Earnings summaries and quarterly performance for Claritev.

Executive leadership at Claritev.

Travis S. Dalton

Chair, President and Chief Executive Officer

Brock Albinson

Senior Vice President and Chief Accounting Officer

Carol H. Nutter

Senior Vice President and Chief People Officer

Douglas M. Garis

Executive Vice President and Chief Financial Officer

Jerome W. Hogge, III

Executive Vice President and Chief Operating Officer

Michael C. Kim

Executive Vice President and Chief Digital Officer

Tara A. O'Neil

Senior Vice President and General Counsel

Tiffani D. Misencik

Senior Vice President and Chief Growth Officer

William B. Mintz

Senior Vice President, Corporate Affairs & Strategy

Board of directors at Claritev.

Allen R. Thorpe

Lead Independent Director

Anthony Colaluca, Jr.

Director

C. Martin Harris

Director

Dale A. White

Director

Jason Kap

Director

John M. Prince

Director

Julie D. Klapstein

Director

Michael S. Klein

Director

Richard A. Clarke

Director

Research analysts who have asked questions during Claritev earnings calls.

Recent press releases and 8-K filings for CTEV.

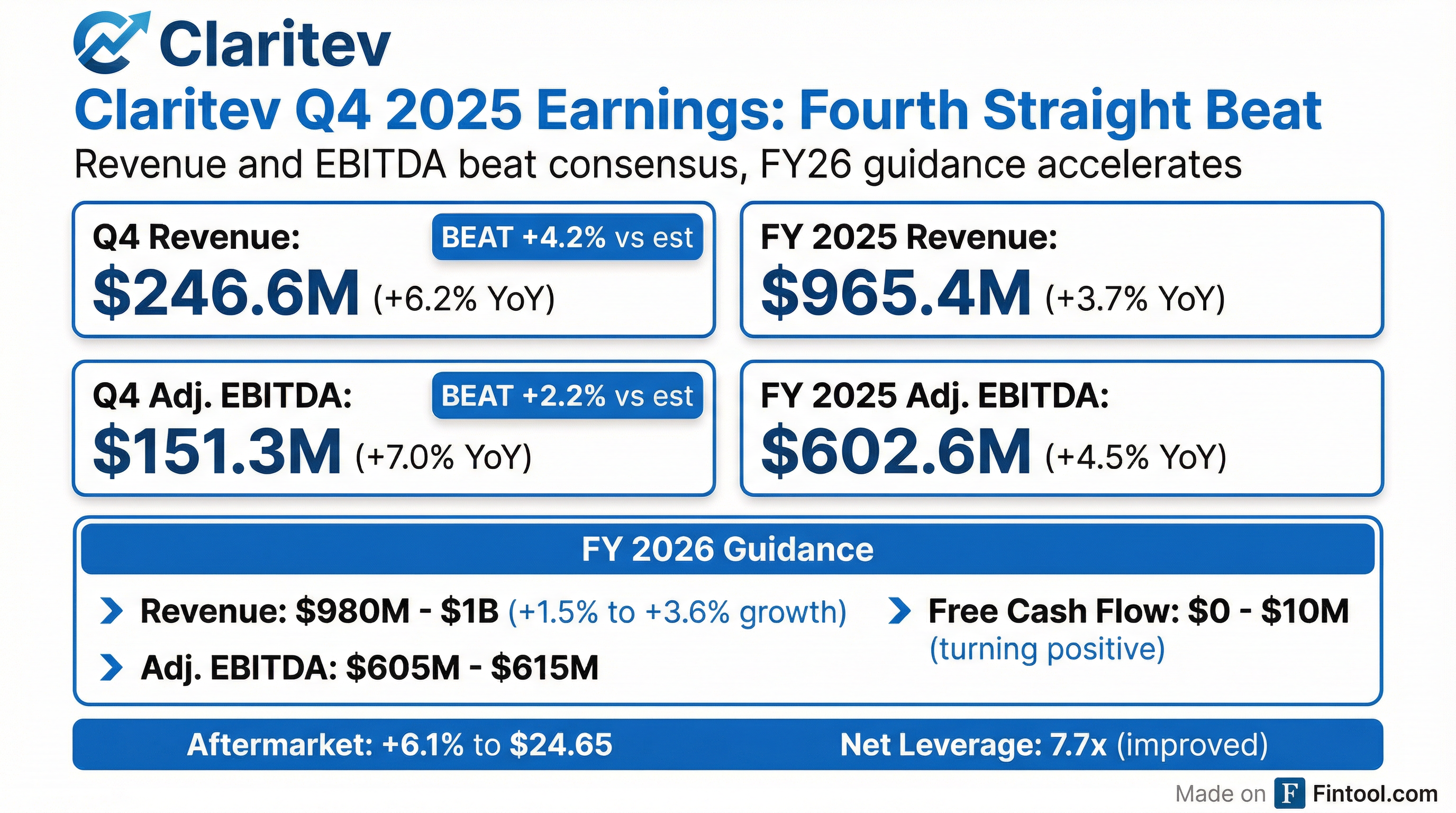

- Claritev reported Q4 2025 revenue of $246.6 million, an increase of 6.2% year-over-year, and Adjusted EBITDA of $151.3 million, up 7% with a 61.4% margin. For the full year 2025, revenue reached $965.4 million, up 3.7%, and Adjusted EBITDA was $602.6 million, up 4.5% over 2024.

- The company achieved record Q4 bookings of $23 million and $67 million in ACV booked for 2025, exceeding internal expectations. Net leverage at year-end was 7.7 times.

- For 2026, Claritev projects revenue between $980 million and $1 billion, representing 2%-4% growth over 2025, or 4%-6% excluding one-time 2025 revenue. Adjusted EBITDA is guided to be $605 million-$615 million with margins of 61%-62%.

- Claritev expects strong double-digit ACV bookings growth in 2026 and projects free cash flow of $0-$10 million for the year. The company is prioritizing organic investments for its Vision 2030 plan, debt reduction, and value-creating M&A.

- The company's strategy, including digital transformation and AI integration, is working, leading to profitable growth sooner than expected, with AI being applied to advance products and workflow automation.

- Claritev reported strong Q4 2025 revenue of $246.6 million, up 6.2% year-over-year, and full-year 2025 revenue of $965.4 million, an increase of 3.7% over 2024, exceeding initial guidance.

- Adjusted EBITDA for Q4 2025 was $151.3 million (up 7% with a 61.4% margin) and full-year 2025 Adjusted EBITDA was $602.6 million (up 4.5%), with levered free cash flow finishing at a use of $12.3 million, significantly better than the initial forecast.

- For full-year 2026, the company provided revenue guidance of $980 million to $1 billion (representing 2%-4% growth, or 4%-6% excluding 2025 one-time revenue) and Adjusted EBITDA guidance of $605 million-$615 million with 61%-62% margins.

- Claritev achieved record bookings of $23 million in Q4 2025 and expects strong double-digit ACV bookings growth in 2026, driven by its digital transformation, vertical market strategy, and AI leadership.

- The company plans to invest $20 million-$25 million in go-to-market and delivery functions in 2026 and anticipates a shift of $10 million-$15 million in previously capitalized costs to OpEx due to cloud migration.

- Claritev reported strong financial performance for Q4 and full year 2025, with revenue, adjusted EBITDA, and free cash flow exceeding initial guidance.

- The company is guiding for continued growth in 2026, with revenue expected to increase by 2%-4% (or 4%-6% excluding one-time revenue) and Adjusted EBITDA between $605 million-$615 million.

- Claritev achieved $67 million in ACV booked in 2025 and anticipates strong double-digit ACV bookings growth in 2026, driven by core offerings and new solutions.

- Strategic focus includes digital transformation, AI leadership, and leveraging competitive advantages like its comprehensive network and deep workflow knowledge to drive sustainable, profitable growth.

Claritev Financial Performance and Guidance (Period: Q4 2025, FY 2025, FY 2026 Guidance; Date: 2026-02-23)

| Metric | Q4 2025 | FY 2025 | FY 2026 Guidance |

|---|---|---|---|

| Total Revenue ($USD Millions) | 246.6 | 965.4 | 980 - 1,000 |

| Adjusted EBITDA ($USD Millions) | 151.3 | 602.6 | 605 - 615 |

| Adjusted EBITDA Margin (%) | 61.4 | N/A | 61 - 62 |

| Levered Free Cash Flow ($USD Millions) | 36.4 | -12.3 | 0 - 10 |

| Total Capital ($USD Millions) | N/A | N/A | 160 - 170 |

- Claritev reported total revenue of $246.6 million for Q4 2025, a 6.2% increase from Q4 2024, and $965.4 million for the full year 2025, up 3.7% from FY 2024.

- The company's Adjusted EBITDA for Q4 2025 was $151,326 thousand, contributing to a full-year 2025 Adjusted EBITDA of $602,557 thousand. However, Claritev reported a net loss of $(80,570) thousand in Q4 2025 and a full-year net loss of $(284,282) thousand for 2025.

- Claritev generated $36,377 thousand in Free Cash Flow for Q4 2025, but reported a negative Free Cash Flow of $(12,277) thousand for the full year 2025, with an Adjusted Cash Conversion Ratio of 45% for FY 2025.

- As of December 31, 2025, Claritev had net debt of $4,615 million and a total leverage ratio, net of cash, of 7.7x based on TTM Adjusted EBITDA of $603 million.

- For fiscal year 2026, Claritev provided guidance expecting revenue between $980 million and $1 billion, Adjusted EBITDA between $605 million and $615 million, and Free Cash Flow between $0 and $10 million.

- Claritev Corporation reported Q4 2025 revenues of $246.6 million and a net loss of $80.6 million, with Adjusted EBITDA of $151.3 million.

- For the full year 2025, revenues reached $965.4 million, an increase of 3.7% compared to FY 2024, and the company reported a net loss of $284.3 million and Adjusted EBITDA of $602.6 million.

- The company initiated full-year 2026 guidance, projecting revenues between $980 million and $1 billion, and free cash flow between $0 million and $10 million.

- Claritev's Board of Directors approved a $75 million, five-year share repurchase program, effective from January 1, 2026, through December 31, 2030, with a $20.0 million limit per calendar year.

- Claritev reported strong financial performance, with Q3 revenue growing 7% and adjusted EBITDA reaching $155 million, its strongest in nine quarters. The company's stock was up 180%-190% year over year.

- The company is executing a digital transformation under its Vision 2030 plan, involving a $100 million incremental investment to move products to Oracle Cloud and rewrite legacy applications, aiming for long-term sustainable growth.

- In late 2024, Claritev restructured $4.5 billion of debt to support its growth strategy and anticipates approximately half a turn or more of leverage reduction annually starting in 2026.

- Strategic initiatives include building a sales team, expanding into new market verticals and internationally, and planning 30 solution enhancements and 10 new products for the current year. The core "Percentage of Savings" business, which is ROI-based, constitutes 90% of revenue.

- Claritev's strategic priorities include organic investments to fuel its Vision 2030 Plan, debt paydown, and value-creating M&A, with share buybacks representing a low percentage of capital allocation.

- The company is positioned for accelerated growth due to its essential role in the healthcare ecosystem, scalable operating platform, innovative technology, recurring revenue from a durable core business, multiple avenues for growth, and refreshed leadership.

- As of September 30, 2025, Claritev reported a significant debt structure with $4,659 million in total outstanding principal balances and a Debt to Equity ratio of 7.8x.

- Adjusted EBITDA showed a strong recovery and growth, increasing from $14,679 thousand in Q1 2024 to $155,132 thousand in Q3 2025, after a dip in late 2023 and early 2024.

- Clariv reported 7% revenue growth and $155 million adjusted EBITDA in Q3, marking its strongest revenue performance in 12 quarters and strongest adjusted EBITDA in nine quarters.

- The company has undergone a significant digital transformation with a $100 million investment in its Vision 2030 plan, including moving products to Oracle Cloud and rewriting legacy applications, following $500 million spent on its core technology stack over the last five years.

- Clariv restructured $4.5 billion of debt in late 2024 and aims to reduce its leverage, which is currently under eight times, by approximately half a turn or more annually starting in 2026 through organic growth.

- Under CEO Travis Dalton, who joined in March 2024, Clariv has focused on sustainable growth, expanding its market reach into new verticals and internationally, and plans over 30 solution enhancements and 10 new products this year.

- Claritev (formerly MultiPlan) reported strong Q3 performance with 7% revenue growth and $155 million adjusted EBITDA, its strongest in nine quarters, following a stock increase of 180%-190% year-over-year.

- The company is undertaking a significant digital transformation as part of its Vision 2030 plan, involving a $100 million net incremental investment to move to Oracle Cloud and rewrite core applications, aiming for operating leverage and revenue acceleration.

- Strategic growth initiatives include expanding into new market verticals and international business, launching 30 solution enhancements and 10 new products this year, and building a new sales team.

- Claritev successfully restructured $4.5 billion of debt in late 2024 and anticipates reducing its high leverage starting in 2026 through organic growth.

- Management highlighted 2026 as a critical year for execution, focusing on delivering strong revenue, EBITDA, and free cash flow growth, alongside continued product innovation.

- Claritev recently renewed its top 10 customers, which comprise 70% of its revenue, and has seen a 67% increase in its pipeline over the last year, with half of that growth coming from existing clients.

- The company's primary revenue model, PSAV (Payment Savings as Value), generates 88% of its revenue and is an ROI-based model where Claritev earns a percentage of the savings it identifies for customers.

- Claritev's growth is driven by rising healthcare inflation and increased demand for transparency, with out-of-network spend expected to remain stable at 5%-7% of overall healthcare spend, particularly in high-ticket categories like ambulatory surgery, musculoskeletal, and behavioral health.

- The No Surprises Act (NSA), initially perceived as a challenge, has become a growth opportunity for Claritev, evolving into its third-largest product category within its analytics business by supporting clients through the IDR process.

- Claritev has booked $45 million in new ACV year-to-date through Q3 and anticipates closing an additional $15 million by year-end, driven by an expanded sales force and increased focus on multiple vertical markets.

Quarterly earnings call transcripts for Claritev.

Ask Fintool AI Agent

Get instant answers from SEC filings, earnings calls & more