West Pharmaceutical Targets $28B Fill-Finish Market With Integrated Syringe System

February 5, 2026 · by Fintool Agent

West Pharmaceutical Services is making its most aggressive push yet into the integrated drug delivery market, hosting a live webinar today through Pharmaceutical Online to showcase its Synchrony S1 prefillable syringe system—a product the company believes can fundamentally change how emerging biotech companies bring injectable drugs to market.

The webinar, led by Dr. Bettina Boltres, West's Director of Scientific Affairs for Integrated Systems, comes just weeks after the system achieved global commercial availability at Pharmapack 2026 in Paris. The timing is strategic: West is positioning Synchrony S1 as the solution to a regulatory and supply chain nightmare that has plagued drug developers for years.

The $500,000-Per-Day Problem

"A single day of delay can already result in losses of around $500,000 in sales, especially in high-value therapeutic areas," Boltres told webinar attendees, framing the stakes for pharmaceutical companies navigating increasingly complex combination product regulations.

The pain point is real. Since 2016, the time from first patent to launch has shortened from 16 years to an average of 10.6 years for larger pharma companies—a compression of 5 years that has made development efficiency critical for protecting patent economics.

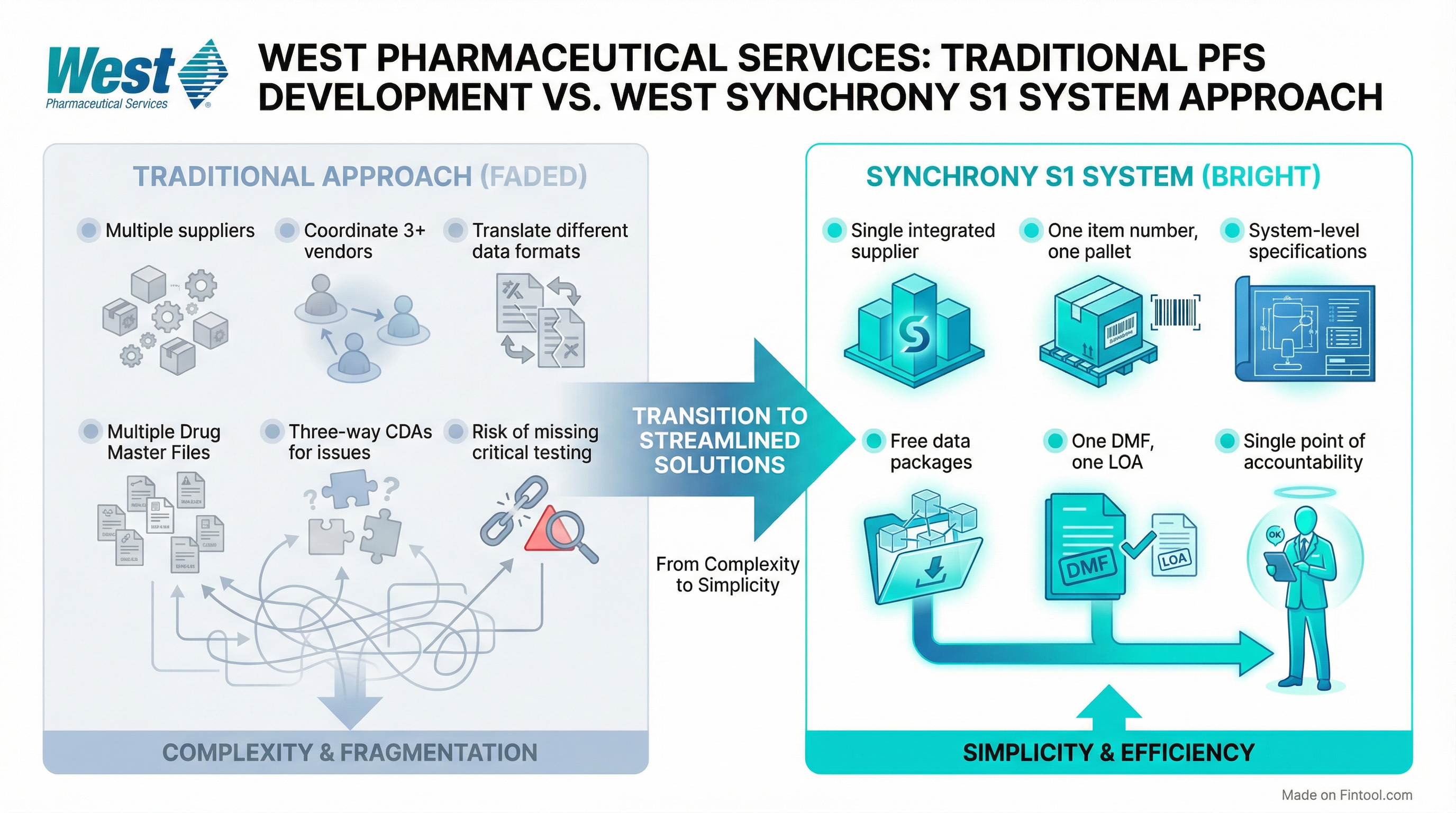

A live poll during the webinar revealed the scope of the problem: 92% of pharmaceutical company attendees said they "know the struggle" of assembling prefilled syringe systems from multiple component suppliers—coordinating glass barrels, plungers, and needle shields from different vendors with varying lead times, data formats, and minimum order quantities.

The Synchrony S1 Solution

West's answer is a fully integrated system that ships as a single SKU from one supplier—glass syringe barrel, closure (rigid needle shield, soft needle shield, or tip cap), and NovaPure or FluroTec plunger—all verified together and delivered on one pallet.

The company has validated over 200 system configurations for biologics and vaccines, covering:

- 1 mL long staked needle and 2.25 mL staked needle options for biologics

- 1 mL standard staked needle and Luer lock options for vaccines

- Multiple needle gauges: 27-gauge thin wall, 29-gauge thin wall, and 27-gauge special thin wall

"Because we own the entire system, we put it all together under one DMF," Boltres explained. "You just need to request one LOA from one company."

The Free Data Package Strategy

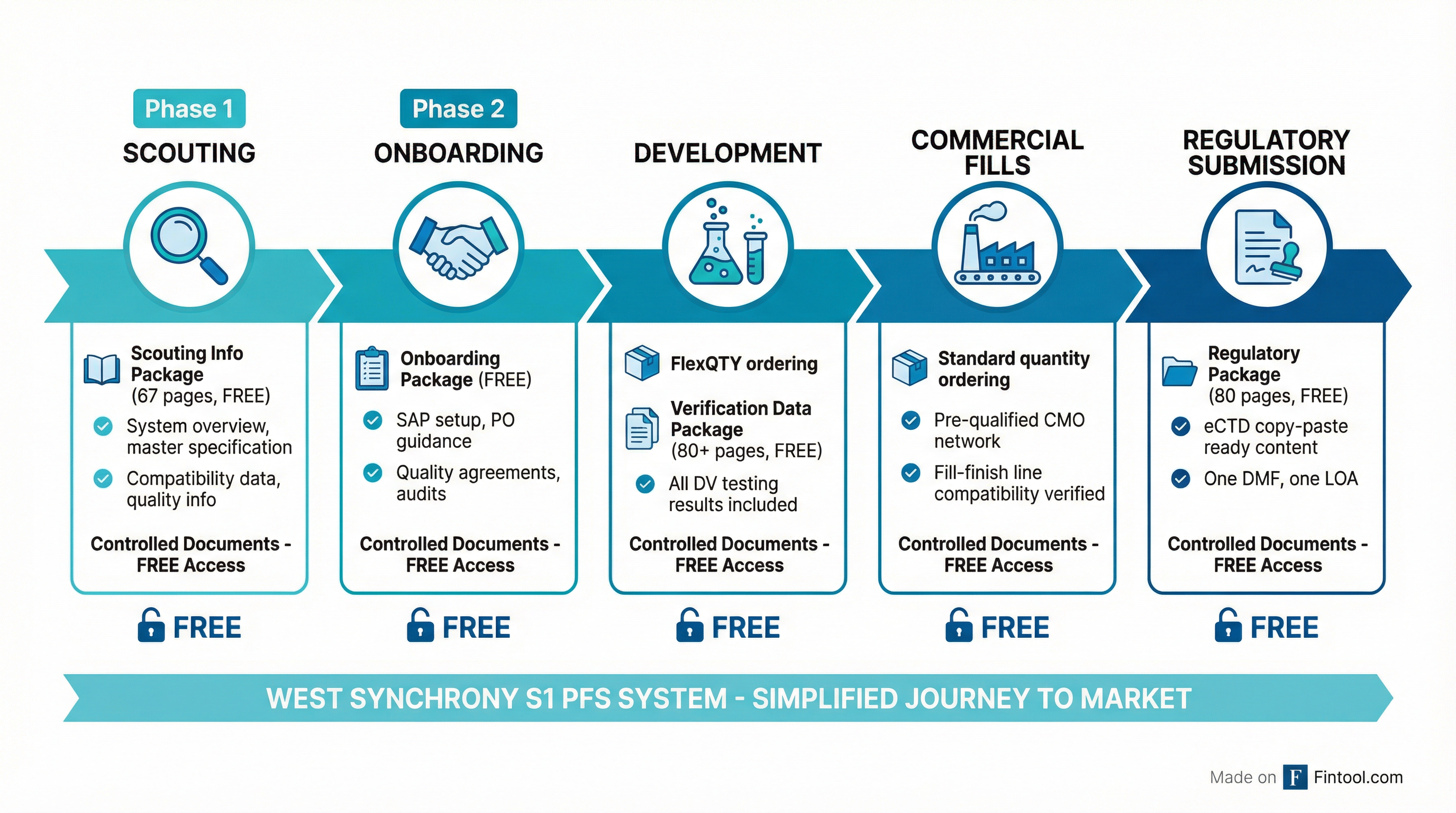

Perhaps the most notable aspect of the Synchrony strategy is West's decision to provide comprehensive data packages at no cost—a departure from the industry norm of selling verification data as premium services.

The company offers four packages aligned to development milestones:

| Package | Contents | Pages |

|---|---|---|

| Scouting Info | System overview, master specification, compatibility data | 67 |

| Onboarding | SAP setup, PO guidance, quality agreements | Varies |

| Verification Data | Complete DV testing results, sample sizing approach, bracketing methodology | 80+ |

| Regulatory | eCTD copy-paste ready content, GSPR documentation for EU MDR | 80 |

"All of these documents are for free and readily available as per your milestone," Boltres emphasized. "All of these documents are controlled documents—peer-reviewed, revision-controlled, a single source of truth that is always up to date."

Pre-Qualified CMO Network

West has gone beyond component supply to build an ecosystem around Synchrony S1. The system is pre-qualified at a global network of contract manufacturing organizations across the Americas, Europe, and Asia, meaning customers can potentially skip engineering runs entirely.

The company has also verified compatibility with:

- Four leading fill-finish line manufacturers for de-bagging, handling, and feeder bowl sorting

- Two leading auto-injector suppliers for their 1 mL devices, testing cap removal force, injection time, and dose accuracy

Make-to-Stock "Signature Systems"

To accelerate time-to-market, West has designated two configurations as make-to-stock items from its Waterford, Ireland facility:

Signature System 1: 1 mL Long Staked Needle

- Rigid needle shield, 27g or 29g thin wall, 0.5-inch, small round flange

- NovaPure or FluroTec plunger options

- FlexQTY: 12,000 systems per order | Standard: 48,000 systems

Signature System 2: 2.25 mL Staked Needle

- Rigid needle shield, 27g thin wall, small round flange

- NovaPure or FluroTec plunger options

- FlexQTY: 7,500 systems per order | Standard: 30,000 systems

These configurations are kept in inventory in Ireland, enabling rapid fulfillment once system-level release testing is completed.

The Market Opportunity

The timing of West's push aligns with favorable industry dynamics. The global fill-finish manufacturing market is projected to reach $28.14 billion by 2030, growing from $18.36 billion in 2025 at an 8.9% CAGR.

Key growth drivers include:

- Annex-1 compliance requirements in Europe enhancing equipment upgrade demand

- Rising demand for automated and small-batch solutions

- Expanding pipeline of monoclonal antibodies and mRNA products

West's own Q3 2025 results showed the momentum: HVP Components grew 16.3% year-over-year (13.3% organic), with GLP-1 elastomer revenue now representing 9% of total sales—up from mid-single-digits in 2024.

West's Financial Position

| Metric | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 |

|---|---|---|---|---|

| Revenue ($M) | $749 | $698 | $767 | $805 |

| Net Income ($M) | $130 | $90 | $132 | $140 |

| Gross Margin | 36.5% | 33.2% | 35.7% | 36.6% |

| EBITDA Margin | 28.4%* | 24.2%* | 26.3%* | 27.2%* |

*Values retrieved from S&P Global

The company raised full-year 2025 guidance after Q3, targeting revenue of $3.060-$3.070 billion and adjusted EPS of $7.06-$7.11.

Stock Performance

WST shares trade at $232.29, down 2% on the day, well below the 52-week high of $335.20 and the consensus analyst price target of $340.71—implying 46% upside from current levels.*

The stock has struggled despite strong fundamentals, with the 50-day moving average at $265.94 and 200-day at $247.53 both above the current price, suggesting the stock remains in a technical downtrend.

*Values retrieved from S&P Global

What to Watch

Near-term catalysts:

- Q4 2025 earnings (expected February 2026)—first full quarter with Synchrony S1 commercially available

- Annex-1 conversion pipeline momentum—management noted less than 40% of projects have converted to revenue so far

- Dublin facility drug handling and cold storage business ramping in early 2026

Key risks:

- The Synchrony approach requires customers to buy the complete system—not individual components—which may limit adoption among companies with existing supplier relationships

- Two-year shelf life on the integrated system (limited by component with shortest shelf life) could constrain inventory flexibility

- PFAS regulatory discussions could impact elastomer formulations longer-term, though West is developing alternatives

The 100% approval rating from webinar attendees on whether they "see a benefit in this approach" suggests market receptivity—but converting interest into commercial adoption among cost-conscious biotech buyers will be the real test.

Related Companies: West Pharmaceutical Services | Becton, Dickinson and Company | Thermo Fisher Scientific | Danaher Corporation