Earnings summaries and quarterly performance for AVIAT NETWORKS.

Executive leadership at AVIAT NETWORKS.

Board of directors at AVIAT NETWORKS.

Research analysts who have asked questions during AVIAT NETWORKS earnings calls.

SS

Scott Searle

ROTH MKM

7 questions for AVNW

Also covers: ADEA, AIOT, AIRG +22 more

Theodore O'Neill

Litchfield Hills Research

7 questions for AVNW

Also covers: ALHM, BELFA, CRNT +9 more

Tim Savageaux

Northland Capital Markets

6 questions for AVNW

Also covers: AAOI, ADTN, AIRG +18 more

Jaeson Schmidt

Lake Street Capital Markets

4 questions for AVNW

Also covers: AIRG, BHE, BKSY +15 more

Dave Kang

B. Riley Financial

2 questions for AVNW

Also covers: AAOI, ADTN, AXTI +2 more

Rustam Kanga

Citizens Capital Markets and Advisory

1 question for AVNW

Also covers: BLZE, KTOS, PENG +1 more

Recent press releases and 8-K filings for AVNW.

Aviat Networks Announces Q2 Fiscal 2026 Results and Fiscal 2026 Guidance

AVNW

Earnings

Guidance Update

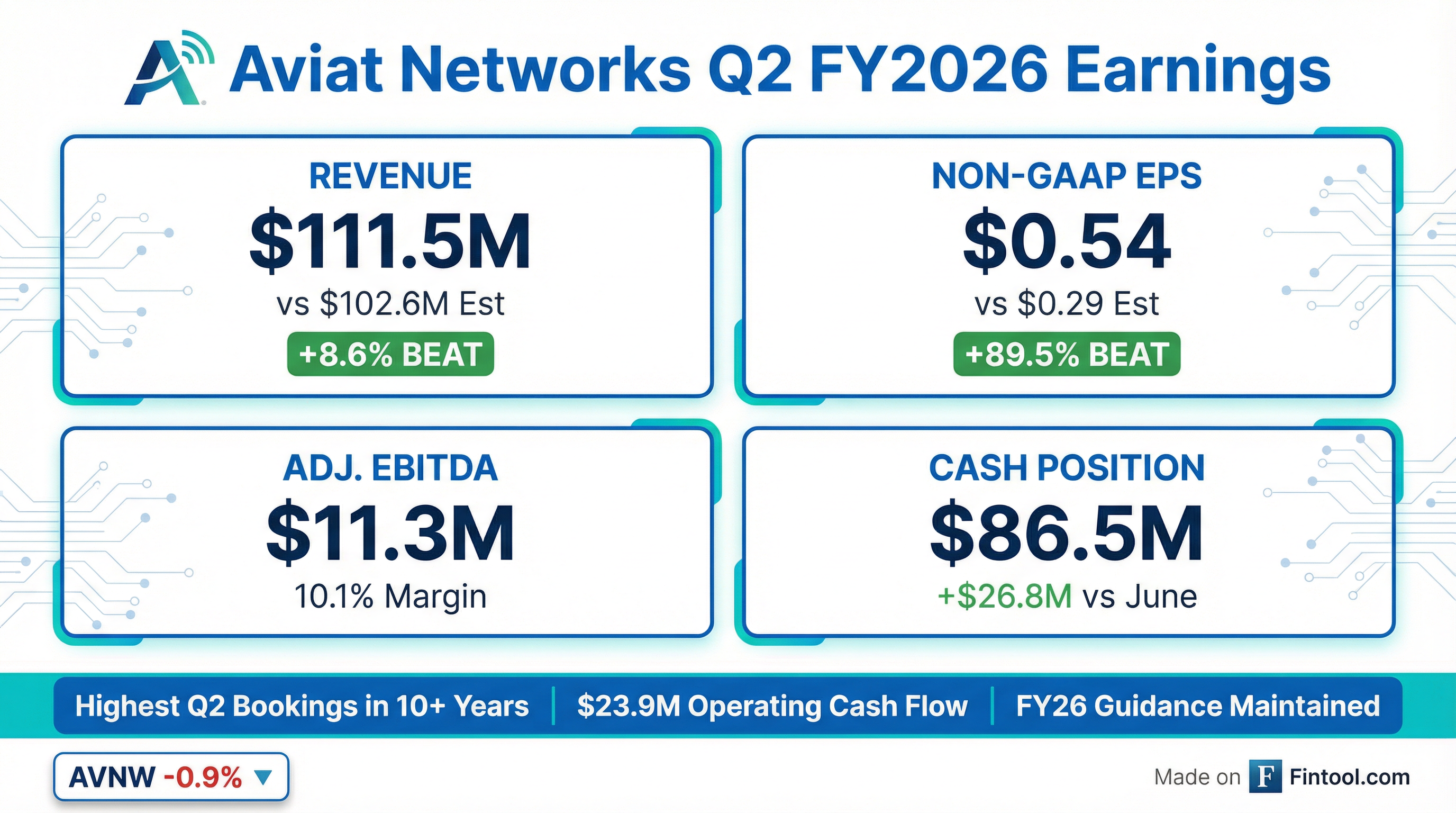

- Aviat Networks reported revenue of $111.5 million for Q2 Fiscal 2026, with Non-GAAP diluted earnings per share of $0.54 and Adjusted EBITDA of $11.3 million.

- For the six-month period ended December 26, 2025, revenues were $218.8 million, up 5.9% versus the year-ago period, and Adjusted EBITDA was $20.4 million, up 185%.

- The company provided Fiscal 2026 guidance for revenue between $440.0 to $460.0 million and Adjusted EBITDA between $45.0 to $55.0 million.

- As of Q2 Fiscal 2026, Cash and Cash Equivalents increased by $21.6 million to $86.5 million, with net debt at $18.9 million. Additionally, Unbilled Receivables were lowered by $20.1 million to $90.6 million, and Inventories were lowered by $7.4 million to $76.6 million.

Feb 3, 2026, 10:00 PM

Aviat Networks Reports Q2 2026 Results, Maintains Full-Year Guidance, and Announces Strategic Progress

AVNW

Earnings

Guidance Update

Product Launch

- Aviat Networks reported Q2 fiscal 2026 revenues of $111.5 million, Adjusted EBITDA of $11.3 million, and Non-GAAP EPS of $0.54, alongside positive cash generation from operations of $23.9 million.

- For the first half of fiscal 2026, total revenues increased by 5.9% to $218.8 million, and Adjusted EBITDA improved by $13.2 million to $20.4 million.

- The company maintained its fiscal 2026 guidance, projecting full-year revenues between $440 million and $460 million and Adjusted EBITDA between $45 million and $55 million.

- Aviat achieved its highest second-quarter bookings in 10 years, with a book-to-bill ratio over one, and announced initial orders for its new Aprisa LTE 5G router and multi-dwelling unit (MDU) solutions.

- The company anticipates reactivating its share buyback program, with approximately $6.5 million remaining on its authorization, and welcomed Andy Schmidt as the new Chief Financial Officer.

Feb 3, 2026, 10:00 PM

Aviat Networks Reports Q2 2026 Results, Maintains Full-Year Guidance, and Announces New CFO

AVNW

Earnings

Guidance Update

CFO Change

- Aviat Networks reported total revenues of $111.5 million and non-GAAP EPS of $0.54 for the second quarter of fiscal 2026, with adjusted EBITDA reaching $11.3 million.

- The company generated $23.9 million in cash from operations during Q2 2026, leading to a net debt position of $18.9 million, an improvement of $23 million from the prior quarter.

- Aviat achieved its highest second-quarter bookings in the last 10 years and reiterated its fiscal 2026 guidance for full-year revenues in the range of $440 million to $460 million and adjusted EBITDA between $45 million and $55 million.

- Strategic developments include receiving the first initial order for its Aprisa LTE 5G router and an initial purchase order for its multi-dwelling unit (MDU) solution.

- Andy Schmidt was introduced as the new Chief Financial Officer.

Feb 3, 2026, 10:00 PM

Aviat Networks Reports Q2 Fiscal 2026 Results, Maintains Guidance, and Announces Key Business Developments

AVNW

Earnings

Guidance Update

New Projects/Investments

- Aviat Networks reported Q2 fiscal 2026 total revenues of $111.5 million, non-GAAP EPS of $0.54, and Adjusted EBITDA of $11.3 million, with $23.9 million in positive cash generation from operations.

- The company maintained its fiscal year 2026 guidance, projecting revenues between $440 million and $460 million and Adjusted EBITDA between $45 million and $55 million.

- The quarter achieved the highest second quarter bookings in the last 10 years, and the company announced initial purchase orders for its multi-dwelling unit (MDU) solution and the Aprisa LTE 5G router.

- Andy Schmidt was appointed as the new Chief Financial Officer, and Aviat plans to reactivate its share buyback program with approximately $6.5 million remaining on authorization.

Feb 3, 2026, 10:00 PM

Aviat Networks Announces Fiscal 2026 Second Quarter and Six Month Financial Results

AVNW

Earnings

Guidance Update

Demand Weakening

- Aviat Networks reported total revenues of $111.5 million for its fiscal 2026 second quarter, a 5.7% decrease compared to the fiscal 2025 second quarter.

- GAAP net income for Q2 2026 was $5.7 million, with diluted earnings per share of $0.44.

- Adjusted EBITDA for the fiscal 2026 second quarter was $11.3 million, a decrease of $3.6 million from the prior year's second quarter.

- For the first six months of fiscal 2026, revenues increased 5.9% to $218.8 million compared to the same period in fiscal 2025.

- The company maintained its fiscal 2026 full-year guidance, projecting revenue between $440 and $460 million and Adjusted EBITDA between $45.0 and $55.0 million.

Feb 3, 2026, 9:06 PM

Aviat Networks Announces Fiscal 2026 Second Quarter and Six-Month Financial Results

AVNW

Earnings

Guidance Update

- Aviat Networks reported total revenues of $111.5 million for its fiscal 2026 second quarter ended December 26, 2025, with GAAP net income of $5.7 million and diluted earnings per share of $0.44.

- The company achieved Adjusted EBITDA of $11.3 million in the fiscal 2026 second quarter.

- For the six months ended December 26, 2025, revenue increased 5.9% to $218.8 million compared to the same period in fiscal 2025.

- GAAP net income increased by $13.3 million and Adjusted EBITDA expanded by $13.2 million in the first half of fiscal 2026 compared to the first half of fiscal 2025.

- Aviat Networks ended the quarter with $86.5 million in cash and cash equivalents as of December 26, 2025, and reiterated its fiscal 2026 full-year guidance for revenue between $440 and $460 million and Adjusted EBITDA between $45.0 and $55.0 million.

Feb 3, 2026, 9:05 PM

Aviat Networks Reports Q1 Fiscal 2026 Financial Results and Fiscal 2026 Guidance

AVNW

Earnings

Guidance Update

- Aviat Networks reported Q1 Fiscal 2026 revenue of $107.3 million, a 21.4% increase compared to the prior year period, with Non-GAAP earnings per share of $0.43 and Adjusted EBITDA of $9.1 million.

- The company provided Fiscal 2026 guidance, projecting revenue between $440.0 million and $460.0 million and Adjusted EBITDA between $45.0 million and $55.0 million.

- As of Q1 Fiscal 2026, Aviat Networks held $64.8 million in cash and marketable securities and a net debt position of $41.7 million, which further improved in Q2 Fiscal 2026 with an increased cash balance and decreased net debt.

Jan 13, 2026, 9:44 PM

Aviat Networks Appoints Andrew C. Schmidt as CFO

AVNW

CFO Change

Management Change

Hiring

- Aviat Networks, Inc. announced the appointment of Andrew C. Schmidt as Senior Vice President and Chief Financial Officer, effective immediately.

- Mr. Schmidt brings over 25 years of senior financial leadership, including more than 20 years as a public company CFO.

- His prior experience includes serving as CFO for Sientra, Inc., Iteris, Inc., and Smith Micro Software, Inc., with a background in public safety and software that aligns with Aviat's strategic goals.

Dec 3, 2025, 9:15 PM

Aviat Networks Secures First Commercial MDU Order and Updates on Growth Initiatives

AVNW

New Projects/Investments

Revenue Acceleration/Inflection

- Aviat Networks has secured its first commercial order for subscriber traffic in the Multi-Dwelling Unit (MDU) market, moving past the Proof of Concept (POC) phase. While revenue in the December quarter will not be material, a significant ramp-up is anticipated in 2025 and 2026, with commercial deployment expected in multiple markets.

- The company identifies strong growth drivers in public safety and utilities, which collectively represent 35-40% of its business and are experiencing mid-single-digit growth. Additional opportunities are seen in private networks and rural broadband.

- Regarding BEAD funding for rural broadband, Aviat Networks, previously pessimistic, is now encouraged, expecting spending to commence in the June or September quarter.

- Financially, Aviat Networks possesses over $450 million in Net Operating Losses (NOLs), which are expected to help minimize cash taxes for the foreseeable future. The company is also actively working to convert approximately $110 million in unbilled receivables into cash.

- Aviat Networks is addressing its material weakness in financial controls, having improved year-over-year, with the goal of full remediation by the end of the current fiscal year.

Nov 18, 2025, 9:30 PM

Aviat Networks Secures First Commercial MDU Order, Anticipates BEAD Funding, and Addresses Financial Controls

AVNW

New Projects/Investments

Revenue Acceleration/Inflection

Share Buyback

- Aviat Networks has secured its first commercial order for Multi-Dwelling Unit (MDU) broadband wireless, moving beyond proof-of-concept, with significant ramp-up anticipated from the back half of 2025 into 2026 and 2027.

- The company expects BEAD funding to commence spending in the June or September quarter, and it is actively engaged in project discussions with key customers.

- Aviat Networks holds over $450 million in Net Operating Losses (NOLs), providing a long runway for minimizing cash taxes, and is focused on reducing its $110 million in unbilled receivables to enhance cash generation.

- Progress is being made in remediating the company's material weakness in financial controls, with the aim of full resolution by the end of the current fiscal year.

- Growth opportunities are driven by public safety and utilities (comprising 35-40% of the business), private networks, and the expanding Huawei replacement cycle in Europe.

Nov 18, 2025, 9:30 PM

Quarterly earnings call transcripts for AVIAT NETWORKS.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more