Earnings summaries and quarterly performance for ALLEGRO MICROSYSTEMS.

Executive leadership at ALLEGRO MICROSYSTEMS.

Board of directors at ALLEGRO MICROSYSTEMS.

Jennie M. Raubacher

Director

Joseph R. Martin

Lead Independent Director

Katsumi Kawashima

Director

Krishna G. Palepu

Director

Mary G. Puma

Director

Richard R. Lury

Director

Susan D. Lynch

Director

Yoshihiro (Zen) Suzuki

Chairman of the Board

Research analysts who have asked questions during ALLEGRO MICROSYSTEMS earnings calls.

Joshua Buchalter

TD Cowen

6 questions for ALGM

Quinn Bolton

Needham & Company, LLC

6 questions for ALGM

Vijay Rakesh

Mizuho

6 questions for ALGM

Blayne Curtis

Jefferies Financial Group

5 questions for ALGM

Gary Mobley

Loop Capital

5 questions for ALGM

Timothy Arcuri

UBS

5 questions for ALGM

Chris Caso

Wolfe Research LLC

3 questions for ALGM

Christopher Caso

Wolfe Research

3 questions for ALGM

Joe Quatrochi

Wells Fargo

3 questions for ALGM

Thomas O’Malley

Barclays Capital

3 questions for ALGM

Vivek Arya

Bank of America Corporation

3 questions for ALGM

Joe Moore

Morgan Stanley

2 questions for ALGM

Joseph Moore

Morgan Stanley

2 questions for ALGM

Mark Lipacis

Evercore ISI

2 questions for ALGM

Tom O'Malley

Barclays

2 questions for ALGM

Grant Jason

UBS

1 question for ALGM

Joseph Quatrochi

Wells Fargo Securities, LLC

1 question for ALGM

Recent press releases and 8-K filings for ALGM.

- Allegro MicroSystems projects a strong recovery for fiscal year 2026, with sales on pace to grow by more than 20% year-over-year and EPS projected to double year-over-year, exiting the year with a 50% gross margin.

- The company introduced a new financial model targeting a mid-teens overall sales CAGR, aiming to double revenue and quadruple EPS on a go-forward basis, while increasing gross margins to above 55% and limiting OpEx growth to the rate of inflation.

- This growth is driven by a sharpened strategic focus on high-growth automotive (xEV and ADAS) and industrial markets (data center and robotics), which represent an $8.5 billion opportunity growing at a 21% CAGR.

- Allegro plans to achieve these targets through dollar content expansion in key applications, accelerated innovation in technologies like TMR and isolated gate drivers, and a reorganized sales force focused on end markets.

- Allegro MicroSystems introduced a new financial model targeting mid-teens sales growth and a path to double revenue and quadruple EPS on a go-forward basis, aiming for gross margins to return to above 55%.

- The company is strategically focused on high-growth automotive (xEV and ADAS) and industrial markets (data center and robotics), which represent a combined $8.4 billion serviceable available market (SAM) growing at a 21% CAGR.

- For fiscal year 2026, Allegro projects sales growth of more than 20% year-over-year and anticipates EPS to double.

- Strategic initiatives include reallocating R&D spending to target markets, implementing an end-market focused sales structure, and leveraging advanced technologies such as TMR sensors and isolated gate drivers to drive significant dollar content gains.

- Allegro MicroSystems has outlined a roadmap to double revenue and quadruple EPS by focusing on high-growth automotive (xEV, ADAS) and industrial (data center, robotics, automation) markets.

- The company is targeting gross margins above 55% and projects mid-teen sales growth, an upgrade from its prior low double-digit model.

- Its focus areas, including xEV, ADAS, data centers, and robotics, represent a combined $8.5 billion serviceable available market (SAM), projected to grow at a 21% CAGR.

- For fiscal year 2026, sales are projected to grow by more than 20% at the midpoint of Q4 guidance, and EPS is expected to double year-over-year.

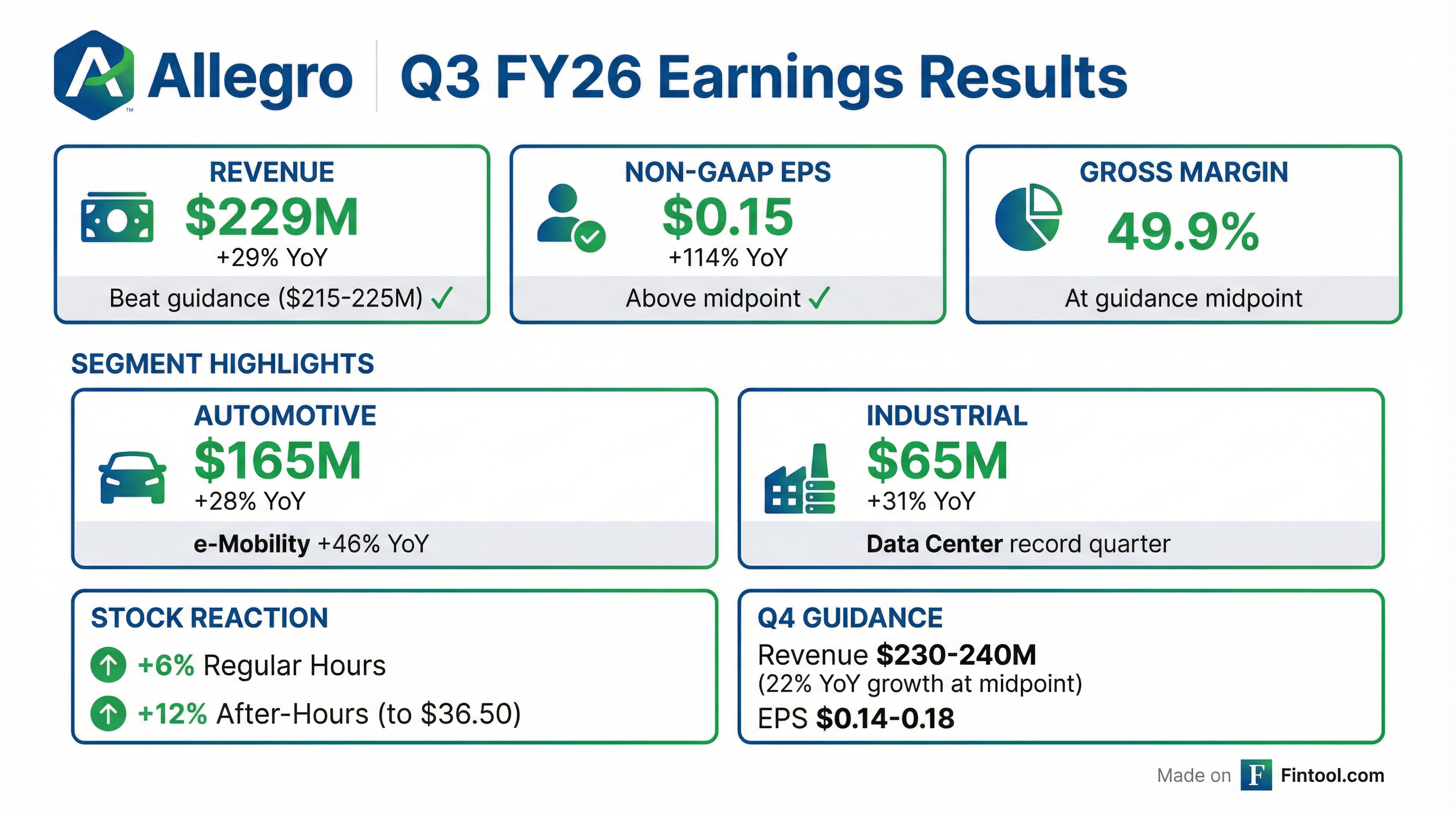

- Allegro MicroSystems reported net sales of $229 million and non-GAAP earnings per share of $0.15 for Q3 2026, representing 29% year-over-year sales growth and 114% year-over-year EPS growth.

- Sales growth was strong across key segments, with industrial and other sales up 31% year-over-year led by record data center sales, which were 10% of total sales and grew 31% sequentially. Automotive sales increased 28% year-over-year, with e-mobility sales up 46% year-over-year.

- For Q4 2026, the company forecasts net sales between $230 million and $240 million and non-GAAP EPS between $0.14 and $0.18 per share. Industrial sales are expected to lead growth, while automotive sales are anticipated to be flat to marginally down due to Chinese New Year.

- Allegro is expanding its presence in data centers, with dollar content per rack projected to grow from $150 to $425, and in robotics, with potential for up to 150 sensor ICs and 50 power ICs in advanced humanoid robots. The company also introduced an innovative current sensor that cuts power-related losses by up to 90%.

- Allegro MicroSystems (ALGM) reported strong Q3 2026 results, with sales of $229 million and non-GAAP EPS of $0.15, both exceeding guidance.

- The company achieved significant year-over-year sales growth of 29%, driven by e-mobility sales up 46% and industrial sales up 31%, with the data center segment reaching a record 10% of total sales.

- For Q4 2026, ALGM expects sales between $230 million and $240 million and non-GAAP EPS between $0.14 and $0.18 per share.

- Key business highlights include multi-quarter highs in bookings and backlog, significant design wins in ADAS, xEV, and data center, and the introduction of new current sensors and isolated gate drivers.

- Management anticipates industrial sales to lead growth in Q1 2027, while automotive sales are expected to be flat to marginally down due to Chinese New Year, with lean inventory levels persisting in the automotive sector.

- Allegro MicroSystems reported Q3 2026 net sales of $229 million and non-GAAP EPS of $0.15, with sales exceeding the high end of guidance and EPS above the midpoint.

- Sales growth was strong, with automotive sales up 28% year-over-year and industrial and other sales up 31% year-over-year, primarily driven by data center sales reaching a record 10% of total sales.

- The company issued Q4 2026 sales guidance of $230 million to $240 million and non-GAAP EPS guidance of $0.14 to $0.18 per share.

- Key growth drivers include e-mobility sales, which increased 46% year-over-year, and significant design wins in ADAS, xEV, and data center, supported by new product introductions like an innovative current sensor and isolated gate driver ICs.

- Management highlighted that distributor inventories have decreased by nearly 50% over the last five quarters, and they anticipate sell-in and point-of-sale to be approximately equal moving forward.

- For 3QFY26, Allegro MicroSystems, Inc. (ALGM) reported Non-GAAP Net Sales of $229M, which was above the high end of guidance, a Gross Margin % of 49.9%, and EPS of $0.15, which was above the midpoint of guidance. The company also generated Free Cash Flow of $41M, or 18% of sales.

- The 29% year-over-year increase in Net Sales for 3QFY26 was led by E-Mobility and Data Center, with Auto sales increasing 28% year-over-year and Industrial and Other sales increasing 31% year-over-year. ALGM also introduced a new current sensor and expanded its Power-Thru™ Gate Driver portfolio.

- For 4QFY26, ALGM provided Non-GAAP guidance for Sales between $230M - $240M, Gross Margin % between 49% - 51%, and EPS between $0.14 - $0.18.

- In January 2026, ALGM repriced its Term Loan down 25 bps to SOFR plus 175 bps, resulting in an additional $700K reduction in annualized interest expense.

- Allegro MicroSystems reported third quarter 2026 net sales of $229 million, an increase of 29% year-over-year and 7% quarter-over-quarter, with non-GAAP diluted EPS of $0.15, more than doubling year-over-year.

- This performance was driven by Automotive sales growth of 28% year-over-year and Industrial sales growth of 31% year-over-year.

- For the fourth quarter of fiscal year 2026, the company expects total net sales between $230 million and $240 million, implying 22% year-over-year growth at the midpoint, and non-GAAP diluted EPS between $0.14 and $0.18.

- The company also repriced its term loan, resulting in an additional $700,000 reduction in annualized interest expense.

- Allegro MicroSystems, Inc. filed an 8-K on January 21, 2026, announcing Amendment No. 4 to its Credit Agreement.

- This amendment includes new term loan commitments totaling $285,000,000.00.

- The document also details financial covenants, such as the Total Net Leverage Ratio, and various definitions related to the credit facility.

- Allegro MicroSystems launched the AHV85003/AHV85043 chipset, expanding its Power-Thru™ isolated gate driver portfolio.

- This expanded portfolio creates a complete ecosystem for high-voltage silicon carbide (SiC) designs in AI data centers, electric vehicles (EVs), and clean energy systems.

- The solution simplifies power conversion design by eliminating the need for external isolated bias supplies, achieving the industry's smallest solution footprint and reducing the bill of materials.

- It significantly improves system efficiency by reducing common-mode capacitance by up to 15x and boosting electromagnetic interference (EMI) performance by up to 20dB.

- The portfolio offers both an integrated solution and a chipset, providing flexibility for designers and supporting a multi-source SiC strategy.

Quarterly earnings call transcripts for ALLEGRO MICROSYSTEMS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more