Earnings summaries and quarterly performance for Amentum Holdings.

Executive leadership at Amentum Holdings.

Board of directors at Amentum Holdings.

Alan Goldberg

Director

Barbara Loughran

Director

Benjamin Dickson

Lead Independent Director

Christopher M.T. Thompson

Director

Connor Wentzell

Director

John Vollmer

Director

Leslie Ireland

Director

Ralph E. Eberhart

Director

Russell Triedman

Director

Sandra Rowland

Director

Vincent K. Brooks

Director

Research analysts who have asked questions during Amentum Holdings earnings calls.

Kenneth Herbert

RBC Capital Markets

10 questions for AMTM

Tobey Sommer

Truist Securities, Inc.

10 questions for AMTM

Colin Canfield

Cantor Fitzgerald

7 questions for AMTM

Mariana Perez Mora

Bank of America

5 questions for AMTM

Trevor Walsh

Citizens JMP

5 questions for AMTM

Andre Madrid

BTIG

4 questions for AMTM

Brian Gesuale

Raymond James & Associates, Inc.

4 questions for AMTM

Kristine Liwag

Morgan Stanley

4 questions for AMTM

Noah Poponak

Goldman Sachs

3 questions for AMTM

Andrew Harte

BTIG, LLC

2 questions for AMTM

Gavin Parsons

UBS Group AG

2 questions for AMTM

Seth Seifman

JPMorgan Chase & Co.

2 questions for AMTM

Recent press releases and 8-K filings for AMTM.

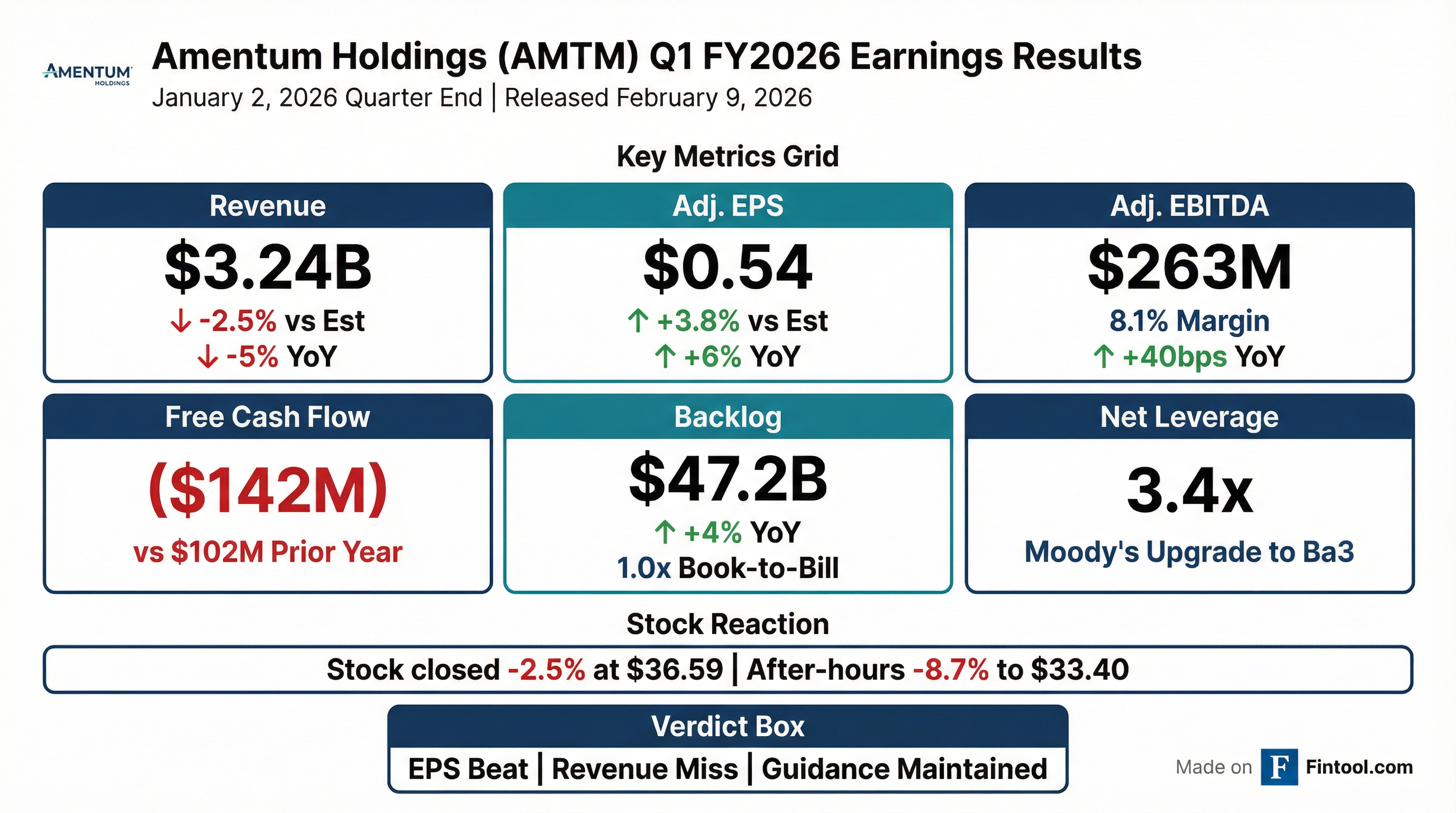

- Amentum Holdings reported Q1 2026 revenue of $3.24 billion, reflecting 3% normalized growth, with adjusted EBITDA of $263 million (8.1% margin) and adjusted diluted earnings per share of $0.54, up 6% year-over-year.

- The company secured $3.3 billion in net bookings, achieving a Q1 book-to-bill of 1x and a last 12 months book-to-bill of 1.1x (or 1.3x including joint ventures), leading to a 4% increase in backlog to over $47 billion.

- Strategic wins in the quarter included over $1 billion in nuclear energy awards and other significant contracts across its accelerating growth markets, contributing to margin expansion.

- Despite a $142 million use in free cash flow in Q1 due to temporary timing issues, the company reaffirmed its full-year guidance, with $23 billion in proposals awaiting award providing strong future revenue visibility.

- Amentum reported Q1 2026 revenue of $3.24 billion, reflecting normalized growth of 3%, adjusted EBITDA of $263 million with 8.1% margins, and adjusted diluted earnings per share of $0.54, up 6% year-over-year.

- The company delivered $3.3 billion in net bookings, achieving a 1x book-to-bill for Q1 and 1.1x for the last 12 months, which grew its industry-leading backlog to over $47 billion.

- Despite a $142 million use of free cash flow in Q1 2026, primarily due to timing-related impacts from an additional pay cycle and government shutdown, Amentum reaffirmed its full-year fiscal 2026 guidance for revenue, adjusted EBITDA, adjusted diluted EPS, and free cash flow.

- Amentum continues to see strong demand in accelerating growth markets, securing nearly $1 billion in nuclear energy awards in Q1 2026, reinforcing its role as a trusted partner in this sector.

- Amentum Holdings (AMTM) reported Q1 FY26 revenue of $3.2 billion, Adjusted EBITDA of $263 million, and Adjusted Diluted EPS of $0.54.

- The company reaffirmed its FY26 guidance, projecting revenue between $13,950 million and $14,300 million, Adjusted EBITDA between $1,100 million and $1,140 million, Adjusted Diluted EPS between $2.25 and $2.45, and Free Cash Flow between $525 million and $575 million.

- AMTM achieved a backlog of $47.2 billion and a LTM book-to-bill of 1.1x , driven by strategic wins in high-demand areas like nuclear energy, space, and critical digital infrastructure.

- Moody's upgraded the company's credit rating to Ba3, reflecting a strong financial profile and the company's trajectory to achieve net leverage below 3x by year-end FY26.

- Despite a Q1 FY26 Free Cash Flow outflow of ($142 million), primarily due to short-term collections timing, the company remains on-track to meet its full-year FCF guidance.

- Amentum Holdings reported Q1 2026 revenue of $3.24 billion, adjusted EBITDA of $263 million, and adjusted diluted earnings per share of $0.54, reflecting normalized revenue growth of 3% and adjusted EBITDA margins of 8.1%.

- The company achieved $3.3 billion in net bookings for Q1 2026, resulting in a 1x book-to-bill for the quarter and growing its industry-leading backlog to over $47 billion.

- Amentum reaffirmed its fiscal year 2026 guidance, expecting revenue between $13.95-$14.3 billion, adjusted EBITDA between $1.1-$1.14 billion, adjusted diluted EPS between $2.25-$2.45, and free cash flow between $525-$575 million.

- Strategic focus on accelerating growth markets, including nuclear energy, space systems, and critical digital infrastructure, led to over $1 billion in awards in the global nuclear energy business in Q1.

- The company ended Q1 with $247 million in cash on hand and a fully undrawn $850 million revolver, maintaining a healthy liquidity position and aiming for net leverage less than 3x by year-end.

- Amentum Holdings, Inc. reported Q1 Fiscal Year 2026 revenues of $3.24 billion, a 5% decrease year-over-year, while net income significantly increased by 267% to $44 million and diluted EPS rose 260% to $0.18 for the quarter ended January 2, 2026.

- Adjusted EBITDA remained flat at $263 million, and Adjusted Diluted EPS grew 6% to $0.54.

- The company's backlog grew 4% annually to $47.2 billion as of January 2, 2026, supported by a book-to-bill ratio of 1.0x for the quarter and 1.1x for the last twelve months.

- Amentum reaffirmed its full-year fiscal year 2026 guidance, projecting revenues between $13,950 million and $14,300 million, Adjusted EBITDA between $1,100 million and $1,140 million, and Adjusted Diluted EPS between $2.25 and $2.45.

- Amentum reported FY 2025 revenues of $14.4 billion, representing 4% pro forma growth, with adjusted EBITDA of $1.1 billion, an increase of 5% year-over-year, and adjusted diluted EPS of $2.22, up 11%.

- The company achieved a full-year book-to-bill ratio of 1.2 times and grew its backlog by 5% to over $47 billion in FY 2025, securing significant wins including a $4 billion US Space Force Range contract and a $1.8 billion Cellifield remediation contract.

- For FY 2026, Amentum expects revenues between $13.95 billion and $14.3 billion, adjusted EBITDA of $1.1 billion to $1.14 billion, adjusted diluted EPS of $2.25 to $2.45, and free cash flow of $525 million to $575 million.

- Amentum reduced its net leverage to 3.2 times by the end of FY 2025 and aims to achieve less than 3 times by the end of FY 2026.

- The company is focusing on accelerating growth markets including space systems and technologies, critical digital infrastructure, and global nuclear energy, which are expected to drive future growth and margin expansion.

- Amentum reported full-year fiscal 2025 revenues of $14.4 billion, representing 4% pro forma growth, and adjusted EBITDA of $1.1 billion, an increase of 5% year-over-year. Adjusted diluted earnings per share grew 11% to $2.22, and free cash flow reached $516 million.

- The company achieved a full-year book-to-bill ratio of 1.2 times and increased its backlog by 5% to over $47 billion, including significant wins such as a $4 billion 10-year US Space Force Range contract.

- For fiscal year 2026, Amentum projects revenues between $13.95 billion and $14.3 billion, adjusted EBITDA between $1.1 billion and $1.14 billion, and adjusted diluted EPS between $2.25 and $2.45. Free cash flow is expected to be between $525 million and $575 million.

- Amentum is on track to deliver at least $60 million in net run rate synergies by the end of fiscal year 2026 and reduced its net leverage to 3.2 times, with a target of less than 3 times by the end of fiscal year 2026.

- Amentum reported strong fiscal year 2025 results, with revenues of $14.4 billion (4% pro forma growth), adjusted EBITDA of $1.1 billion (5% increase), and adjusted diluted EPS of $2.22 (11% increase).

- The company secured $6.4 billion in Q4 bookings, contributing to a full-year book-to-bill ratio of 1.2 times and a 5% increase in backlog to over $47 billion, including a $4 billion US Space Force Range contract.

- For fiscal year 2026, Amentum projects revenues between $13.95 billion and $14.3 billion, adjusted EBITDA between $1.1 billion and $1.14 billion, and adjusted diluted EPS between $2.25 and $2.45.

- Amentum is on track to achieve at least $60 million in net run rate synergies by the end of fiscal year 2026 and aims for 8.5% to 9% margins by FY 2028.

- The company expects to reduce its net leverage to less than 3 times by the end of fiscal year 2026, supported by projected free cash flow of $525 million to $575 million in FY 2026.

- Momentum (AMTM) reported FY 2025 revenue of $14.4 billion and adjusted diluted EPS of $2.22, representing 2.5% and 11% year-over-year growth, respectively.

- Adjusted EBITDA for FY 2025 reached $1.1 billion, an increase of 5%, with 10 basis points of margin expansion, and free cash flow was $516 million.

- For FY 2026, the company projects revenues between $13.95 billion and $14.3 billion, adjusted EBITDA of $1.1 billion to $1.14 billion, and adjusted diluted EPS of $2.25 to $2.45.

- Momentum aims to reduce net leverage to less than 3 times by the end of FY 2026 and is on track to deliver at least $60 million in net run rate synergies by the same period, supporting a long-term margin goal of 8.5% to 9% by FY 2028.

- The company is strategically focused on accelerating growth in Space Systems and Technologies, critical digital infrastructure, and global nuclear energy, with operations for the Space Force Range contract commencing in December.

- AMTM concluded FY25 with strong financial performance, reporting revenues of $14.4 billion (+4% YoY), Adjusted EBITDA of $1,104 million (+5% YoY), and Adjusted Diluted EPS of $2.22 (+11% YoY).

- The company demonstrated robust growth momentum with a Q4 book-to-bill of 1.6x and secured significant strategic awards totaling over $8.3 billion in Q4 FY25, contributing to a year-end backlog of $47.1 billion.

- AMTM achieved its deleveraging goals ahead of schedule, reducing net leverage to 3.2x by the end of FY25, and generated $516 million in Free Cash Flow for the year.

- For FY26, the company initiated guidance, forecasting revenues between $13,950 million and $14,300 million, Adjusted EBITDA between $1,100 million and $1,140 million, and Adjusted Diluted EPS between $2.25 and $2.45.

Quarterly earnings call transcripts for Amentum Holdings.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more