Venezuela Ends Two Decades of Oil Nationalization, Opens Sector to Foreign Investment

January 30, 2026 · by Fintool Agent

Venezuela's Acting President Delcy Rodríguez signed into law a sweeping overhaul of the country's hydrocarbons framework Thursday, reversing nearly two decades of socialist oil nationalization and opening the door for foreign companies to take operational control of the world's largest proven oil reserves.

The reform comes less than a month after U.S. military forces captured former President Nicolás Maduro, and represents a dramatic capitulation to Washington's demands for greater American access to Venezuelan crude.

"We're talking about the future. We are talking about the country that we are going to give to our children," Rodríguez said of the reform, which passed unanimously in Venezuela's National Assembly.

What Changed

The new law fundamentally restructures the relationship between foreign investors and state oil company Petróleos de Venezuela S.A. (PDVSA):

Operational control: Private companies can now exercise "technical and operational management" of oil projects directly, even as minority partners in joint ventures. Previously, PDVSA was required to maintain majority control over all operational decisions.

Revenue access: Companies gain direct access to proceeds from oil sales, breaking PDVSA's monopoly over commercialization.

Dispute resolution: International arbitration is now permitted for contract disputes, removing the prior mandate that all disagreements be settled in Venezuelan courts controlled by the ruling party.

Royalty flexibility: The royalty cap remains at 30%, but the executive branch can now reduce rates to zero based on capital investment needs and project competitiveness.

Asset transfers: The law formalizes the ability to transfer oil assets currently owned by PDVSA and outsource oilfield operations to private companies.

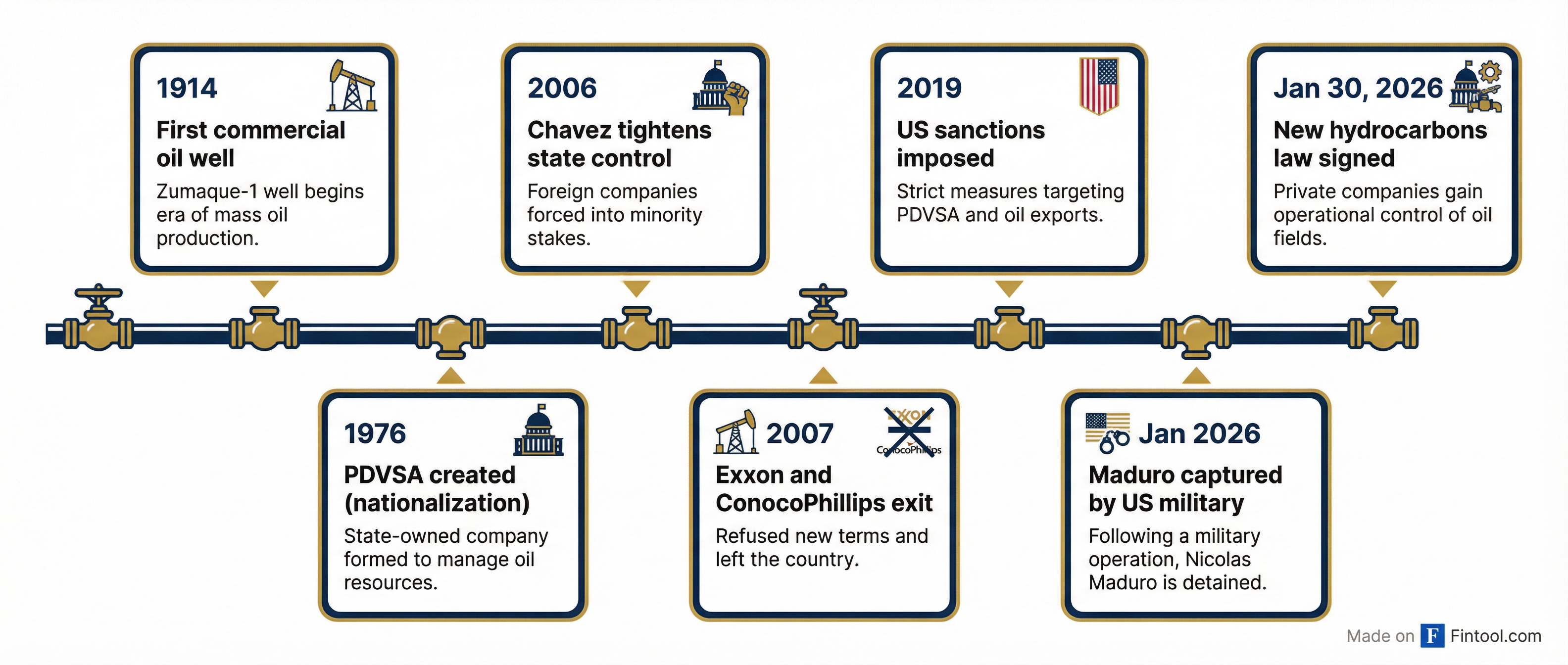

History of Venezuela's Oil Industry

The reform effectively reverses the 2006 changes imposed by Hugo Chávez, Maduro's mentor and predecessor, which made heavy state control over oil a central pillar of Venezuela's socialist-inspired revolution.

In tearing up contracts that foreign companies signed in the 1990s, Chávez nationalized assets belonging to American and European firms that refused to accept new terms requiring PDVSA to hold at least 60% stakes in all major projects. Exxon Mobil and Conocophillips both exited in 2007, initiating legal battles that continue to this day.

From heady days of lavish state spending funded by oil revenues estimated at $981 billion between 1999 and 2011, PDVSA's fortunes turned dramatically. A drop in oil prices, systemic corruption, and catastrophic mismanagement eroded profits and production. By 2013, Venezuela had fallen into dire economic crisis, driving more than 7.7 million citizens to migrate.

US Oil Majors: Divergent Positions

Chevron: The Lone Major Still Operating

Chevron is uniquely positioned as the only U.S. supermajor that maintained continuous operations in Venezuela, operating under a special U.S. Treasury license since 2019. CEO Mike Wirth has repeatedly emphasized the company's century-long presence in the country.

"We've been operating in Venezuela for over one hundred years and believe our presence has played an important role in regional energy security as well as maintaining American economic interests," Wirth said on Chevron's Q2 2025 earnings call. The company's joint ventures are producing around 200,000 barrels per day, and Chevron has been steadily recovering debt owed by PDVSA.

Chevron reported Q4 2025 adjusted earnings of $3.0 billion ($1.52 per share), beating analyst estimates of $1.45, with worldwide production reaching a record 4.05 million barrels of oil equivalent per day.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $46.1 | $44.4 | $48.2 | $45.8 |

| Net Income ($B) | $3.5 | $2.5 | $3.5 | $2.8 |

| Cash from Operations ($B) | $5.2 | $8.6 | $9.4 | $10.8 |

Exxon Mobil: Burned Before, Wary Now

Exxon Mobil lost substantial assets in Venezuela's 2007 nationalization and has been pursuing arbitration awards against the government ever since. At a recent White House meeting, CEO Darren Woods reportedly told officials that Venezuela remains "uninvestable" despite the reforms.

Exxon reported Q4 2025 earnings of $6.5 billion ($1.53 per share) excluding identified items of $7.3 billion ($1.71 per share), beating estimates. This marked the company's first quarterly profit increase in more than a year.

| Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 |

|---|---|---|---|---|

| Revenue ($B) | $81.1 | $79.5 | $83.3 | $80.0 |

| Net Income ($B) | $7.7 | $7.1 | $7.5 | $6.5 |

| Cash from Operations ($B) | $13.0 | $11.6 | $14.8 | $12.7 |

ConocoPhillips: Owed Billions, Still Collecting

Conocophillips is in an even more complex position. In 2007, the government of Venezuela expropriated ConocoPhillips' interests in the Petrozuata and Hamaca heavy oil ventures, as well as the offshore Corocoro development project.

In March 2019, an ICSID tribunal unanimously ordered Venezuela to pay ConocoPhillips approximately $8.7 billion (later reduced to $8.5 billion) plus interest for the unlawful expropriation. On January 22, 2025, an ICSID annulment committee dismissed Venezuela's application to annul the tribunal's decision and upheld the $8.5 billion award plus interest in full.

Cumulatively, as of September 30, 2025, ConocoPhillips had received approximately $793 million in connection with the first ICC award, leaving over $7.7 billion still outstanding. Collection actions for all three arbitration awards remain ongoing.

US Sanctions Eased Simultaneously

Hours after the Venezuelan National Assembly passed the reform, the U.S. Treasury Department issued a general license authorizing American companies to engage in certain oil-related transactions with the Venezuelan government and PDVSA.

The license permits activities related to "the lifting, exportation, reexportation, sale, resale, supply, storage, marketing, purchase, delivery, or transportation of Venezuelan-origin oil, including the refining of such oil, by an established US entity."

Previously, all of Venezuela's oil sector was subject to sweeping U.S. sanctions imposed in 2019 during Trump's first term as president.

The coordinated timing between Caracas and Washington was not coincidental. The Trump administration has made clear that the U.S. will control Venezuela's oil exports and revenues indefinitely following the January 3 capture of Maduro. Secretary of State Marco Rubio has said proceeds will be deposited into a U.S.-controlled account, initially in Qatar, with Venezuela submitting monthly budgets to the White House for approval.

Investment Implications

Analysts view the reform as "good enough" to encourage initial investment to recover Venezuela's depleted industry, while acknowledging significant uncertainty remains.

David Vera, an associate dean in the Craig School of Business, captured the investor dilemma: "This law was necessary, and overall a positive step. But it still falls short of what US oil companies need to commit capital at scale. Yes, there's more flexibility on royalties, taxes, arbitration, and commercialisation, but a lot of executive discretion and legal uncertainty remains."

Key investor concerns include:

- Execution risk: Much of Maduro's government apparatus remains intact, creating uncertainty about consistent enforcement of the new rules

- Prior compensation: Exxon and ConocoPhillips are still owed billions from the 2007 nationalization, and have received no assurances about resolution

- Infrastructure decay: Venezuela's oil infrastructure has deteriorated significantly, requiring substantial capital to restore production capacity

- Political instability: The broader political situation remains volatile less than a month after the U.S. military intervention

The $100 Billion Question

President Trump has proposed a $100 billion reconstruction plan for Venezuela's oil industry, with American companies expected to take the lead.

Venezuela holds approximately 304 billion barrels of proven oil reserves—the largest in the world, exceeding even Saudi Arabia. Yet production has collapsed from 3.2 million barrels per day in the late 1990s to under 900,000 barrels per day due to chronic underinvestment, sanctions, and mismanagement.

Restoring Venezuela to its historical production levels would require:

- Massive infrastructure investment to repair and replace decaying equipment

- Technical expertise that fled the country during two decades of socialist governance

- Long-term capital commitments in an uncertain regulatory and political environment

- Resolution of outstanding arbitration claims from prior expropriations

For now, Chevron appears best positioned to capitalize on the reform, given its existing operations and relationship with the government. Whether Exxon, ConocoPhillips, and other majors will follow remains the key question for investors watching one of the most dramatic energy policy reversals in modern history.