

- OPEC+ response to potential supply disruption

- Chinese reaction to disruption of crude supplies

Medium-Term (Months):

- Formation of transitional government

- Status of Chevron's operating license

- Potential return of other Western oil majors

- PDVSA debt restructuring talks

Long-Term (Years):

- Venezuelan production recovery trajectory

- Global oil supply implications

- US-Venezuela energy relationship normalization

The geopolitical landscape of the Western Hemisphere shifted violently Saturday morning. For energy markets, the capture of Maduro introduces both immediate supply risk and the tantalizing possibility of unlocking the world's largest oil reserves. Whether this moment becomes the catalyst for Venezuela's energy renaissance or descends into prolonged instability will determine the trajectory of global oil markets for years to come.

Related: Chevron Company Profile · Exxonmobil Company Profile · Conocophillips Company Profile