Earnings summaries and quarterly performance for Acadian Asset Management.

Executive leadership at Acadian Asset Management.

Board of directors at Acadian Asset Management.

Research analysts who have asked questions during Acadian Asset Management earnings calls.

Recent press releases and 8-K filings for AAMI.

Acadian Reports Record AUM and ENI EPS for Q4 and Full Year 2025

AAMI

Earnings

Dividends

Share Buyback

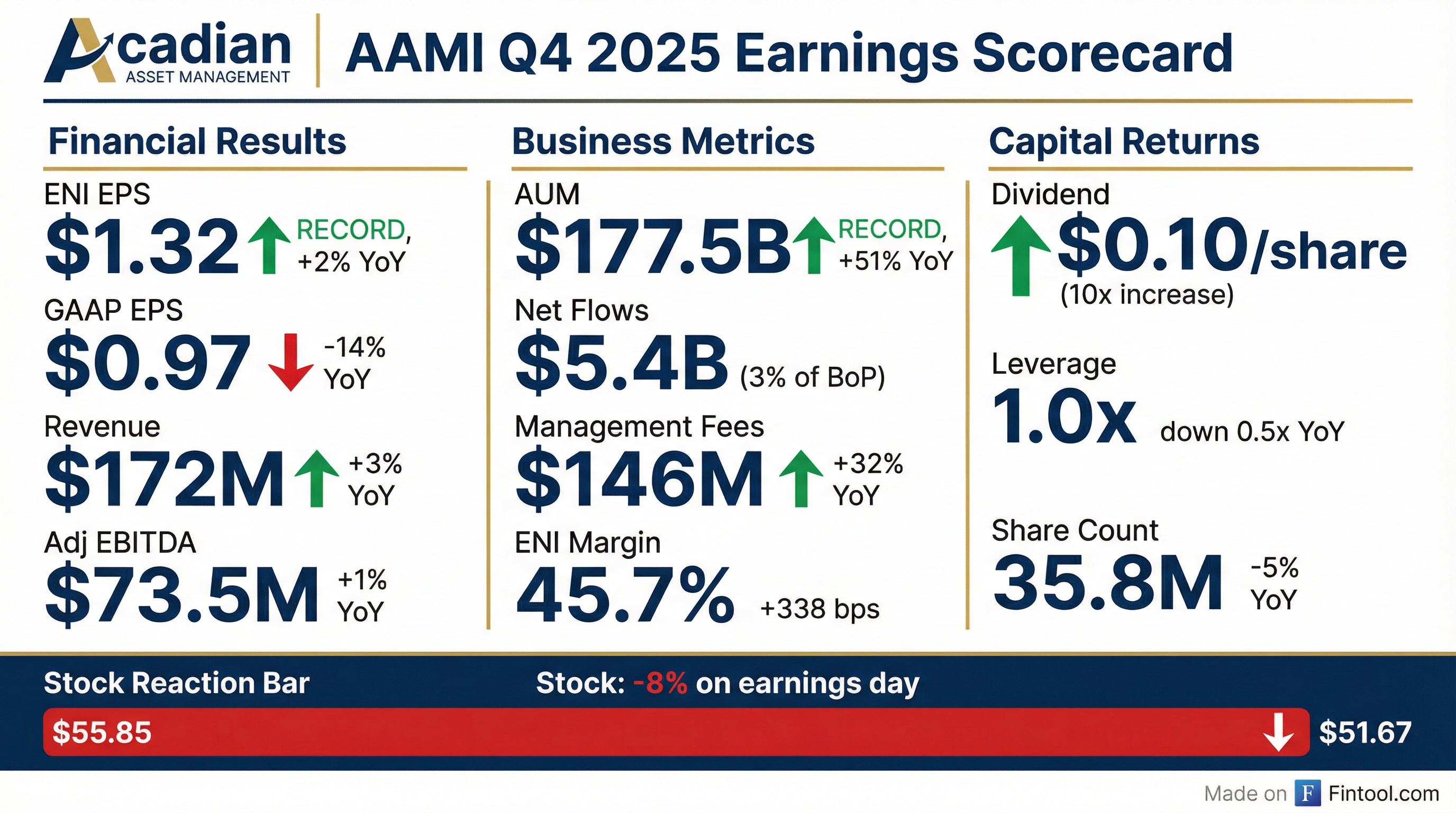

- Acadian achieved record Assets Under Management (AUM) of $177.5 billion as of December 31, 2025 , driven by $29.4 billion in net client cash flows for FY 2025, marking the highest annual net inflows in the firm's history.

- The company reported record Economic Net Income (ENI) diluted EPS of $3.25 for FY 2025, an 18% increase from the prior year , and $1.32 for Q4 2025 , both representing the highest ever ENI EPS.

- Acadian strengthened its balance sheet, with the leverage ratio declining to 1.0x and net leverage ratio to 0.5x as of December 31, 2025 , while also increasing its quarterly interim dividend to $0.10 per share and repurchasing 1.8 million shares in 2025, reducing total shares outstanding by 5%.

- Investment performance was strong, with 100% of major strategy group assets outperforming benchmarks over 3, 5, and 10-year timeframes as of December 31, 2025 , and 95% of revenue-weighted assets outperforming benchmarks over the same periods.

1 day ago

Acadian Asset Management Inc. Reports Record AUM and Strong Q4 2025 Financial Results

AAMI

Earnings

Dividends

Share Buyback

- Acadian Asset Management Inc. (AAMI) reported a record AUM of $177.5 billion as of December 31, 2025, driven by $5.4 billion in positive net client cash flows in Q4 2025 and $29 billion for the full year 2025, marking eight consecutive quarters of positive net flows.

- For Q4 2025, AAMI achieved record management fees of $146 million, a 32% increase from Q4 2024, and a record ENI diluted EPS of $1.32, up 2% year-over-year.

- The company expanded its ENI operating margin to 45.7% in Q4 2025, up from 42.3% in Q4 2024, and reduced its gross leverage to 1x at year-end 2025 from 1.5x at year-end 2024.

- AAMI increased its interim quarterly dividend to $0.10 per share from $0.01 per share, to be paid on March 27, 2026, and expects to resume share repurchases after a Q4 2025 suspension for debt refinancing.

1 day ago

Acadian Asset Management Inc. (AAMI) Reports Record AUM and ENI EPS for Q4 and Full Year 2025

AAMI

Earnings

Dividends

Share Buyback

- Acadian Asset Management Inc. (AAMI) reported a record Assets Under Management (AUM) of $177.5 billion as of December 31, 2025, driven by $5.4 billion in positive net client cash flows for Q4 2025 and $29 billion for the full year 2025.

- For Q4 2025, AAMI achieved a record ENI diluted EPS of $1.32, up 2% year-over-year, and record management fees of $146 million, a 32% increase from Q4 2024. Full-year 2025 ENI EPS was $3.25, up 18%.

- The company expanded its Q4 2025 ENI operating margin to 45.7% from 42.3% in Q4 2024, reflecting improved operating leverage.

- AAMI strengthened its balance sheet by reducing gross leverage to 1x and net leverage to 0.5x as of year-end 2025, and announced an increase in its quarterly dividend to $0.10 per share. Share repurchases, which were suspended in Q4 2025 to support deleveraging, are expected to be a priority in 2026.

1 day ago

Acadian Asset Management Inc. Reports Record AUM and Strong Q4 2025 ENI EPS

AAMI

Earnings

Dividends

Share Buyback

- Acadian Asset Management Inc. (AAMI) achieved record Assets Under Management (AUM) of $177.5 billion as of December 31, 2025, driven by $5.4 billion in positive net client cash flows in Q4 2025 and $29 billion for the full year 2025.

- The company reported record ENI diluted EPS of $1.32 for Q4 2025, up 2% year-over-year, and full-year 2025 ENI EPS of $3.25, up 18% from 2024, alongside an expanded ENI operating margin of 45.7% in Q4 2025.

- AAMI strengthened its balance sheet by reducing its gross leverage ratio to 1x from 1.5x at year-end 2024 and announced an increase in its quarterly dividend to $0.10 per share.

- Investment performance remained robust, with over 95% of strategies by revenue outperforming benchmarks across 3-, 5-, and 10-year periods as of December 31, 2025.

1 day ago

Acadian Asset Management Inc. Reports Q4 2025 Results and Increases Quarterly Dividend

AAMI

Earnings

Dividends

Share Buyback

- The Board of Directors of Acadian Asset Management Inc. approved a quarterly interim dividend of $0.10 per share, an increase from the prior $0.01 per share level, payable on March 27, 2026, to shareholders of record as of March 13, 2026.

- The company reported record Assets Under Management (AUM) of $177.5 billion as of December 31, 2025, driven by $5.4 billion in net inflows for Q4 2025.

- Acadian Asset Management Inc. achieved record quarterly management fees of $146.4 million, a 32% increase from Q4 2024.

- Economic Net Income (ENI) earnings per share for Q4 2025 increased 2% to $1.32, compared to $1.30 in Q4 2024.

- In 2025, the company repurchased 1.8 million shares of common stock for an aggregate total of $48.0 million, representing a 5% reduction in total shares outstanding from the end of 2024.

1 day ago

Acadian Reports Q3 2025 Results with Record AUM and Strong ENI Growth

AAMI

Earnings

Revenue Acceleration/Inflection

Share Buyback

- Acadian (AAMI) reported record Assets Under Management (AUM) of $166.4 billion as of Q3 2025, representing a 38% increase from Q3 2024, driven by net inflows of $6.4 billion.

- For Q3 2025, U.S. GAAP diluted EPS decreased 7% to $0.42, while Economic Net Income (ENI) diluted EPS increased 29% to $0.76. This divergence was primarily due to increased non-cash expenses impacting GAAP results, while ENI benefited from significant growth in recurring management fees.

- Adjusted EBITDA grew 12% to $45.1 million in Q3 2025. ENI revenue increased 11.5% to $136.3 million, with management fees up 21% to $136.1 million.

- The company continued its capital management efforts, repurchasing 0.1 million shares for $5.0 million in Q3 2025, and announced the redemption of $275 million in Senior Notes to be financed by a new $200 million bank term loan and balance sheet cash.

- Acadian maintains a strong performance track record, with 95% of strategies by revenue outperforming benchmarks over a 5-year period.

Oct 30, 2025, 3:00 PM

Acadian Asset Management Inc. Reports Record AUM and Strong Q3 2025 Financial Performance

AAMI

Earnings

Revenue Acceleration/Inflection

Share Buyback

- Acadian Asset Management Inc. achieved a record high AUM of $166.4 billion as of September 30, 2025, driven by $6.4 billion in positive net client cash flows in Q3 2025, which was the second highest in the firm's history.

- For Q3 2025, the company's ENI diluted EPS was $0.76, up 29% compared to the prior year, and ENI revenue increased 12% to $136 million from Q3 2024.

- The ENI operating margin expanded to 33.2% in Q3 2025, up from 31.7% in Q3 2024, reflecting improved operating leverage.

- Acadian repurchased 0.1 million shares, or $5 million of stock, during Q3 2025 and announced the refinancing of its $275 million senior notes with a new $200 million term loan, which is expected to reduce the gross debt to adjusted EBITDA ratio to approximately 1 times.

Oct 30, 2025, 3:00 PM

Quarterly earnings call transcripts for Acadian Asset Management.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more