US-Taiwan Trade Deal Nears Completion: TSMC to Double Arizona Chip Investment

January 12, 2026 · by Fintool Agent

The Trump administration is finalizing a trade agreement with Taiwan that would slash tariffs on the island's exports to 15% while securing Taiwan Semiconductor Manufacturing Company's commitment to build at least five additional chip fabrication plants in Arizona—roughly doubling its planned US manufacturing footprint.

TSMC shares surged 3.5% to an all-time high of $333.36 on the news, pushing the company's market capitalization to $1.73 trillion.

The Deal Structure

The agreement, which has been under negotiation for months and is now in final legal review, would bring Taiwan's tariff rate in line with Japan and South Korea—both of which struck deals with Washington last year that included massive investment packages in US shipbuilding, nuclear energy, and critical minerals.

Key terms:

- 15% tariff rate on Taiwanese goods (down from 20%)

- 5+ additional fabs in Arizona on top of 6 already planned

- Companies investing domestically may be exempt from Section 232 tariffs

- Deal expected to be announced later this month

Under the arrangement, TSMC would expand its Arizona manufacturing complex from six planned fabs to eleven or more, creating what would become the largest advanced semiconductor manufacturing cluster outside of Asia.

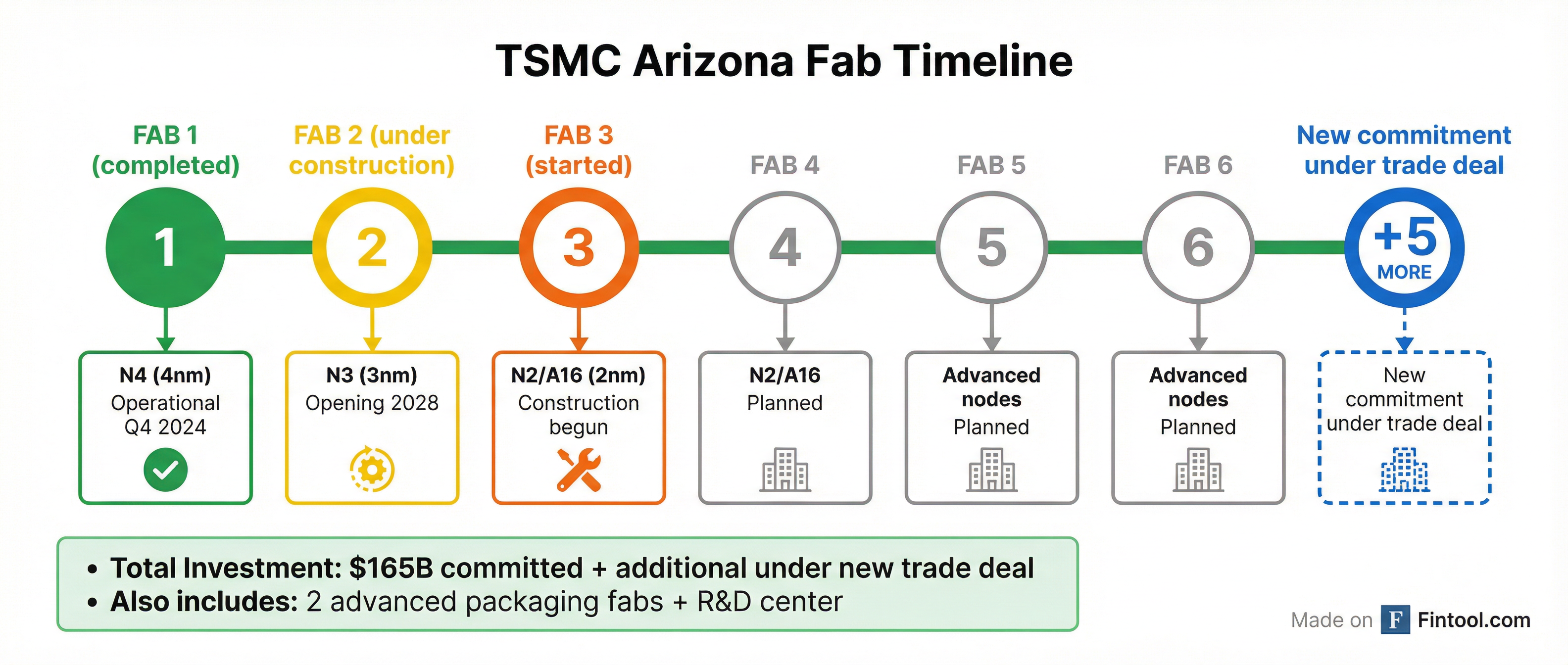

TSMC's Arizona Expansion Roadmap

TSMC Chairman CC Wei announced in July 2025 that the company would invest $165 billion in US semiconductor manufacturing, including six advanced fabs, two packaging facilities, and a major R&D center.

| Fab | Process Node | Status | Timeline |

|---|---|---|---|

| Fab 1 | N4 (4nm) | Operational | Q4 2024 |

| Fab 2 | N3 (3nm) | Construction complete | 2028 |

| Fab 3 | N2/A16 (2nm) | Under construction | TBD |

| Fab 4-6 | Advanced nodes | Planned | Customer-driven |

| Fab 7-11+ | New commitment | Trade deal terms | TBD |

The first Arizona fab achieved yields "comparable to our fab in Taiwan," according to Wei—a critical milestone that had been questioned given TSMC's early struggles with US workforce and construction timelines.

Market Reaction

TSMC shares have rallied 147% from their 52-week low of $134.25, with the trade deal news pushing the stock to record territory. The company's $1.73 trillion market cap makes it the world's most valuable semiconductor company and one of the ten most valuable companies globally.

| Metric | Q3 2025 | Q2 2025 | Q1 2025 | Q4 2024 |

|---|---|---|---|---|

| Revenue ($B) | $32.5* | $31.9* | $25.2* | $26.5* |

| Net Income ($B) | $14.8* | $13.6* | $10.9* | $11.0* |

| Gross Margin | 59.5%* | 58.6% | 58.8% | 59.0%* |

| EBIT Margin | 50.6%* | 49.6%* | 48.5%* | 49.0%* |

*Values retrieved from S&P Global

TSMC raised its full-year 2025 revenue guidance to 30% growth in US dollar terms, driven by "strong demand for our industry-leading three-nanometer and five-nanometer technologies underpinned by our HPC platform."

Geopolitical Context: Why This Deal Matters

The deal represents a strategic victory for the Trump administration's push to reshore critical chip manufacturing. Commerce Secretary Howard Lutnick has argued that Taiwan's dominant position—producing roughly 44% of logic chips and 24% of memory chips used in the US—poses an unacceptable national security risk given China's threats against the island.

Taiwan's semiconductor dominance:

- 67.6% global foundry market share (Q1 2025)

- 95% of chips used in critical US technology come from Taiwan

- TSMC supplies Apple, Nvidia, AMD, Qualcomm, and virtually every leading tech company

The US had previously considered more aggressive measures, including a 1:1 production mandate requiring chip companies to manufacture as many chips domestically as they import, and steep tariffs to force reshoring.

Taiwan, for its part, has resisted sharing its most advanced manufacturing technology abroad, and officials have rejected proposals for a 50-50 production split between the US and Taiwan.

Beneficiaries and Second-Order Effects

The deal has immediate implications for TSMC's largest customers and the broader semiconductor equipment supply chain.

Big Tech Customers

Apple, Nvidia, and Amd are among TSMC's largest customers and stand to benefit from expanded US manufacturing capacity—particularly for AI chips where demand has outstripped supply. TSMC noted "strong interest from our leading US customers" in speeding up volume production schedules.

Equipment Suppliers

Each new leading-edge fab costs more than $25 billion, with TSMC's Arizona site alone containing cleanrooms totaling over 600,000 square feet. Equipment suppliers including ASML, Applied Materials, KLA, and Lam Research stand to capture multibillion-dollar orders from the expanded buildout.

The global fab construction surge has created massive demand:

- Intel's €33 billion Magdeburg complex in Germany

- GlobalFoundries receiving $1.5 billion in CHIPS Act grants

- Construction starting on 35 new fabs globally between 2024-2025

Competitive Impact

Intel, which has struggled to compete with TSMC on advanced manufacturing, faces intensified pressure as TSMC's US footprint grows. Intel has bet heavily on its own foundry ambitions, but TSMC's proven yields at its Arizona fab demonstrate the Taiwanese giant can replicate its manufacturing excellence on US soil.

What to Watch

The deal is expected to be announced within weeks, but several questions remain:

- Timeline for additional fabs: The agreement commits TSMC to 5+ more facilities, but the construction and ramp schedule will depend on customer demand

- Section 232 exemptions: How exactly companies will qualify for tariff exemptions based on domestic investment

- Technology sharing: Whether TSMC will bring its most advanced nodes (beyond 2nm) to Arizona

- Chinese response: How Beijing reacts to the expanded US-Taiwan semiconductor partnership

Nvidia CEO Jensen Huang has warned that achieving supply chain independence from Taiwan could take "between a decade and two decades"—suggesting the new TSMC commitment, while significant, is just one step in a longer strategic realignment.