Earnings summaries and quarterly performance for Bank of Marin Bancorp.

Executive leadership at Bank of Marin Bancorp.

Timothy D. Myers

President and Chief Executive Officer

Brandi Campbell

Head of Retail Banking

David Bloom

Head of Commercial Banking

David Bonaccorso

Chief Financial Officer

Misako Stewart

Chief Credit Officer

Robert Gotelli

Director of Human Resources

Sathis Arasadi

Chief Information Officer

Board of directors at Bank of Marin Bancorp.

Brian M. Sobel

Director

Charles D. Fite

Director

Cigdem F. Gencer

Director

James C. Hale

Director

Joel Sklar, MD

Director

Kevin R. Kennedy

Director

Nicolas C. Anderson

Director

Russell A. Colombo

Director

Secil Tabli Watson

Director

Research analysts who have asked questions during Bank of Marin Bancorp earnings calls.

Jeff Rulis

D.A. Davidson & Co.

10 questions for BMRC

David Feaster

Raymond James

8 questions for BMRC

Andrew Terrell

Stephens Inc.

7 questions for BMRC

Matthew Clark

Piper Sandler

7 questions for BMRC

Woody Lay

Keefe, Bruyette & Woods (KBW)

7 questions for BMRC

Timothy Coffey

Janney Montgomery Scott LLC

5 questions for BMRC

Adam Butler

Piper Sandler

3 questions for BMRC

Tim Coffey

Janney Montgomery Scott

2 questions for BMRC

Wood Lay

Keefe, Bruyette & Woods

1 question for BMRC

Recent press releases and 8-K filings for BMRC.

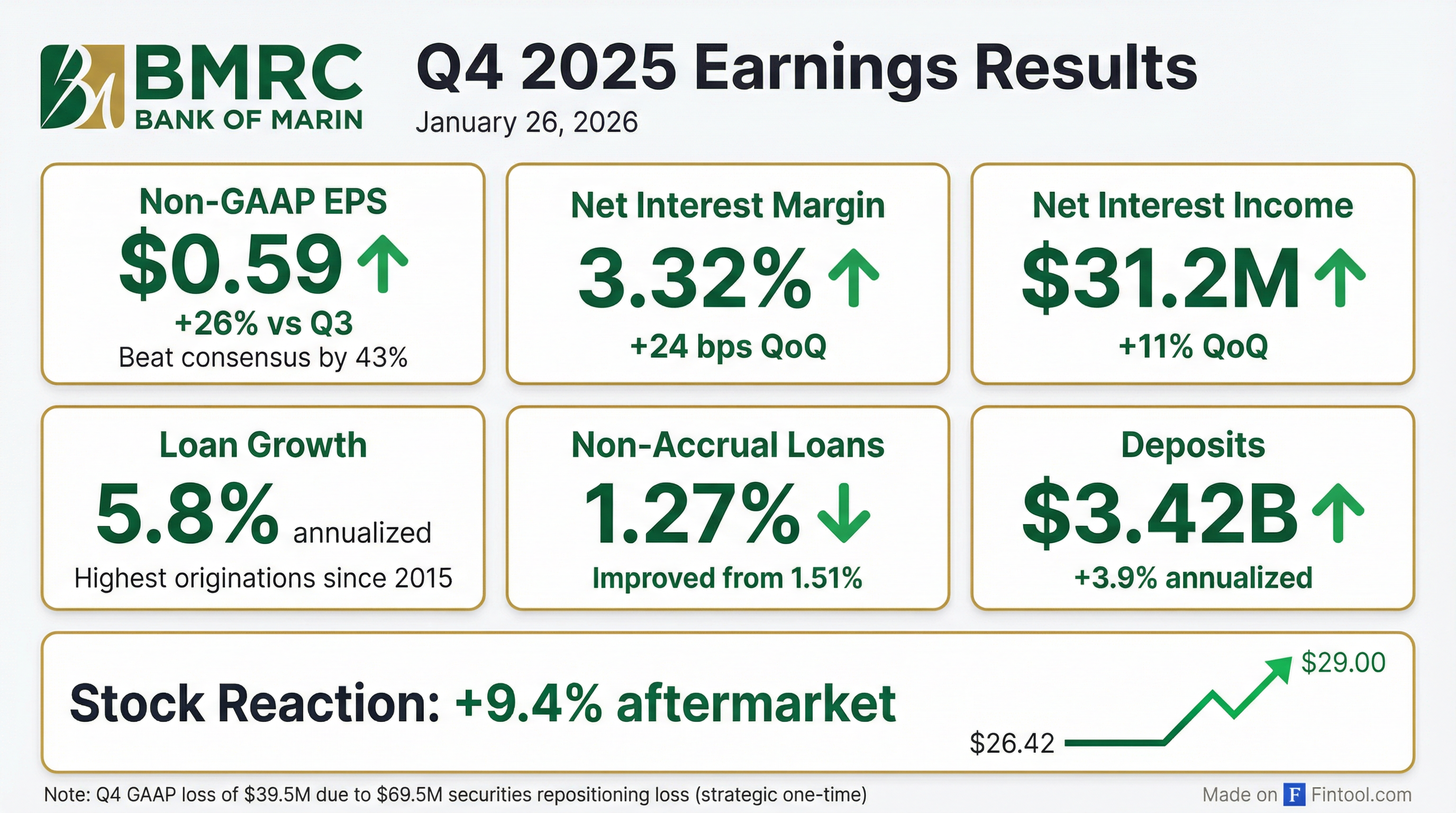

- Bank of Marin Bancorp reported strong loan growth in Q4 2025, with newly funded loans reaching $106.5 million, the highest since Q4 2015, contributing to a 5.84% annualized increase in total loans, while credit quality improved with non-accrual loans decreasing to 1.27% of total loans and classified loans decreasing to 1.51% of total loans.

- The company completed a strategic repositioning of its HTM securities portfolio, selling $593.2 million in securities at a pre-tax loss of $69.5 million, but redeploying proceeds into securities at a higher yield of 4.26% and issuing $45 million in subordinated debt to replenish capital, maintaining a Bancorp total risk-based capital of 15.25% and tangible common equity ratio of 8.35% at year-end 2025.

- The tax-equivalent net interest margin increased 24 basis points to 3.32% in Q4 2025, primarily driven by the securities repositioning, and the cost of deposits decreased 10 basis points to 1.19%.

- While GAAP net loss was $(39,541) thousand and diluted EPS was $(2.49) for Q4 2025 due to the securities sale, comparable non-GAAP net income was $9,391 thousand and diluted EPS was $0.59, reflecting a 31% sequential improvement in pre-tax pre-provision net income on a non-GAAP basis.

- Bank of Marin Bancorp reported a net loss of $39.5 million, or $2.49 per share, in Q4 2025, primarily due to a $69 million loss from a securities portfolio repositioning.

- Excluding the securities loss, non-GAAP net income was $9.4 million, or $0.59 per share. This balance sheet restructuring is expected to yield $0.40 of earnings per share accretion and a 25 basis point net interest margin lift over 12 months.

- The company achieved strong loan originations of $141 million in Q4 2025, with $106 million funded, marking one of its best quarters in a decade. Total deposits also increased, and the cost of deposits decreased by 10 basis points.

- Credit quality improved significantly, with classified loans declining 35% quarter-over-quarter to 1.5% of total loans, and non-accrual loans decreasing 14% to 1.3% of total loans.

- The Board of Directors declared a cash dividend of $0.25 per share. The company anticipates solid loan growth in 2026, targeting mid-single digit net growth.

- Bank of Marin Bancorp reported a net loss of $39.5 million, or $2.49 per share, in Q4 2025, primarily due to a $69 million loss from a securities portfolio repositioning. On a non-GAAP basis, net income was $9.4 million, or $0.59 per share.

- A balance sheet restructuring completed in Q4 2025 is expected to yield approximately $0.40 of earnings per share accretion and 25 basis points of net interest margin lift over a 12-month period.

- The company achieved strong loan originations of $141 million in Q4 2025, with $106 million funded, predominantly in commercial loans, and total deposits increased while the cost of deposits was reduced by 10 basis points.

- Credit quality improved significantly, with classified loans declining 35% quarter-over-quarter to 1.5% of total loans, and non-accrual loans decreasing 14% to 1.3% of total loans.

- The Board of Directors declared a cash dividend of $0.25 per share on January 22nd, 2026.

- Bank of Marin Bancorp reported a net loss of $39.5 million, or $2.49 per share, for Q4 2025, primarily due to a $69 million loss from a securities portfolio repositioning. On a non-GAAP basis, net income was $9.4 million, or $0.59 per share.

- The balance sheet restructuring is expected to generate approximately $0.40 of earnings per share accretion and a 25 basis point net interest margin lift over a 12-month period.

- The company achieved robust loan originations of $141 million in Q4 2025, contributing to $374 million in new loans for the full year 2025, a 79% increase from the prior year. Total deposits increased in Q4, and the cost of deposits was reduced by 10 basis points.

- Credit quality showed significant improvement, with classified loans declining 35% quarter-over-quarter to 1.5% of total loans and non-accrual loans decreasing 14% to 1.3% of total loans. The allowance for credit losses remains strong at 1.42% of total loans.

- Management anticipates solid loan growth in 2026, targeting mid-single digit production, and the board declared a cash dividend of $0.25 per share.

- Bank of Marin Bancorp reported a GAAP net loss of $39.5 million and diluted loss per share of $2.49 for the fourth quarter of 2025, primarily due to $69.5 million in pre-tax losses on the sale of securities as part of a balance sheet repositioning. Excluding these losses, non-GAAP net income was $9.4 million and diluted earnings per share was $0.59 for the quarter.

- The company completed a balance sheet repositioning, reclassifying $816.6 million in held-to-maturity securities to available-for-sale and selling $593.2 million of these, which is expected to increase annualized net interest margin by 25 basis points and annual EPS by $0.40.

- Loans increased by $30.5 million (5.84% annualized) and deposits grew by $33.0 million (3.88% annualized) in Q4 2025, with non-interest bearing deposits comprising 43.7% of total deposits.

- The tax-equivalent net interest margin expanded by 24 basis points to 3.32% in Q4 2025 from 3.08% in the prior quarter. Asset quality also strengthened, with non-accrual loans decreasing to 1.27% of total loans and classified loans to 1.51% of total loans.

- Bank of Marin Bancorp reported a GAAP net loss of $39.5 million and diluted loss per share of $2.49 for the fourth quarter of 2025, primarily due to $69.5 million in pre-tax losses from a balance sheet repositioning.

- On a non-GAAP basis, excluding these losses, net income for Q4 2025 was $9.4 million (a 25% increase from the prior quarter) and diluted earnings per share was $0.59. Full-year 2025 non-GAAP net income increased 82% to $26.5 million.

- The balance sheet repositioning, which involved selling $593.2 million in available-for-sale securities, is projected to yield a 25 basis point increase in annualized net interest margin and $0.40 in annual earnings per share accretion. The tax-equivalent net interest margin improved 24 basis points to 3.32% in Q4 2025.

- The company experienced significant growth in Q4 2025, with loans increasing by $30.5 million (5.84% annualized) to $2.121 billion and deposits increasing by $33.0 million (3.88% annualized) to $3.416 billion.

- Capital ratios remained robust, with Bancorp's total risk-based capital ratio at 15.25% and the Bank's at 13.90% as of December 31, 2025, both exceeding well-capitalized regulatory thresholds. A cash dividend of $0.25 per share was declared on January 22, 2026.

- Bank of Marin Bancorp reported net income of $7.5 million and diluted earnings per share of $0.47 for the third quarter of 2025.

- The company's tax-equivalent net interest margin increased to 3.08% in Q3 2025.

- Capital levels remained robust, with a Bancorp total risk-based capital of 16.13% and a tangible common equity to total assets ratio of 9.7% as of September 30, 2025.

- Asset quality showed improvement, as non-accrual loans decreased to 1.51% of total loans and classified loans decreased to 2.36% of total loans in Q3 2025.

- The company repurchased $1.1 million in shares during Q3 2025 and saw total deposits increase by $137.5 million.

- Bank of Marin Bancorp (BMRC) has completed a balance sheet repositioning, reclassifying its entire held-to-maturity (HTM) securities portfolio to available-for-sale (AFS). This action is estimated to result in a $59 million after-tax negative adjustment to equity as of October 31, 2025.

- As part of the repositioning, BMRC sold $595 million book value of securities at a pre-tax loss of $69.5 million and is reinvesting the proceeds into lower effective duration securities.

- The repositioning was supported by a $45 million private placement of 6.750% Fixed-to-Floating Rate Subordinated Notes due 2035, which received an investment grade rating of BBB- from KBRA.

- The company expects this initiative to generate $8.3 million in incremental pre-tax income and an annual earnings per share increase of $0.37.

- For Q3 2025, BMRC reported net income of $7.5 million and diluted EPS of $0.47, with total assets of $3.9 billion and a total risk-based capital ratio of 16.13% as of September 30, 2025.

- Bank of Marin Bancorp reported net income of $7.5 million and diluted EPS of $0.47 for Q3 2025. The tax-equivalent net interest margin increased to 3.08% from 2.93% in the prior quarter.

- As of September 30, 2025, the company had $3.9 billion in total assets and a market capitalization of $390.8 million. Total deposits increased by $137.5 million in Q3, with non-interest bearing deposits representing 43.1% of the total.

- The Bancorp maintained strong capital levels with a total risk-based capital ratio of 16.13% and a tangible common equity to tangible assets ratio of 9.7%.

- Credit quality improved, with non-accrual loans decreasing to 1.51% of total loans and classified loans decreasing to 2.36% of total loans in Q3 2025.

- In Q3 2025, the company repurchased $1.1 million in shares at an average price of $22.33 per share. President and CEO Tim Myers and EVP and CFO David Bonaccorso are scheduled to participate in the Keefe Bruyette & Woods Virtual West Coast Bank Field Trip on November 20, 2025.

- Bank of Marin Bancorp reported net income of $7.5 million, or $0.47 per share, for Q3 2025, representing a 65% increase compared to Q3 2024. Pre-tax pre-provision net income also increased 28% sequentially.

- The company achieved $101 million in total loan originations, with $69 million in fundings, marking the largest since Q2 2022, and experienced an increase in total deposits.

- Net interest income rose to $28.2 million, driven by a 17 basis point increase in asset yield. The spot cost of deposits declined 4 basis points to 1.25% by quarter-end, with expectations for further net interest margin expansion in a falling rate environment.

- Capital ratios remain strong, with a total risk-based capital ratio of 16.13% and a TCE ratio of 9.72%. The company repurchased $1.1 million in shares and declared a cash dividend of $0.25 per share.

- No provision for credit losses was required in Q3 2025 due to improved asset quality, and the allowance for credit losses remains strong at 1.43% of total loans.

Quarterly earnings call transcripts for Bank of Marin Bancorp.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more