Earnings summaries and quarterly performance for CARDINAL HEALTH.

Executive leadership at CARDINAL HEALTH.

Jason M. Hollar

Chief Executive Officer

Aaron E. Alt

Chief Financial Officer

Deborah L. Weitzman

Chief Executive Officer, Pharmaceutical and Specialty Solutions Segment

Jessica L. Mayer

Chief Legal and Compliance Officer

Stephen M. Mason

Chief Executive Officer, Global Medical Products and Distribution Segment

Board of directors at CARDINAL HEALTH.

Akhil Johri

Director

Christine A. Mundkur

Director

David C. Evans

Director

Gregory B. Kenny

Independent Chairman of the Board

Michelle M. Brennan

Director

Nancy Killefer

Director

Patricia A. Hemingway Hall

Director

Robert W. Azelby

Director

Robert W. Musslewhite

Director

Sheri H. Edison

Director

Sudhakar Ramakrishna

Director

Research analysts who have asked questions during CARDINAL HEALTH earnings calls.

Allen Lutz

Bank of America

8 questions for CAH

Daniel Grosslight

Citigroup

8 questions for CAH

Eric Percher

Nephron Research

8 questions for CAH

Erin Wright

Morgan Stanley

8 questions for CAH

Kevin Caliendo

UBS

8 questions for CAH

Michael Cherny

Leerink Partners

8 questions for CAH

George Hill

Deutsche Bank

7 questions for CAH

Steven Valiquette

Mizuho

7 questions for CAH

Charles Rhyee

TD Cowen

6 questions for CAH

Elizabeth Anderson

Evercore ISI

6 questions for CAH

Brian Tanquilut

Jefferies

5 questions for CAH

Lisa Gill

JPMorgan Chase & Co.

5 questions for CAH

Eric Coldwell

Robert W. Baird & Co.

4 questions for CAH

Stephen Baxter

Wells Fargo & Company

3 questions for CAH

Elizabeth Anderson

Evercore

2 questions for CAH

Glen Santangelo

Jefferies

2 questions for CAH

Jack Slevin

Jefferies Financial Group Inc.

2 questions for CAH

James

Jefferies

1 question for CAH

John Stansel

JPMorgan Chase & Co.

1 question for CAH

Stephanie Davis

Barclays

1 question for CAH

Stephen Baxter

Wells Fargo

1 question for CAH

Recent press releases and 8-K filings for CAH.

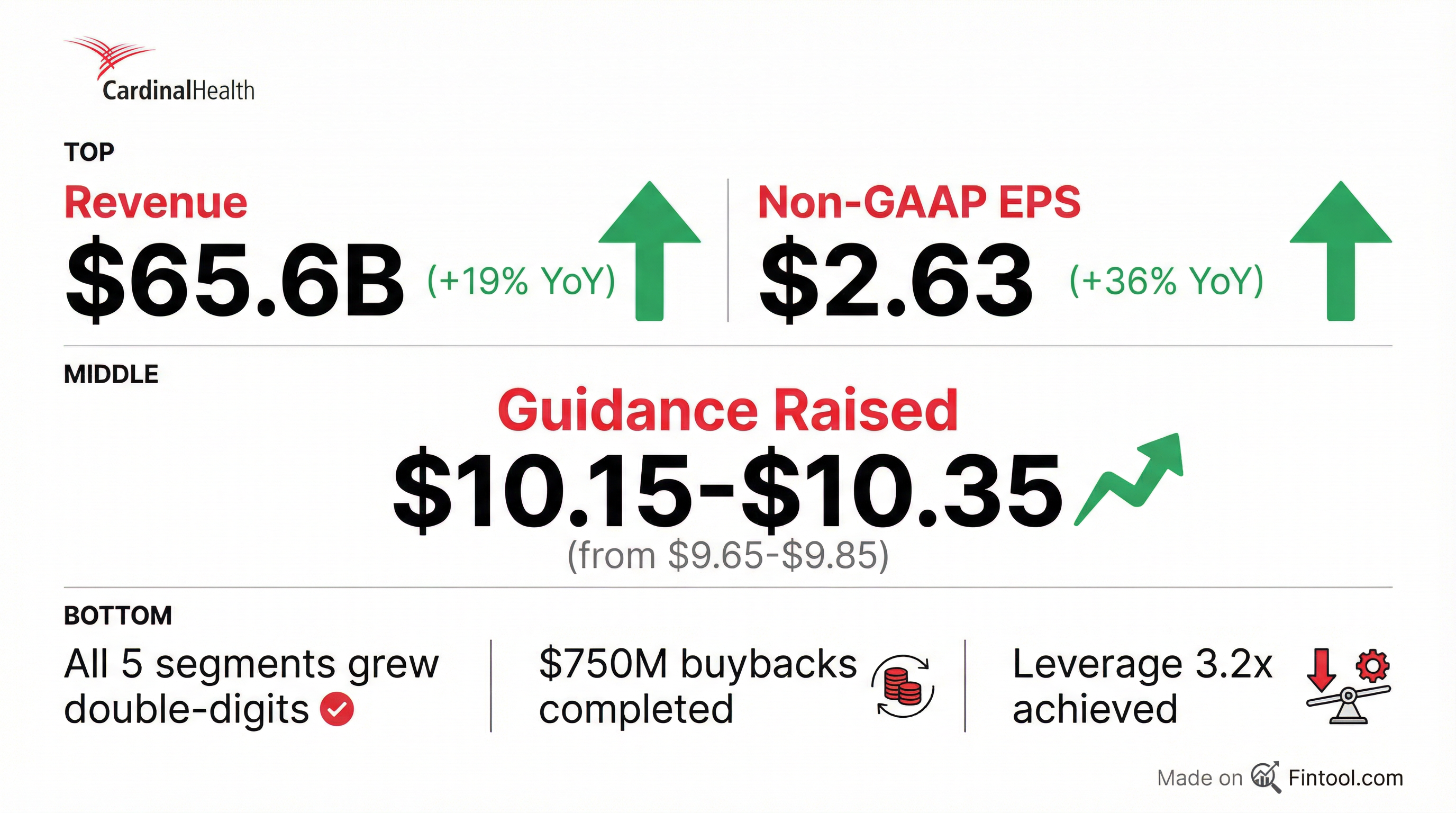

- Cardinal Health reported Q2 FY26 revenue of $65.6 B, up 19% Y/Y on a GAAP basis.

- Non-GAAP diluted EPS of $2.63, a 36% increase Y/Y.

- Pharmaceutical & Specialty Solutions segment delivered $60.7 B in revenue (+19%) and $687 M segment profit (+29%).

- FY26 guidance raised to $10.15–$10.35 non-GAAP EPS, with ~$750 M in share repurchases and $3.0–$3.5 B non-GAAP free cash flow expected.

- Cardinal Health delivered 19% revenue growth to $66 billion, 24% gross margin growth to $2.4 billion, 38% operating earnings growth to $877 million, and 36% non-GAAP EPS growth to $2.63.

- The company raised fiscal 2026 EPS guidance to $10.15–$10.35, implying 23%–26% year-over-year growth.

- Segment highlights: Pharmaceutical & Specialty Solutions revenues up 19% to $61 billion with profit up 29% to $687 million; GMPD revenues up 3% to $3.3 billion with profit of $37 million; other growth businesses revenues up 34% to $1.7 billion with profit up 52% to $179 million.

- Year-to-date adjusted free cash flow reached $1.8 billion, cash on hand was $2.8 billion, $240 million of capex invested, $1 billion returned to shareholders (including $750 million in share repurchases), and leverage at 3.2×.

- Cardinal Health delivered strong Q2 performance with 19% revenue growth to $66 billion, 38% operating earnings growth to $877 million, and 36% EPS growth to $2.63.

- The company raised its FY 2026 EPS guidance to $10.15–$10.35 (23–26% growth) and lifted segment profit outlooks: Pharma & Specialty to 20–22%, GMPD to ~$150 million, and Other growth businesses to 33–35%.

- Segment highlights: Pharma & Specialty revenue +19% to $61 billion and profit +29% to $687 million; GMPD revenue +3% to $3.3 billion and profit +$19 million to $37 million; Other growth businesses revenue +34% to $1.7 billion and profit +52% to $179 million.

- Year-to-date adjusted free cash flow of $1.8 billion, cash balance of $2.8 billion, $750 million in share repurchases, $240 million in CapEx, and a Moody’s adjusted leverage ratio of 3.2x, within target.

- Revenue rose 19% to $66 billion, driving operating earnings up 38% to $877 million and non-GAAP EPS to $2.63, a 36% increase year-over-year.

- All five segments delivered double-digit profit growth: Pharmaceutical & Specialty Solutions revenue grew 19% to $61 billion (segment profit +29% to $687 million); GMPD revenue +3% to $3.3 billion (profit to $37 million); Other Growth businesses revenue +34% to $1.7 billion (profit +52% to $179 million).

- Raised full-year 2026 guidance: EPS to $10.15–$10.35 (+23–26%); Pharmaceutical segment profit growth to 20–22%; GMPD profit to ~$150 million; Other segment profit growth to 33–35%; lowered tax rate to 21–23%; free cash flow expected at $3–3.5 billion.

- Generated $1.8 billion of adjusted free cash flow year-to-date, ended the quarter with $2.8 billion cash; invested $240 million in capex and returned $1 billion to shareholders, including $750 million in share repurchases.

- Reported 19% revenue growth to $65.6 billion, with GAAP diluted EPS up 19% to $1.97 and non-GAAP diluted EPS up 36% to $2.63.

- Raised fiscal year 2026 non-GAAP EPS guidance to $10.15–$10.35, driven by stronger segment profit forecasts and a lower tax rate.

- Completed $750 million of share repurchases year-to-date and achieved its targeted leverage range.

- Revenue increased 19% to $65.6 billion in Q2 FY26

- GAAP EPS rose 19% to $1.97; Non-GAAP EPS climbed 36% to $2.63

- Raised FY26 non-GAAP EPS guidance to $10.15–$10.35 (up 23%–26%)

- Completed $750 million annual share repurchase to date

- Cardinal Health projects over $50 billion in specialty revenue for fiscal 2026, reflecting a 16 percent three-year CAGR in its specialty business.

- The company reiterated a target of at least $10 EPS for fiscal 2026 and a 12–14 percent EPS CAGR, driven by broad-based growth across its enterprise.

- Strategic priorities remain focused on pharma and specialty solutions, with continued organic and inorganic investments in nuclear, at-home, and OptiFreight segments to capture faster-growing secular trends.

- Within specialty, Cardinal Health is emphasizing MSO growth in autoimmune, urology, and oncology, and aims to reach $1 billion in biopharma solutions revenue by 2028 (20 percent CAGR).

- The capital allocation framework stays disciplined, prioritizing organic investments, maintaining an investment-grade balance sheet, returning capital via dividends and share repurchases, and pursuing high-ROI tuck-in M&A.

- Raised fiscal 2026 non-GAAP diluted EPS guidance to $10.00 per share, up from $9.65–$9.85.

- Specialty Solutions expected to exceed $50 billion in revenue in FY26, reflecting a 16 % three-year CAGR.

- FY26 snapshot: ~$255 billion in revenue, ~$3.4 billion in operating earnings, and ~$3.25 billion in adjusted free cash flow (midpoint guidance).

- Launched ContinuCare Pathway for diabetes supply management, enrolling 11,000+ pharmacies and partnering with Publix Super Markets Inc..

- Cardinal Health highlighted pharma & specialty solutions as its core high-margin business, with three growth platforms—nuclear, at-home, and OptiFreight—complementing its GMPD turnaround segment.

- Management reaffirmed USD 10+ EPS guidance for FY 2026 and a 12-14% EPS CAGR, supported by specialty and Biopharma Solutions investments, including a >$50 billion specialty revenue target (16% CAGR over three years).

- Strategic priorities remain: (1) pharma & specialty solutions, (2) nuclear, at-home, and OptiFreight growth, (3) GMPD, while maintaining an investment-grade balance sheet and returning capital via dividends and buybacks.

- Emphasis on robust utilization drivers—aging demographics and specialty demand—supported by technology investments , ongoing M&A , and stable generics market dynamics.

- Cardinal Health expects at least $10 EPS in fiscal 2026, driven by broad-based market growth and specialty momentum. The firm has delivered a 14% core operating earnings CAGR, 18% EPS CAGR, and averaged $3 billion in adjusted free cash flow with >150% conversion, targeting > $250 billion in revenue and 99% U.S. exposure.

- Specialty solutions revenue is now guided to > $50 billion in FY 26 (a 16% CAGR over three years), with focus on autoimmune, urology and oncology via a 3,000-provider MSO platform, and Biopharma Solutions set to grow > 30% in FY 26 en route to $1 billion by FY 28.

- Pharmaceutical distribution remains robust and broad-based across branded, generic, specialty and biosimilars. Contract clauses allow price renegotiation for IRA-driven reductions, preserving fee-for-service economics and model resiliency.

- The company maintains a disciplined capital allocation framework—prioritizing organic investments, dividends, share repurchases and an investment-grade balance sheet—while pursuing tuck-in M&A in specialty and integrating recent platform acquisitions. GMPD has been turned around to positive free cash flow with continued infrastructure investment.

Fintool News

In-depth analysis and coverage of CARDINAL HEALTH.

Quarterly earnings call transcripts for CARDINAL HEALTH.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more