Earnings summaries and quarterly performance for Cencora.

Executive leadership at Cencora.

Board of directors at Cencora.

Research analysts who have asked questions during Cencora earnings calls.

Charles Rhyee

TD Cowen

8 questions for COR

Elizabeth Anderson

Evercore ISI

8 questions for COR

Eric Percher

Nephron Research

8 questions for COR

Erin Wright

Morgan Stanley

8 questions for COR

George Hill

Deutsche Bank

8 questions for COR

Kevin Caliendo

UBS

8 questions for COR

Lisa Gill

JPMorgan Chase & Co.

8 questions for COR

Allen Lutz

Bank of America

7 questions for COR

Daniel Grosslight

Citigroup

7 questions for COR

Steven Valiquette

Mizuho

7 questions for COR

Michael Cherny

Leerink Partners

5 questions for COR

Michael Cherney

Jefferies Financial Group Inc.

3 questions for COR

Eric Coldwell

Robert W. Baird & Co.

2 questions for COR

Stephen Baxter

Wells Fargo & Company

2 questions for COR

Stephen Baxter

Wells Fargo

2 questions for COR

Glenn Santangelo

Barclays

1 question for COR

Glen Santangelo

Jefferies

1 question for COR

Jack Slevin

Jefferies Financial Group Inc.

1 question for COR

Stephanie Davis

Barclays

1 question for COR

Recent press releases and 8-K filings for COR.

- $3.0 billion senior notes offering closed, comprising $500 million of 3.950% notes due 2029, $500 million of 4.250% notes due 2030, $500 million of 4.600% notes due 2033, $1.0 billion of 4.900% notes due 2036 and $500 million of 5.650% notes due 2056.

- Net proceeds to repay amounts under the 364-Day Term Credit Agreement (dated January 12, 2026) used for the OneOncology acquisition; any remaining proceeds for general corporate purposes.

- Joint book-running managers: Citigroup, J.P. Morgan, BofA Securities and Wells Fargo; final prospectus available on the SEC website.

- Cencora priced and closed a $3.0 billion senior notes offering comprising $500 million of 3.950% notes due 2029, $500 million of 4.250% notes due 2030, $500 million of 4.600% notes due 2033, $1.0 billion of 4.900% notes due 2036 and $500 million of 5.650% notes due 2056.

- Net proceeds will repay amounts outstanding under its 364-Day Term Credit Agreement used to fund the OneOncology acquisition, with any remainder for general corporate purposes.

- The offering was underwritten by Citigroup, J.P. Morgan, BofA Securities and Wells Fargo Securities and conducted pursuant to an SEC shelf registration filed November 26, 2024.

- Cencora priced $500 million 3.950% Senior Notes due February 13, 2029; $500 million 4.250% Senior Notes due November 15, 2030; $500 million 4.600% Senior Notes due February 13, 2033; $1.0 billion 4.900% Senior Notes due February 13, 2036; and $500 million 5.650% Senior Notes due February 13, 2056 in an underwritten registered public offering.

- The offering is expected to close on February 13, 2026, subject to customary closing conditions.

- Cencora intends to use the net proceeds to repay amounts outstanding under its 364-Day Term Credit Agreement and, to the extent available, for general corporate purposes.

- Upon closing, net proceeds are estimated at approximately $2.98 billion, after underwriting discounts and offering expenses.

- Cencora priced $3.0 billion aggregate principal amount of senior notes in five tranches: $500 million 3.950% due 2029; $500 million 4.250% due 2030; $500 million 4.600% due 2033; $1.0 billion 4.900% due 2036; and $500 million 5.650% due 2056.

- The offering is expected to close on February 13, 2026, subject to customary closing conditions.

- Net proceeds will repay borrowings under Cencora’s 364-Day Term Credit Agreement (which funded the OneOncology acquisition) and any remainder will be used for general corporate purposes.

- Cencora completed the acquisition of a majority equity interest in One Oncology, integrating its MSO platform with Retina Consultants of America to strengthen its specialty pharmacy and provider services capabilities.

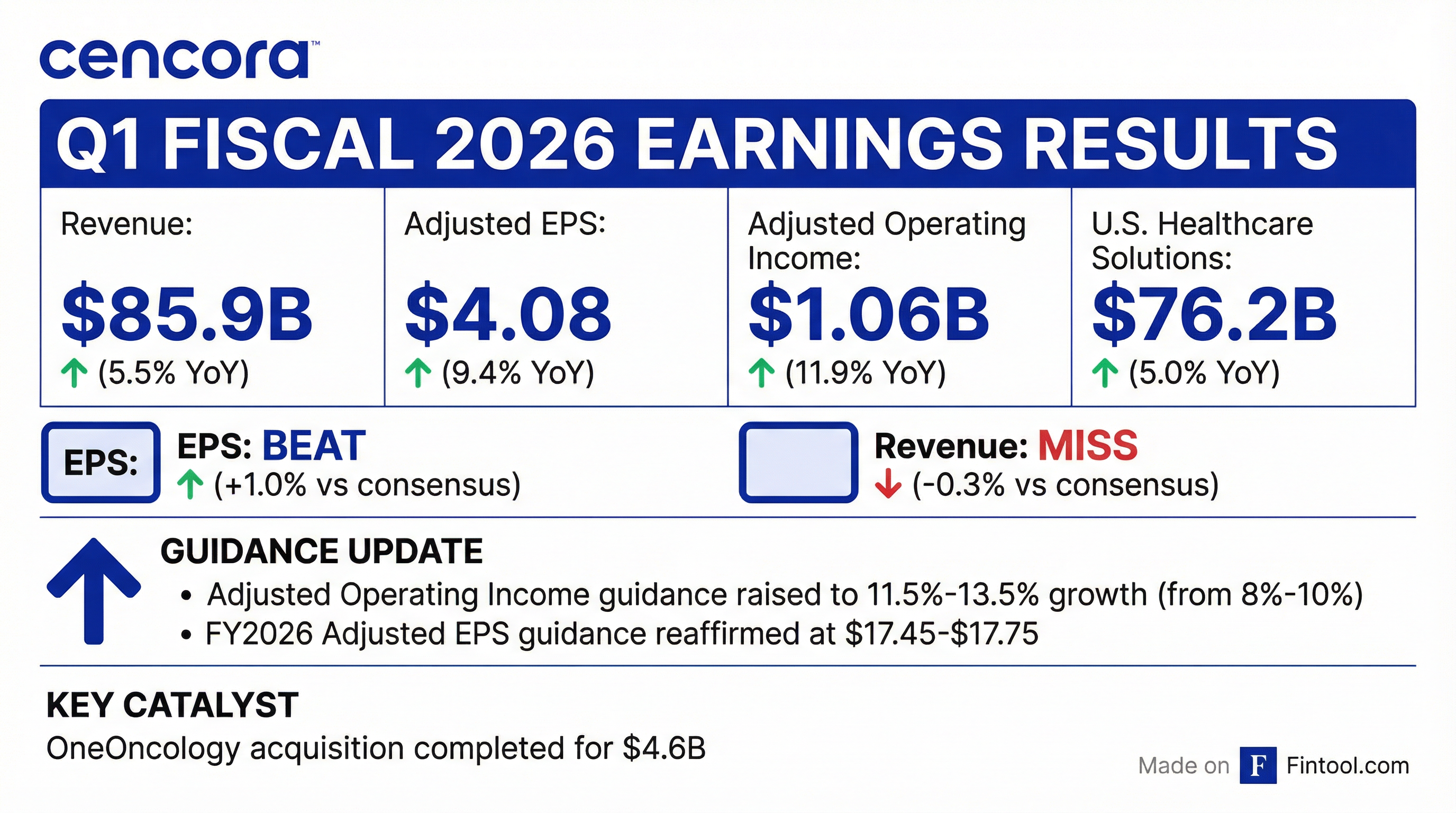

- In Q1 2026, Cencora reported adjusted diluted EPS of $4.08 (up 9%), revenue of $85.9 billion (up 5.5%), gross profit of $3.0 billion (up 18%), and operating income of $1.1 billion (up 12%); the company ended the quarter with $1.8 billion in cash and negative adjusted free cash flow of $2.4 billion due to seasonal working capital dynamics.

- Cencora raised full-year fiscal 2026 guidance to $17.45–$17.75 adjusted EPS, 11.5%–13.5% operating income growth, and 7%–9% consolidated revenue growth, reflecting One Oncology’s contribution and ongoing strength in U.S. Healthcare Solutions.

- The expanded MSO footprint supports Cencora’s growth priorities—specialty leadership, partnering with market leaders, and enhancing patient access—through advanced analytics, clinical research, and operational excellence.

- Completed majority acquisition of One Oncology and integrated with RCA to expand specialty pharmaceutical MSO capabilities and patient access.

- Reported in Q1 FY2026 revenue of $85.9 billion (+5.5%), adjusted EPS of $4.08 (+9%), and adjusted operating income of $1.1 billion (+12%).

- U.S. Healthcare Solutions: $76.2 billion revenue (+5%), $831 million operating income (+21%); International: $7.6 billion revenue (+10% reported, +6% cc), $142 million operating income (-14% reported, -17% cc); Other: $2.1 billion revenue (+6%), $91 million operating income (-6%).

- Raised FY2026 guidance: consolidated revenue growth to 7%–9%, adjusted operating income growth to 11.5%–13.5%, reaffirmed adjusted EPS at $17.45–$17.75, and interest expense now expected at $480–$500 million.

- Completed acquisition of a majority stake in OneOncology and raised fiscal 2026 adjusted operating income growth guidance to 11.5%–13.5%, EPS guidance to $17.45–$17.75, and revenue growth to 7%–9%.

- Delivered Q1 adjusted diluted EPS of $4.08 (+9%) and consolidated revenue of $85.9 billion (+5.5%); gross profit was $3.0 billion (+18%) and operating income $1.1 billion (+12%).

- U.S. Healthcare Solutions revenue rose to $76.2 billion (+5%) with operating income of $831 million (+21%); International Healthcare Solutions posted revenue of $7.6 billion (+10% as-reported; +6% cc) and operating income of $142 million (–14% as-reported; –17% cc).

- Ended Q1 with $1.8 billion in cash and negative adjusted free cash flow of $2.4 billion (vs –$2.8 billion a year ago); full-year free cash flow is expected to be ~$3 billion. Share repurchases are paused and diluted share count is projected at 195.5 million.

- Consolidated revenue was $85.9 billion, up 5.5% year-over-year; adjusted diluted EPS was $4.08, up 9.4%( ).

- Fiscal 2026 adjusted operating income guidance raised to 11.5%–13.5% growth, up from 8%–10%( ).

- Completed acquisition of the remaining equity interests in OneOncology on February 2, 2026( ).

- Declared a quarterly cash dividend of $0.60 per share( ).

- Cencora reported Q1 revenue of $85.9 billion, up 5.5% YoY, with GAAP diluted EPS of $2.87 and adjusted diluted EPS of $4.08.

- The company raised its full-year adjusted operating income guidance to growth of 11.5%–13.5% and reaffirmed adjusted diluted EPS guidance of $17.45–17.75.

- Cencora completed the acquisition of OneOncology, expanding its specialty MSO footprint in cancer care.

- The Board declared a $0.60 quarterly cash dividend per share, payable March 2, 2026.

- Revenue in the first quarter of fiscal 2026 was $85.9 billion, up 5.5% year-over-year; GAAP diluted EPS was $2.87 and adjusted diluted EPS was $4.08.

- Adjusted operating income guidance for fiscal 2026 was raised to growth of 11.5%–13.5%, while the full-year adjusted diluted EPS range of $17.45–$17.75 was reaffirmed.

- Cencora completed the acquisition of OneOncology, expanding its specialty MSO footprint in oncology care.

- In Q1, U.S. Healthcare Solutions revenue grew 5.0% and International Healthcare Solutions revenue grew 9.6% year-over-year.

Quarterly earnings call transcripts for Cencora.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more