Yum Brands to Close 250 Pizza Huts as Taco Bell Shines—Strategic Review Advances

February 4, 2026 · by Fintool Agent

Yum! Brands is closing approximately 250 Pizza Hut locations in the United States during the first half of 2026, the company revealed Wednesday during its Q4 earnings call, as its strategic review of the embattled pizza chain advances and could culminate in a sale later this year.

The closures are part of a new initiative called "Hut Forward," which CFO Ranjith Roy described as "a bridge to longer-term acceleration of the brand" while the strategic options review proceeds. The 250 targeted locations represent roughly 4% of Pizza Hut's approximately 6,500 U.S. restaurants and are expected to reduce the brand's Q1 core operating profit by approximately 15%.

Yum! Brands shares rose 0.5% to $159.57 on the news, as investors weighed the mixed quarterly results against management's confidence in the remaining portfolio.

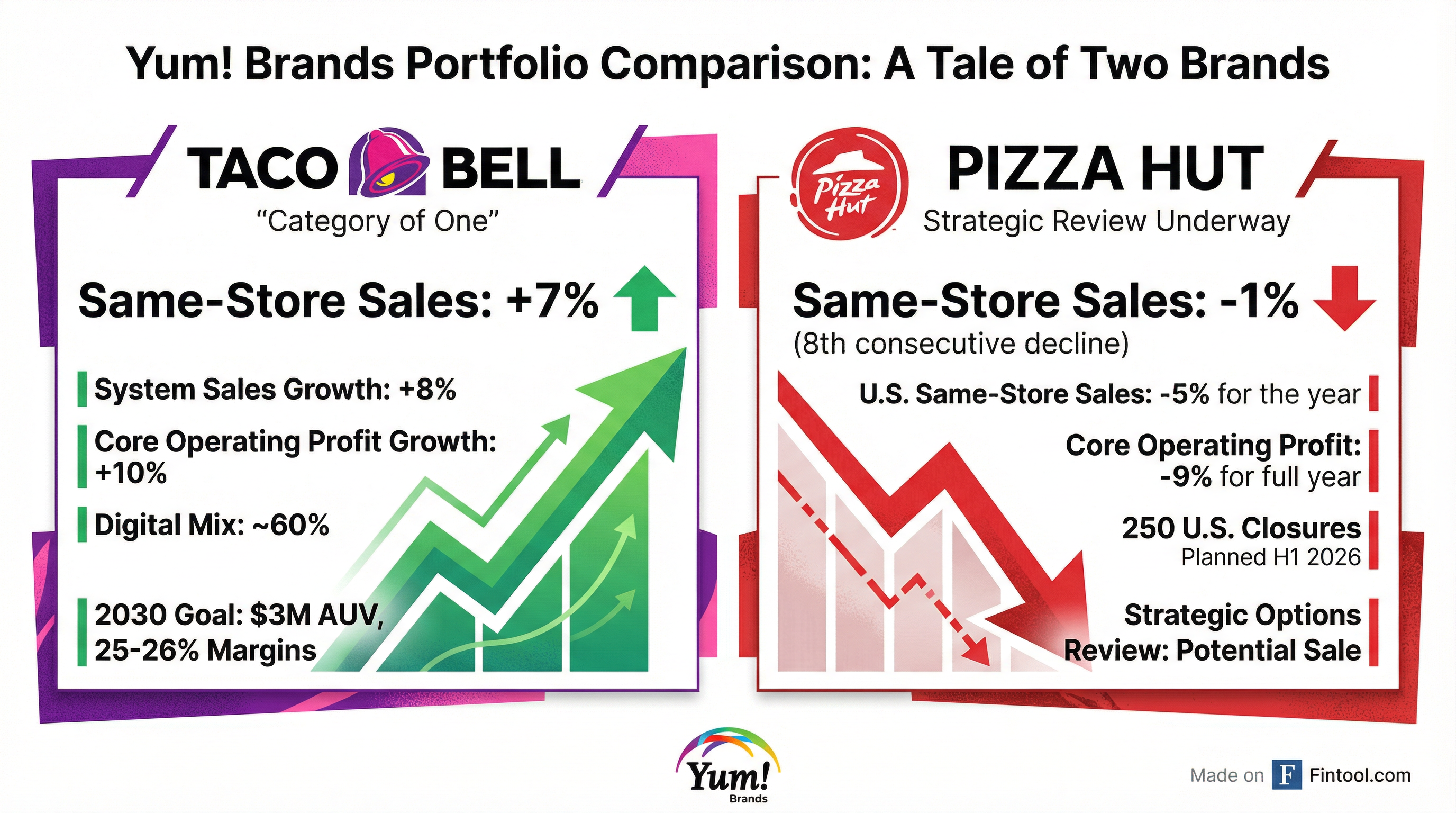

A Tale of Two Brands

The earnings report laid bare the stark divergence between Yum's crown jewel and its problem child. While Taco Bell delivered industry-leading 7% same-store sales growth for both the quarter and full year 2025, Pizza Hut posted its eighth consecutive quarter of same-store sales declines, with U.S. comps down 5% for the year.

| Metric | Taco Bell | KFC | Pizza Hut |

|---|---|---|---|

| Q4 Same-Store Sales | +7% | +3% | -1% |

| FY 2025 Same-Store Sales | +7% | +3% | -1% |

| System Sales Growth (ex-FX) | +8% | +6% | -2% |

| Core Operating Profit Growth | +10% | +10% | -8% |

| U.S. Same-Store Sales (FY) | +7% | -1% | -5% |

"Taco Bell again gained market share, outperforming the QSR industry with exceptional 7% same-store sales growth," CEO Chris Turner said on the call. "That growth is broad-based, with increased penetration among higher income consumers, families, and younger guests."

The Numbers Behind the Story

Yum reported Q4 adjusted EPS of $1.73, missing Wall Street's $1.77 estimate, though revenue of $2.51 billion topped the $2.45 billion consensus. The EPS miss was attributed to a higher-than-expected tax rate.

| Metric | Q4 2025 | Q4 2024 | Change |

|---|---|---|---|

| Revenue | $2.51B | $2.36B | +6% |

| GAAP EPS | $1.91 | $1.49 | +28% |

| Adjusted EPS | $1.73 | $1.61 | +8% |

| Core Operating Profit Growth | +11% | — | — |

| Digital Sales | $11B+ | — | +25% YoY |

| Digital Mix | 60% | — | +9 ppts |

For the full year, Yum delivered adjusted EPS of $6.05, up 10% year-over-year, and core operating profit growth of 7%. Excluding Pizza Hut, core operating profit grew 10%.

Strategic Review: Potential Sale on the Table

The strategic options review for Pizza Hut, announced in November 2025, is "proceeding as planned," Turner said, though he declined to share specifics. "As of now, we intend to complete the review of options this year. Given the ongoing nature of the process at this time, we cannot share further details."

The review came after Pizza Hut recorded its eighth consecutive quarter of same-store sales declines domestically and saw its U.S. footprint shrink nearly 17% over the past decade. Domino's, which focused on delivery and carryout while Pizza Hut maintained large dine-in locations, has surpassed it to become the world's largest pizza chain with 21,750 locations versus Pizza Hut's approximately 20,000.

The Hut Forward program includes:

- ~250 targeted U.S. closures in H1 2026

- Vibrant marketing program with one-time Yum contribution

- Technology modernization initiatives

- Updated franchise agreements

Taco Bell: The Magic Formula

While Pizza Hut struggles, Taco Bell continues to dominate. The brand delivered 7% same-store sales growth for the fifth consecutive quarter, with management attributing success to a combination of innovation, value, digital engagement, and cultural relevance.

"Taco Bell is showing us a great example of how to battle for that future consumer," Turner said. "They have a really cool brand that is incredibly relevant in culture. They are providing craveability, tremendous value, and a convenient experience. Some other brands can do one or two of those things, but Taco Bell does all four incredibly well."

Key 2025 highlights included:

- 23% growth in loyalty members

- 5+ points ahead of QSR category in same-store sales

- Nearly 5 points ahead in transaction growth vs. category

- Highest penetration growth among 18-24 year olds

Looking ahead, Taco Bell unveiled its largest value launch in brand history with the Luxe Value Menu featuring items at $3 or less, and management reiterated its 2030 targets of approximately $3 million in U.S. average unit volume and 25-26% restaurant-level margins.

KFC: Record Development Momentum

KFC, which represents 51% of Yum's divisional operating profit, delivered record gross unit openings with nearly 3,000 new restaurants in 2025 across 105 countries—despite headwinds from 537 Turkey restaurant closures earlier in the year.

"Were it not for the Turkey closures in the first quarter of 2025, KFC would have set a net new unit record in 2025," Roy noted.

The brand saw particularly strong performance in:

- UK: +10% same-store sales in Q4, high single-digits for the year

- Middle East: High single-digit same-store sales growth in Q4

- China: +9% system sales growth in Q4

- Latin America: +13% system sales growth in Q4

What to Watch

Hut Forward Execution: The 250 closures will pressure Pizza Hut's Q1 operating profit by approximately 15%. Investors will be watching whether the streamlined footprint improves same-store sales trends and franchisee economics.

Strategic Review Outcome: Management expects to complete the review this year. Potential outcomes range from a full sale to a partial spin-off to retention with accelerated turnaround efforts.

Ex-Pizza Hut Algorithm: Yum guided that its remaining portfolio (Taco Bell, KFC, Habit Burger) will "meet or exceed every component of our long-term growth algorithm" in 2026, including 5% unit growth, 7% system sales growth, and at least 8% core operating profit growth.

Dividend Increase: The board approved a 6% dividend increase to $0.75 per share quarterly, signaling confidence in cash flow generation despite Pizza Hut challenges.