Earnings summaries and quarterly performance for AtriCure.

Executive leadership at AtriCure.

Michael H. Carrel

President and Chief Executive Officer

Angela L. Wirick

Chief Financial Officer

Douglas J. Seith

Chief Operating Officer

Justin J. Noznesky

Chief Marketing and Strategy Officer

Karl S. Dahlquist

Chief Legal Officer

Salvatore Privitera

Chief Technical Officer

Vinayak Doraiswamy

Chief Scientific Officer

Board of directors at AtriCure.

Research analysts who have asked questions during AtriCure earnings calls.

Marie Thibault

BTIG

6 questions for ATRC

Suraj Kalia

Oppenheimer & Co. Inc.

6 questions for ATRC

William Plovanic

Canaccord Genuity

5 questions for ATRC

John McAulay

Stifel

4 questions for ATRC

Danielle Antalffy

UBS Group AG

3 questions for ATRC

Daniel Stauder

Citizen JMP

3 questions for ATRC

Lilia-Celine Lozada

JPMorgan Chase & Co.

3 questions for ATRC

Matthew O'Brien

Piper Sandler & Co.

3 questions for ATRC

Michael Matson

Needham & Company

3 questions for ATRC

Danny Stauder

Citizens JMP

2 questions for ATRC

Lily Lozada

JPMorgan Chase & Co.

2 questions for ATRC

Mike Matson

Needham & Company, LLC

2 questions for ATRC

Anna

Wolfe Research

1 question for ATRC

Danielle Antalffy

UBS

1 question for ATRC

Frederick Wise

Stifel

1 question for ATRC

Jana

TD Cowen

1 question for ATRC

Joseph Conway

Needham & Company, LLC

1 question for ATRC

Lilly Quezada

JPMorgan Chase & Co.

1 question for ATRC

Zachary Day

Canaccord Genuity

1 question for ATRC

Recent press releases and 8-K filings for ATRC.

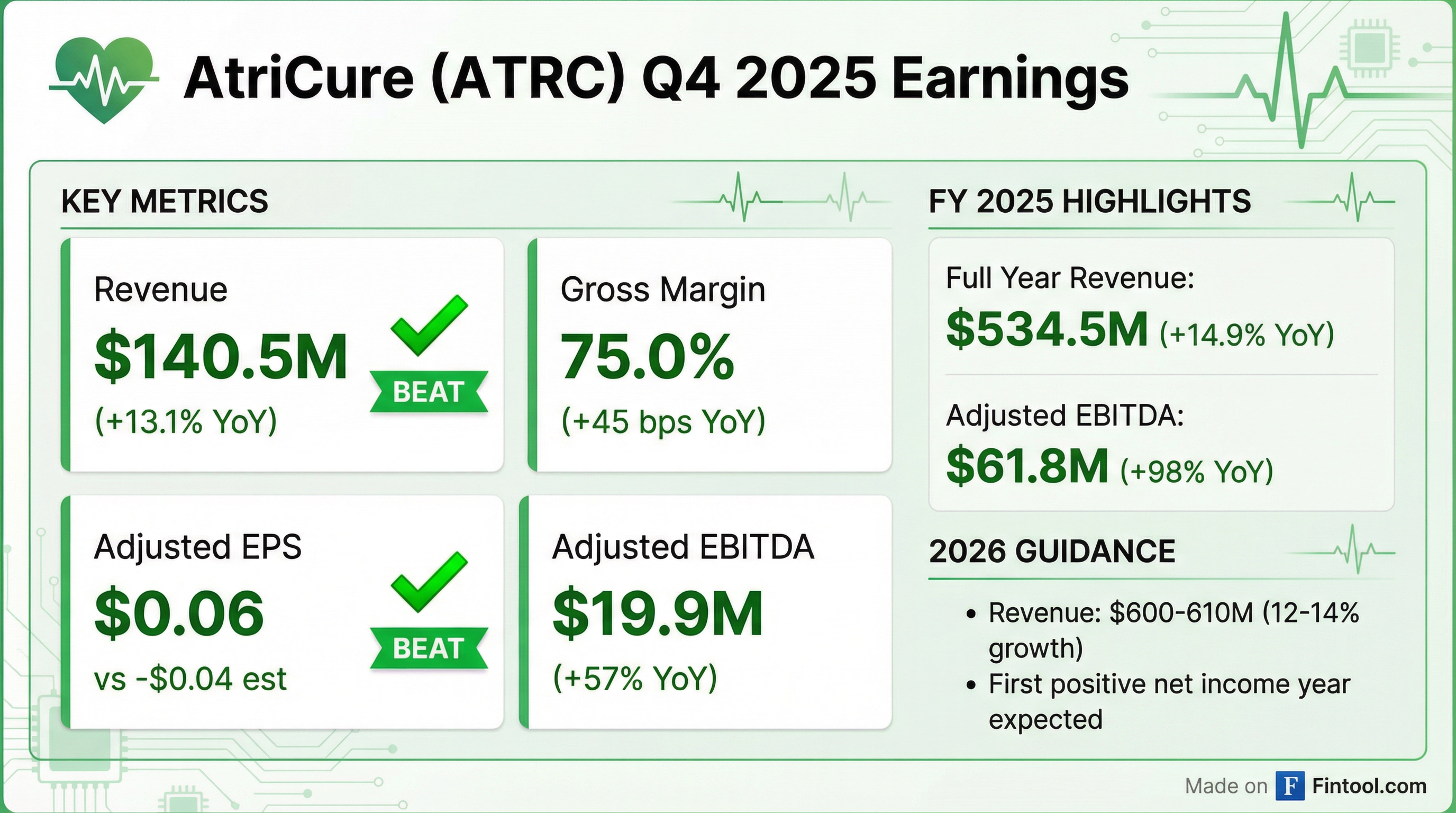

- AtriCure reported total revenue of $534.5 million for full-year 2025, marking 14.9% growth over 2024, and $140.5 million for Q4 2025, a 13.1% increase over Q4 2024. The company achieved $61.8 million in adjusted EBITDA and $45 million in cash generated for full-year 2025, with Q4 2025 adjusted EBITDA at $19.9 million and net income at $1.8 million.

- The company reaffirmed its 2026 guidance, projecting revenue between $600 million and $610 million (12%-14% growth) and adjusted EBITDA between $80 million and $82 million, along with anticipated full-year net income and positive cash generation.

- Strategic growth in 2025 was driven by new product launches such as cryoSPHERE MAX, AtriClip FLEX MINI, AtriClip PRO MINI, and CryoXT, and continued adoption of the Encompass clamp. The LEAPS clinical trial completed enrollment, and the BOX X NoAF clinical trial was initiated, aiming for market expansion.

- The minimally invasive AFib treatment segment experienced a 26% decline in full-year worldwide revenues in 2025 due to PFA adoption, a trend expected to continue in 2026 at a moderated rate. Additionally, international sales were impacted by funding and reimbursement uncertainty in the UK in Q4 2025, which is factored into the 2026 outlook.

- AtriCure reported Q4 2025 worldwide revenue of $140.5 million, a 13.1% increase year-over-year, and full-year 2025 revenue of $534.5 million, up 14.9%. The company achieved Q4 2025 adjusted EBITDA of $19.9 million and full-year 2025 adjusted EBITDA of $61.8 million, generating approximately $45 million in cash for the year.

- For 2026, AtriCure projects revenue between $600 million and $610 million, translating to 12%-14% growth, with anticipated adjusted EBITDA in the range of $80 million-$82 million and adjusted earnings per share of $0.09-$0.15.

- Growth in 2025 was fueled by new product launches, including cryoSPHERE MAX and AtriClip FLEX-Mini, and increased adoption of the EnCompass clamp. The company also completed enrollment for the LeAAPS clinical trial and initiated the BoxX-NoAF clinical trial, while advancing development of a dual-energy EnCompass Clamp.

- The pain management franchise's worldwide revenue grew 33% in 2025, and the left atrial appendage franchise grew 19% worldwide, though international revenue was affected by funding and reimbursement uncertainty in the U.K..

- AtriCure reported full-year 2025 revenue of $534.5 million, a 14.9% increase over 2024, and Q4 2025 revenue of $140.5 million, up 13.1% from Q4 2024.

- The company achieved adjusted EBITDA of $61.8 million for full-year 2025 and $19.9 million for Q4 2025, with net income of $1.8 million in Q4 2025.

- For 2026, AtriCure expects revenue between $600 million and $610 million, representing 12%-14% growth, and anticipates adjusted EBITDA of $80 million-$82 million.

- Key growth drivers included the cryoSPHERE MAX, AtriClip FLEX MINI, and Encompass clamp, while minimally invasive AFib treatment faced headwinds. The LEAPS clinical trial completed enrollment, and the BOX X NoAF trial was initiated.

- AtriCure reported fourth quarter 2025 worldwide revenue of $140.5 million, an increase of 13.1% year-over-year, and full year 2025 worldwide revenue of $534.5 million, up 14.9% from 2024.

- The company achieved net income of $1.8 million and adjusted EBITDA of $19.9 million for Q4 2025, while the full year 2025 saw a net loss of $11.4 million and adjusted EBITDA of $61.8 million.

- For full year 2026, AtriCure projects revenue between $600 million and $610 million, reflecting 12% to 14% growth, and anticipates adjusted EBITDA of $80 million to $82 million, along with positive net income.

- AtriCure, Inc. reported fourth quarter 2025 worldwide revenue of $140.5 million, a 13.1% year-over-year increase, with net income of $1.8 million and adjusted EBITDA of $19.9 million.

- For the full year 2025, worldwide revenue reached $534.5 million, up 14.9% from the previous year, resulting in a net loss of $11.4 million and adjusted EBITDA of $61.8 million.

- The company issued full year 2026 guidance, projecting revenue between $600 million and $610 million, adjusted EBITDA of $80 million to $82 million, and net earnings per share from $0.00 to $0.04.

- AtriCure reported preliminary fourth quarter 2025 revenue of $140.5 million, reflecting 13% growth, and full year 2025 revenue of $534.5 million, representing 15% growth over 2024.

- The company achieved positive adjusted EBITDA of approximately $57 million to $59 million for full year 2025 and ended the year with approximately $167 million in cash and investments.

- Management projects 2026 revenue of approximately $600 million to $610 million, reflecting 12% to 14% growth over full year 2025, and anticipates positive adjusted EBITDA of approximately $80 million to $82 million in 2026.

- AtriCure expects positive full year net income and projects continued positive cash flow in 2026.

- AtriCure (ATRC) anticipates its total annual market opportunity to grow from $1 billion to over $10 billion, with cardiac surgery alone representing an over $7 billion annual opportunity and pain management an over $2 billion opportunity.

- The company reported 15% overall growth and an 86% increase in positive EBITDA for 2025, with adjusted EBITDA reaching $57-$59 million. AtriCure expects to generate net income for the first time in 2026 and projects 12%-14% growth for 2026.

- Future growth is expected to accelerate significantly from ongoing clinical trials, LeAAPS and BOX-no-AF, which are ahead of schedule and aim to establish ablation and clip procedures as the standard of care for all cardiac surgery patients.

- AtriCure is ahead of its long-term plan to become a $1 billion company with a 20% operating margin on an EBITDA basis by the end of the decade.

- AtriCure (ATRC) highlighted a $10 billion annual market opportunity for its AFib and pain management solutions, with less than 10% penetration in the global cardiac surgery market.

- The company achieved 15% overall growth in 2025, with adjusted EBITDA increasing by 86% to $57-$59 million.

- For 2026, AtriCure projects 12%-14% revenue growth and $80-$82 million in adjusted EBITDA, anticipating its first year of net income profitability.

- Growth is driven by product innovations such as the EnCompass Clamp, Flex Mini, and Cryo XT, and ongoing clinical trials (LeAAPS and BOX-NO-AF) expected to establish new standards of care for cardiac surgery patients.

- Q4 2025 saw strong performance in cryo nerve block and open ablation/clip segments, with the hybrid business showing its first sequential revenue increase in a long time, despite international budget pressures.

- AtriCure reported 15% overall growth and an 86% increase in positive EBITDA for the past year, generating $44 million in cash.

- The company provided 2026 revenue growth guidance of 12%-14% and adjusted EBITDA guidance of $80-$82 million, anticipating net income for the first time in 2026.

- AtriCure is addressing a $10 billion annual market opportunity by focusing on reducing AFib and pain after surgery, driven by product innovations such as the Encompass Clamp, Flex Mini, and the newly launched Cryo XT.

- Strategic clinical trials, LeAAPS and BOX-no-AF, are expected to expand market penetration and establish new standards of care for cardiac surgery patients, with data anticipated to accelerate growth in the latter half of the decade.

- Fourth quarter performance included strong growth in cryo nerve block, open ablation, and open atrial clip, though it experienced pressure from the U.K. market and continued challenges in the hybrid business, which showed a sequential uptick.

- AtriCure, Inc. announced its preliminary financial results for the fourth quarter and full year 2025.

- The company also provided its 2026 financial guidance.

- Preliminary, unaudited revenue for the fourth quarter of 2025 is expected to be $140.5 million, reflecting approximately 13% growth over the fourth quarter of the previous year.

Quarterly earnings call transcripts for AtriCure.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more