Earnings summaries and quarterly performance for ALBANY INTERNATIONAL CORP /DE/.

Executive leadership at ALBANY INTERNATIONAL CORP /DE/.

Gunnar Kleveland

President and Chief Executive Officer

Chris Stone

President, Albany Engineered Composites

Joseph Gaug

Senior Vice President, General Counsel & Secretary

Merle Stein

President, Machine Clothing

Sean Valashinas

Vice President, Controller and Principal Accounting Officer

Willard Station

Executive Vice President and Chief Financial Officer

Board of directors at ALBANY INTERNATIONAL CORP /DE/.

Research analysts who have asked questions during ALBANY INTERNATIONAL CORP /DE/ earnings calls.

Michael Ciarmoli

Truist Securities, Inc.

6 questions for AIN

Peter Arment

Robert W. Baird & Co.

4 questions for AIN

Chigusa Katoku

JPMorgan Chase & Co.

3 questions for AIN

Jordan Lyonnais

Bank of America

3 questions for AIN

Ronald Epstein

Bank of America

2 questions for AIN

Steve Tusa

JPMorgan Chase & Co.

2 questions for AIN

Alexander Preston

Bank of America Merrill Lynch

1 question for AIN

Jack Ayers

TD Cowen

1 question for AIN

Tusa

JPMorgan Chase & Co.

1 question for AIN

Recent press releases and 8-K filings for AIN.

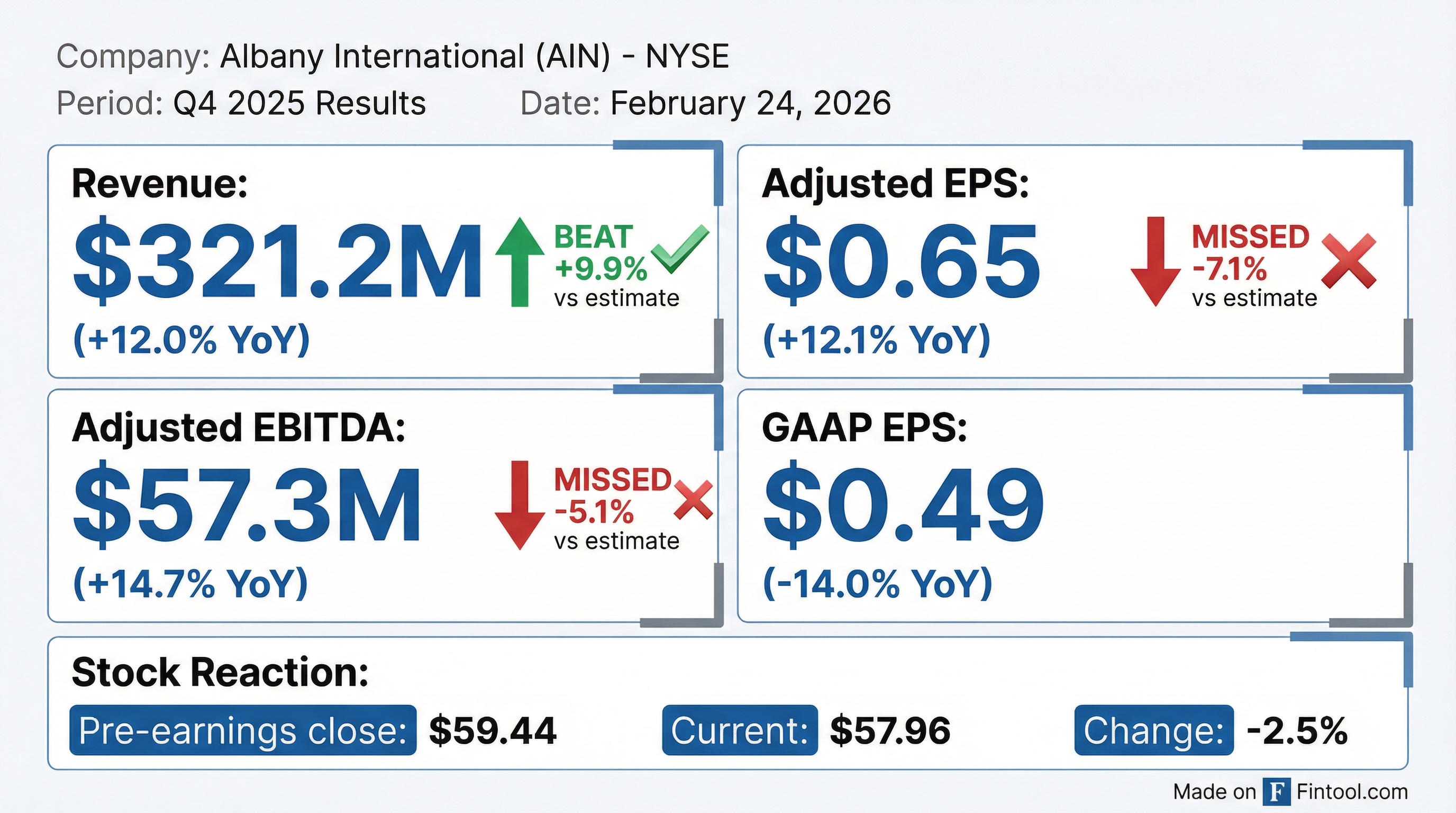

- Albany International reported Q4 2025 consolidated sales of $321.2 million, a 12% increase year-over-year, and Adjusted EBITDA of $57.3 million, representing 17.8% of sales.

- For Q1 2026, the company expects consolidated revenue between $275 million and $285 million and Adjusted EPS of $0.50 to $0.60, with a $0.10 to $0.15 impact on EPS from an equipment failure in a Machine Clothing facility.

- The Engineered Composites segment revenue grew to $143.7 million in Q4 2025, driven by programs like LEAP, and is expected to see strong growth in 2026, while the Machine Clothing segment revenue was $177.5 million, affected by continued weakness in China, which is anticipated to persist through 2026.

- The company generated $81 million in free cash flow for 2025 and returned approximately $218 million to shareholders through share repurchases, including roughly 10% of shares outstanding, and dividends.

- A strategic review of the Amelia Earhart facility in Salt Lake City is in progress, with Guggenheim advising on options for the site.

- Albany International reported Q4 2025 consolidated sales of $321.2 million, an increase of 12% year-over-year, with Adjusted EBITDA of $57.3 million, representing 17.8% of sales. This performance was primarily driven by strong growth in Engineered Composites, which saw sales of $143.7 million, while Machine Clothing sales were $177.5 million, impacted by mid-single digit declines due to weakness in China.

- The company provided Q1 2026 guidance, projecting consolidated revenue between $275 million and $285 million and Adjusted EPS in the range of $0.50 to $0.60. Q1 results are expected to be the lowest of the year, absorbing a $0.10 to $0.15 EPS impact from an equipment failure in a Machine Clothing facility, with lost volume anticipated to be recovered over the year.

- A strategic review of the Amelia Earhart facility in Salt Lake City is underway, with Guggenheim retained as an advisor, and the company notes significant interest from both private equity and strategics.

- For the full year 2026, Engineered Composites is expected to continue strong growth across key platforms, including LEAP and missile applications, with normalized margin levels. Machine Clothing anticipates stable demand in Europe and North America but continued weakness in China, with margins generally in line with the second half of 2025.

- In 2025, Albany International generated $81 million in free cash flow and returned approximately $218 million to shareholders through dividends and share repurchases, including roughly 10% of shares outstanding.

- Albany International reported Q4 2025 total revenue of $321.2 million, an increase from $286.9 million in Q4 2024, with Adjusted Diluted EPS rising to $0.65 from $0.58 in the prior year period.

- The Engineered Composites segment drove revenue growth, reaching $143.7 million in Q4 2025, a significant increase from $98.8 million in Q4 2024, while Machine Clothing revenue declined to $177.5 million.

- For the full year 2025, the company generated $81 million in Free Cash Flow and returned $218 million to shareholders, including repurchasing 10% of outstanding shares.

- The company issued Q1 2026 guidance, forecasting consolidated revenue between $275 million and $285 million and Adjusted EPS between $0.50 and $0.60.

- Operational trends indicate growth in Engineered Composites driven by increasing LEAP deliveries and defense programs, while Machine Clothing faces softness in Asia and an equipment failure impact in the Americas for Q1 2026.

- Albany International Corp. reported Q4 2025 consolidated sales of $321.2 million, an increase of 12% year-over-year, with Adjusted EBITDA of $57.3 million, representing 17.8% of sales.

- Growth was primarily driven by the Engineered Composites segment, which saw sales of $143.7 million, compared to $98.8 million in the prior year, while the Machine Clothing segment's sales were $177.5 million, impacted by softer demand in China.

- For Q1 2026, the company expects consolidated revenue between $275 million and $285 million and Adjusted EPS between $0.50 and $0.60, with an anticipated $0.10-$0.15 EPS impact due to an equipment failure in a Machine Clothing facility.

- In 2025, the company generated approximately $81 million in free cash flow and returned about $218 million to shareholders through share repurchases and dividends, while also making substantial progress on the strategic review of its Amelia Earhart facility.

- Albany International reported Q4 2025 net revenue of $321.2 million, an increase from $286.9 million in Q4 2024, with Adjusted EBITDA growing to $57.3 million from $50.0 million in the prior year.

- For Q4 2025, net income was $14.0 million, or $0.49 per share, while Adjusted EPS was $0.65.

- The company repurchased $16.8 million of common stock (360,267 shares) and paid $7.9 million in dividends during the fourth quarter of 2025.

- Albany International provided Q1 2026 guidance, anticipating consolidated revenue between $275 million and $285 million and Adjusted EPS between $0.50 and $0.60.

- A strategic review of the structures assembly business and its associated production site in Salt Lake City is underway, with an advisor engaged to guide this transaction.

- Albany International reported Q4 2025 net revenue of $321.2 million, an increase from $286.9 million in Q4 2024, and Adjusted EPS of $0.65, up from $0.58 in the prior year.

- The Engineered Composites (AEC) business saw a 43.1% increase in net revenues (currency adjusted) in Q4 2025, while the Machine Clothing (MC) business experienced a 7.9% decrease (currency adjusted).

- The company is undertaking a strategic review of its structures assembly business and its associated production site in Salt Lake City.

- In Q4 2025, Albany International repurchased 360,267 shares of common stock for $16.8 million and declared a quarterly dividend of $0.28 per share.

- For Q1 2026, the company anticipates consolidated revenue between $275 million and $285 million and Adjusted EPS between $0.50 and $0.60.

- Albany International Corp. (AIN) has achieved the U.S. Department of War (DoW) Cybersecurity Maturity Model Certification (CMMC) Level 2 certification for its Albany Engineered Composites (AEC) business segment.

- This certification is crucial for national security, ensuring defense contractors can safeguard sensitive data from cyber threats.

- AEC is among the first one percent of the estimated 80,000 DoW suppliers required to achieve CMMC Level 2 certification.

- This early certification positions AEC as an approved, strategic supplier for critical next-generation military programs, including fixed-wing, hypersonic, missile, and rotorcraft.

- The CMMC Level 2 is a prerequisite for companies working on a wide range of defense programs with the DoW, requiring adherence to 110 security practices aligned with NIST Special Publication 800-171.

- Albany International Corp. is exploring strategic alternatives, including a potential sale, for its structures assembly business at the Amelia Earhart Drive Facility (AED Facility) in Salt Lake City.

- The company is in the process of selecting a financial advisor and developing financial models for the AED Facility, with interest to date primarily from private equity investors.

- If a divestiture of the AED Facility is completed, the company expects the Adjusted EBITDA margin for the Albany Engineered Composites business segment to be in the mid to high teens.

- This information was disclosed to satisfy Regulation FD obligations following an inadvertent selective disclosure during a meeting with a research analyst on November 25, 2025.

- Albany International announced a strategic review of its structures assembly business, including the potential sale of its Salt Lake City facility, and recognized a $147 million loss reserve for the CH-53K program over the next eight years.

- The company also reached a definitive agreement to complete its current contract with Gulfstream by the end of 2025, with these actions aimed at de-risking the remaining portfolio and focusing on core competencies.

- For Q3 2025, the company reported revenue of $261.4 million, a GAAP net loss of $97.8 million ($3.37 per diluted share), and adjusted EBITDA of $56.2 million.

- Albany International is withdrawing its full-year 2025 guidance due to the ongoing strategic review and anticipates Q3 underlying trends to continue into Q4.

- During the quarter, the company repurchased $50.5 million of common stock.

- Albany International reported Q3 2025 revenue of $261.4 million, a decrease from $298.4 million in Q3 2024, which included an unfavorable $46.0 million impact related to CH-53K program adjustments.

- The company posted a GAAP net loss of $97.8 million, or $3.37 per diluted share, in Q3 2025, primarily due to $147.3 million in pre-tax loss reserve and program adjustments on the CH-53K program.

- Excluding the CH-53K program adjustments, adjusted net income was $20.6 million, or $0.71 per diluted share, and adjusted EBITDA was $56.2 million in Q3 2025.

- Albany International initiated a strategic review of its structures assembly business and reached a definitive agreement to conclude the Gulfstream contract to increase focus on differentiated advanced composite technologies.

- The company repurchased $50.5 million of common stock and paid $8.0 million in dividends during Q3 2025, but withdrew its full-year guidance due to the ongoing strategic review.

Quarterly earnings call transcripts for ALBANY INTERNATIONAL CORP /DE/.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more