Earnings summaries and quarterly performance for Axogen.

Executive leadership at Axogen.

Board of directors at Axogen.

Research analysts who have asked questions during Axogen earnings calls.

Michael Sarcone

Jefferies

6 questions for AXGN

Jayson Bedford

Raymond James

5 questions for AXGN

Caitlin Cronin

Canaccord Genuity

4 questions for AXGN

David Turkaly

Citizens JMP

4 questions for AXGN

Frank Takkinen

Lake Street Capital Markets

4 questions for AXGN

Chris Pasquale

Nephron Research LLC

3 questions for AXGN

Christopher Pasquale

Nephron Research

3 questions for AXGN

Ross Osborn

Cantor Fitzgerald

3 questions for AXGN

Anthony Petrone

Mizuho Group

2 questions for AXGN

Caitlin Roberts

Canaccord Genuity

2 questions for AXGN

Michael Kratky

Leerink Partners

2 questions for AXGN

Mike Kratky

Leerink Partners

2 questions for AXGN

Simran Kaur

Wells Fargo & Company

2 questions for AXGN

Brett Gasaway

Leerink Partners

1 question for AXGN

Jason Bedford

Raymond James & Associates, Inc.

1 question for AXGN

Matthew Park

Cantor Fitzgerald

1 question for AXGN

Mike Craky

H.C. Wainwright & Co., LLC

1 question for AXGN

Recent press releases and 8-K filings for AXGN.

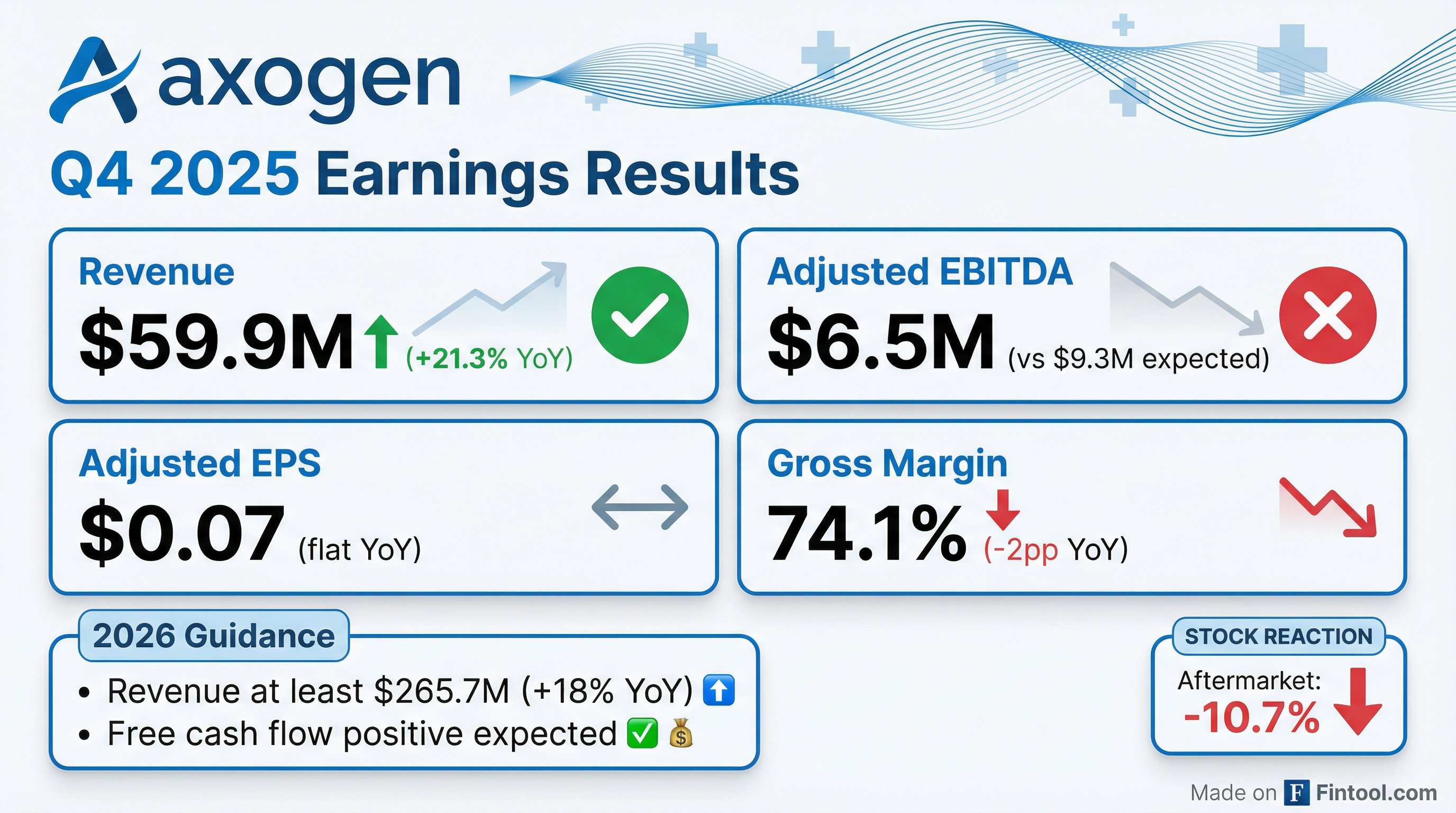

- AxoGen reported strong financial results for Q4 and full year 2025, with Q4 revenue of $59.9 million (up 21.3% year-over-year) and full year revenue of $225.2 million (up 20.2% compared to 2024). The full year adjusted EBITDA grew 41% to $27.9 million, with an adjusted EBITDA margin of 12.4%.

- A significant milestone was achieved in December 2025 with the FDA approval of the Biologics License Application for Avance, establishing it as the first and only FDA-approved biologic therapeutic for peripheral nerve discontinuities with 12 years of market exclusivity.

- The company strengthened its financial position by completing an upsized public offering, raising $133.3 million in net proceeds, and used $69.7 million to fully retire its term loan facility. AxoGen's cash position increased by $6 million to $45.5 million as of December 31, 2025.

- For 2026, AxoGen expects revenue growth of at least 18% (total revenue of at least $265.7 million), anticipates a gross margin in the range of 74%-76%, and projects to be free cash flow positive for the full year.

- AxoGen reported strong financial performance for Q4 2025, with revenue of $59.9 million (up 21.3% year-over-year), and full year 2025 revenue of $225.2 million (up 20.2% from 2024). Full year Adjusted EBITDA grew 41% to $27.9 million, and the company's cash position increased by $6 million to $45.5 million.

- A significant strategic achievement was the FDA approval of the Biologics License Application (BLA) for Avance in December 2025, making it the first and only FDA-approved biologic therapeutic for peripheral nerve discontinuities with 12 years of market exclusivity.

- The company enhanced its financial flexibility by completing an upsized public offering that raised $133.3 million in net proceeds, using $69.7 million to fully retire its term loan facility. For 2026, AxoGen expects revenue growth of at least 18% (totaling at least $265.7 million), a gross margin of 74%-76%, and anticipates being free cash flow positive.

- AxoGen delivered strong financial performance in Q4 and full year 2025, with Q4 revenue of $59.9 million, representing 21.3% growth year-over-year, and full year revenue of $225.2 million, up 20.2% compared to 2024.

- The company achieved a significant milestone in December 2025 with the FDA approval of the Biologics License Application for Avance, establishing it as the first and only FDA-approved biologic therapeutic for peripheral nerve discontinuities with 12 years of market exclusivity.

- AxoGen's full year 2025 adjusted EBITDA grew 41% to $27.9 million, and its cash position increased by $6 million to $45.5 million as of December 31, 2025.

- The company strengthened its capital structure by completing an upsized public offering, raising $133.3 million in net proceeds, and used $69.7 million to fully retire its term loan facility.

- For full year 2026, AxoGen expects revenue growth of at least 18%, targeting total revenue of at least $265.7 million, with a gross margin range of 74%-76%, and anticipates being free cash flow positive.

- AXGN reported Q4 2025 revenue of $59.9 million, an increase of 21.3% year-over-year, and full-year 2025 revenue of $225.2 million, up 20.2% year-over-year.

- For Q4 2025, Adjusted EBITDA was $6.5 million and Adjusted Diluted EPS was $0.07, while full-year 2025 saw Adjusted EBITDA of $27.9 million and Adjusted Diluted EPS of $0.29. These results were achieved despite significant one-time stock-based compensation costs related to the Avance® FDA Biologics License Application (BLA) approval.

- The company provided 2026 guidance, projecting revenue growth of at least 18% to $265.7 million, a gross margin of 74% to 76%, and net free cash flow positive.

- A key achievement was the FDA approval of Avance®, establishing it as the first and only FDA-approved biologic for peripheral nerve repair and granting 12 years of U.S. market exclusivity.

- AXGN also strengthened its capital structure by raising $133.3 million and retiring a $69.7 million term loan.

- Axogen, Inc. reported full-year 2025 revenue of $225.2 million, marking a 20.2% increase compared to 2024.

- For the fourth quarter of 2025, the company recorded a net loss of $13.2 million or $0.28 per share, while adjusted net income was $3.5 million or $0.07 per share.

- The FDA approved the Biologics License Application (BLA) for Avance® on December 3, 2025.

- On January 23, 2026, Axogen closed an upsized public offering, generating $133.3 million in net proceeds, with $69.7 million used to fully repay its Oberland loan facility.

- For full-year 2026, the company projects revenue growth of at least 18%, targeting $265.7 million, and expects to be free cash flow positive.

- Axogen, Inc. announced an upsized public offering of 4,000,000 shares of its common stock at a price of $31.00 per share.

- The gross proceeds from the offering are expected to be approximately $124 million, before underwriting discounts and commissions and assuming no exercise of the underwriters' option.

- Axogen granted the underwriters a 30-day option to purchase up to an additional 600,000 shares of common stock.

- The net proceeds from the offering are intended for the early payoff and termination of its term loan facility with Oberland Capital, working capital, capital expenditures, and other general corporate purposes.

- The offering is expected to close on January 23, 2026.

- Axogen, Inc. (Nasdaq: AXGN) announced the pricing of an upsized underwritten public offering of 4,000,000 shares of its common stock at $31.00 per share.

- The gross proceeds to Axogen from the proposed offering are expected to be approximately $124 million, assuming no exercise of the underwriters’ option to purchase additional shares.

- The proposed offering is expected to close on January 23, 2026.

- Axogen intends to use the net proceeds from the offering for early payoff and termination of its term loan facility with Oberland Capital, working capital, capital expenditures, and other general corporate purposes.

- Axogen, Inc. announced its intent to offer and sell $85.0 million of shares of its common stock in a proposed underwritten public offering, with an option for underwriters to purchase an additional $12.75 million.

- The company plans to use the net proceeds for the early payoff and termination of its term loan facility with Oberland Capital, working capital, capital expenditures, and other general corporate purposes.

- The proposed offering is being made pursuant to an automatic shelf registration statement on Form S-3ASR that became effective on January 21, 2026.

- AxoGen announced the completion of the Biologics License Application (BLA) approval for its Avance Nerve Graft in December, establishing it as the first-of-its-kind approved biologic therapeutic solution for nerve discontinuities.

- The company projects 15%-20% annual growth over its strategic planning period, an acceleration from past performance, and has achieved operational leverage, positive cash flow, and profitability. Post-BLA, it anticipates a 75% plus gross margin business.

- Strategic market expansion includes high double-digit growth in breast reconstruction and the development of prostate as a new market application, with clinical signals expected in the second half of 2026.

- Reimbursement efforts have added almost 20 million covered lives last year, and a new CMS level three code for outpatient nerve procedures, effective January 1st, 2026, is expected to make these procedures more economical.

- AxoGen recently achieved Biologics License Application (BLA) approval for its Avance Nerve Graft in December, transitioning it from a device regulatory status to the first-of-its-kind approved biologic therapeutic solution for nerve discontinuities. This is expected to aid in payer engagement and enable more aggressive clinical studies.

- The company projects 15%-20% annual growth over its strategic planning period, an acceleration from the previous five years' 15% growth. This growth is primarily driven by volume.

- AxoGen has reached a financial inflection point, achieving operational leverage, positive cash flow, and profitability. Post-BLA, they anticipate becoming a 75% plus gross margin business, with further improvements expected in 2027.

- Key market developments include a new prostate application with clinical signals expected in the second half of 2026 , and the breast reconstruction (Resensation) business, which is a high double-digit growth area with a 70%-90% addressable market.

- Reimbursement progress includes adding almost 20 million covered lives in the last year and the introduction of a new Level III CMS code for outpatient nerve procedures starting January 1, 2026, which is expected to make these procedures more economical.

Quarterly earnings call transcripts for Axogen.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more