Earnings summaries and quarterly performance for ANAVEX LIFE SCIENCES.

Executive leadership at ANAVEX LIFE SCIENCES.

Board of directors at ANAVEX LIFE SCIENCES.

Research analysts who have asked questions during ANAVEX LIFE SCIENCES earnings calls.

TB

Tom Bishop

H.C. Wainwright & Co.

10 questions for AVXL

Also covers: STRL

JS

Jesse Silveira

Spirit of the Coast Analytics

6 questions for AVXL

SR

Soumit Roy

JonesTrading

3 questions for AVXL

Also covers: CMRX, CRIS, DAWN +4 more

MO

Michael Obadiah

H.C. Wainwright

2 questions for AVXL

RS

Ram Selvaraju

H.C. Wainwright

2 questions for AVXL

Also covers: ABEO, ADXN, AXSM +11 more

Recent press releases and 8-K filings for AVXL.

Anavex Life Sciences Reports Q1 2026 Financials and Provides Regulatory/Pipeline Updates

AVXL

Earnings

New Projects/Investments

Guidance Update

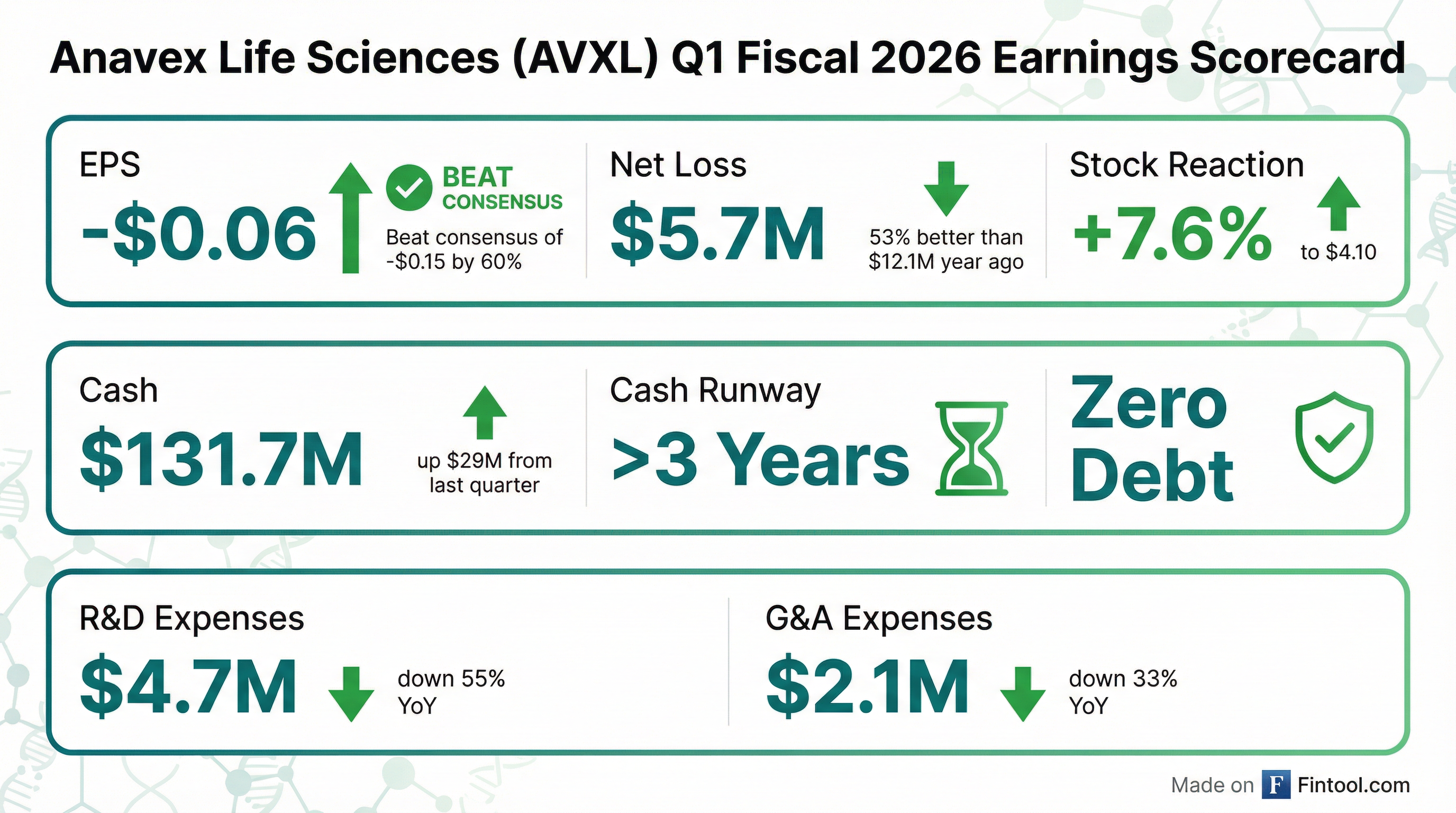

- Anavex Life Sciences reported a net loss of $5.7 million or $0.06 per share for Q1 2026, with a cash position of $131.7 million and a cash runway of more than three years.

- The company is undergoing an EMA re-examination process for blarcamesine's marketing authorization application, following a negative opinion in December, with this process expected to conclude in the first half of this year. Anavex also plans to submit existing Phase IIB/III data for blarcamesine to the FDA following a Type C meeting.

- Blarcamesine will be evaluated in a placebo-controlled clinical prediction study (AD006) as part of the European ACCESS-AD initiative, intended to confirm efficacy in early Alzheimer's disease for regulatory purposes.

- Anavex is advancing Anavex 3-71 towards pivotal clinical studies for schizophrenia-related disorders and planning new blarcamesine studies for Parkinson's disease and Fragile X syndrome.

Feb 9, 2026, 1:30 PM

Anavex Life Sciences Reports Q1 2026 Financials and Provides Regulatory Updates

AVXL

Earnings

New Projects/Investments

Guidance Update

- Anavex Life Sciences reported a cash position of $131.7 million with no debt as of December 31st, and anticipates a cash runway of over three years at the current utilization rate.

- Following a negative opinion from the CHMP in December regarding blarcamesine, Anavex requested the EMA to re-examine its marketing authorization application, with this process expected to conclude in the first half of 2026.

- The company received feedback from an FDA Type C meeting in January concerning blarcamesine's development plans for Alzheimer's disease and intends to submit existing data from the Phase IIB/III program to the FDA.

- Blarcamesine will be evaluated in a clinical prediction study as part of the European ACCESS-AD initiative, which aims to accelerate the adoption of innovative Alzheimer's disease approaches.

Feb 9, 2026, 1:30 PM

Anavex Life Sciences Reports Q1 2026 Financials and Provides Regulatory Updates

AVXL

Earnings

Guidance Update

New Projects/Investments

- Anavex Life Sciences reported a net loss of $5.7 million or $0.06 per share for Q1 2026, with a cash position of $131.7 million and a cash runway of more than three years.

- The company is undergoing a re-examination process with the EMA for blarcamesine, expected to conclude in the first half of 2026, and plans to submit existing phase IIB/III data to the FDA for early Alzheimer's disease.

- Blarcamesine will be further evaluated in a new placebo-controlled clinical prediction study (AD006) as part of the ACCESS-AD European initiative, intended to confirm efficacy for regulatory purposes.

- Anavex is also advancing ANAVEX3-71 towards pivotal clinical studies for schizophrenia-related disorders and planning new trials for Parkinson's disease and Fragile X.

Feb 9, 2026, 1:30 PM

Anavex Life Sciences Reports Fiscal Q1 2026 Financial Results and Business Updates

AVXL

Earnings

Management Change

New Projects/Investments

- Anavex Life Sciences Corp. reported a net loss of $5.7 million, or $0.06 per share, for the first quarter of fiscal 2026, compared to a net loss of $12.1 million, or $0.14 per share, for the comparable quarter of fiscal 2025.

- The company's cash and cash equivalents totaled $131.7 million at December 31, 2025, up from $102.6 million at September 30, 2025, with an anticipated cash runway of more than 3 years at its current utilization rate.

- In regulatory developments for blarcamesine in early Alzheimer's disease, Anavex received feedback from an FDA Type C meeting indicating interest in its development plans, while the CHMP in Europe adopted a negative opinion on the marketing authorization application, which the company has requested to be re-examined.

- On January 8, 2026, Wolfgang Liedtke, MD PhD, was appointed Senior Vice President, Global Head of Neurology.

Feb 9, 2026, 12:31 PM

Anavex Life Sciences Reports Fiscal Q1 2026 Financial Results and Business Updates

AVXL

Earnings

Management Change

New Projects/Investments

- Anavex Life Sciences reported cash and cash equivalents of $131.7 million as of December 31, 2025, with an anticipated cash runway of more than 3 years.

- For the first quarter of fiscal 2026, the company recorded a net loss of $5.7 million, or $0.06 per share, and Research and development expenses of $4.7 million.

- The company received feedback from an FDA Type C meeting regarding potential pathways for a New Drug Application (NDA) for blarcamesine in Alzheimer's disease and requested the EMA to re-examine its negative opinion on the marketing authorization application for blarcamesine in early Alzheimer's disease.

- Anavex announced the appointment of Wolfgang Liedtke, MD PhD, as Senior Vice President, Global Head of Neurology.

Feb 9, 2026, 12:30 PM

Anavex Life Sciences Presents Positive Blarcamesine Alzheimer's Data and Regulatory Pathway Update

AVXL

New Projects/Investments

Revenue Acceleration/Inflection

- Anavex Life Sciences' lead asset, blarcamesine, a once-daily oral treatment for Alzheimer's disease, demonstrated significant cognitive benefit in its Phase IIb/III study, including a 36.3% benefit at 48 weeks and up to 49.8% in a pre-specified patient population, alongside a solid safety profile.

- In a specific genetically defined cohort, blarcamesine showed an 84.7% clinical benefit over placebo, with patients potentially gaining up to 18 months of sustained functional benefit.

- The company is actively pursuing marketing authorization, with the EMA re-examination process for blarcamesine for Alzheimer's disease commencing in Q1 2026.

- Anavex maintains a strong financial position with approximately $120 million in cash, providing over three years of runway without debt, and has IP protection for its lead candidates until 2040.

- Beyond Alzheimer's, Anavex is advancing a broad pipeline including studies for Parkinson's disease, Fragile X syndrome, and Anavex 3-71 for schizophrenia.

Jan 15, 2026, 12:30 AM

Anavex Life Sciences Provides Update on Blarcamesine Clinical Progress and Pipeline Expansion

AVXL

Product Launch

New Projects/Investments

Guidance Update

- Anavex Life Sciences reported positive Phase 2b/3 study results for its lead asset, blarcamesine, in Alzheimer's disease, demonstrating a 36.3% slowing of cognitive decline (up to 49.8% in a pre-specified population) at 48 weeks, along with a solid safety profile.

- The company is actively engaged in discussions with regulatory agencies to determine pathways for marketing authorization of blarcamesine, with the EMA re-examination process for Alzheimer's disease commencing in Q1 2026.

- Blarcamesine, a once-daily oral small molecule, showed 84.7% clinical benefit compared to placebo in a genetically defined cohort and provided up to 18 months of sustained patient benefit by maintaining functionality and independence compared to a natural history study.

- Anavex maintains a strong financial position with approximately $120 million in cash, providing over three years of cash runway without debt, and holds IP protection until 2040 for its product candidates.

- The company is expanding its pipeline, planning larger trials for Parkinson's disease and Fragile X syndrome in 2026, and advancing Anavex 371 for schizophrenia after solid Phase 2 data.

Jan 15, 2026, 12:30 AM

Anavex Life Sciences Presents Blarcamesine Alzheimer's Data and Pipeline Expansion at J.P. Morgan Conference

AVXL

New Projects/Investments

Product Launch

- Anavex Life Sciences' lead asset, blarcamesine, a once-daily oral small molecule for Alzheimer's disease, demonstrated significant slowing of cognitive decline in its Phase 2b/3 study, showing a 36.3% benefit at 48 weeks and up to 49.8% in a pre-specified patient population, with a solid safety profile.

- The company is actively engaged in regulatory discussions, with the most advanced being a re-examination process with the EMA for blarcamesine for Alzheimer's disease, scheduled to commence in the first quarter of 2026.

- Blarcamesine's clinical data highlighted an 84.7% clinical benefit compared to placebo in a specific genetically defined cohort and showed significant improvement in quality of life for APOE4 patients, with the advantage of being an oral treatment requiring no PET, MRI, or lumbar puncture.

- Anavex is expanding its pipeline with plans for larger studies in Parkinson's disease and Fragile X syndrome in 2026, and maintains a strong financial position with approximately $120 million in cash and no debt, providing over three years of cash runway and IP protection until 2040.

Jan 15, 2026, 12:30 AM

Anavex Life Sciences Receives FDA Feedback on Alzheimer’s Disease Program

AVXL

New Projects/Investments

- The U.S. Food and Drug Administration (FDA) invited Anavex Life Sciences to present its Alzheimer's disease clinical trial results, reflecting the Agency’s interest in the company’s development efforts.

- During a Type C meeting, the FDA discussed potential pathways to support a New Drug Application (NDA) for the treatment of Alzheimer’s disease.

- Anavex committed to submitting existing data from its Phase IIb/III ANAVEX2-73-AD-004 program to the FDA as requested.

- The company's lead drug candidate, blarcamesine (ANAVEX®2-73), has successfully completed Phase 2a and Phase 2b/3 clinical trials for Alzheimer's disease.

Jan 6, 2026, 12:30 PM

Anavex Life Sciences Requests EMA Re-Examination for Blarcamesine Opinion

AVXL

Product Launch

New Projects/Investments

- Anavex Life Sciences Corp. (AVXL) has requested the European Medicines Agency (EMA) to re-examine its opinion regarding blarcamesine for the treatment of early Alzheimer's disease.

- The re-examination procedure will involve a new evaluation by a different rapporteur and co-rapporteur, and Anavex has also asked the EMA to consult a Scientific Advisory Group for an independent recommendation.

- Blarcamesine (ANAVEX®2-73), Anavex's lead drug candidate, has successfully completed Phase 2a and Phase 2b/3 clinical trials for Alzheimer's disease.

Dec 18, 2025, 12:30 PM

Quarterly earnings call transcripts for ANAVEX LIFE SCIENCES.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more