Earnings summaries and quarterly performance for ATS Corp /ATS.

Research analysts who have asked questions during ATS Corp /ATS earnings calls.

MS

Maxim Sytchev

National Bank Financial, Inc.

9 questions for ATS

Also covers: CIGI, NOA, RBA +1 more

Sabahat Khan

RBC Capital Markets

7 questions for ATS

Also covers: ACM, DE, DOOO +10 more

MG

Michael Glen

Raymond James

6 questions for ATS

Also covers: MGA

PB

Patrick Baumann

JPMorgan Chase & Co.

6 questions for ATS

Also covers: CNM, FAST, GWW +5 more

DO

David Ocampo

Cormark Securities

5 questions for ATS

Also covers: ASTL

Justin Keywood

Stifel Financial Corp.

5 questions for ATS

Also covers: HWAIF, QIPT

CR

Cherilyn Radbourne

TD Cowen

4 questions for ATS

Also covers: BAM, BIP, BN +1 more

PS

Patrick Sullivan

TD Cowen

4 questions for ATS

Also covers: BIP

FG

Fred Gatali

Raymond James Financial, Inc.

2 questions for ATS

Joe Ritchie

Goldman Sachs

2 questions for ATS

Also covers: ALLE, CARR, CGNX +20 more

Jonathan Goldman

Scotiabank

2 questions for ATS

Also covers: DOOO, MG, MGA +1 more

Recent press releases and 8-K filings for ATS.

ATS Corporation Reports Q3 2026 Results and Announces Leadership Changes

ATS

Earnings

Management Change

Guidance Update

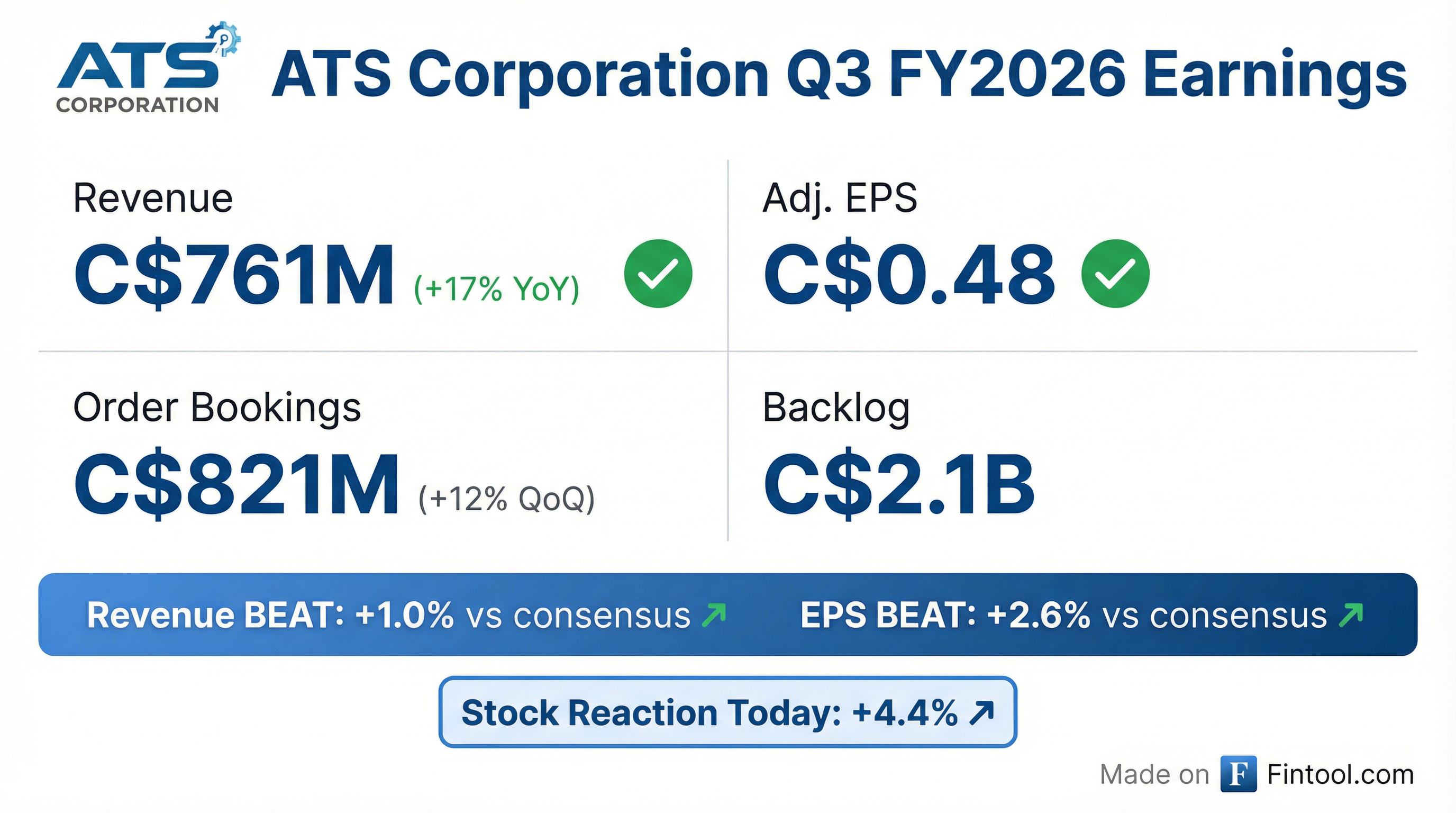

- ATS Corporation reported Q3 2026 revenues of $761 million, marking a 16.7% increase year-over-year, with adjusted earnings from operations at $79.9 million, up 21.6% from Q3 last year, and adjusted earnings per share of $0.48.

- Order bookings for Q3 2026 were $821 million, and the company concluded the quarter with an order backlog of approximately $2.1 billion.

- The company anticipates Q4 2026 revenues to be between $710 million and $750 million.

- Doug Wright has been appointed as the new Chief Executive Officer, and Anne Cybulski will assume the role of Interim Chief Financial Officer following Ryan McLeod's departure.

- New CEO Doug Wright outlined strategic priorities focusing on margin expansion through operational improvements and commercial actions, and disciplined capital deployment with a preference for M&A.

Feb 4, 2026, 1:30 PM

ATS Corporation Reports Q3 2026 Results and Updates Outlook

ATS

Earnings

Guidance Update

Management Change

- ATS Corporation reported Q3 2026 revenues of $761 million, a 16.7% increase year-over-year, and adjusted earnings from operations of $79.9 million, up 21.6%.

- Order bookings for Q3 2026 were $821 million, contributing to an order backlog of approximately $2.1 billion at quarter-end.

- The company anticipates Q4 2026 revenues to be between $710 million and $750 million.

- New CEO Doug Wright, who joined in mid-January, is prioritizing execution discipline, margin performance, and capital allocation, with a focus on M&A as leverage ratios are within the target range.

- Total restructuring costs are now projected at approximately CAD 20 million, an increase from the CAD 5.5 million incurred in Q3, aimed at further cost structure realignment.

Feb 4, 2026, 1:30 PM

ATS Corporation Reports Q3 2026 Results and New CEO Outlines Strategic Priorities

ATS

Earnings

CEO Change

Guidance Update

- Doug Wright, the new CEO, outlined his initial focus on execution discipline, margin performance, and capital allocation, emphasizing margin expansion and deploying capital towards M&A.

- For Q3 2026, ATS Corporation reported $761 million in revenues, a 16.7% increase compared to the previous year, and $0.48 adjusted earnings per share.

- Order bookings for the quarter were $821 million, and the company concluded the period with an order backlog of approximately $2.1 billion.

- The company expects Q4 revenues to be in the range of $710 million to $750 million.

- ATS updated its restructuring program, with total costs now anticipated to be approximately CAD 20 million.

Feb 4, 2026, 1:30 PM

ATS Corporation Reports Strong Q3 Fiscal 2026 Revenue Growth and Provides Q4 Guidance

ATS

Earnings

Guidance Update

Demand Weakening

- ATS Corporation reported Q3 fiscal 2026 revenues of $760.7 million, a 16.7% increase year over year, primarily driven by 12.6% organic revenue growth. Net income rose to $30.0 million (or $0.31 per basic share) from $6.5 million ($0.07 per basic share) in the prior year.

- Order Bookings for Q3 fiscal 2026 were $821 million, a decrease from $883 million a year ago, reflecting a 10.4% decrease in organic Order Bookings. The Order Backlog remained stable at $2,053 million as of December 28, 2025.

- Management provided Q4 fiscal 2026 revenue guidance in the range of $710 million to $750 million.

- The company's net debt to pro forma adjusted EBITDA ratio was 3.0 times at December 28, 2025, which is at the top end of its target range. Restructuring expenses of $5.5 million were recorded in the quarter, with total anticipated restructuring expenses of approximately $20 million for the fiscal year.

Feb 4, 2026, 12:10 PM

ATS Corporation Announces New Normal Course Issuer Bid

ATS

Share Buyback

- ATS Corporation announced a new Normal Course Issuer Bid (NCIB), accepted by the Toronto Stock Exchange, to repurchase up to 8,225,621 common shares.

- This quantity represents approximately 10% of the public float of 82,256,213 common shares outstanding as of December 10, 2025.

- The share repurchase program will commence on December 22, 2025, and is scheduled to end on or before December 21, 2026.

- Under the company's previous NCIB, which concluded on December 15, 2025, ATS repurchased and cancelled 308,758 common shares at a weighted average price of $32.39 per common share.

Dec 18, 2025, 2:18 PM

ATS Corporation Announces New CEO

ATS

CEO Change

Management Change

Board Change

- ATS Corporation announced the appointment of Doug Wright as its new Chief Executive Officer (CEO) and a member of its Board of Directors.

- Mr. Wright's appointment is effective on or before January 14, 2026.

- Prior to this role, Mr. Wright served as CEO of Indicor and President and CEO, Building Technologies, at Honeywell International.

- Ryan McLeod will continue as interim CEO until Mr. Wright joins, at which point he will return to his position as Chief Financial Officer.

Dec 17, 2025, 7:29 PM

ATS Corporation Reports Strong Q2 Fiscal Results and Strategic Outlook

ATS

Guidance Update

New Projects/Investments

Management Change

- ATS Corporation reported strong Q2 fiscal results, with 12% revenue growth in the first half of the year and a 13.5% increase in backlog year-over-year, reaffirming high single-digit revenue growth and margin expansion for the year.

- Key growth drivers include Life Sciences (with GLP-1 representing approximately 10% of total revenues and radiopharma expected to be a higher growth area) and Nuclear (driven by new builds and a significantly increased backlog of $280 million).

- The Transportation business is not expected to be a growth vertical for the next three to five years, with the company focusing on optimizing its performance and exploring adjacent industrial manufacturing opportunities.

- The company is targeting 15% EBITDA margins and aims to reduce leverage to below 3x by its fiscal year-end, supported by a recent $15 million restructuring program with savings reinvested into higher growth areas.

- The search for a permanent CEO is "well advanced," with the ideal candidate possessing a strong background in continuous improvement and M&A.

Nov 18, 2025, 3:40 PM

ATS Reports Strong Q2 2026 Results and Reaffirms Full-Year Guidance

ATS

Earnings

Guidance Update

New Projects/Investments

- ATS reported strong Q2 2026 results, with revenues of $729 million, up 19% year-over-year, and adjusted earnings from operations of $79.1 million, a 40% increase from the prior year.

- The company's order backlog stands at approximately $2.1 billion, providing good revenue visibility, and the trailing 12-month book-to-bill ratio remained healthy at 1.12 to 1.

- ATS expects Q3 revenues to be between $700 million and $740 million, reaffirming its full-year fiscal 2026 guidance for high single-digit revenue growth and adjusted operating margin improvement.

- A $15 million restructuring is planned for the second half of fiscal 2026 to realign cost structure and improve operational efficiencies, with an expected payback of less than one year.

- The company is actively working to reduce its net debt-to-adjusted EBITDA ratio from 3.4 times to its target range of 2-3 times by the end of the fiscal year.

Nov 5, 2025, 1:30 PM

ATS Reports Strong Q2 Fiscal 2026 Results and Provides Q3 Revenue Guidance

ATS

Earnings

Guidance Update

Management Change

- ATS Corporation reported robust financial performance for the second quarter of fiscal 2026, with revenues increasing 18.9% year over year to $728.5 million and net income reaching $33.6 million, a significant turnaround from a net loss of $0.9 million in the prior year.

- Basic earnings per share for the quarter were 34 cents, up from (1) cent a year ago, while adjusted basic earnings per share rose to 45 cents from 25 cents.

- The company's Order Backlog increased by 13.5% year over year, reaching $2,070 million as of September 28, 2025, which is expected to support future revenue generation.

- Ryan McLeod is currently serving as the Interim Chief Executive Officer.

- For the third quarter of fiscal 2026, management projects revenues to be between $700 million and $740 million.

Nov 5, 2025, 12:05 PM

Quarterly earnings call transcripts for ATS Corp /ATS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more