Earnings summaries and quarterly performance for Powerfleet.

Executive leadership at Powerfleet.

Board of directors at Powerfleet.

Research analysts who have asked questions during Powerfleet earnings calls.

AS

Alexander Sklar

Raymond James Financial, Inc.

8 questions for AIOT

Also covers: BL, DUOL, EVCM +11 more

Dylan Becker

William Blair

8 questions for AIOT

Also covers: AZPN, BLND, BSY +16 more

GG

Greg Gibas

Northland Securities, Inc.

8 questions for AIOT

Also covers: ACEL, AMRK, ASUR +8 more

SS

Scott Searle

ROTH MKM

8 questions for AIOT

Also covers: ADEA, AIRG, ARLO +22 more

GP

Gary Prestopino

Barrington Research

7 questions for AIOT

Also covers: ACVA, CARS, CCC +19 more

AS

Anthony Stoss

Craig-Hallum Capital Group LLC

6 questions for AIOT

Also covers: ACTG, AIRG, APPS +8 more

GP

Gary Prespettino

Barrington Research

1 question for AIOT

Also covers: LQDT

Recent press releases and 8-K filings for AIOT.

Powerfleet Reports Strong Q3 2026 Results and Secures Landmark South African Contract

AIOT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

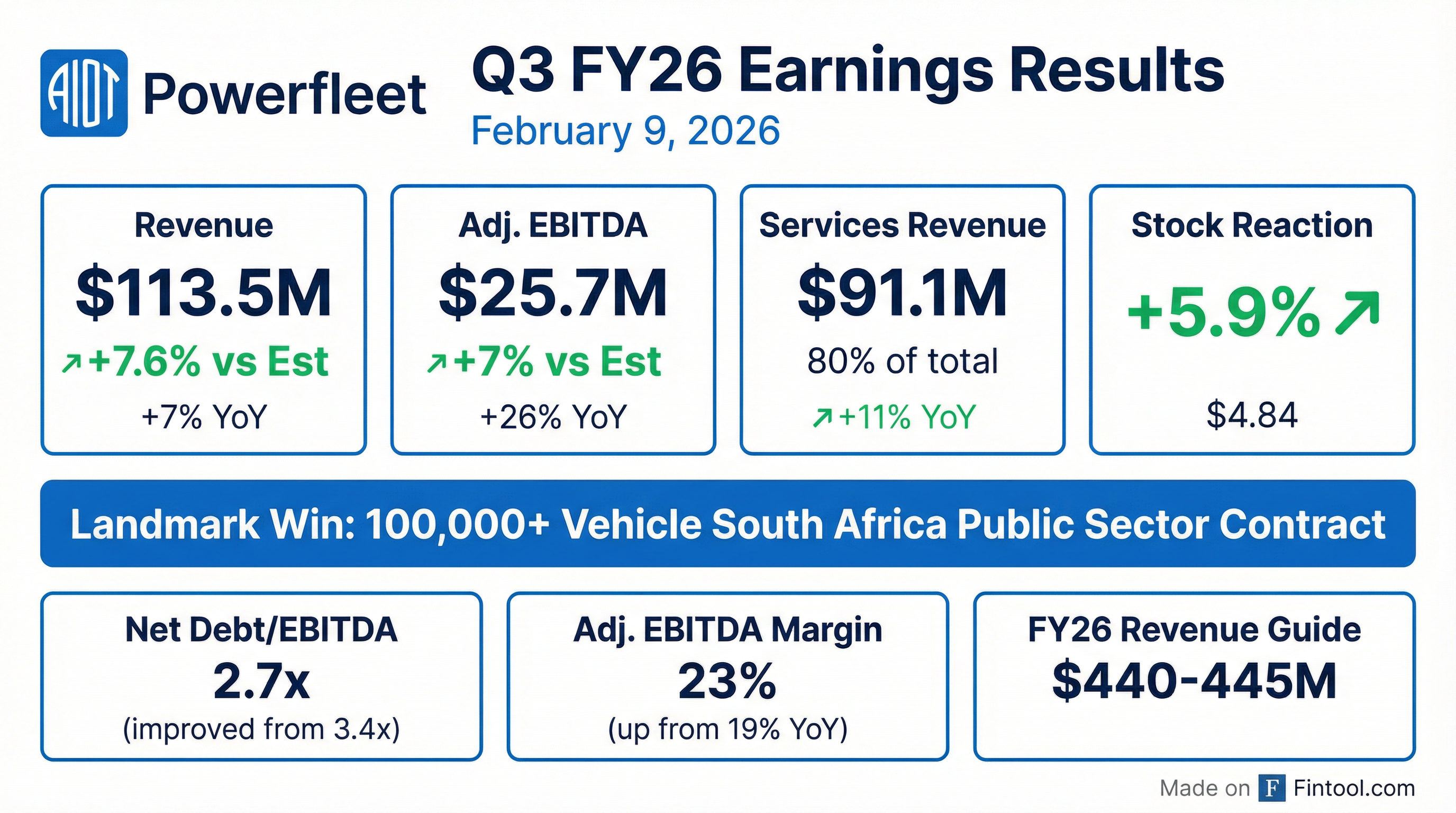

- Powerfleet reported Q3 2026 total revenue growth of 7% year-over-year (9% on an adjusted basis) and service revenue growth of 11% year-over-year, with services now comprising 80% of total revenue.

- Adjusted EBITDA increased 26% year-over-year to $25.7 million, with margins expanding by 4% to 23%, and net debt to Adjusted EBITDA strengthened to 2.7 times.

- The company secured a landmark South African public sector contract to deliver AI video and visibility services to government fleets, anticipated to generate meaningful recurring SaaS and services revenue over a multi-year term.

- Powerfleet expects to achieve a Q4 FY26 exit run rate of 10% total revenue growth and over 10% recurring revenue growth, and updated its FY26 Adjusted EBITDA guidance to approximately 45% annual growth.

Feb 9, 2026, 1:30 PM

Powerfleet Reports Strong Q3 2026 Financial Results with Increased Revenue and Adjusted EBITDA

AIOT

Earnings

Revenue Acceleration/Inflection

New Projects/Investments

- Powerfleet reported a 7% year-over-year increase in total revenue to $113.5 million for Q3 2026.

- Services revenue grew by 11% year-over-year to $91.1 million, representing 80% of total revenue in Q3 2026, up from 77% in the prior year.

- Adjusted EBITDA increased by 26% year-over-year to $25.7 million, with adjusted EBITDA margins rising to 23% from 19% in the prior year.

- The company's net debt to EBITDA ratio improved to 2.7x in Q3 2026, down from 2.9x in the prior quarter and 3.4x at the end of FY 2025.

- Powerfleet secured a major South Africa public sector contract to deliver video and visibility services for over 100,000 vehicles and achieved significant enterprise expansions with several Fortune 500 companies.

Feb 9, 2026, 1:30 PM

Powerfleet Reports Strong Q3 2026 Results and Secures Landmark South African Contract

AIOT

Earnings

Guidance Update

New Projects/Investments

- Powerfleet reported strong Q3 2026 financial results, with total revenue increasing 9% year-over-year on an adjusted basis and service revenue growing 11% year-over-year, now comprising 80% of total revenue. Adjusted EBITDA rose 26% year-over-year to $25.7 million, with margins expanding by 4% to 23%.

- The company secured a "landmark win" with a South African public sector contract to deliver AI video and visibility services to government fleets operating over 100,000 assets, expected to generate significant recurring SaaS and services revenue over multiple years. This represents the single largest deployment in the company's history.

- Powerfleet updated its FY26 Adjusted EBITDA guidance to approximately 45% annual growth (from a prior range of 45%-50%), citing investments for the new Tier 1 public sector win and working capital dynamics. The company targets 15% ARR growth for FY27.

- Operational momentum is evident with the AI video pipeline build increasing 71% sequentially and the overall ARR pipeline growing 13% sequentially.

Feb 9, 2026, 1:30 PM

Powerfleet Reports Strong Q3 2026 Results and Secures Landmark South African Contract

AIOT

Earnings

Guidance Update

New Projects/Investments

- Powerfleet (AIOT) reported strong Q3 2026 financial results, with adjusted total revenue growing 9% year-over-year and service revenue increasing 11% year-over-year, now comprising 80% of total revenue.

- Adjusted EBITDA rose 26% year-over-year to $25.7 million, with margins expanding by 4% to 23%.

- The company secured a landmark South African public sector contract for AI video and visibility services to government fleets, anticipated to be one of its largest deployments and generate significant multi-year recurring revenue.

- Powerfleet maintains confidence in achieving a Q4 FY26 exit run rate of 10% total revenue growth and over 10% recurring revenue growth.

- FY26 Adjusted EBITDA growth guidance was updated to approximately 45% (from 45%-50%), and net debt to EBITDA is projected to decline to around 2.4x by year-end.

Feb 9, 2026, 1:30 PM

Powerfleet Reports Robust Q3 FY26 Results and Updates Full-Year Guidance

AIOT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Powerfleet, Inc. reported Q3 FY26 total revenue of $113.5 million, a 7% year-over-year increase, with services revenue growing 11% to $91.1 million.

- The company's operating profit improved to $6.3 million in Q3 FY26, compared to an operating loss of $1.2 million in Q3 FY25, and Adjusted EBITDA rose 26% year-over-year to $25.7 million.

- Net loss significantly improved to $3.4 million in Q3 FY26 from $14.3 million in Q3 FY25, with adjusted net income per share at $0.02.

- For full-year 2026, Powerfleet tightened its revenue guidance to $440 million to $445 million and expects Adjusted EBITDA growth of approximately 45% year-over-year.

- The adjusted net debt to adjusted EBITDA leverage ratio improved to 2.7x in Q3 FY26 and is projected to reach approximately 2.4x by March 31, 2026.

Feb 9, 2026, 12:34 PM

Powerfleet Reports Record Q3 FY26 Revenue and Updates Full-Year Guidance

AIOT

Earnings

Guidance Update

Revenue Acceleration/Inflection

- Powerfleet reported a record total revenue of $113.5 million in Q3 FY26, a 7% increase year-over-year, primarily driven by an 11% rise in services revenue to $91.1 million, which now constitutes 80% of total revenue.

- The company achieved significant profitability improvements, moving from an operating loss of $1.2 million in Q3 FY25 to an operating profit of $6.3 million in Q3 FY26, and increasing Adjusted EBITDA by 26% year-over-year to $25.7 million.

- Net loss substantially improved to $3.4 million (or $0.03 per share) in Q3 FY26, compared to a net loss of $14.3 million (or $0.11 per share) in the prior year.

- Powerfleet updated its full-year 2026 guidance, narrowing revenue expectations to $440 million to $445 million and anticipating approximately 45% year-over-year Adjusted EBITDA growth.

- A major South Africa public sector contract was awarded for AI video and visibility services, influencing continued investments in operating expenses to support expected future demand.

Feb 9, 2026, 12:00 PM

Powerfleet Secures South Africa Government Contract

AIOT

New Projects/Investments

Revenue Acceleration/Inflection

- Powerfleet, Inc. (NASDAQ: AIOT) has been awarded a milestone public sector contract to deliver integrated video intelligence and real-time fleet visibility services for South African government departments overseeing more than 100,000 vehicles.

- This agreement is anticipated to generate material recurring SaaS and services revenue over a minimum five-year term following phased implementation.

- The contract also expands Powerfleet's existing partnership with MTN, supporting nationwide delivery through secure connectivity and managed network infrastructure.

- Deployment is expected to begin mid-calendar year, with revenue commencing upon installation and scaling as subscribers are brought onto the platform.

- Financial terms were not disclosed.

Feb 9, 2026, 12:00 PM

PowerFleet CFO Highlights M&A-Driven Growth and Undervaluation

AIOT

M&A

Revenue Acceleration/Inflection

New Projects/Investments

- PowerFleet (AIOT) has undergone significant transformation through M&A, projecting $440 million in revenue and $100 million in EBITDA this year, up from $135 million and $7 million respectively when the CFO joined.

- The company achieved 12% year-over-year organic services revenue growth in the most recent quarter for its legacy MiX and PowerFleet businesses, demonstrating successful integration of MiX Telematics and Fleet Complete acquisitions.

- Key growth drivers include the Unity solution for holistic data management, AI cameras, and in-warehouse safety solutions, with a medium-term target of 15% revenue growth.

- Strategic partnerships with AT&T, TELUS, and MTN are expanding indirect sales, which are targeted to reach 40% of total bookings, alongside significant enterprise wins like the Pepsi deal, valued at $25 million-$30 million in the U.S..

- The CFO views the stock as significantly undervalued, noting a disconnect between its accelerating top-line growth and current market valuation.

Dec 9, 2025, 6:40 PM

PowerFleet CFO Discusses Strategic Transformation and Growth Drivers

AIOT

M&A

Guidance Update

Revenue Acceleration/Inflection

- PowerFleet's CFO, David Wilson, highlighted the company's significant transformation, with revenue growing from $135 million and EBITDA from $7 million to a guided $440 million revenue and $100 million EBITDA this year, largely driven by the acquisitions of MiX Telematics and Fleet Complete.

- The company reported 12% year-over-year organic services revenue growth for the legacy MiX and PowerFleet businesses as of the September close, indicating successful integration and amplification of the acquired entities.

- PowerFleet is expanding its go-to-market strategy through indirect channels, including partnerships with AT&T, TELUS, and MTN, aiming to increase indirect sales from approximately 25% to 40% of total sales.

- Key growth drivers include AI cameras, in-warehouse solutions, and the Unity platform, which addresses customer pain points by ingesting and harmonizing data from various telematics devices.

- The company's leverage is projected to decrease from 2.9 times recently to 2.25 times by the end of this year, with a medium-term growth target of 15%.

Dec 9, 2025, 6:40 PM

Powerfleet Showcases Unity Platform, Strategic Partnerships, and Strong Financial Guidance

AIOT

Guidance Update

New Projects/Investments

Revenue Acceleration/Inflection

- Powerfleet's Unity platform, enhanced by Aura AI, provides an integrated data ecosystem for AIoT solutions, focusing on safety, compliance, and efficiency across various operations.

- The company is expanding its market reach through strategic partnerships with Telus and AT&T, leveraging their networks and sales forces to deliver AI-driven solutions for warehouse and facility safety and AI video.

- Powerfleet projects FY2027 revenue in the region of $485 million, with adjusted EBITDA expected to reach approximately $130 million in FY2027, representing a 45% CAGR from FY2024. The company also anticipates generating over $40 million in free cash flow in FY2027 and reducing net debt to adjusted EBITDA to approximately 1.5 times by the end of FY2027.

- The company has transitioned to a SaaS-centric business model, driving service-driven growth and stronger margins, and has secured significant customer expansions, including a major deal with PepsiCo.

Nov 14, 2025, 2:00 PM

Quarterly earnings call transcripts for Powerfleet.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more