Earnings summaries and quarterly performance for Yum China Holdings.

Executive leadership at Yum China Holdings.

Board of directors at Yum China Holdings.

Christina Xiaojing Zhu

Director

David Hoffmann

Director

David Wei

Director

Edouard Ettedgui

Director

Fred Hu

Chairman of the Board

Grace Xin Ge

Director

Mikel Durham

Director

Min Zhang

Director

Robert Aiken

Director

Ruby Lu

Director

William Wang

Director

Zili Shao

Director

Research analysts who have asked questions during Yum China Holdings earnings calls.

Lillian Lou

Morgan Stanley

9 questions for YUMC

Michelle Cheng

China Renaissance

9 questions for YUMC

Chen Luo

Bank of America

8 questions for YUMC

Christine Peng

UBS Group AG

8 questions for YUMC

Sijie Lin

China International Capital Corporation

8 questions for YUMC

Anne Ling

Jefferies

5 questions for YUMC

Brian Bittner

Oppenheimer & Co.

5 questions for YUMC

Ethan Wang

CLSA Limited

3 questions for YUMC

Linda Huang

Macquarie Group

3 questions for YUMC

Xiao Pua Wei

Citi

2 questions for YUMC

Yushen Wang

CLSA

2 questions for YUMC

Kin Shun (Anne) Ling

Jefferies

1 question for YUMC

Sujie Lin

CICC

1 question for YUMC

Walter Woo

CMB International

1 question for YUMC

Xiaopo Wei

CITIC Securities

1 question for YUMC

Recent press releases and 8-K filings for YUMC.

- Yum China delivered strong financial results in 2025, with operating profit growing 11% to $1.3 billion and diluted EPS increasing 8% to $2.51 for the full year, while Q4 operating profit rose 23% and diluted EPS increased 29%.

- The company significantly expanded its footprint, opening over 1,700 net new stores in 2025 to reach over 18,000 total stores, and plans to open over 1,900 net new stores in 2026 with a long-term goal of over 30,000 stores by 2030.

- Yum China returned $1.5 billion to shareholders in 2025 through dividends and share repurchases and committed to returning another $1.5 billion in 2026, including a 21% increase in the quarterly dividend to $0.29.

- For 2026, the company anticipates mid to high single-digit system sales growth, high single-digit operating profit growth, and a same-store sales index of 100-102.

- Yum China Holdings (YUMC) reported strong full-year 2025 results, with operating profit growing 11% to $1.3 billion and diluted EPS increasing 8% to $2.51. The OP margin expanded to 10.9%, marking the highest level since its U.S. listing.

- The company demonstrated significant expansion, opening over 1,700 net new stores in 2025, bringing the total to over 18,000 stores. It aims to reach over 20,000 stores in 2026 and over 30,000 stores by 2030.

- YUMC returned $1.5 billion to shareholders in 2025 through dividends and share repurchases and committed to returning another $1.5 billion in 2026. The quarterly dividend was raised by 21% to $0.29.

- For 2026, the company expects mid to high single-digit system sales growth and high single-digit operating profit growth, with plans to open over 1,900 net new stores.

- Yum China reported strong financial results for Q4 and full year 2025, with full-year operating profit growing 11% to $1.3 billion and diluted EPS increasing 8% to $2.51.

- The company significantly expanded its footprint, opening over 1,700 net new stores in 2025 to reach over 18,000 total stores, and plans to open over 1,900 net new stores in 2026 towards a goal of 30,000 stores by 2030.

- Shareholder returns were robust, with $1.5 billion returned in 2025 through dividends and share repurchases, and a commitment to return another $1.5 billion in 2026, including a 21% increase in the quarterly dividend.

- For 2026, Yum China expects mid to high single-digit system sales growth, high single-digit operating profit growth, and double-digit EPS growth, alongside a slight improvement in restaurant and operating margins.

- Both KFC and Pizza Hut contributed to growth in 2025, with KFC's system sales growing 5% for the full year and Pizza Hut's restaurant margins improving 80 basis points to 12.8% for the full year.

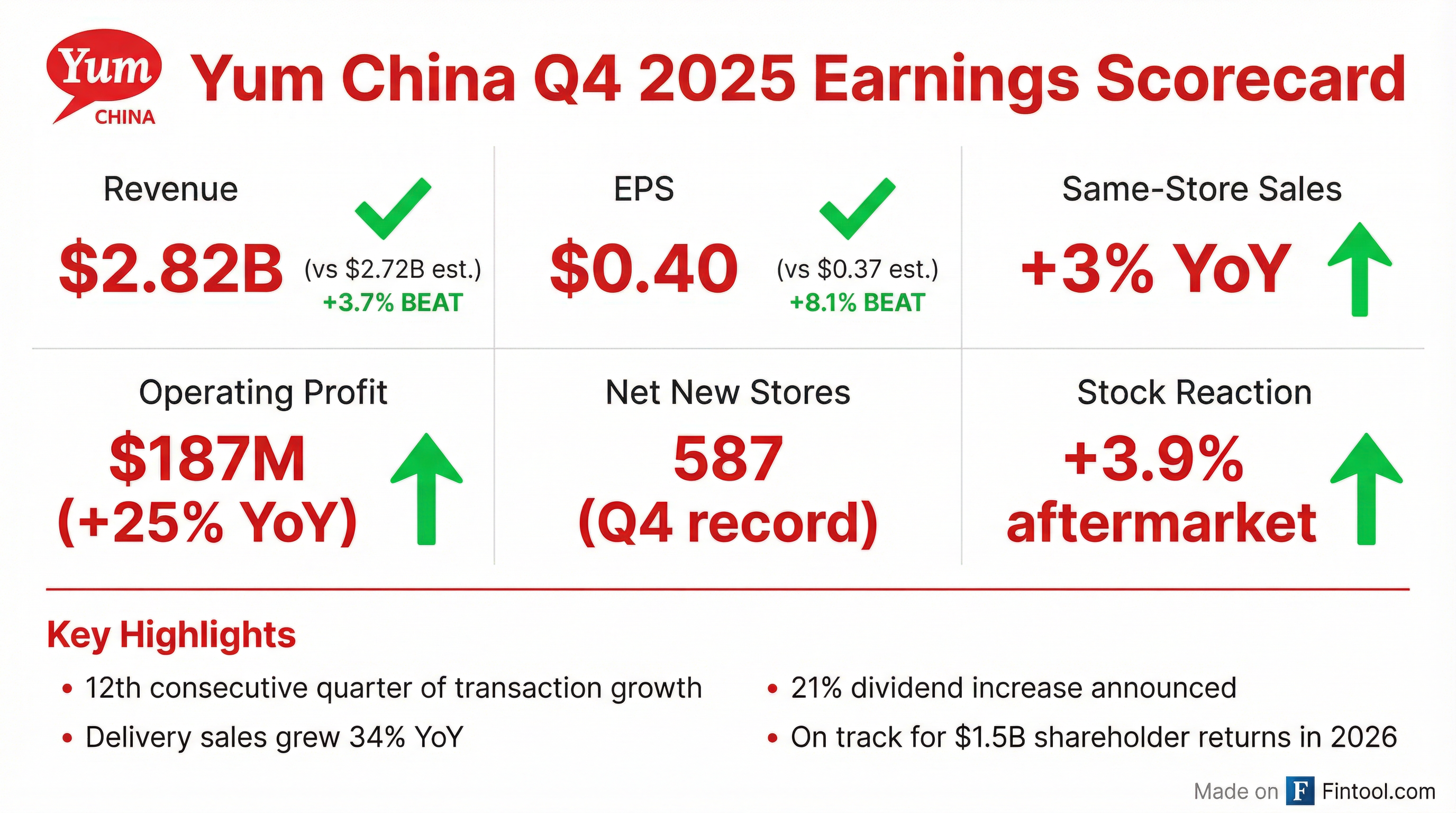

- Yum China Holdings, Inc. reported strong financial results for Q4 2025, with total revenues increasing 9% year-over-year to $2.8 billion, operating profit growing 25% to $187 million, and diluted EPS rising 33% to $0.40.

- For the full year 2025, total revenues increased 4% to $11.8 billion, operating profit grew 11% to $1.3 billion, and the company opened 1,706 net new stores, reaching a total of 18,101 stores as of December 31, 2025.

- The company demonstrated a commitment to shareholder returns, having returned $1.5 billion in 2025, and announced a 21% increase in its cash dividend to $0.29 per share. It also plans to return $1.5 billion in capital to shareholders in 2026 and targets over 20,000 stores in 2026 and more than 30,000 stores by 2030.

- Yum China Holdings (YUMC) reported a 9% year-over-year increase in total revenues to $2.8 billion and a 25% increase in operating profit to $187 million for the fourth quarter ended December 31, 2025. Diluted EPS rose 33% to $0.40.

- For the full year 2025, total revenues grew 4% to $11.8 billion, and operating profit increased 11% to $1.3 billion, with diluted EPS up 8% to $2.51.

- The company expanded its footprint significantly, opening a record 587 net new stores in Q4 2025 and 1,706 net new stores for the full year, bringing the total store count to 18,101 as of December 31, 2025.

- Yum China announced a 21% increase in its cash dividend to $0.29 per share and is on track to return $1.5 billion to shareholders in 2026 through dividends and share repurchases.

- The company projects continued growth, targeting over 20,000 total stores in 2026 and anticipating annual capital returns of approximately $900 million to over $1 billion in 2027 and 2028.

- Yum China Holdings, Inc. announced on December 12, 2025, an increase in its share repurchase authorization by US$1 billion.

- This expansion brings the total share repurchase authorization to an aggregate of US$5.4 billion.

- As of December 11, 2025, the company had repurchased approximately 97.7 million shares for US$4.2 billion since 2017.

- The remaining authorization for share repurchases is approximately US$1.2 billion and has no expiration date.

- Yum China Holdings has entered into share repurchase agreements for approximately US$460 million for the first half of 2026, commencing on January 12, 2026.

- These agreements are part of a broader plan to return US$1.5 billion to shareholders in 2026 through dividends and share repurchases, which is equivalent to approximately 9% of its market capitalization as of December 11, 2025.

- The company is on track to return US$4.5 billion to shareholders from 2024 through 2026.

- Starting in 2027, Yum China plans to return approximately 100% of annual free cash flow after subsidiaries' dividend payments to non-controlling interests, with an expected average annual return of approximately US$900 million to over US$1 billion in 2027 and 2028.

- Yum China Holdings, Inc. has increased its share repurchase authorization by US$1 billion, bringing the total aggregate authorization to US$5.4 billion.

- As of December 11, 2025, the company had repurchased approximately 97.7 million shares for US$4.2 billion since 2017.

- This increase leaves approximately US$1.2 billion remaining under the authorization, which has no expiration date.

- Yum China (YUMC) is pursuing an RGM 3.0 strategy, focusing on resilience, growth, and moat, driven by innovation and operational efficiency. The company aims to reach 20,000 stores by the end of 2026 and 25,000 stores by 2028, with a long-term goal of 30,000 stores in China by 2030. KFC specifically plans to increase its lower-tier city penetration from 2,500 to 4,500 cities by 2030.

- For the period of 2026 to 2028, YUMC targets a mid to high single-digit system sales CAGR, a high single-digit operating profit CAGR, and double-digit EPS CAGR and free cash flow per share CAGR. The operating profit margin is expected to improve from 10.8%-10.9% in 2025 to 11.5% or higher in 2028, with Return on Invested Capital (ROIC) projected to reach approximately 20% in 2028 (up from 16.9% in 2024).

- The company plans to return approximately $1.5 billion to shareholders annually from 2024 to 2026, totaling $4.5 billion. For 2027 and beyond, YUMC expects to return around 100% of free cash flow to the parent company, translating to an average annual return of $900 million to $1 billion+ in 2027 and 2028, and exceeding $1 billion in 2028 and onward. Average annual capital expenditure is targeted at $600 million to $700 million from 2026 to 2028.

- Yum China plans to open over 3,000 additional franchise stores between 2026 and 2028, increasing the total franchise unit mix to the 20% range by 2028. KFC aims for ¥10 billion in operating profit by 2028 , while Pizza Hut has shortened its new store payback period to 2-3 years and expects to sell over 200 million pizzas in the current year.

- Yum China Holdings, Inc. announced 3-year CAGR targets from 2026 to 2028, including high-single-digit operating profit, double-digit diluted EPS, and double-digit free cash flow per share.

- The company plans significant store expansion, aiming to reach 20,000 stores by 2026 and over 30,000 stores by 2030. Specifically, KFC targets over 17,000 stores by 2028 with operating profit surpassing RMB 10 billion in 2028, while Pizza Hut expects to exceed 6,000 stores by 2028 and double its operating profit by 2029 versus 2024.

- For the 2025 full year, Yum China projects an OP margin of 10.8%-10.9% and free cash flow per share of $2.2 to $2.3. By 2028, the company targets an OP margin of at least 11.5% for Yum China.

- The company is committed to returning capital to shareholders, on track to return $1.5 billion each year from 2024 to 2026, and plans to return approximately 100% of annual free cash flow after dividend payments to non-controlling interests starting in 2027.

Quarterly earnings call transcripts for Yum China Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more