Earnings summaries and quarterly performance for Amcor.

Executive leadership at Amcor.

Peter Konieczny

Chief Executive Officer

Ian Wilson

Executive Vice President, Strategic Development

L. Frederick (Fred) Stephan

Chief Operating Officer, Global Flexibles

Stephen R. Scherger

Executive Vice President and Chief Financial Officer

Susana Suarez Gonzalez

Executive Vice President, Chief Human Resources Officer

Board of directors at Amcor.

Achal Agarwal

Director

Graeme Liebelt

Chairman of the Board

Graham Chipchase CBE

Director

James T. Glerum, Jr.

Director

Jill A. Rahman

Director

Jonathan F. Foster

Director

Lucrèce Foufopoulos-De Ridder

Director

Nicholas T. Long (Tom)

Director

Stephen E. Sterrett

Deputy Chairman

Susan Carter

Director

Research analysts who have asked questions during Amcor earnings calls.

George Staphos

Bank of America

8 questions for AMCR

John Purtell

Macquarie Group

8 questions for AMCR

Anthony Pettinari

Citigroup Inc.

7 questions for AMCR

Brook Campbell-Crawford

Barrenjoey

7 questions for AMCR

Nathan Reilly

UBS

7 questions for AMCR

Cameron McDonald

E&P Financial Group

6 questions for AMCR

Michael Roxland

Truist Securities

6 questions for AMCR

Ghansham Panjabi

Robert W. Baird & Co.

5 questions for AMCR

Jakob Cakarnis

Jarden

5 questions for AMCR

Keith Chau

MST Marquee

5 questions for AMCR

Ramoun Lazar

Jefferies

5 questions for AMCR

Matt Roberts

Raymond James Financial

4 questions for AMCR

Daniel Kang

CLSA

3 questions for AMCR

Gabe Hajde

Wells Fargo & Company

2 questions for AMCR

Jeffrey Zekauskas

JPMorgan Chase & Co.

2 questions for AMCR

Jeff Zajkowski

JPMorgan Chase & Co.

2 questions for AMCR

Matthew Roberts

Raymond James

2 questions for AMCR

Niraj-Samip Shah

Goldman Sachs

2 questions for AMCR

Aaron Viswanathan

RBC Capital Markets

1 question for AMCR

Arun Viswanathan

RBC Capital Markets

1 question for AMCR

James Wilson

Jarden Australia

1 question for AMCR

Matthew Krueger

Baird

1 question for AMCR

Sam Cielo

Citigroup

1 question for AMCR

Samuel Seow

Citigroup

1 question for AMCR

Recent press releases and 8-K filings for AMCR.

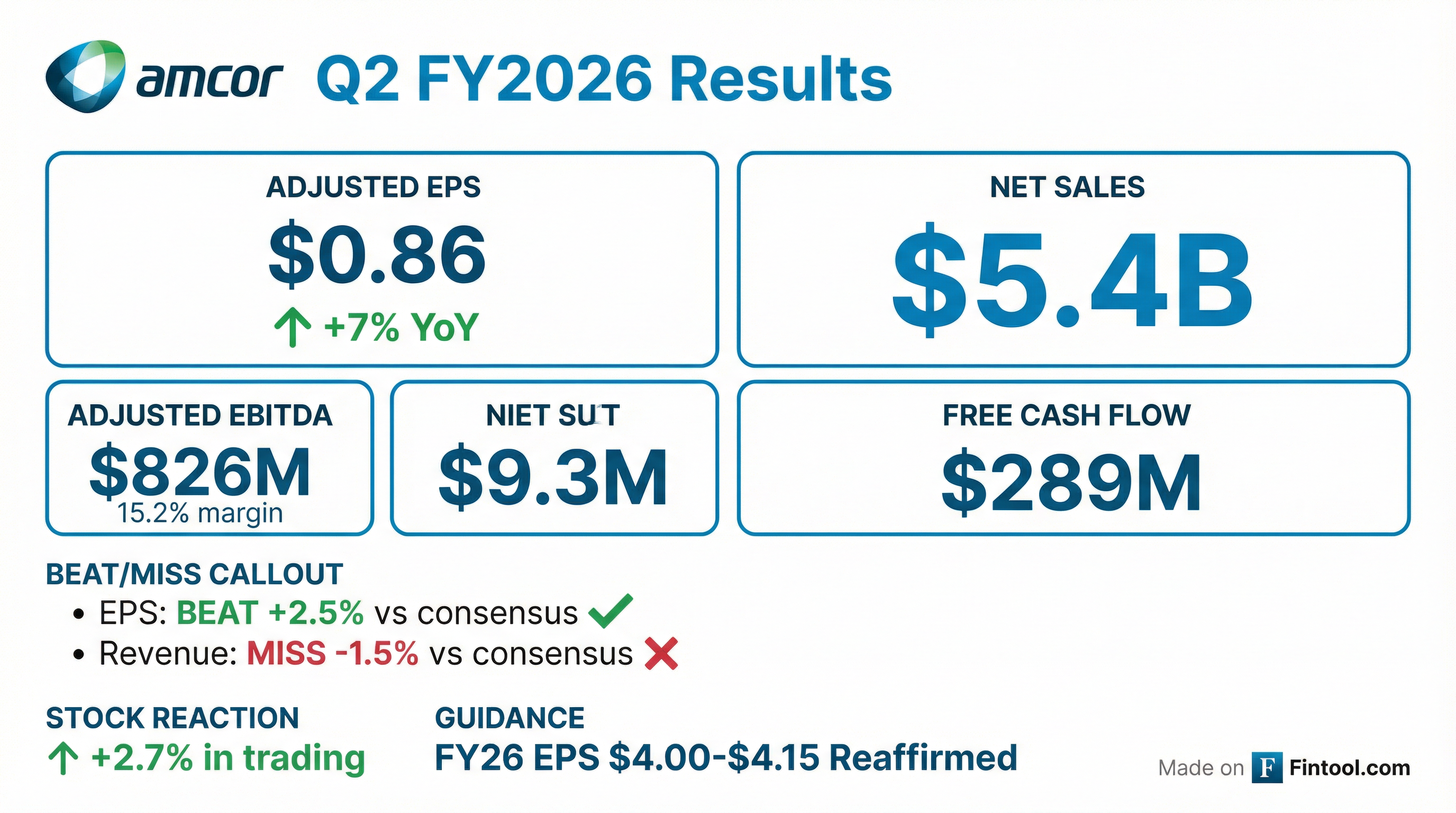

- Adjusted Q2 EPS of $0.86 beats consensus of $0.83 and improves from $0.80 a year ago, while revenue of $5.45 billion narrowly misses expectations.

- Management said the quarter met projections and credited earnings growth to the recent Berry acquisition.

- The company reiterated its fiscal 2026 earnings outlook and expects free cash flow of $1.8 billion to $1.9 billion.

- Operations are concentrated in flexible packaging (≈90% of earnings) with about half of sales in North America; market cap is ~$20.8 billion and shares are up ~4.9% YTD.

- Q2 net sales of $5.45 billion, adjusted EPS of $0.86 (+7% YoY), and free cash flow of $289 million

- Guidance reaffirmed for FY2026: adjusted EPS of $4.00–$4.15 and free cash flow of $1.8–$1.9 billion

- Synergy realization: Q2 synergies of $55 million, H1 synergies of $93 million, on track for at least $260 million in FY26

- Balance sheet: net debt of $14.08 billion as of December 31, 2025, with leverage at 3.6×, expected to end FY26 at 3.1–3.2×

- Amcor delivered 7% adjusted EPS growth in Q2 and 14% for 1H, driven by synergy benefits and cost offsets to lower volumes.

- Synergies from the Berry acquisition reached $55 million in Q2 and $93 million YTD, reaffirming a $260 million target for FY 2026 and $650 million through FY 2028.

- Q2 volumes fell 2.5%, with the core portfolio down 1.5%; focus segments (e.g., pet care, meat proteins) outperformed by 50–100 bps.

- Free cash flow was $289 million in Q2, resulting in a 1H cash outflow of $53 million; FY 2026 capex remains $850–900 million, and leverage was 3.6x, on track to 3.1–3.2x year-end.

- Management reaffirmed FY 2026 guidance of $4.00–4.15 EPS (12–17% growth) and $1.8–1.9 billion free cash flow, reflecting a 1-for-5 reverse split.

- Amcor generated $5.4 billion in Q2 revenue, $826 million in EBITDA, $603 million in EBIT and $0.86 adjusted EPS (up 7% YoY); free cash flow was $289 million and the board declared a $0.65 quarterly dividend.

- Synergies accelerated to $55 million in Q2 and $93 million in the first half, with targets of at least $260 million for fiscal 2026 and $650 million through fiscal 2028.

- The $20 billion core portfolio outperformed the combined business with volumes down 1.5% (100 bps better than total), while $2.5 billion of non-core assets—including North American beverage—are under active optimization.

- Fiscal 2026 guidance was reaffirmed at $4.00–$4.15 adjusted EPS per share (post 1-for-5 reverse split) and $1.8–$1.9 billion free cash flow; leverage exited Q2 at 3.6x, with year-end expected at 3.1–3.2x.

- Flexible Packaging sales rose 23% on a constant-currency basis (volumes down ~2%, 12.6% adjusted EBIT margin), while Rigid Packaging saw flat volumes ex-non-core and a 12% margin, reflecting synergy benefits.

- Delivered $5.4 bn revenue, $826 m EBITDA, $603 m EBIT, $0.86 adjusted EPS, and $289 m free cash flow in Q2 2026.

- Achieved $55 m of synergies in Q2 and $93 m in H1, on track for at least $260 m this fiscal year and $650 m through FY 2028.

- Core portfolio volumes declined 1.5%, outperforming the total company’s 2.5% volume drop, with focus categories faring best.

- Reaffirmed FY 2026 guidance of $4.00–$4.15 EPS, $1.8–$1.9 bn free cash flow, and Q3 EPS of $0.90–$1.00.

- Appointed Steve Scherger as CFO, strengthening leadership with his packaging industry expertise.

- Net sales of $5,449 million, up 68% year-over-year, led by the Berry acquisition; GAAP net income $177 million and diluted EPS $0.38.

- Adjusted EBITDA $826 million, up 83%, and adjusted EPS $0.86, up 7%.

- Free cash flow of $289 million in the quarter, and quarterly dividend of $0.65 per share declared.

- Reaffirmed fiscal 2026 guidance: adjusted EPS of $4.00–$4.15 (12–17% constant currency growth) and free cash flow of $1.8–$1.9 billion.

- Amcor will implement a 1-for-5 reverse stock split; it expects to file an amendment to its memorandum on January 14, 2026, with split-adjusted trading commencing on January 15, 2026.

- The split will reduce outstanding ordinary shares from approximately 2.3 billion to 461 million and proportionately decrease authorized shares while increasing the par value to $0.05 per share.

- No fractional shares will be issued; shareholders entitled to fractions will receive a cash payment in lieu, and unvested equity awards will be proportionately adjusted.

- Post-split, Amcor ordinary shares will continue trading on the NYSE under AMCR (new CUSIP), and its CHESS Depositary Interests will trade on ASX under AMC on a 1-for-5 basis.

- €750 million 3.200% senior notes due 2029 and €750 million 3.750% senior notes due 2033 issued by Amcor UK Finance plc, fully guaranteed by Amcor plc and affiliates.

- Net proceeds of approximately €1,488 million to repay Berry Global’s $1.525 billion 1.570% senior secured notes due 2026, with remainder for commercial paper and general corporate purposes.

- 2029 Notes pay interest annually on November 17 (first coupon November 17, 2026) and mature November 17, 2029; 2033 Notes pay annually on February 20 (short first coupon February 20, 2026) and mature February 20, 2033.

- Notes are senior unsecured obligations with make-whole redemption at comparable government bond rate + 20 bps before par call dates (October 17, 2029 for 2029 Notes; November 20, 2032 for 2033 Notes) and callable at 100% thereafter.

- Amcor delivered Net Sales of $5,745 million (+68%), EBITDA of $909 million (+92%) and EPS of 19.3 cents (+18%) in Q1 FY2026.

- Berry acquisition synergies: $38 million realized in Q1; on track for $260 million in FY2026 and $650 million total.

- Free Cash Flow of $(343) million in Q1 (including $115 million integration costs); as of September 30 2025, Net Debt $13,999 million and Leverage 3.6×.

- Reaffirmed FY2026 outlook: Adjusted EPS of $0.80–0.83 per share, Free Cash Flow of $1.8–1.9 billion; dividend increased to 13.0 cents per share.

- Adjusted EPS of $0.193 (up 18% cc) and EBIT of $687 million (+4% cc), with a 12% reported margin (+110 bps y/y)

- Delivered $38 million in synergies in Q1, on track for $260 million in FY 2026 and $650 million through FY 2028

- Flexible packaging net sales rose 25% cc (comparable volume down 2.8%), with adjusted EBIT of $426 million and margin of 13.1% (+20 bps)

- Board approved a quarterly dividend increase to $0.13 per share and reaffirmed guidance for 12–17% EPS growth and doubling free cash flow in FY 2026

- CFO Michael Casamento to step down, with Steve Sugar joining as CFO next week

Quarterly earnings call transcripts for Amcor.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more