Earnings summaries and quarterly performance for COSTAR GROUP.

Executive leadership at COSTAR GROUP.

Andrew C. Florance

Chief Executive Officer and President

Christian Lown

Chief Financial Officer

Frank Simuro

Chief Technology Officer

Frederick Saint

President, Marketplaces

Gene Boxer

General Counsel and Corporate Secretary

Lisa Ruggles

Senior Vice President, Global Operations

Board of directors at COSTAR GROUP.

Research analysts who have asked questions during COSTAR GROUP earnings calls.

Peter Christiansen

Citigroup Inc.

9 questions for CSGP

Ryan Tomasello

Keefe, Bruyette & Woods

9 questions for CSGP

Curtis Nagle

Bank of America

6 questions for CSGP

Jeffrey Meuler

Robert W. Baird & Co. Incorporated

5 questions for CSGP

Stephen Sheldon

William Blair & Company

5 questions for CSGP

Alexei Gogolev

JPMorgan Chase & Co.

4 questions for CSGP

Brett Huff

Stephens Inc.

4 questions for CSGP

George Tong

Goldman Sachs

4 questions for CSGP

Stephen Sheldon

William Blair

4 questions for CSGP

John Campbell

Stephens Inc.

3 questions for CSGP

Andrew Boone

JMP Securities

2 questions for CSGP

Craig Huber

Huber Research Partners

2 questions for CSGP

Jeffrey Silber

BMO Capital Markets

2 questions for CSGP

Keen Fai Tong

Goldman Sachs Group Inc.

2 questions for CSGP

Nicholas Jones

Citizens JMP

2 questions for CSGP

Scott Wurtzel

Wolfe Research

2 questions for CSGP

Sid Chhabra

RBC Capital Markets

2 questions for CSGP

Ashish Sabadra

RBC Capital Markets

1 question for CSGP

Basal Wit

Deutsche Bank

1 question for CSGP

Basil Witte

Deutsche Bank

1 question for CSGP

Jun Yong

Wells Fargo & Company

1 question for CSGP

Jun Zhang

Wells Fargo

1 question for CSGP

Surinder Thind

Jefferies Financial Group

1 question for CSGP

Recent press releases and 8-K filings for CSGP.

- National U.S. apartment rents rose to $1,716 in February 2026, a +0.1% increase from December’s revised $1,714.

- Annual rent growth slowed to 0.4% in February 2026, down from 0.6% in January 2026 and +1.5% in February 2025.

- Month-over-month, 38 of the top 50 markets posted gains; Richmond led at +0.8%, while San Francisco delivered the strongest annual increase at +5.7%.

- Elevated supply pressures continue to temper momentum, with Sun Belt metros like Austin (-5.1%) and Phoenix (-3.3%) recording the steepest annual declines.

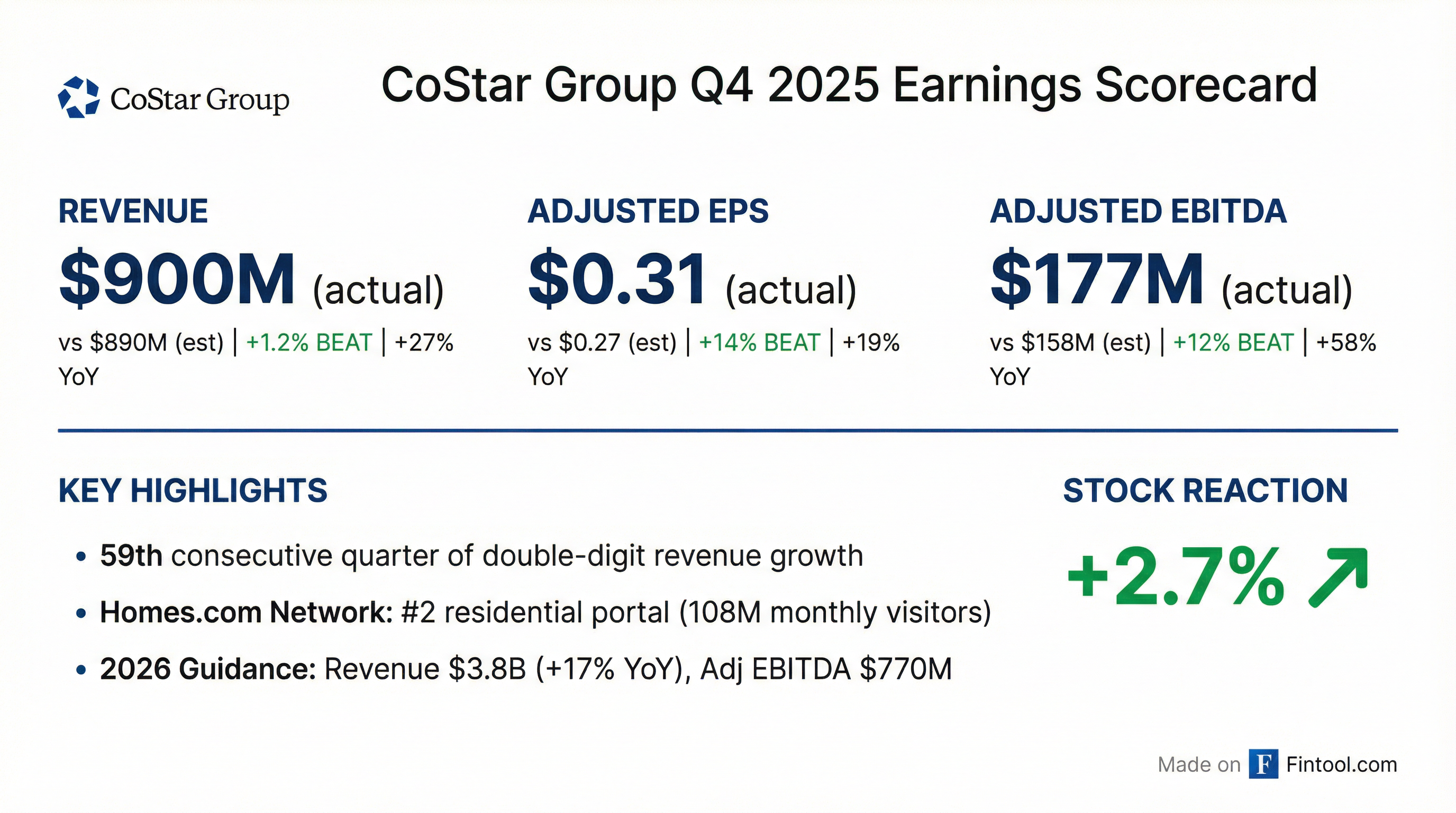

- CoStar delivered Q4 revenue of $900 million (27% y/y) and FY 2025 revenue of $3.2 billion (19% y/y); adjusted EBITDA was $442 million, up 83% y/y (14% margin).

- The company affirmed 2026 guidance: revenue of $3.78 billion–$3.82 billion (16–18% y/y growth) and adjusted EBITDA of $740 million–$800 million (20–21% margin).

- In 2025, the residential segment generated $1.46 billion in revenue (+20% y/y) and the commercial segment $1.79 billion (+18%); 2026 segment guidance is $1.825 billion–$1.845 billion for residential and $1.955 billion–$1.975 billion for commercial.

- The board authorized a new $1.5 billion share repurchase, with $700 million planned in 2026—including a $500 million accelerated buyback in Q1.

- CoStar launched Homes AI, an AI-driven home-search interface; AI users spend ~16 min 50 sec on site vs. 4 min 24 sec for non-AI users and submit 7× more leads, enhancing residential engagement.

- CoStar Group posted Q4 revenue of $900 million (up 27% YoY) and full‐year 2025 revenue of $3.2 billion (up 19% YoY), alongside full‐year adjusted EBITDA of $442 million (14% margin, +83% YoY).

- The newly defined commercial segment generated $1.79 billion in 2025 revenue (up 18% YoY), while the residential segment achieved $1.46 billion (up 20% YoY, 12% organic).

- For 2026, CoStar affirmed guidance of $3.78–3.82 billion in revenue (16–18% growth) and $740–800 million in adjusted EBITDA (20–21% margin), with quarterly EBITDA margins expected to expand by ~5 p.p. each quarter.

- Announced a $700 million share repurchase program in 2026, comprising a $500 million accelerated share repurchase this quarter and $200 million in open‐market buys.

- CoStar Group delivered Q4 revenue of $900 million (+27% Y/Y) and FY 2025 revenue of $3.2 billion (+19% Y/Y).

- GAAP net income was $47 million in Q4 and $7 million for FY, with Q4 adjusted EBITDA of $177 million (20% margin) and FY adjusted EBITDA of $442 million (14% margin).

- CoStar Group sites averaged 139 million unique visitors in Q4 2025; the Homes.com network reached 108 million.

- 2026 guidance calls for Q1 revenue of $890 million–$900 million (22%–23% Y/Y) and FY revenue of $3.78 billion–$3.82 billion; a $1.5 billion stock repurchase program was authorized, with $700 million expected to be repurchased in 2026.

- Q4 2025 revenue was $900 M, up 27% YoY; full‐year 2025 revenue reached $3.2 B, a 19% increase.

- Full‐year 2025 adjusted EBITDA was $442 M, up 83% YoY; 2026 full‐year adjusted EBITDA guidance of $740 M–$800 M (20–21% margin) and Q1 2026 EBITDA of $95 M–$115 M.

- 2025 segment revenues: Commercial at $1.79 B (+18%) and Residential at $1.46 B (+20%).

- Net new bookings in FY 2025 totaled $308 M (+23%), with Q4 2025 bookings of $75 M (+42%).

- 2026 revenue guidance of $3.78 B–$3.82 B (16–18% growth) and Q1 2026 revenue of $890 M–$900 M (+22–23%).

- Revenue for the year ended December 31, 2025 was $3.2 billion, up 19% year-over-year; Q4 2025 revenue was $900 million, up 27% versus Q4 2024.

- Profitability: Net income was $7 million for full-year 2025 and $47 million in Q4 2025; Adjusted EBITDA rose 83% to $442 million for the year and 58% to $177 million in Q4.

- Record net new bookings of $308 million in 2025; the Company completed $500 million of share repurchases in Q4 and plans to repurchase $700 million in 2026.

- 2026 guidance: full-year revenue of $3.78 billion – $3.82 billion (≈17% growth) and Adjusted EBITDA of $740 million – $800 million; Q1 2026 revenue of $890 million – $900 million and Adjusted EBITDA of $95 million – $115 million; Adjusted EPS of $1.22 – $1.33 for the year and $0.16 – $0.19 for Q1.

- Revenue of $3.2 B for the full year, up 19% YoY; Q4 revenue was $900 M, a 27% increase over Q4 2024.

- GAAP net income of $7 M (EPS $0.02) in FY 2025; adjusted net income of $364 M (+23%) and adjusted EBITDA of $442 M (+83%).

- Q4 2025 net income was $47 M (EPS $0.11); adjusted EBITDA of $177 M, a 58% YoY rise.

- Recorded net new bookings of $308 M for the year.

- Announced a $700 M share repurchase plan for 2026 after completing $500 M in Q4 2025.

- CoStar Group launched Homes AI, a real-time, voice-enabled AI experience on Homes.com powered by Microsoft Azure OpenAI, enabling two-way conversational home searches.

- Homes AI draws on Homes.com’s property database, Matterport 3D digital twins, images, proprietary school and neighborhood data, and market intelligence to deliver personalized guidance.

- The AI operates entirely within Homes.com’s proprietary ecosystem and does not train external models, while upholding “Your Listing, Your Lead” to route buyer and renter inquiries directly to listing agents.

- CoStar plans to roll out this AI capability across its other platforms, including Apartments.com, LoopNet, Land.com, and BizBuySell.

- CoStar Group has already refreshed its board with three new independent directors (including two recommended by D.E. Shaw and Third Point) and appointed a new independent board chair in response to activist demands.

- The company formed a Capital Allocation Committee and will reduce Homes.com net investment by $300 million in 2026 (and $100 million annually thereafter) to achieve break-even by 2029 while increasing commercial product investments.

- CoStar has accelerated its $500 million share repurchase program initiated in 2025 and authorized an additional $1.5 billion repurchase in January 2026.

- After engaging the top 50 stockholders (representing 77% of shares), CoStar implemented a redesigned 2026 executive compensation program with more rigorous, quantitative goals, enhanced transparency, and a simplified structure.

- Despite 14 meetings over nine months (including two with independent directors only), CoStar asserts D.E. Shaw’s narrative mischaracterizes the board’s engagement and understates the value creation plan for Homes.com.

- D. E. Shaw criticizes CoStar’s board for value-destructive spending on Homes.com and chronic underperformance, and intends to support shareholder-driven change at the 2026 Annual Meeting.

- CoStar has invested over $3 billion in Homes.com over the past four years, diverting core earnings, yet the platform generated only $80 million in revenue and $2 billion in cumulative losses versus $700 million–$1 billion projected by 2027.

- The stock has recorded five consecutive years of declines, with a cumulative 32% loss versus a 101% gain for the S&P 500, underscoring investor dissatisfaction.

- CEO Andy Florance earned approximately $130 million in compensation over the last five years (payouts at 200% of target on average), while nearly 50% of shareholders opposed CoStar’s 2025 say-on-pay proposal.

- D. E. Shaw urges exiting or sharply reducing Homes.com to breakeven by 2027 and adding independent directors, estimating these moves could create over $10 billion in shareholder value.

Fintool News

In-depth analysis and coverage of COSTAR GROUP.

Quarterly earnings call transcripts for COSTAR GROUP.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more