Visa CEO Doubles Down on Stablecoin Strategy at AGM, Reports $40B Revenue Year

January 27, 2026 · by Fintool Agent

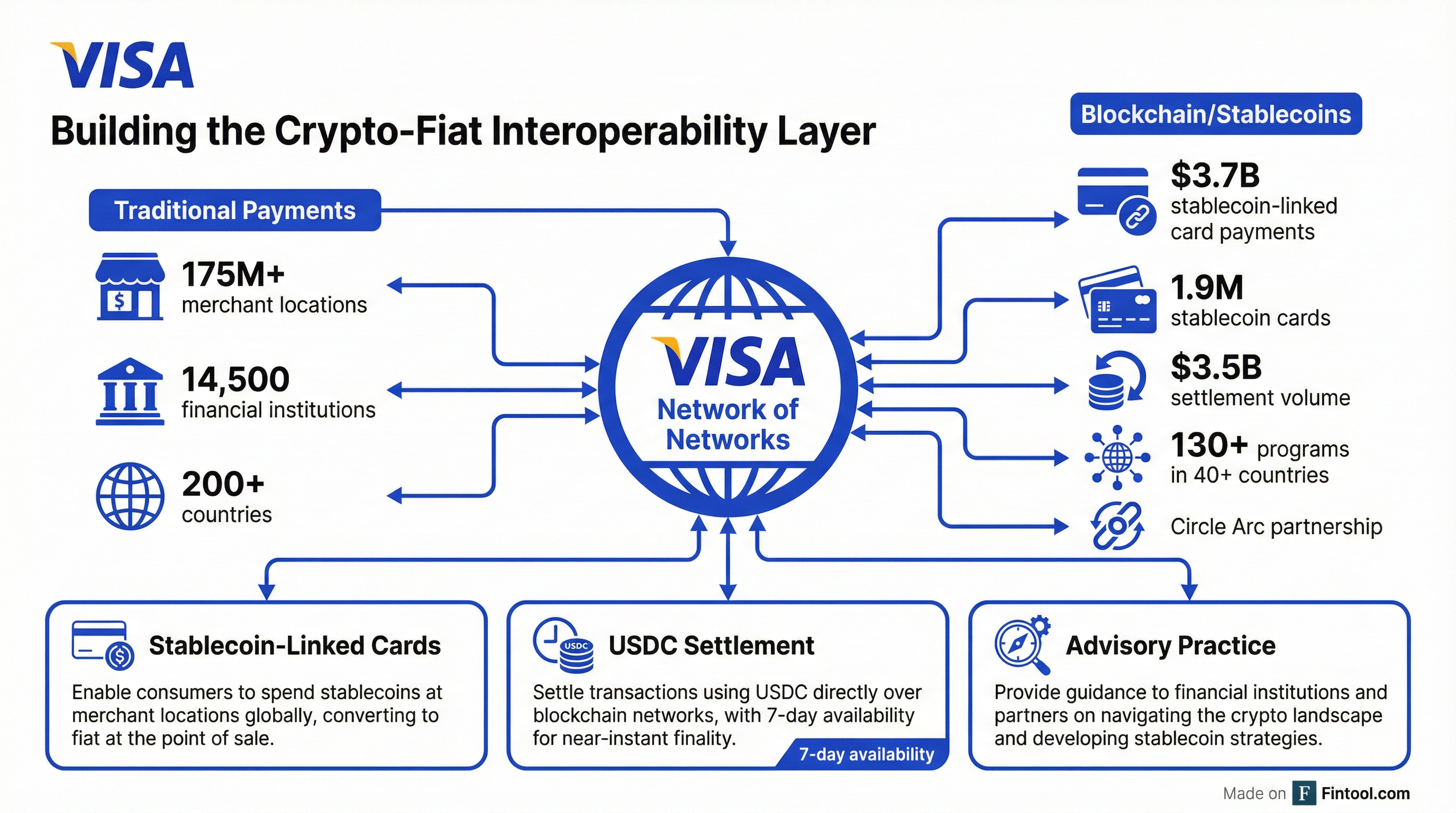

Visa CEO Ryan McInerney used the company's 2026 Annual Shareholder Meeting to stake out an aggressive position in digital assets, declaring Visa's mission to "build a secure and seamless interoperable layer between stablecoins and traditional fiat payments at scale" while delivering FY 2025 results that topped $40 billion in revenue.

The bullish commentary comes six weeks after Visa launched USDC settlement in the United States—a move that allows partner banks to settle obligations in stablecoins rather than through traditional fiat rails. The company has now processed $3.7 billion in stablecoin-linked card payments from 1.9 million stablecoin-denominated cards, positioning itself as the dominant bridge between crypto wallets and everyday commerce.

Shares traded down 0.4% to $327.15 following the meeting, with the stock off 2.2% over the past year compared to Mastercard's 4.4% decline.

Strong FY 2025 Results

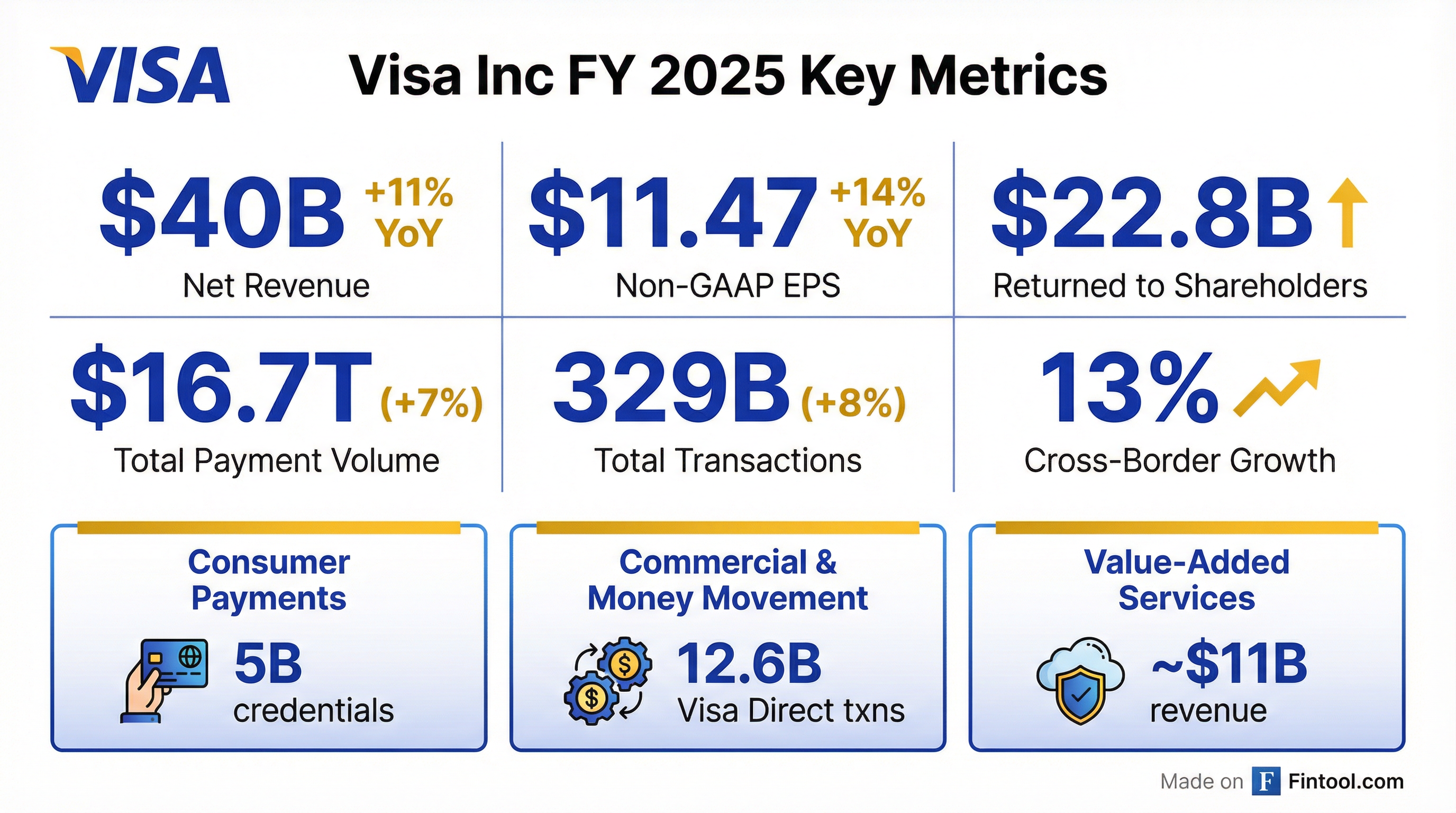

McInerney opened his presentation with FY 2025 financial highlights that underscored the durability of Visa's core business while telegraphing the strategic importance of emerging payment rails.

| Metric | FY 2022 | FY 2023 | FY 2024 | FY 2025 |

|---|---|---|---|---|

| Revenue ($B) | $29.3 | $32.7 | $35.9 | $40.0 |

| Diluted EPS | $7.00 | $8.28 | $9.73 | $10.20 |

| EBITDA Margin | 70.1%* | 70.0%* | 69.7%* | 70.1%* |

*Values retrieved from S&P Global

Key operating metrics showed continued momentum:

- Total payment volume: $16.7 trillion, up 7% in constant dollars

- Total transactions: 329 billion, up 8%

- Cross-border volume: Up 13% year-over-year in constant dollars (excluding intra-Europe)

- Capital returns: $22.8 billion to shareholders through buybacks and dividends

The Stablecoin Thesis

McInerney devoted significant time to explaining why stablecoins represent an additive opportunity rather than a competitive threat. "The areas where there is product market fit for stablecoins are areas with significant opportunity and generally areas where Visa is very under-penetrated," he explained.

The strategic logic centers on emerging markets where demand for US dollars is high but card penetration remains low. "In most of these markets, we think broad-based adoption of stablecoins will actually accelerate our progress digitizing cash through stablecoin-linked cards and other products," McInerney said.

Visa's stablecoin capabilities span three key areas:

Settlement Infrastructure: In December 2025, Visa launched USDC settlement in the United States with banking partners Cross River Bank and Lead Bank, both settling on the Solana blockchain. The company reported $3.5 billion in annualized stablecoin settlement volume as of November 30, 2025. Visa is also a design partner for Arc, Circle's new Layer 1 blockchain optimized for payments, where the company plans to operate a validator node.

Card Issuance: Visa now operates more than 130 stablecoin-linked card programs in over 40 countries, enabling consumers to spend stablecoins at any of Visa's 175+ million merchant locations without merchants needing to change anything.

Advisory Services: The company launched its Stablecoins Advisory Practice in December 2025, offering strategy development, market entry planning, and technology integration services to banks, fintechs, and merchants.

Competitive Positioning vs Mastercard

Visa's execution in stablecoins has opened a gap with rival Mastercard, which has taken a more modular, infrastructure-focused approach.

| Capability | Visa | Mastercard |

|---|---|---|

| Stablecoin Settlement Volume | $3.5B annualized | Not disclosed |

| US Settlement | Live (Dec 2025) | Pilot stage |

| Stablecoin Card Programs | 130+ in 40+ countries | 100+ globally |

| Blockchain Partnership | Circle Arc (design partner) | Multi-Token Network |

| Primary Focus | Settlement execution | Infrastructure frameworks |

Industry analysts have noted the divergence. "Visa likely retains leadership and scales stablecoin settlement materially," wrote research firm insights4vc in a January 2026 report. "Mastercard [could be a] loser if Visa's lead becomes winner-take-most."

Mastercard has countered with partnerships like Thunes for stablecoin wallet payouts and its Multi-Token Network for tokenized deposits, but has not disclosed settlement volumes comparable to Visa's.

Value-Added Services: The Other Growth Engine

Beyond stablecoins, McInerney highlighted Value-Added Services as "a key driver for Visa," generating nearly $11 billion in revenue with a compound annual growth rate exceeding 20% since 2021 in constant dollars.

The segment now includes more than 200 products across four portfolios:

- Issuing Solutions: Pismo, Visa's core banking platform, expanded to clients in 5+ countries across 4 regions

- Acceptance Solutions: Launched unified checkout experience and new Authorize.net gateway

- Risk & Security: Featurespace acquisition closed 100+ client deals; Visa Protect for A2A provides real-time fraud monitoring

- Advisory Services: $6.5 billion in incremental revenue realized for clients across 4,500 consulting engagements

The company also reached a tokenization milestone: over 50% of e-commerce transactions are now tokenized, up from just 4% in 2019.

Shareholder Proposals Rejected

All four shareholder proposals on the ballot were defeated:

| Proposal | Topic | Result |

|---|---|---|

| #5 | Mandatory independent board chair | Not approved |

| #6 | Shareholder written consent rights | Not approved |

| #7 | Report on AI-generated pornography policies | Not approved |

| #8 | DEI return-on-investment audit | Not approved |

The board recommended against all four, arguing existing governance practices provide adequate oversight. The proposal on AI-generated child pornography, introduced by Oklahoma Treasurer Todd Russ, drew particular attention given state attorneys general pressure on payment networks to address loopholes in content moderation.

Capital Allocation

McInerney reiterated Visa's capital allocation priorities:

- Invest in the business (organic and M&A)

- Dividends: 20-25% of EPS ($4.6 billion distributed in FY 2025)

- Share repurchases: $18.2 billion in FY 2025, with $24.9 billion remaining authorization

- Maintain credit ratings: Target gross debt/EBITDA below 1.5x

Since its IPO, Visa has returned more than $165 billion to shareholders—$19 billion in dividends and $68 billion in buybacks over the last five years alone.

Analyst View

Wall Street remains constructive on Visa, with a consensus price target of $398, implying 22% upside from current levels.*

| Metric | FY 2026E | FY 2027E |

|---|---|---|

| Revenue ($B) | $44.5 | $48.9 |

| EPS | $12.80 | $14.45 |

| YoY Revenue Growth | 11% | 10% |

*Estimates retrieved from S&P Global

The forward estimates imply continued double-digit revenue growth as Visa expands its addressable market through stablecoins, Visa Direct, and Value-Added Services.

What to Watch

-

Stablecoin settlement scale: Can Visa's $3.5B annualized volume reach double digits as US availability broadens through 2026?

-

Circle Arc launch: Visa's participation as a validator node on Circle's new L1 blockchain could accelerate infrastructure development

-

Regulatory clarity: The GENIUS Act and EU MiCAR provide frameworks, but implementation details will shape stablecoin economics

-

Mastercard response: Will Mastercard's infrastructure-first approach translate to competitive settlement volumes?

-

Cross-border growth sustainability: The 13% constant-dollar growth in cross-border volume—Visa's highest-margin segment—remains the key financial driver

Related