Earnings summaries and quarterly performance for GRAPHIC PACKAGING HOLDING.

Executive leadership at GRAPHIC PACKAGING HOLDING.

Board of directors at GRAPHIC PACKAGING HOLDING.

Research analysts who have asked questions during GRAPHIC PACKAGING HOLDING earnings calls.

Arun Viswanathan

RBC Capital Markets

8 questions for GPK

Ghansham Panjabi

Robert W. Baird & Co.

7 questions for GPK

Gabe Hajde

Wells Fargo & Company

6 questions for GPK

George Staphos

Bank of America

6 questions for GPK

Mark Weintraub

Seaport Research Partners

6 questions for GPK

Lewis Merrick

BNP Paribas S.A.

5 questions for GPK

Matthew Roberts

Raymond James

4 questions for GPK

Matt Roberts

Raymond James Financial

4 questions for GPK

Anojja Shah

UBS Group AG

3 questions for GPK

Michael Roxland

Truist Securities

3 questions for GPK

Anthony Pettinari

Citigroup Inc.

2 questions for GPK

Charlie Muir-Sands

BNP Paribas

2 questions for GPK

Gansham Punjabi

Baird

1 question for GPK

John Dunigan

Jefferies

1 question for GPK

Lars Kjellberg

Stifel

1 question for GPK

Louis Merrick

BNP Paribas

1 question for GPK

Mike Roxland

Truist Securities

1 question for GPK

Philip Ng

Jefferies

1 question for GPK

Recent press releases and 8-K filings for GPK.

- Graphic Packaging Holding Company (GPK) executed Amendment No. 1 to its Fifth Amended and Restated Credit Agreement on February 26, 2026.

- The amendment, acknowledged by Graphic Packaging Holding Company, involves Graphic Packaging International, LLC as the borrower, with Bank of America, N.A. serving as the administrative agent.

- The Euro Term Loans under the amended agreement are designated to refinance outstanding Incremental Euro Term Loans and cover associated transaction fees and expenses.

- The agreement includes an Incremental Equivalent Fixed Amount Basket for certain indebtedness, set at the greater of $1,750,000,000 or 100% of EBITDA, and mandates that the Consolidated Senior Secured Leverage Ratio not exceed 3.50 to 1.00 for such indebtedness.

- It also restricts Asset Sales, with individual sales not exceeding $50,000,000 and aggregate annual sales capped at $200,000,000.

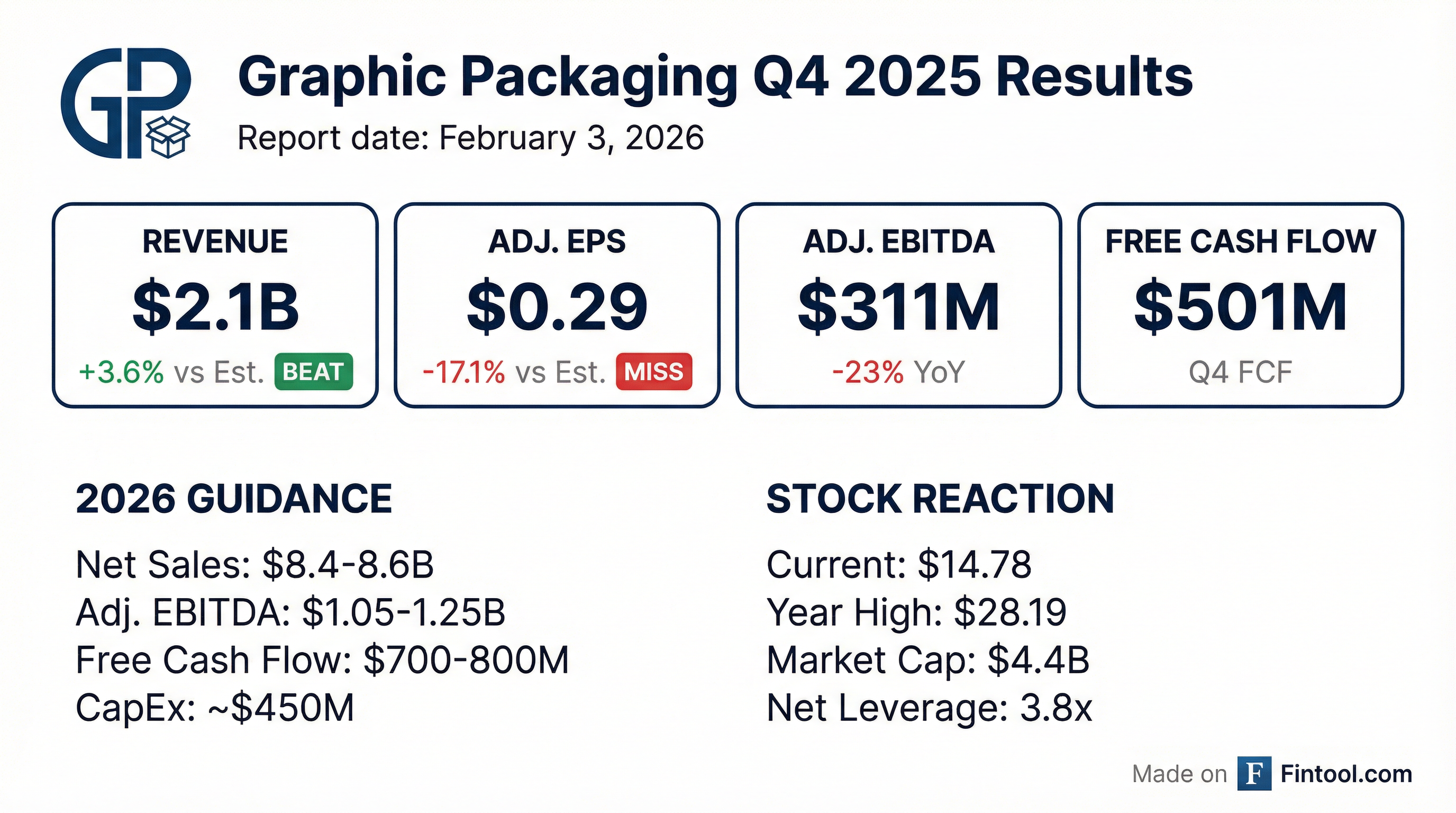

- Graphic Packaging reported Q4 2025 net sales of $2.1 billion, which were flat year-over-year, and Adjusted EBITDA of $311 million. For the full year 2025, net sales were $8.6 billion, down approximately 2%, Adjusted EBITDA was approximately $1.4 billion, and Adjusted EPS was $1.80, with net leverage ending at 3.8x.

- For 2026, the company expects net sales in the range of $8.4 billion-$8.6 billion and Adjusted EBITDA between $1.05 billion and $1.25 billion. This guidance assumes continued competitive pressure in packaging pricing and reflects an expectation of continued inflationary pressure and affordability challenges in consumer staples markets.

- Adjusted Free Cash Flow is projected to be between $700 million and $800 million in 2026, a significant improvement driven primarily by a step down in capital spending to approximately $450 million and inventory reduction actions.

- Deleveraging is the highest near-term capital allocation priority, with plans to pay down approximately $500 million of debt in 2026 to progress towards an investment-grade credit rating by 2030.

- Graphic Packaging's new President and CEO, Robbert Rietbroek, who started in early 2026, has initiated a comprehensive operational and business review to enhance profitability, reduce inventory and capital spending, and drive disciplined organic growth.

- For 2026, the company projects Adjusted Free Cash Flow between $700 million and $800 million and Adjusted EPS in the range of $0.75-$1.15.

- Graphic Packaging aims to pay down approximately $500 million of debt in 2026 and reduce capital spending to around $450 million, with a strategic goal to achieve an investment-grade credit rating by 2030.

- Current market challenges include overcapacity in commodity bleached paperboard markets and higher than required inventory levels, which the company is actively addressing.

- Graphic Packaging reported Q4 2025 net sales of $2.1 billion and full-year 2025 net sales of $8.6 billion, with full-year Adjusted EBITDA at approximately $1.4 billion and Adjusted EPS at $1.80.

- For 2026, the company forecasts net sales between $8.4 billion-$8.6 billion, Adjusted EBITDA in the range of $1,150 million-$1,250 million, and Adjusted EPS between $0.75-$1.15.

- The company expects to generate $700 million-$800 million in Adjusted Free Cash Flow in 2026, driven by a significant reduction in capital spending to approximately $450 million from $935 million in 2025.

- Graphic Packaging plans to pay down approximately $500 million of debt in 2026 and reduce inventory from an elevated 20% of sales at year-end 2025 to a target of 15%-16% of sales.

- New CEO Robbert Rietbroek is focusing on a comprehensive operational and business review to enhance profitability through cost actions and operational efficiencies, acknowledging challenges from overcapacity in bleached paperboard markets and uneven consumer demand.

- Graphic Packaging reported Q4 2025 Net Sales of $2.1 billion and full-year 2025 Net Sales of $8.6 billion, with full-year Adjusted EBITDA of $1.4 billion and Adjusted Free Cash Flow of $169 million.

- The company provided 2026 guidance, projecting Net Sales between $8.4 billion and $8.6 billion, Adjusted EBITDA between $1.05 billion and $1.25 billion, and a significant increase in Adjusted Free Cash Flow to $700 million-$800 million.

- The 2025 declines were primarily driven by the divestiture of the Augusta, GA facility and price declines, with overcapacity in the commodity bleached paperboard market contributing to pricing pressure and impacting volumes due to stretched consumers.

- Graphic Packaging has initiated a Value Creation Plan focused on enhancing profitability through cost actions, generating free cash flow by reducing inventory and capital spending (projected to be ~$450 million in 2026), reducing debt, and optimizing its portfolio and footprint. The Waco facility's commercial production is successfully ramping up.

- Graphic Packaging Holding Company reported full-year 2025 Net Sales of $8.6 billion, a decrease from $8.8 billion in 2024, and Net Income of $444 million, down from $658 million in 2024. Adjusted EBITDA for the full year was $1,395 million, compared to $1,682 million in the prior year.

- For the fourth quarter of 2025, Net Sales were $2,103 million, flat year-over-year, while Net Income was $71 million ($0.24 per diluted share), a decrease from $138 million ($0.46 per diluted share) in Q4 2024. Adjusted EBITDA for the quarter was $311 million, down from $404 million in Q4 2024.

- The company provided 2026 guidance, expecting Net Sales of $8.4 billion to $8.6 billion, Adjusted EBITDA of $1.05 billion to $1.25 billion, and Adjusted EPS of $0.75 to $1.15. It also affirmed an Adjusted Free Cash Flow target of $700 million to $800 million and plans for approximately $450 million in capital spending.

- The Waco, Texas greenfield facility is substantially complete, with $1.58 billion spent through year-end 2025 out of a total projected cost of $1.67 billion. The Net Leverage Ratio for full-year 2025 increased to 3.8x from 3.0x in 2024.

- Graphic Packaging reported full-year 2025 Net Sales of $8.6 billion, a decrease from $8.8 billion in 2024, with Net Income of $444 million (down from $658 million in 2024), Adjusted Diluted EPS of $1.80 (down from $2.49 in 2024), and Adjusted EBITDA of $1,395 million (down from $1,682 million in 2024).

- The company affirmed its 2026 Adjusted Free Cash Flow target of $700 million to $800 million and issued 2026 guidance including Net Sales of $8.4 billion to $8.6 billion, Adjusted EBITDA of $1.05 billion to $1.25 billion, and Adjusted EPS of $0.75 to $1.15.

- The Waco, Texas greenfield facility is substantially complete, with $1.58 billion of the $1.67 billion total projected spend incurred through year-end 2025.

- In 2025, Graphic Packaging returned approximately $281 million to stockholders through dividends and share repurchases, and initiated a comprehensive review of its organization structure, operations, footprint, and portfolio.

- Eminence Capital, a private investment firm owning approximately 4.2% of Graphic Packaging Holding Company (GPK), sent an open letter to shareholders criticizing the Board's "factually inaccurate and misleading" justification for replacing CEO Mike Doss with Robbert Rietbroek.

- Eminence alleges the Board is using Doss as a scapegoat for a nearly 50% decline in GPK's share price over the past year, attributing the decline to industry oversupply and macroeconomic headwinds rather than Doss's performance.

- The firm claims Rietbroek has a pattern of leaving employers in a worse state and that his previous public company CEO role was marked by failure.

- Eminence urges shareholders to demand the reinstatement of Mike Doss as CEO.

- Graphic Packaging Holding Company (GPK) announced that Robbert Rietbroek will assume the role of Chief Executive Officer on January 1, 2026.

- The Board initiated the CEO transition in response to recent performance not meeting expectations, including a nearly 50% decline in share price over the past year, to ensure leadership capable of advancing the company's strategy and enhancing long-term shareholder value.

- The company is committed to its Vision 2030 strategy, focusing on improving free cash flow, optimizing cost structure, and enhancing operational efficiency.

- To support these goals, Graphic Packaging has engaged AlixPartners, a performance-improvement advisor, to identify additional opportunities for cost reduction and working capital optimization, with the aim of returning EBITDA margins to recently demonstrated levels.

- Eminence Capital, a private investment firm owning approximately 4.2% of Graphic Packaging Holding Company (GPK), sent a letter to the Board of Directors on December 15, 2025, criticizing the decision to replace CEO Mike Doss with Robbert Reitbroek.

- The firm views the CEO change as misguided, ill-timed, and lacking proper diligence, noting Reitbroek's recent termination from his only prior public company CEO role due to operational failures.

- Eminence Capital called for the resignation of Chairman Phil Martens, alleging his outsized influence and highlighting his 70% reduction in share ownership prior to recent executive departures, which they believe jeopardizes shareholder value.

- Eminence has demanded the immediate reinstatement of Mike Doss and submitted a request to inspect GPK's books and records related to the CEO transition, threatening a public campaign if their demands are not met.

Quarterly earnings call transcripts for GRAPHIC PACKAGING HOLDING.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more